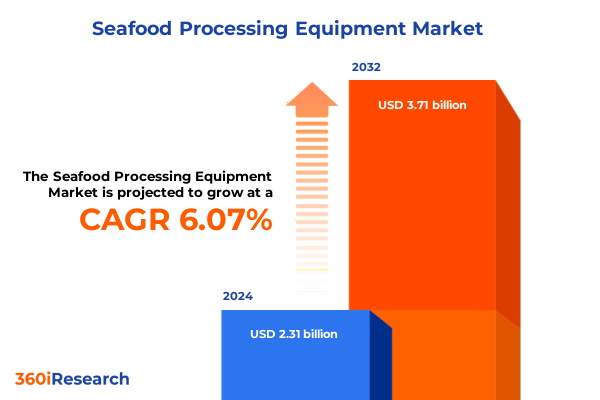

The Seafood Processing Equipment Market size was estimated at USD 2.45 billion in 2025 and expected to reach USD 2.58 billion in 2026, at a CAGR of 6.08% to reach USD 3.71 billion by 2032.

Setting the Stage for Seafood Processing Equipment Market Evolution by Unveiling Core Drivers, Challenges, and Foundational Trends Shaping Industry Growth

The seafood processing equipment market is at a pivotal juncture, shaped by evolving consumer tastes and technological innovation. In this introduction, we define the scope of equipment-from cutting and filleting machinery to freezing, packaging, peeling, sorting, and washing solutions-while highlighting how each category underpins the end-to-end workflow. Alongside traditional manual operations, there is growing emphasis on semi-automated and fully automated systems, reflecting a drive for efficiency and precision. This convergence of equipment types and technologies establishes a complex yet opportunity-rich environment for stakeholders.

To contextualize current industry dynamics, we explore the influence of capacity tiers, ranging from small-scale artisanal facilities to medium and large-scale industrial plants. Each capacity segment carries distinct operational requirements, investment thresholds, and labor considerations. Moreover, specialized applications such as crustacean, fish, mollusk, and shrimp processing introduce unique engineering demands, reinforcing the necessity for tailored equipment solutions.

As this summary will demonstrate, the interplay between equipment innovation, digital transformation, and shifting consumer preferences sets the stage for a market defined by agility and resilience. By outlining foundational trends and framing emerging challenges, readers will gain a comprehensive understanding of the forces driving change and catalyzing future growth in the seafood processing equipment landscape.

Navigating the Sea of Change by Identifying Technological, Regulatory, and Consumer Shifts Revolutionizing Seafood Processing Equipment Landscape

Over the past few years, the seafood processing equipment sector has experienced dramatic shifts driven by technological breakthroughs, changing regulatory frameworks, and evolving consumer expectations. Most notably, the emergence of precision robotics and advanced IoT-enabled systems has ushered in a new era of smart processing lines. These intelligent machines not only enhance throughput and yield but also integrate real-time monitoring capabilities, enabling predictive maintenance and reducing costly downtime. As a result, early adopters of these technologies are realizing improvements in product quality and operational efficiency.

Coupling these innovations, regulatory bodies across major markets have increased their focus on food safety and traceability requirements. Mandatory adoption of digital recordkeeping for temperature control, sanitation cycles, and equipment performance is now more stringent, compelling processors to upgrade legacy machinery or incorporate retrofit solutions. This regulatory impetus, while initially challenging, is catalyzing a wave of modernization that aligns with consumer demands for transparency and sustainability.

Additionally, consumer preferences are shifting toward responsibly sourced and minimally processed seafood products. This cultural trend is pushing manufacturers to explore eco-friendly equipment designs, such as energy-efficient freezing units and water-saving washing systems. By integrating sustainable practices into equipment development, vendors are not only complying with environmental standards but also differentiating themselves in a crowded marketplace.

Taken together, these transformative shifts in technology, regulation, and consumer attitudes are redefining operational benchmarks and strategic priorities. As companies realign their investment roadmaps, those who proactively adapt to these dynamics stand to capture significant competitive advantages and establish new industry norms.

Assessing the Ripple Effect of 2025 United States Tariffs on Seafood Processing Equipment Costs, Supply Chains, and Competitive Positioning in North American Markets

In early 2025, the United States implemented revised tariff schedules on imported seafood processing machinery, impacting both capital expenditures and supply chain architectures. New duties, which vary by equipment type, were designed to protect domestic manufacturers but have also prompted material cost inflation. Firms reliant on imported cutting, freezing, or packaging systems have seen lead times extend as vendors adjust to updated compliance procedures and duty classifications.

Beyond direct cost implications, the tariff framework has induced strategic recalibrations among industry players. Some processors have pivoted to domestic suppliers, negotiating long-term agreements to lock in favorable pricing and minimize exposure to future trade actions. Conversely, others have diversified procurement sources to emerging markets where lower-cost equipment meets quality benchmarks, thereby maintaining production continuity without compromising standards.

