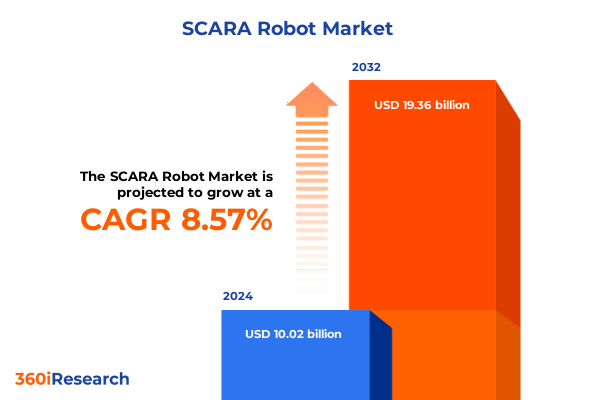

The SCARA Robot Market size was estimated at USD 10.80 billion in 2025 and expected to reach USD 11.64 billion in 2026, at a CAGR of 8.69% to reach USD 19.36 billion by 2032.

Comprehensive Exploration of How SCARA Robot Advancements Are Revolutionizing Efficiency and Precision Across Modern Manufacturing Environments

SCARA (Selective Compliance Assembly Robot Arm) robots have emerged as a cornerstone in modern industrial automation, offering unparalleled precision and speed in assembly tasks. These robots operate on a four-axis configuration that grants rigidity in the vertical plane while maintaining flexibility horizontally, making them ideally suited for high-volume, repetitive operations. As production cycles accelerate and product complexity increases, manufacturers across electronics, automotive, pharmaceuticals, and consumer goods industries increasingly rely on SCARA platforms to enhance throughput and minimize defect rates.

The evolution of material science and actuator technology has fortified SCARA robots with lighter yet stronger components, reducing cycle times without compromising accuracy. Concurrent advancements in integrated vision systems and real-time data analytics enable dynamic path correction and adaptive control, further elevating operational efficiency. Moreover, the modular nature of contemporary SCARA designs facilitates rapid reconfiguration of end effectors and payload modules, empowering production lines to pivot swiftly between product variants.

Transitioning from traditional fixed automation to these agile robotics solutions, enterprises gain not only speed and precision but also strategic resilience. The ability to redeploy SCARA cells across multiple lines, coupled with plug-and-play integration of peripheral systems, fosters both flexibility in capacity planning and cost-effective scalability. As global supply chain uncertainties persist, the agility afforded by SCARA automation positions manufacturers to respond rapidly to shifting market demands while maintaining rigorous quality standards.

Strategic investments in SCARA technology are reshaping labor dynamics by automating ergonomic tasks and reallocating human talent to value-adding functions such as system design and quality assurance. This shift diminishes reliance on manual labor for repetitive handling, thereby improving workplace safety and fostering an environment where skilled operators oversee multi-cell operations. In turn, this elevates the overall competitive posture of manufacturing facilities by blending human ingenuity with mechanical precision.

Examination of Cutting-Edge Transformations and Technological Milestones Propelling SCARA Robot Applications into New Frontiers of Automated Precision

In the past few years, the SCARA robot landscape has been transformed by rapid integration of artificial intelligence, cloud connectivity, and collaborative capabilities. Industry 4.0 frameworks now emphasize interlinked production environments where SCARA systems communicate with enterprise resource planning and manufacturing execution systems in real time. This convergence enables predictive maintenance protocols that anticipate component fatigue and schedule service interventions before unplanned downtime occurs.

Simultaneously, the advent of lightweight, force-sensitive robotic arms has ushered in a new era of human-robot collaboration. Unlike traditional industrial robots confined by safety cages, modern SCARA variants operate alongside personnel to handle intricate assembly tasks, blend materials, or assist with packaging lines. These cobot-centric models leverage embedded vision technologies to detect proximity, adjust grip strength, and perform micro-assembly operations with minimal supervision.

