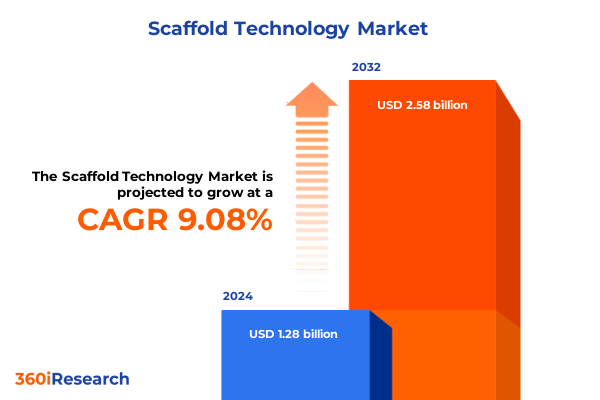

The Scaffold Technology Market size was estimated at USD 1.40 billion in 2025 and expected to reach USD 1.54 billion in 2026, at a CAGR of 9.05% to reach USD 2.58 billion by 2032.

Exploring How Emerging Technologies And Industry Dynamics Are Reshaping The Scaffold Technology Landscape For Enhanced Safety And Efficiency

The scaffolding sector is undergoing a profound transformation as digital innovation merges with traditional access solutions to elevate safety and productivity on worksites. Artificial intelligence–enabled project management platforms now analyze vast streams of risk data in real time, predicting potential hazards and optimizing scaffold placement based on complex load distribution models. These AI-driven tools have shifted decision-making from intuition to data-backed strategies, enhancing worker protection while reducing costly delays.

Sensor technology further augments these capabilities by embedding miniature devices within structural components to continuously monitor integrity, environmental conditions, and usage patterns. Construction teams receive instant alerts on smartphone dashboards when micro-shifts, overloading, or corrosion risks emerge, enabling preemptive maintenance and averting critical failures. This integration of real-time data into the operational lifecycle has quickly become indispensable for large-scale projects in both urban construction and industrial facilities.

Beyond sensors, advanced scaffolding systems now leverage augmented reality overlays and virtual reality simulations to streamline planning and training processes. By visualizing digital models in situ through AR headsets, engineers and installers can identify misalignments before physical assembly, thereby minimizing rework and material waste. VR environments offer immersive safety training scenarios that replicate high-risk conditions in controlled settings, strengthening workforce readiness and compliance with stringent regulatory standards.

Examining The Transformative Shifts Driving Scaffold Technology Innovation Through Digital Integration Safety Enhancements And Modular Design Evolution

Digital integration is redefining scaffolding operations as building information modeling (BIM) and project management software converge to deliver unprecedented planning precision. Detailed 3D scaffold designs generated through CAD software feed directly into BIM workflows, enabling seamless collaboration across architectural, engineering, and construction teams. As a result, scaffold inventory management, site logistics, and assembly sequencing are coordinated via a unified digital platform, significantly reducing scheduling conflicts and material bottlenecks.

Parallel to digital design, automation and robotics are emerging as pivotal forces in high-risk scaffold tasks. Robotic assemblers capable of lifting and connecting heavy components minimize human exposure to height-related hazards, while drone-enabled remote inspections provide comprehensive site overviews and detailed condition assessments without requiring personnel to ascend unstable structures. These automations not only enhance safety protocols but also compress project timelines, enabling scaffold setups that once took days to be completed in mere hours.

Modular and prefabricated scaffolding solutions are also gaining traction for their operational flexibility and quality control. Off-site manufacturing in controlled environments ensures consistent adherence to safety standards and material specifications. Once delivered to the site, these modular units can be rapidly assembled into customized configurations, adapting to diverse project requirements from high-rise facade installations to intricate shipbuilding operations. This shift toward off-site prefabrication enhances worker productivity, reduces labor costs, and aligns with just-in-time construction methodologies.

Analyzing How The United States Tariffs Imposed In 2025 Have Altered Scaffolding Material Costs Supply Chains And Strategic Planning For Industry Stakeholders

In early 2025, the United States implemented sweeping tariff measures that increased duties on imported steel and aluminum to 25 percent in March and escalated them to 50 percent by June. These policy changes eliminated most previous exemptions, triggering an immediate rise in raw material costs that reverberated through the scaffold manufacturing and construction supply chains.

