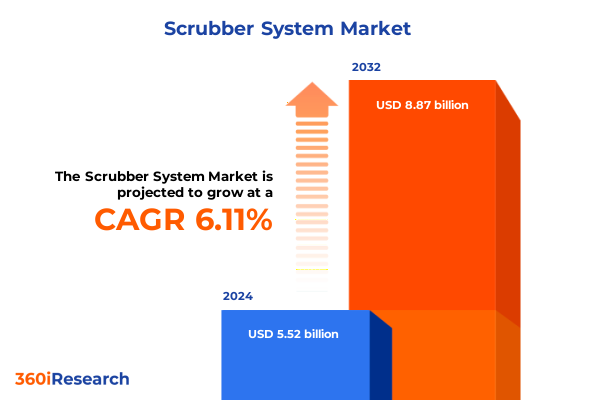

The Scrubber System Market size was estimated at USD 5.80 billion in 2025 and expected to reach USD 6.10 billion in 2026, at a CAGR of 6.25% to reach USD 8.87 billion by 2032.

Industrial scrubber system market poised for unparalleled expansion driven by stringent emission regulations, sustainability imperatives, and innovation

The industrial scrubber system market is navigating an era defined by increasingly stringent environmental regulations and an unwavering corporate commitment to sustainable operations. As industries worldwide confront mounting pressure to diminish their emissions footprint, scrubber technologies have emerged as indispensable solutions for controlling airborne pollutants. From traditional wet scrubbers that leverage liquid–gas interaction to advanced dry and semi-dry systems, the breadth of offerings reflects a vibrant ecosystem of innovation aimed at meeting diverse application requirements.

In response to expanding regulatory mandates, equipment manufacturers have accelerated product development cycles to integrate digital monitoring and advanced materials. Consequently, real-time analytics are now embedded within many systems, enabling predictive maintenance and optimized chemical usage. These advancements not only reduce operational downtime but also ensure compliance with both domestic standards set by agencies such as the US Environmental Protection Agency and international directives targeting maritime and heavy industry emissions.

Furthermore, corporate sustainability agendas are fostering deeper collaboration between end users and technology providers. Cross-sector partnerships have proliferated, combining expertise in chemical absorption, adsorption media, and biofiltration. As a result, the membrane of traditional industrial boundaries is dissolving, giving way to integrated environmental management platforms that align emission control with broader energy efficiency and waste reduction objectives.

Global scrubber system landscape undergoing transformative shifts as digitalization and stringent environmental policies shape the future of emission control

In recent years, the emission control landscape has undergone profound transformation as digitalization and policy shifts converge to redefine scrubber system capabilities. Advanced sensor networks and the Industrial Internet of Things now enable continuous performance monitoring, predictive diagnostics, and automated chemical dosing. Consequently, operators can anticipate maintenance cycles, reduce reagent waste, and optimize energy consumption with unprecedented precision.

Moreover, the drive toward decarbonization has spurred the integration of scrubber systems with renewable energy assets. Facilities equipped with solar or wind generation are piloting hybrid configurations, wherein scrubber power demands are partially offset by green energy sources. This evolution not only mitigates greenhouse gas emissions but also aligns environmental compliance with corporate net-zero targets.

Additionally, evolving regulatory frameworks have accelerated the adoption of low-impact technologies. Stricter limits on sulfur oxide and particulate emissions have incentivized the replacement of legacy units with more efficient absorption and adsorption solutions. As a result, the market is witnessing a shift from conventional wet designs toward dry and semi-dry alternatives, driven by concerns over water scarcity and wastewater management. These combined forces are setting a new paradigm for emission control that prioritizes adaptability, resilience, and environmental stewardship.

