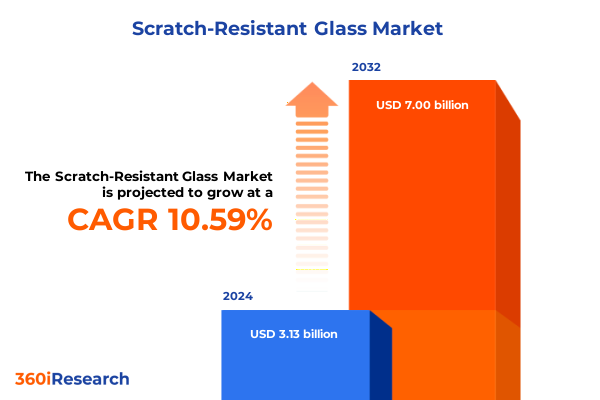

The Scratch-Resistant Glass Market size was estimated at USD 3.46 billion in 2025 and expected to reach USD 3.84 billion in 2026, at a CAGR of 10.56% to reach USD 7.00 billion by 2032.

Pioneering Clarity and Durability Across Industries Through Advanced Scratch-Resistant Glass Solutions, Driving Performance and Innovation

Scratch-resistant glass technology has reshaped the way industries approach durability and clarity in products ranging from consumer electronics to architectural applications. Originally propelled into the spotlight by Corning’s introduction of Gorilla Glass in 2008, the field has seen successive generations of material enhancements emphasizing both scratch resistance and thinness, catering to the growing demand for sleeker, more robust devices. With the debut of Gorilla Armor 2 and Gorilla Glass Ceramic 2 in 2025, manufacturers have achieved unprecedented drop performance while maintaining high hardness levels, underscoring the material’s transformative role in modern design and engineering.

As device ecosystems evolved, the need for surfaces that could withstand daily wear and tear without compromising optical clarity intensified. Scratch-resistant glass transitioned from a premium feature to a standard expectation in smartphone displays, tablet screens, and wearable devices. This shift has cascaded into adjacent sectors, reinforcing the value of abrasion-resistant surfaces for solar modules, architectural glazing, and precision instrumentation. Consequently, the material has become a foundational component in product roadmaps, driving manufacturers to incorporate advanced coatings and strengthened substrates early in the development cycle.

Revolutionary Material Innovations and Sustainability Imperatives Redefining the Scratch-Resistant Glass Industry Landscape

Breakthrough material innovations have redefined performance benchmarks and sustainability imperatives within the scratch-resistant glass domain. Recent advancements in thin-film deposition techniques allow for anti-scratch, hard, and oleophobic coatings that bond at the molecular level, enhancing wear resistance while supporting ultra-thin form factors. These dynamic coatings not only extend product lifespans but also reduce overall material usage, contributing to circular economy objectives and lowering environmental footprints without sacrificing quality.

Simultaneously, ion exchange processes have matured into versatile multi-stage and single-stage protocols that optimize surface compression and subsurface tensile strength. These refined treatments deliver tailored hardness profiles suitable for diverse applications, from rugged smartphone covers to large-format architectural panels. The integration of data-driven quality control and Industry 4.0 methodologies in manufacturing facilities has further accelerated process consistency and yield, enabling producers to meet escalating demand with minimal waste and heightened energy efficiency.

In parallel, stringent environmental regulations and stakeholder pressure have catalyzed the adoption of eco-friendly raw materials and water-efficient coatings. Manufacturers are leveraging closed-loop water systems and renewable energy sources to power their production lines, aligning with global decarbonization targets and bolstering corporate sustainability narratives. As a result, the industry is witnessing a convergence of performance-driven innovation and responsible manufacturing practices, driving long-term competitive differentiation.

Assessing the Multi-Sector Effects of 2025 U.S. Tariff Actions on the Scratch-Resistant Glass Supply Chain and Cost Structures

The cumulative impact of U.S. tariff actions in 2025 has reverberated across the scratch-resistant glass supply chain, influencing cost structures and sourcing strategies. On March 26, 2025, a presidential proclamation invoked Section 232 to impose an additional 25% tariff on imported passenger vehicles and light trucks, with an effective rate of 27.5% on passenger cars and 50% on light trucks, as well as 25% on automotive parts by May 3. This escalation has directly increased the cost of automotive-grade scratch-resistant windshields and rear windows, prompting major OEMs and aftermarket suppliers to explore nearshoring in Mexico and realignment of regional value chains.