Another pivotal shift stems from the proliferation of digital twin simulations and edge computing solutions. Manufacturers can now model SCARA workflows virtually, optimize cycle paths, and validate process changes without disrupting physical lines. Edge-enabled analytics also facilitate localized data processing, reducing latency and ensuring secure control over sensitive intellectual property. As a result, production planners can iterate designs rapidly, enhance energy efficiency, and refine takt times with unprecedented depth of insight.

Moreover, sustainability considerations are driving material and energy optimizations within SCARA robotics. Innovations such as regenerative braking, eco-mode programming, and recyclable composite arm structures are reducing the carbon footprint of automated cells. These green initiatives resonate with corporate responsibility objectives and emerging regulatory standards, reinforcing SCARA robots as not only productivity enhancers but also contributors to sustainable manufacturing goals.

Insightful Analysis of the Mounting Effects of United States 2025 Tariff Policies on SCARA Robot Supply Chains Costs and Strategic Responses

The implementation of new United States tariffs in 2025 on imported robotic systems has had a profound effect on the cost structures of SCARA automation deployments. With import duties rising by up to 25% on equipment originating from key international suppliers, companies now face increased capital expenditures or constrained supplier choices. As a result, procurement teams are reevaluating vendor contracts, negotiating long-term service agreements, and seeking alternative sources to preserve budgetary targets.

In response to these trade measures, several OEMs have accelerated plans for local production facilities or warehousing hubs within the United States. By onshoring assembly and component manufacturing, they mitigate tariff exposure and shorten logistics cycles. This localized approach also fosters closer collaboration between integrators and end-user facilities, translating into more responsive support services and customized system adaptations.

Nonetheless, short-term disruptions have manifested in extended lead times for critical components such as precision bearings, actuator modules, and specialized end effectors. Such delays have incentivized inventory buffers and flexible manufacturing strategies, prompting some enterprises to adopt circular economy principles by refurbishing existing SCARA units rather than procuring new models. Over the longer term, these shifts may drive innovation in modular design, allowing retrofit kits to upgrade legacy systems into advanced, tariff-resilient configurations.

Furthermore, the tariff landscape has spurred deeper industry collaboration to lobby for harmonized trade regulations and mutual recognition agreements. Stakeholders including trade associations, equipment manufacturers, and corporate buyers are advocating for targeted exemptions on essential automation technologies to preserve global competitiveness.

Deep Dive into SCARA Robot Market Segmentation and How Diverse Type Class Payload Capacity Material and End Effector Variations Shape Adoption Dynamics

In examining the various segments of the SCARA robot market, the distinctions between articulated SCARA models and those designed for selective compliance assembly underscore the diversity of operational requirements across industries. Articulated variants excel in complex axis movements and higher payload scenarios, whereas classic selective compliance arms provide rapid pick-and-place efficiency for lightweight assembly tasks. Manufacturers tailor product classes accordingly, offering G-Series configurations optimized for general purpose applications alongside LS-Series, RS-Series, and T-Series lines that address specialized production environments and varying throughput targets.

Payload capacity further refines segmentation, encompassing low-capacity units handling between one to five kilograms for tasks such as micro-electronics assembly, mid-range options supporting five to ten kilograms used in component handling, and more robust models in the ten to fifteen kilogram range suited to heavier material removal operations. High-capacity systems exceeding fifteen kilograms serve niche applications in aerospace and heavy machinery, where endurance under repetitive stress defines operational success.

Material composition of robot arms presents another layer of differentiation, as choices between aluminum, carbon steel, plastic, and stainless steel influence both weight characteristics and resistance to environmental factors like corrosion or chemical exposure. This diversity extends to end effectors, where grippers ranging from two-finger mechanisms to three-finger variants-alongside specialty tools and vacuum cups-enable precision handling of diverse workpieces.