Compounded effects of 2025 United States tariffs reverberate across scrubber system supply chains, driving cost escalation and strategic realignment

The cumulative impact of 2025 United States tariffs has rippled through scrubber system supply chains, recalibrating cost structures and supplier relationships. In particular, levies on key metals and chemical precursors have elevated component prices, prompting original equipment manufacturers to reassess procurement strategies. Consequently, firms have begun negotiating long-term contracts to stabilize input costs and mitigate future tariff volatility.

In parallel, the tariffs have catalyzed a nearshoring trend, as companies seek to shorten lead times and reduce exposure to international trade uncertainties. This adjustment has driven investment in domestic fabrication capabilities and fostered partnerships with local catalyst and filter media producers. As a result, supply chain resilience has improved, although some end users continue to face inventory shortages and delivery delays due to the lingering effects of prior trade disruptions.

Furthermore, the tariff landscape has underscored the importance of strategic inventory management. Organizations are increasingly leveraging buffer stocks and safety inventories for critical spare parts, ensuring uninterrupted operations in the face of fluctuating material costs. At the same time, the cumulative financial burden has intensified the focus on lifecycle cost analysis, driving demand for scrubber systems with lower operational expenditures and extended maintenance intervals.

Granular segmentation insights reveal how application, product type, technology, end user, and deployment modes shape scrubber system adoption patterns

Granular segmentation reveals that the demand landscape for scrubber systems varies significantly across industrial applications, product configurations, underlying technologies, end-use industries, and deployment architectures. In chemical processing, scrubber adoption is heavily influenced by the specific needs of agrochemical, inorganic, and petrochemical sub-segments, where precise pH control and high removal efficiencies are essential. Meanwhile, in metals and mining operations, robust corrosion resistance and particulate handling capabilities are paramount, prompting a preference for semi-dry and wet scrubbers with advanced mist elimination.

From a product perspective, dry scrubbers incorporating cyclone separators, electrostatic precipitators, and fabric filters are gaining traction in sectors facing water scarcity, whereas wet scrubbers-encompassing packed beds, spray towers, and venturi designs-remain indispensable where high pollutant solubility is targeted. Technological dynamics further nuance this picture, as absorption solutions leveraging chemical and physical media continue to compete with adsorption systems based on activated carbon and zeolite. Biofiltration, although still emerging, is attracting interest for odor-control applications in food and beverage processing.

In the context of end-user industries, automotive facilities are adopting scrubbers both in OEM assembly lines and aftermarket service centers, and healthcare environments deploy them in clinics and hospitals to manage sterilization by-products. Food and beverage plants, spanning beverages and dairy operations, prioritize hygiene and compliance, while heavy and light manufacturing sectors focus on minimizing particulate emissions. Deployment modes range from portable units for temporary remediation projects to fixed or skid-mounted stationary systems designed for continuous operations, each catering to distinct operational requirements and capital considerations.

This comprehensive research report categorizes the Scrubber System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Deployment Mode

- Application

- End User

Comparative regional dynamics in Americas, Europe Middle East & Africa, and Asia-Pacific underscore divergent drivers of scrubber system deployment

Regional dynamics are markedly distinct across the Americas, Europe Middle East & Africa, and Asia-Pacific, with each zone shaped by unique regulatory, economic, and infrastructural drivers. In North America, stringent federal and state regulations have incentivized retrofitting of aging industrial installations, and growing environmental advocacy is accelerating the replacement of legacy systems. Meanwhile, Latin American markets are characterized by nascent regulatory enforcement, creating opportunities for early movers to establish strong distribution and service networks.

Across Europe, ambitious carbon reduction targets and the expansion of emissions trading schemes have cultivated a mature market for high-efficiency scrubber technologies. The Middle East is witnessing a gradual shift from oil-dependent frameworks toward greener production methods, with major petrochemical complexes beginning to integrate advanced sorbent and absorption systems. In Africa, infrastructure development in mining and power generation is prompting interest in modular and portable scrubber solutions, particularly in regions where grid stability remains a challenge.