In the electronics sector, 2025 tariff adjustments of 25–35% on semiconductors and consumer devices have introduced higher input costs for scratch-resistant display covers and cover lenses. The elevated duties have accelerated migration toward alternative component sources in Southeast Asia and India, while manufacturers are intensifying investments in domestic assembly lines to secure partial mitigations under evolving content-certification schemes.

Meanwhile, renewable energy applications have felt the effects of both Section 201 safeguard tariffs averaging 14% on crystalline silicon photovoltaic cells and modules, as well as a doubling of polysilicon duties to 50% from China effective January 1, 2025. These measures have raised the cost of tempered and strengthened glass modules used in utility-scale and rooftop solar installations by an estimated 30%, compelling project developers to reassess technology providers and consider integrated glass-cell solutions to achieve stable pricing.

Collectively, these tariff actions underscore the importance of supply chain agility. They have driven stakeholders to diversify sourcing across Mexico, Vietnam, and India, negotiate tariff exclusions, and pursue strategic inventory management, ensuring continuity of supply and cost predictability amid an increasingly complex trade environment.

Unveiling Critical Insights Across Application, Product Type, and Distribution Channel Segmentation to Illuminate Market Dynamics

Drawing insights from application segmentation reveals that the automotive industry’s demand for durable, scratch-resistant windshields and side windows has galvanized investment in both coated and chemically strengthened glass solutions. In building and construction, architects and developers prioritize abrasion-resistant facades and interior partitions that maintain visual clarity over time, while consumer electronics manufacturers rely on ultra-thin, scratch-proof cover glass to meet rigorous drop and scratch tests. In the medical devices arena, biocompatible glass surfaces with sterilization resistance are essential, and precision optical instruments demand substrate uniformity and surface integrity. The solar energy segment similarly values robust protective layers on PV modules that withstand exposure to environmental particulates and cleaning cycles.

Examining product type segmentation uncovers parallel dynamics: Coated glass offerings span anti-scratch coatings, which employ diamond-like carbon films to bolster surface hardness; hard coatings that integrate silicon carbide matrices for superior wear resistance; and oleophobic layers that repel oils and reduce smear. Ion exchanged glass variants leverage multi-stage salt-bath protocols to induce deep compressive layers suitable for thicker profiles, as well as single-stage processes optimized for cost-effective strengthening of slender substrates, accommodating diverse form factors and performance criteria.

In distribution channel segmentation, aftermarket providers address retrofitting and repair needs, servicing both automotive windshields and architectural panels. Original equipment manufacturers embed scratch-resistant glass directly into product assemblies, ensuring seamless integration and consistent quality. Retail channels bifurcate into offline direct sales through specialty stores and large-format retailers offering hands-on customer experiences, and online platforms where company websites and e-commerce marketplaces facilitate rapid procurement and technical consultation for B2B and B2C clients.

This comprehensive research report categorizes the Scratch-Resistant Glass market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- Distribution Channel

Comparative Regional Dynamics in the Americas, EMEA, and Asia-Pacific Shaping the Evolution of the Scratch-Resistant Glass Market

In the Americas, the United States, Canada, and Mexico dominate by virtue of advanced automotive manufacturing hubs and high consumer electronics penetration. Regional trade agreements and robust infrastructure investments underpin substantial demand for scratch-resistant glass in vehicle windshields, smartphone displays, and solar installations. Meanwhile, Latin American markets exhibit growing interest in energy-efficient building envelopes and PV systems, albeit tempered by fiscal constraints and slower adoption curves.

Europe, the Middle East & Africa present a diverse landscape shaped by stringent safety and sustainability regulations. Western European nations emphasize circular economy practices and local production, supporting advanced architectural glazing and specialty optics. The Middle East’s accelerated investment in large-scale solar farms increases demand for durable protective glass, while African markets are in earlier stages of industrialization, signaling future potential as infrastructure and manufacturing capabilities expand.