End-user industries cement this segmentation: automotive facilities employ SCARA robots for assembly processes including material removal and parts handling, while consumer goods manufacturers leverage them for material handling and packaging operations. Electronics producers integrate SCARA systems into final assembly, micro-electronics production, and PCB handling, whereas food and beverage companies optimize packaging and processing workflows. In metals and machinery, cutting and welding tasks benefit from rigid yet agile arms, and pharmaceutical organizations adopt SCARA robotics for lab automation and hygienic packaging applications.

This comprehensive research report categorizes the SCARA Robot market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Class

- Payload Capacity

- Material

- End Effector

- End-User Industry

Strategic Regional Perspective on SCARA Robot Deployment Trends Across the Americas Europe Middle East Africa and Asia Pacific Industrial Sectors

A regional lens reveals distinctive adoption patterns and deployment strategies for SCARA robotics across the Americas, Europe, Middle East and Africa, and the Asia-Pacific. In the Americas, rapid reshoring initiatives have catalyzed investment in automation cells as companies prioritize supply chain resilience. Key industries such as automotive manufacturing, consumer electronics, and pharmaceuticals are integrating SCARA robots to streamline high-volume production and reduce dependency on manual labor. Moreover, North American system integrators are forging partnerships with local suppliers to expedite customization and ensure compliance with domestic regulatory standards.

Across Europe, the Middle East and Africa, advanced manufacturing hubs in Germany, France, and the United Kingdom drive demand for SCARA systems capable of supporting both large-scale automotive assembly and niche artisanal production. Labor cost pressures in Western Europe incentivize adoption of robots that can handle precision tasks in food processing, packaging, and medical device assembly, while nations in the Middle East are investing in robotics to diversify economic bases and enhance operational efficiency in industries ranging from oil and gas to consumer goods.

The Asia-Pacific region retains its position as the largest market for SCARA robotics, fueled by strong electronics production in China, Japan, and South Korea. Manufacturers in these markets leverage high-speed SCARA platforms for semiconductor wafer handling, micro-electronics assembly, and mobile device packaging. Emerging economies in Southeast Asia and India are also ramping up deployment of mid-range payload models to support automotive component fabrication and pharmaceutical packaging, bolstered by favorable government incentives for advanced manufacturing.

Across all regions, strategic alignment between local policy frameworks and automation roadmaps continues to shape investment decisions. Incentive programs for smart factories, tax credits for capital equipment, and vocational training initiatives collectively influence the pace at which SCARA robotics permeates diverse industrial sectors.

This comprehensive research report examines key regions that drive the evolution of the SCARA Robot market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Evaluation of Major SCARA Robot Manufacturers and Technology Innovators Steering Competitive Dynamics and Collaborative Partnerships Globally

In the competitive arena of SCARA robotics, several multinational corporations and specialized technology innovators are driving continuous evolution through product enhancements and strategic alliances. Industry stalwarts such as FANUC and Yaskawa have fortified their portfolios with advanced control architectures and expanded global service networks, enabling faster deployment cycles and comprehensive after-sales support. Meanwhile, Epson and Omron have introduced lightweight, force-sensing cobot variants that capitalize on intuitive programming interfaces, appealing to manufacturers seeking rapid ROI on automation investments.

Kawasaki and Toshiba have diversified their offerings by integrating proprietary vision guidance systems and edge analytics capabilities into their SCARA lines, thereby facilitating adaptive process optimization and real-time error correction. These developments underscore a broader trend toward turnkey solutions where hardware, software, and maintenance services converge under unified vendor agreements. Additionally, emerging players specializing in modular end effector design and artificial intelligence algorithms are carving niche positions by delivering hyper-customized tooling for semiconductor, medical device, and laboratory automation applications.

Collaborative partnerships between equipment OEMs and system integrators have also gained prominence, streamlining the translation of theoretical research into factory floor implementations. Joint ventures aimed at developing open architecture control platforms and interoperable network protocols highlight the industry’s shift toward standardized ecosystems. In turn, end users benefit from reduced integration complexity and enhanced scalability as they build multi-vendor automation strategies that leverage the strengths of different technology providers.