Asia-Pacific stands out for its rapid industrialization and dual focus on air quality improvement and energy transition. China’s commitment to peak carbon by 2030 is driving large-scale installations in steel, cement, and power sectors, while India’s modernization efforts are catalyzing demand for retrofits in coal-fired plants. Southeast Asian economies, balancing growth with environmental stewardship, are exploring hybrid systems that optimize water use and energy efficiency, reflecting a broader trend toward sustainable industrial ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Scrubber System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic positioning and competitive benchmarks among leading scrubber system manufacturers illuminate pathways for differentiation and market leadership

Leading scrubber system manufacturers are employing distinct strategies to secure competitive advantage, from technology licensing and joint ventures to targeted acquisitions. Several global players have expanded their portfolios through the integration of digital service platforms, providing customers with remote monitoring, analytics, and performance optimization tools. This shift toward servitization enables companies to differentiate through recurring revenue models and deepen customer relationships.

Some organizations are focusing on proprietary sorbent and catalyst developments, leveraging in-house research and development to improve pollutant capture efficiencies and extend media lifetimes. Others are forging strategic alliances with specialist chemical providers to co-develop turnkey solutions, thereby reducing time to market and enhancing cost competitiveness. In parallel, a cohort of innovative entrants is disrupting the status quo with biofiltration modules and modular skid-mounted designs tailored for rapid deployment and minimal footprint.

Moreover, performance benchmarking has become a cornerstone of corporate positioning. Companies are publishing rigorous third-party validation studies and securing certifications that attest to removal rates for sulfur oxide, hydrogen sulfide, and volatile organic compounds. As a result, procurement teams are increasingly evaluating offerings not only on capital costs but also on total cost of ownership and environmental impact metrics, underscoring the multidimensional nature of competitive leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Scrubber System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aarco Engineering Projects Pvt. Ltd.

- Aerotech Equipments And Projects (P) Ltd

- Apzem Inc

- Aswathi Industries Limited

- Branch Environmental Corp.

- Catalytic Products International

- CDC Dust Control

- CECO Enviromental Crop

- EBARA Technologies, Inc.

- Enoch’s Industries Pvt. Ltd.

- Fuji Electric Corp.

- Gaumer Process

- MIURA CHEMICAL EQUIPMENT CO.,LTD.

- Pollution Systems

- Prantner GmbH Verfahrenstechnik

- PVAG water systems GmbH

- Scheuch GmbH

- Schutte & Koerting

- Stratgem Projects

- Teral-Aerotech Fans Pvt. Ltd

- Texel-Seikow U.S.A Inc

- Valmet Oyj

- VG Engineers Pvt Ltd.

- Zhengzhou Laboao Instrument Equipment CO., LTD

- Äager GmbH

Clear strategic recommendations empower industry leaders to optimize operations, mitigate risks, and capitalize on emerging opportunities in scrubber systems

Industry leaders should prioritize the integration of digital twins and advanced analytics into scrubber systems to elevate predictive maintenance and reduce operational downtime. By investing in real-time performance dashboards, organizations can identify emerging issues before they escalate into costly shutdowns, thereby maximizing asset uptime and extending equipment lifespans. In addition, adopting modular designs will enhance flexibility for capacity expansion and facilitate quicker installation, enabling agile responses to fluctuating emissions requirements.

Furthermore, companies must diversify their supply chains to mitigate the lingering effects of tariff volatility and global disruptions. Establishing partnerships with multiple regional suppliers of critical media and components ensures continuity and cost stability. Concurrently, embedding sustainability criteria into vendor selection processes enhances resilience and aligns procurement practices with overarching ESG goals.

Finally, industry stakeholders should explore strategic alliances and co-innovation initiatives with end-user industries. Collaborative pilots and joint R&D programs can accelerate the development of next-generation sorbents, membranes, and biofiltration media, positioning participants at the forefront of emerging technology curves. Together, these recommendations will enable organizations to optimize performance, manage risk, and capitalize on evolving market opportunities in the scrubber system domain.