The tariff-driven price surge has been most acute for steel rebar and structural tubing, essential components in supported scaffolding systems. Benchmark steel prices climbed by up to 26 percent, pushing per-ton costs to roughly $1,240 and adding thousands of dollars to large-scale project budgets. Domestic steel producers responded by ramping up output by 8 percent year-to-date, yet persistent import shortfalls and extended lead times of 14 to 18 weeks have created fabrication bottlenecks. This supply-demand imbalance has compelled project planners to factor in material cost contingencies exceeding 20 percent versus pre-tariff levels of around 5 percent.

Consequently, scaffold providers and contractors have adopted adaptive procurement strategies, including index-based pricing clauses, early-order initiatives, and supplier diversification efforts to lock in stable pricing. Many firms have also accelerated investment in aluminum-based and composite scaffolding solutions to mitigate exposure to steel tariff volatility. This recalibration of sourcing and pricing models underscores the enduring impact of trade policy on scaffold operations and highlights the necessity of proactive risk management.

Uncovering Core Segmentation Insights Highlighting Scaffold Market Opportunities Across Types Materials Industries Applications Heights Access Methods And Pricing Strategies

The scaffold market’s segmentation framework reveals multiple pathways to tailored growth and innovation. Segmentation by scaffold type distinguishes between cantilever, mobile, rolling, supported, and suspended systems, each designed for specific load-bearing requirements and site geometries. Cantilever scaffolds extend beyond support points to access obstructed areas, while mobile units prioritize portability for rapid deployment across short-term maintenance and cleaning tasks. Wind-resistant curtain-wall construction increasingly favors supported scaffolds for their stability, whereas suspended systems remain indispensable for high-rise façade work.

Material segmentation further refines market dynamics through a differentiation of aluminum, composite, steel, and integrated system solutions. Aluminum scaffolds excel in lightweight applications and chemical plant environments, while composite options resist corrosion in harsh industrial settings. Steel scaffolds maintain dominance where structural robustness is paramount, particularly in heavy construction and power generation projects. System-based offerings bifurcate into frame systems that streamline standard site builds and modular systems that deliver customizable configurations for complex architectural profiles.

End-user industry segmentation underscores the diverse applications of scaffold solutions across construction, events, maintenance and cleaning, oil and gas, power generation, and shipbuilding. Construction projects drive volume demand for supported systems and rolling scaffolds, while the events sector leverages mobile and cantilever platforms for staging and overhead rigging. Maintenance teams rely on compact rolling scaffolds for routine inspections, whereas the oil and gas industry demands corrosion-resistant composites for refinery turnarounds. In shipbuilding, suspended and cantilever scaffolds facilitate exterior outfitting and hull inspections.

Application segmentation focuses on facade work, inspection and repair, painting, and structural tasks, aligning scaffold types and materials with project scopes. Facade installations often integrate suspended modules with composite decking for safety and accessibility. Structural scaffolding employs robust steel frames to support heavy loads during load-bearing assembly and concrete pouring. Meanwhile, inspection and painting crews favor lightweight aluminum systems for swift repositioning and height adjustments.

This comprehensive research report categorizes the Scaffold Technology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Scaffold Type

- Material

- End User Industry

- Application

- Platform Height

- Access Type

- Pricing Model

Navigating Regional Nuances In Scaffold Technology Adoption Across The Americas Europe Middle East Africa And The Asia Pacific To Inform Strategic Decisions

The Americas region continues to command a significant share of scaffold technology adoption, driven by robust construction activity in the United States and Canada. Rising infrastructure investments and an emphasis on sustainable retrofit projects have bolstered demand for advanced modular and prefabricated scaffolds. North American firms are increasingly integrating digital management platforms and real-time monitoring to enhance operational efficiency and safety compliance. Despite tariff-related cost pressures on steel and aluminum, market participants have leveraged supplier partnerships and alternative material solutions to maintain project pipelines throughout 2025.

In Europe, Middle East, and Africa, the scaffold market is characterized by a blend of legacy providers and emerging innovators catering to stringent regulatory environments. German and French manufacturers lead in engineering-driven modular systems, combining off-site fabrication with precision-designed frame scaffolds for complex architectural applications. The enforcement of rigorous safety standards across the EU has accelerated adoption of sensor-equipped scaffolding, while Middle Eastern infrastructure booms in the energy sector spur high-capacity suspended systems. Conversely, fluctuating raw material pricing in Africa has encouraged greater reliance on composite and aluminum scaffolds where corrosion resistance is critical.