Altogether, this dynamic competitive landscape challenges market participants to invest in continuous innovation, deepen customer engagement, and pursue cross-industry collaborations to maintain leadership in a rapidly evolving automation frontier.

This comprehensive research report delivers an in-depth overview of the principal market players in the SCARA Robot market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Anhui EFORT Intelligent Equipment Co., Ltd.

- Comau S.p.A.

- Delta Electronics, Inc.

- DENSO Corporation

- Estun Automation Co., Ltd.

- FANUC Corporation

- Inovance Technology Co., Ltd.

- Kawasaki Heavy Industries, Ltd. (Robotics Division)

- KUKA AG

- Mitsubishi Electric Corporation

- Nachi-Fujikoshi Corp.

- Omron Corporation

- QKM (Robot) Co., Ltd.

- Seiko Epson Corporation

- Shibaura Machine Co., Ltd.

- Siasun Robot & Automation Co., Ltd.

- Stäubli International AG

- Yamaha Motor Co., Ltd.

- Yaskawa Electric Corporation

Targeted Recommendations to Empower Industrial Leaders with Actionable Strategies for Harnessing SCARA Robotics to Elevate Operational Excellence

Industry leaders poised to leverage SCARA robotics effectively should prioritize modular system architectures that facilitate rapid reconfiguration of production cells to accommodate evolving product portfolios. By adopting standardized communication protocols and interoperable hardware interfaces, manufacturers can streamline integration of new components without extensive reengineering. Concurrently, investing in cohesive partnerships with vision system providers and analytics platforms empowers real-time process monitoring and agility in addressing quality deviations.

To mitigate the impact of trade-related cost fluctuations, organizations should develop localized supply chain strategies that balance domestic sourcing with global vendor relationships. Establishing regional assembly or refurbishment centers for SCARA units not only reduces tariff burdens but also accelerates maintenance response times. Moreover, embedding preventative maintenance schedules coupled with condition-based monitoring extends equipment longevity and safeguards operational continuity.

Workforce development initiatives represent another critical lever for success. Upskilling technicians in robotics programming, data interpretation, and collaborative robot safety protocols ensures that human capital complements automated work cells. Structured training programs and certification pathways foster a culture of continuous improvement, enabling cross-functional teams to identify process bottlenecks and collaborate on solutions.

Finally, piloting digital twin simulations of SCARA workflows allows decision-makers to validate layout configurations, optimize cycle times, and stress-test emergency stop scenarios in a virtual environment. This practice reduces on-floor disruptions and informs capital allocation decisions with a higher degree of confidence. Collectively, these actionable strategies will position forward-looking enterprises to harness the full potential of SCARA robotics, driving productivity gains and sustainable competitive advantage.

Transparent Overview of Rigorous Research Methodology Underpinning SCARA Robot Market Insights Including Data Collection Analysis and Validation Processes

The research underpinning this analysis combines rigorous primary and secondary methodologies to ensure comprehensive coverage of SCARA robot market dynamics. Primary research involved structured interviews with senior executives at original equipment manufacturers, system integrators, and leading end users across automotive, electronics, and pharmaceutical sectors. These qualitative insights were complemented by targeted surveys designed to capture real-world utilization patterns, procurement criteria, and expected technology adoption timelines.

Secondary research encompassed an extensive review of industry publications, technical whitepapers, patent filings, and regulatory filings from governmental agencies overseeing trade and industrial standards. This desk research provided vital context regarding technological breakthroughs, tariff policy changes, and regional investment incentives. Data points extracted from public financial statements and corporate disclosures were meticulously cross-referenced to validate trends observed in primary interviews.

To triangulate findings, a multi-level validation process was deployed, wherein preliminary conclusions were presented to an external advisory panel comprising robotics researchers, manufacturing engineers, and trade policy experts. Feedback loops ensured that emerging hypotheses maintained empirical grounding and reflected the latest innovations in control systems, materials engineering, and additive manufacturing techniques for end effectors.