Asia-Pacific maintains its position as the global production nucleus for scratch-resistant glass. Japan, South Korea, and China lead with cutting-edge ion exchange facilities and thin-film coating lines. Rapid urbanization and digital adoption in China and India drive volumes in consumer devices and building materials, while Southeast Asia emerges as both a consumption and secondary manufacturing base as global players diversify away from single-country dependence.

This comprehensive research report examines key regions that drive the evolution of the Scratch-Resistant Glass market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles and Innovation Leadership Driving Competitive Advantage in the Scratch-Resistant Glass Sector

Corning Incorporated has solidified its leadership through continuous innovation in the Gorilla Glass franchise. The introduction of Gorilla Armor 2 and Gorilla Glass Ceramic 2 in 2025 demonstrates the company’s commitment to advancing both drop performance and scratch resistance, earning adoption by leading smartphone OEMs such as Samsung for the Galaxy S25 series.

AGC Inc., founded in 1907 and headquartered in Tokyo, commands global presence across automotive, architectural, and specialty glass segments. Through subsidiaries such as AGC Automotive Glass Mexico and Asahi India Glass, the company blends proprietary coatings and ion exchange technologies to deliver tailored solutions for windshields, building facades, and solar applications, reinforcing its status as the world’s largest glass producer.

Guardian Glass LLC and SCHOTT AG distinguish themselves through high-performance laminated products and glass-ceramic composites. Guardian’s DiamondGuard coating, deployed on landmark installations like the Empire State Building, offers a tenfold increase in scratch resistance and aligns with LEED Gold sustainability goals by reducing replacement frequency. SCHOTT’s focus on medical and optical instrumentation has led to innovations in ultra-clear, scratch-resistant ceramics, supporting rigorous sterility and imaging requirements.

Nippon Electric Glass Co., Ltd. and Edmund Optics Inc. cater to precision markets by manufacturing high-clarity optical substrates with tightly controlled composition and polishing protocols, ensuring scratch resistance for lenses, windows, and sensor covers. Meanwhile, Crystalwise Technology Inc., KYOCERA Corporation, Monocrystal, and Rubicon Technology advance specialty substrates for emerging sectors such as augmented reality, photonics, and semiconductor process equipment, leveraging proprietary materials and deposition processes to meet exacting performance specifications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Scratch-Resistant Glass market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- Arcon Flach- und Sicherheitsglas GmbH & Co. KG

- Asahi Glass Co.

- Beijing Northglass Technologies Co. Ltd.

- Cardinal Glass Industries

- Central Glass Co., Ltd.

- China Glass Holdings Limited

- Compagnie de Saint-Gobain S.A.

- Corning Incorporated

- Crystalwise Technology Inc.

- Fuyao Glass Industry Group Co., Ltd.

- Guardian Industries, LLC

- Kyocera Corporation

- Murata Manufacturing Co., Ltd.

- Nippon Electric Glass Co., Ltd.

- POLYVANTIS GmbH

- Qingdao Tsing Glass Co. Limited

- SCHOTT AG

- Taiwan Glass Industry Corporation

- Türkiye Şişe ve Cam Fabrikaları A.Ş.

- Xinyi Glass Holdings Limited

- Şişecam Group

Strategic Action Roadmap for Industry Leaders to Capitalize on Emerging Opportunities in the Scratch-Resistant Glass Market

Industry leaders should prioritize strategic diversification of supply chains by engaging suppliers in Mexico, India, and Southeast Asia, mitigating tariff exposure and geopolitical risks while capitalizing on favorable trade frameworks. Concurrently, forging deeper partnerships with OEMs across automotive and electronics verticals can unlock integrated design synergies, streamlining certification pathways and accelerating time to market.

Investing in next-generation coating platforms and ion exchange facilities is critical for maintaining performance differentiation. Allocating R&D resources toward glass-ceramic composites and multifunctional coatings-such as combined anti-reflective and scratch-resistant layers-will address evolving customer demands in solar energy, architectural design, and wearable devices. Complementary investments in digital manufacturing, including real-time process monitoring and predictive maintenance, will further enhance yield and cost efficiency.

Sustainability must underpin future growth strategies. Implementing closed-loop recycling systems for end-of-life glass and relocating toward zero-carbon manufacturing baselines will resonate with regulators and end-users alike. Companies should pursue circular economy certifications and integrate lifecycle assessments into product roadmaps to demonstrate verifiable environmental benefits.