The Asia-Pacific region exhibits the fastest growth trajectory, underpinned by significant infrastructure spending in China, India, and Southeast Asia. Local manufacturers are scaling production of cost-effective steel scaffolds to meet the demands of urbanization and transport network expansions. Meanwhile, joint ventures with European and North American technology providers have introduced sensor integration and modular prefabrication expertise to these markets. As emerging economies prioritize both speed and safety, demand is rising for balanced solutions that blend lightweight aluminum systems with digital lifecycle management platforms.

This comprehensive research report examines key regions that drive the evolution of the Scaffold Technology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping The Competitive Landscape With Insights Into Leading Scaffold Solution Providers Their Strategic Moves And Innovation Priorities Shaping Market Leadership

Altrad Group and BrandSafway jointly hold a commanding position within the global scaffolding arena, capitalizing on extensive product portfolios and rigorous safety compliance to secure approximately 18 percent of industry revenue. Their integrated services span equipment rental, engineering consultation, and turnkey access solutions, enabling seamless project execution from design through dismantling. Both firms sustain their leadership through continuous investment in digital inventory management and strategic partnerships that broaden their global footprints.

European stalwarts Layher GmbH and PERI GmbH distinguish themselves with engineered modular systems tailored for complex high-rise construction and infrastructure projects. Layher’s emphasis on precision-manufactured aluminum components ensures lightweight setups that accelerate assembly, while PERI’s formwork-integrated scaffolds afford dual functionality for simultaneous concrete pouring and support operations. Each has expanded into emerging Asian markets through targeted joint ventures, aligning their modular expertise with local fabricators to capture rapid urban growth demands.

ULMA Construction and AT-PAC have gained momentum by focusing on advanced aluminum and composite solutions optimized for corrosive environments, such as chemical plants and coastal projects. Both companies have increased their R&D spending by more than 22 percent year-on-year, channeling innovation into lightweight framing systems that reduce transport costs and assembly time. Strategic collaborations with technology providers have further enhanced their offerings with embedded sensor options for real-time load and tilt monitoring.

Sunbelt Rentals stands out as a dominant rental platform across North America, reporting revenues near $9.8 billion in 2023 and leveraging a vast equipment fleet to serve diverse end-users. The company has deployed a proprietary digital portal that integrates scaffolding asset tracking, maintenance scheduling, and predictive analytics to optimize utilization rates and minimize downtime. This convergence of rental scale and digital capabilities reinforces Sunbelt’s position as a one-stop access solution provider.

This comprehensive research report delivers an in-depth overview of the principal market players in the Scaffold Technology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acrow Formwork & Scaffolding Pty Ltd

- ADTO Inc.

- Anish Scaffolding India Private Limited

- Atlantic Pacific Equipment LLC

- BSL Scaffolding

- Cangzhou Weisitai Scaffolding Co.,Ltd.

- Changli XMWY Formwork Scaffolding Co., Ltd.

- Guangdong Youying Group

- KHK Scaffolding & Formwork LLC

- MJ-Gerüst GmbH

- PERI SE

- Pilosio Srl

- Rapid Scaffolding(Engineering) Co.

- Rizhao Fenghua Scaffoldings Co., Ltd.

- Scafom-rux GmbH

- Sriman Scaffolding

- StepUp Scaffold

- Uni-Span

- Waco Kwikform Limited

- Wellmade Group

- Wilhelm Layher GmbH & Co KG

- World Scaffolding Co., Ltd.

- Youngman India Pvt. Ltd.

Actionable Strategies For Industry Leaders To Harness Scaffold Technology Innovations Drive Sustainability And Build Resilient Supply Chains In A Shifting Market

Industry leaders should fortify their supply chains by diversifying raw material sources and negotiating index-based pricing agreements with suppliers. Given the recent escalation of steel and aluminum duties, establishing dynamic procurement strategies-such as forward buying and multi-supplier frameworks-will mitigate exposure to volatile tariffs and ensure continuity of critical component availability. Implementing early engagement with domestic and alternative material producers can also secure preferential lead times amid capacity constraints.

Investing in digital transformation across product design, lifecycle monitoring, and rental operations remains paramount. Companies can achieve competitive advantage by integrating AI-powered analytics into scaffold management platforms to predict maintenance needs, optimize asset allocation, and enhance safety compliance through real-time alerts. By coupling sensor-enabled hardware with cloud-based dashboards, scaffold providers can offer differentiated service models that deliver measurable uptime improvements and cost efficiencies for clients.