Finally, data synthesis was achieved through advanced analytics tools that organized insights by segmentation, region, and technology theme. Strict quality control measures, including consistency checks and peer reviews, reinforced the reliability of the report’s conclusions, offering stakeholders a robust foundation for strategic decision-making in the evolving landscape of SCARA robotics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our SCARA Robot market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- SCARA Robot Market, by Type

- SCARA Robot Market, by Class

- SCARA Robot Market, by Payload Capacity

- SCARA Robot Market, by Material

- SCARA Robot Market, by End Effector

- SCARA Robot Market, by End-User Industry

- SCARA Robot Market, by Region

- SCARA Robot Market, by Group

- SCARA Robot Market, by Country

- United States SCARA Robot Market

- China SCARA Robot Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Summative Reflection on SCARA Robot Evolution Key Insights and Implications for Industry Stakeholders Navigating Future Automation Challenges

In conclusion, SCARA robots stand at the forefront of industrial automation, marrying high-speed precision with adaptable configurations that address the nuanced demands of modern manufacturing. Recent technological advancements in force-sensitive actuators, embedded vision, and digital twin simulations have expanded their applicability across diverse sectors ranging from micro-electronics assembly to pharmaceutical packaging. These developments underscore the critical role of SCARA solutions in achieving operational excellence and sustaining competitive differentiation.

The introduction of augmented tariff measures in 2025 has challenged stakeholders to adopt more resilient supply chain models and to emphasize local production and refurbishment capabilities. At the same time, segmentation analysis reveals that varying class, payload capacity, material composition, and end effector configurations offer targeted pathways to optimize performance for specific tasks. Regional insights highlight differentiated growth trajectories, with the Americas focusing on reshoring, Europe and Middle East and Africa prioritizing high-value production, and Asia-Pacific leading in scale and innovation.

Major technology providers continue to enhance their offerings through strategic alliances, AI-driven control systems, and service network expansions, while emerging specialists push the boundaries of end-of-arm tooling and collaborative operation. For industry leaders, the confluence of these dynamics presents an opportunity to refine automation strategies, invest in workforce upskilling, and deploy predictive analytics to drive ROI.

Ultimately, the evolution of SCARA robotics will pivot on the ability of organizations to integrate advanced technologies, navigate policy shifts, and harness deep insights into segmentation and regional variances. By doing so, manufacturers can secure a dynamic and resilient automation framework that unlocks new levels of productivity and agility.

Direct Invitation to Engage with Ketan Rohom Associate Director Sales Marketing for Exclusive Access to In-Depth SCARA Robot Market Research Report

We invite you to take the next step in fortifying your automation strategy by engaging with Ketan Rohom, Associate Director of Sales and Marketing. With in-depth expertise in industrial robotics market intelligence, Ketan can guide you through the comprehensive report that dissects SCARA robot segmentation, regional dynamics, competitive landscapes, and actionable recommendations tailored to your operational needs.

By partnering with Ketan, you gain access to exclusive analyses that illuminate the latest technological breakthroughs, tariff impact assessments, and strategic best practices. His consultative approach ensures that the insights provided align with your organization’s objectives, whether optimizing production throughput, enhancing quality control, or designing resilient supply chains. Schedule a personalized walkthrough of the findings to uncover how SCARA robotics can transform your manufacturing capabilities and position your enterprise for long-term success.

Whether you lead procurement, engineering, or executive decision-making, gaining clarity on SCARA robotics is essential to maintain a competitive edge. Reach out to Ketan to explore custom research packages, receive tailored data sets, and understand how these insights translate into measurable performance improvements. Don’t miss the opportunity to leverage market-leading expertise and catalyze your journey toward smarter, more efficient production systems.

Connect directly with Ketan Rohom to secure your copy of the SCARA Robot Market Research Report today and unlock the targeted intelligence that will empower your automation initiatives.

- How big is the SCARA Robot Market?

- What is the SCARA Robot Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?