Finally, engaging proactively in policy dialogues and securing tariff exemptions or content-certification programs can yield tangible cost advantages. By participating in industry consortia and working groups, companies will gain early visibility into regulatory shifts and align advocacy efforts to safeguard market access and competitiveness.

Rigorous Multi-Dimensional Research Methodology Combining Qualitative and Quantitative Analysis with Industry-Expert Validation

This research employs a multi-tiered approach, beginning with extensive secondary analysis of public filings, regulatory databases, and industry publications to contextualize market drivers and emerging trends. The initial data matrix was populated with specifications, technological attributes, and regulatory developments drawn from authoritative sources and cross-referenced for consistency.

Subsequently, primary research was conducted through in-depth interviews with senior executives, R&D heads, and procurement leads across major glass manufacturers, OEMs, and end-user organizations. These discussions validated secondary findings, provided qualitative insights into supply chain adaptations, and illuminated strategic imperatives, ensuring that the report’s conclusions reflect real-world decision-making criteria.

Data triangulation techniques were applied by comparing aggregated interview insights against public announcements and trade data, thereby reinforcing the credibility of key themes. Segmentation analyses were developed using rigorous criteria, mapping application, product type, and distribution channels to performance metrics and adoption rates. Each stage was subject to peer review by an external advisory panel of glass industry experts, who vetted methodological integrity and data accuracy.

Risk assessment frameworks were integrated to evaluate geopolitical, regulatory, and technological uncertainties. The final report synthesizes these layers to deliver actionable intelligence, balancing depth of analysis with clarity to support informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Scratch-Resistant Glass market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Scratch-Resistant Glass Market, by Product Type

- Scratch-Resistant Glass Market, by Application

- Scratch-Resistant Glass Market, by Distribution Channel

- Scratch-Resistant Glass Market, by Region

- Scratch-Resistant Glass Market, by Group

- Scratch-Resistant Glass Market, by Country

- United States Scratch-Resistant Glass Market

- China Scratch-Resistant Glass Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Synthesis of Strategic Insights Illustrating the Critical Role of Scratch-Resistant Glass in Driving Future Market Success

The comprehensive examination of technological advancements, tariff implications, and segmentation dynamics underscores the pivotal role of scratch-resistant glass in shaping the future of multiple industries. Material innovations, from advanced coatings to glass-ceramic composites, are converging with sustainability imperatives to elevate performance benchmarks and environmental stewardship.

Regional insights highlight diverse growth trajectories, with the Americas, EMEA, and Asia-Pacific each presenting unique opportunities shaped by regulatory environments, industrial capacity, and consumption patterns. Leading companies are leveraging R&D, strategic partnerships, and supply chain realignment to maintain competitiveness, while targeted recommendations emphasize resilience and forward-looking investment.

By adhering to a robust research methodology that marries secondary data with executive-level insights, stakeholders gain a nuanced understanding of market catalysts and constraints. The strategic roadmap and actionable guidance equip decision-makers to navigate complexities, capitalize on emerging trends, and secure lasting differentiation in an increasingly competitive landscape.

Unlock In-Depth Market Intelligence and Drive Growth by Engaging Directly with Associate Director Ketan Rohom for Comprehensive Research Access

Embark on a journey toward unmatched competitive insight by connecting directly with Ketan Rohom, Associate Director of Sales & Marketing. Engage in a personalized consultation that illuminates granular market nuances, enabling you to align product development and go-to-market strategies with real-time intelligence and stakeholder perspectives.

Secure exclusive early access to comprehensive analytical frameworks, enabling you to anticipate industry inflection points and preemptively shape your roadmap. This partnership extends beyond a transaction; it fosters an ongoing dialogue tailored to your organization’s objectives, ensuring that each data-driven recommendation is fully contextualized for your business environment.

Take action now to elevate your strategic initiatives with specialized advisory support. By partnering with Ketan Rohom, you’ll gain direct access to proprietary research, custom segment analyses, and priority briefing sessions designed to accelerate decision-making and drive revenue growth.

- How big is the Scratch-Resistant Glass Market?

- What is the Scratch-Resistant Glass Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?