Robust mixed-method research approach leveraging primary interviews and secondary sources ensures comprehensive analysis and rigor of scrubber system findings

The research methodology underpinning this analysis combines a structured, mixed-method approach to ensure both breadth and depth in understanding the scrubber system ecosystem. Secondary research involved an exhaustive review of industry journals, regulatory filings, patent databases, and technical standards to map historical developments and technological innovations. This desk-based work provided the foundational context for identifying trends, challenges, and emerging use cases.

Primary research comprised in-depth interviews with equipment manufacturers, chemical suppliers, system integrators, and end users across key industries. Closed- and open-ended questionnaires enabled experts to share candid perspectives on market drivers, technology adoption barriers, and strategic priorities. These qualitative insights were rigorously triangulated with quantitative data, such as cost components and maintenance cycle frequencies, to validate conclusions and minimize bias.

To ensure data integrity, a multi-layered quality control process was implemented, including cross-verification against third-party datasets and iterative stakeholder feedback loops. Analytical frameworks such as SWOT, Porter’s Five Forces, and value chain mapping were applied to interpret findings and structure the final report. This methodology guarantees that the research delivers actionable intelligence with a high degree of accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Scrubber System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Scrubber System Market, by Product Type

- Scrubber System Market, by Technology

- Scrubber System Market, by Deployment Mode

- Scrubber System Market, by Application

- Scrubber System Market, by End User

- Scrubber System Market, by Region

- Scrubber System Market, by Group

- Scrubber System Market, by Country

- United States Scrubber System Market

- China Scrubber System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2862 ]

Conclusive insights emphasize the critical role of scrubber systems in achieving sustainable industrial growth and meeting escalating environmental expectations

In conclusion, scrubber systems stand at the nexus of environmental responsibility and industrial efficiency, offering a critical pathway toward cleaner air and sustainable operations. As regulatory frameworks tighten and corporate commitments to net-zero intensify, the demand for versatile, high-performance emission control solutions will only accelerate. Companies that embrace technological innovation, broaden their supplier networks, and align with regional policy objectives are best positioned to lead the market.

The convergence of digitalization, modular design, and advanced sorbent technologies is reshaping the competitive landscape, compelling stakeholders to adopt a holistic view of total cost of ownership and environmental impact. Simultaneously, the lessons learned from recent tariff disruptions highlight the importance of strategic foresight and resilient supply chain architectures.

Ultimately, the next chapter of growth in the scrubber system arena will be defined by collaboration across the value chain, from chemical innovators to end-user operators and service providers. By integrating sustainability into every facet of product development and deployment, industry participants can drive measurable improvements in air quality and organizational performance alike.

Connect with Ketan Rohom to explore tailored insights and secure your comprehensive scrubber system market research report for strategic advantage

Engaging directly with Ketan Rohom offers an exclusive opportunity to access a bespoke market research report tailored to your strategic objectives in the scrubber system sector. By collaborating with a seasoned sales and marketing leader, stakeholders can unlock nuanced competitive intelligence and customized insights that align with their operational and financial goals.

Initiating a dialogue with Ketan will provide clarity on how advanced emission control technologies can be integrated into existing workflows, as well as the critical factors shaping procurement and investment decisions. This consultative approach ensures that each inquiry is met with targeted analysis, from regulatory frameworks to emerging technology evaluations, ultimately empowering decision-makers to seize market opportunities with confidence.

Schedule a personalized consultation to explore detailed case studies, proprietary data, and scenario analyses that reflect the latest industry developments and supply chain dynamics. Connect with Ketan Rohom, Associate Director, Sales & Marketing, to secure your comprehensive report and embark on a strategic partnership geared toward sustainable growth and competitive differentiation in the next phase of the scrubber system market.

- How big is the Scrubber System Market?

- What is the Scrubber System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?