Prioritizing modular and prefabricated solutions will yield operational agility and cost savings. Off-site fabrication under controlled conditions not only accelerates on-site assembly but also ensures consistent quality and adherence to evolving safety regulations. Leaders should leverage partnerships with specialized manufacturers to co-develop bespoke modular units tailored to landmark construction and industrial maintenance projects, reinforcing their reputations as innovation catalysts and trusted technical advisors.

To address sustainability imperatives, stakeholders must explore eco-friendly materials and processes, such as recyclable composite components and energy-efficient coatings. Embracing circular economy principles-through component reuse programs and end-of-life material recovery-will reduce environmental impact and align scaffold offerings with corporate ESG goals, thereby strengthening customer loyalty and securing regulatory goodwill.

Detailing Our Rigorous Research Methodology Combining Primary Interviews Secondary Data Triangulation And Robust Analysis To Ensure Report Accuracy And Reliability

Our research methodology integrates rigorous primary and secondary approaches to ensure the highest standard of accuracy and reliability. A first phase of primary interviews engaged a cross-section of stakeholders, including engineering directors, procurement managers, and site supervisors, to capture qualitative insights on emerging trends, operational pain points, and technology adoption drivers. These dialogues were conducted across North America, Europe, and Asia-Pacific to reflect diverse regulatory and market contexts.

The secondary research phase entailed a comprehensive review of industry publications, government trade data, and specialized news outlets to validate material cost dynamics, policy impacts, and competitive developments. Market segmentation was derived from thematic analysis of product types, materials, end-use industries, applications, platform heights, access methods, and pricing models. Data were triangulated through cross-referencing trade associations’ reports with company financial disclosures and regulatory filings.

Quantitative analysis included trend extrapolation based on historical tariff adjustments, production volumes, and regional infrastructure spending. We applied sensitivity testing to assess the robustness of pricing and supply chain forecasts under varying tariff scenarios. All findings underwent a multi-tiered validation process, involving a panel of industry experts who reviewed key assumptions and analytical frameworks. This layered methodology ensures that our report delivers actionable insights grounded in empirical evidence and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Scaffold Technology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Scaffold Technology Market, by Scaffold Type

- Scaffold Technology Market, by Material

- Scaffold Technology Market, by End User Industry

- Scaffold Technology Market, by Application

- Scaffold Technology Market, by Platform Height

- Scaffold Technology Market, by Access Type

- Scaffold Technology Market, by Pricing Model

- Scaffold Technology Market, by Region

- Scaffold Technology Market, by Group

- Scaffold Technology Market, by Country

- United States Scaffold Technology Market

- China Scaffold Technology Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings And Implications For Stakeholders To Propel Scaffold Technology Adoption And Navigate Emerging Industry Challenges With Confidence

Throughout this executive summary, we have highlighted the fusion of digital transformation, modular innovation, and strategic supply chain management as the critical vectors shaping scaffold technology in 2025. The convergence of AI-driven planning, sensor-based monitoring, and automated inspection methods signifies a paradigm shift toward proactive safety and operational efficiency. Simultaneously, the imposition of significant steel and aluminum tariffs underscores the enduring influence of trade policy on material sourcing and project viability.

Segmentation insights illuminate the expansive spectrum of scaffold types, materials, and pricing models available to developers seeking tailored access solutions. Regional analysis reveals differentiated adoption trajectories, from advanced prefabrication hubs in Europe to high-growth infrastructure markets in Asia-Pacific. Key industry players continue to leverage scale, engineering specialization, and digital offerings to secure market leadership, while emerging challengers focus on niche solutions and sustainability enhancements.

Looking ahead, the scaffold industry’s future will be defined by its ability to harmonize innovation with resilience-balancing advanced technological capabilities against evolving regulatory and economic landscapes. Stakeholders equipped with the comprehensive insights and strategic frameworks provided herein will be better positioned to navigate complexity, seize growth opportunities, and deliver safe, efficient, and sustainable access solutions across global construction and industrial projects.

Empower Your Strategic Initiatives With Comprehensive Scaffold Market Insights Contact Ketan Rohom To Secure Your Full Research Report And Drive Informed Decision Making

Discover how our in-depth analysis can illuminate critical opportunities and empower your strategic roadmap in the scaffold technology market. Partner directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to access the comprehensive market research report that provides actionable intelligence across emerging trends, tariff impacts, segmentation dynamics, regional outlooks, and competitive positioning. Engage with a trusted expert to secure tailored insights that drive informed decision-making, minimize risks, and accelerate growth. Reach out today to unlock the full scope of data-driven guidance and transform your understanding of this evolving industry.

- How big is the Scaffold Technology Market?

- What is the Scaffold Technology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?