From a financing perspective, tariff-induced capital expenditure increases have led companies to explore alternative investment models. Equipment-as-a-service (EaaS) contracts and leasing options have gained traction, providing processors with flexible financing structures that mitigate upfront spending and distribute tariff-related costs over extended periods. This evolving ecosystem underscores the importance of adaptive financial planning in the face of ongoing policy fluctuations.

Overall, the cumulative impact of the United States tariffs in 2025 underscores the need for agile sourcing strategies and innovative procurement solutions. Companies that harness creativity in supplier negotiations, embrace flexible financing, and strategically balance domestic and international partnerships will be best positioned to navigate tariff-driven headwinds and safeguard their operational resilience.

Extracting Deep Insights from Equipment Type, Technology, Capacity, Application, and End User Segmentation to Illuminate Market Niches and Growth Levers

Deep analysis of equipment type segmentation reveals that cutting, filleting, freezing, packaging, peeling, sorting, and washing machinery each demand dedicated innovation pathways. Cutting and filleting equipment continue to benefit from precision robotics that enhance yield, whereas freezing systems prioritize energy efficiency and rapid cooldown technologies. Packaging solutions, in turn, integrate modified atmosphere capabilities and automated sealing functions, while peeling units combine high-throughput designs with gentle handling to preserve product integrity. Sorting and washing machines are increasingly equipped with vision systems and water-recycling features that reduce operational overhead and environmental impact.

Examining the technology dimension, fully automated processes extend beyond standalone machinery to encompass end-to-end smart lines, while semi-automated arrangements balance manual oversight with mechanized support and manual configurations maintain their relevance in artisanal and niche operations. Across all three categories, there is growing interest in modular designs that facilitate or interchange equipment modules to address varying batch sizes and product specifications without the need for extensive line overhauls.

Capacity-driven insights highlight that large-scale facilities gravitate toward integrated, high-capacity processing lines designed for continuous operation, whereas medium-scale operators prioritize flexible systems that can pivot between different species and processing methods. Small-scale processors often opt for compact, cost-effective units that excel in low-volume, high-variety production. This stratification underscores the importance of scalable solutions that deliver consistent performance across diverse operational footprints.

Applications segmentation-crustacean, fish, mollusk, and shrimp processing-delineates specialized requirements for each category. Crustacean processors emphasize heavy-duty sorting and peeling systems to handle robust shell structures. Fish processors deploy delicate filleting and portioning machines for a wide range of species, while shrimp processing demands high-speed cleaning and grading equipment to maximize throughput. Mollusk facilities prioritize sorting and washing solutions designed to remove sediments and impurities without damaging delicate shells.

Finally, end user dynamics reveal a bifurcation between research institutions and processing plants. Academic and government labs focus on pilot-scale equipment that supports laboratory trials and method development. In contrast, artisanal facilities seek modular, easy-to-operate machines that enhance craftsmanship without sacrificing quality, and industrial plants invest in fully integrated, high-throughput lines to meet global demand. These diverse end user requirements drive targeted innovation and aftermarket service models, ensuring tailored value propositions.

This comprehensive research report categorizes the Seafood Processing Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Technology

- Capacity

- Application

- End User

Mapping Regional Diversification by Comparing Market Dynamics, Consumer Preferences, and Infrastructure Developments Across Americas, EMEA, and Asia-Pacific Destinations

Across the Americas region, North and South American markets exhibit strong demand for high-capacity freezing and packaging equipment, driven by large-scale export operations in the United States, Canada, and Chile. In this market, processors are investing heavily in cold chain infrastructure to maintain product quality from catch to consumer, and they increasingly seek integrated processing lines that minimize manual handling and optimize yield. The economic maturity of the region, coupled with stringent food safety regulations, has led to significant adoption of automated and semi-automated solutions that deliver both throughput and compliance.

Transitioning to Europe, Middle East & Africa, the market reflects diverse regulatory environments and consumption patterns. Western Europe emphasizes energy-saving technologies and eco-friendly designs to comply with decarbonization targets, while the Middle East focuses on modular systems that can adapt to seasonal production patterns and a growing aquaculture industry. In Africa, expanding coastal processing hubs show early-stage demand for basic washing and sorting equipment, complemented by government incentives aimed at boosting local value addition. This wide spectrum of regional needs fosters a heterogeneous vendor landscape, where customization and rapid deployment capabilities are key differentiators.

In Asia-Pacific, robust seafood consumption and rapid industrialization drive unprecedented demand for advanced processing lines. Countries such as Japan and South Korea are at the forefront of integrating robotics and AI-driven inspection systems, while China and Southeast Asia emphasize scalable solutions capable of handling high processing volumes in multinational facilities. Aquaculture expansion across the region also creates opportunities for specialized harvesting and primary processing units. Economic growth and infrastructure development collectively favor investments in end-to-end processing ecosystems that support both domestic markets and global export channels.

This comprehensive research report examines key regions that drive the evolution of the Seafood Processing Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders and Innovators Driving Progress with Breakthrough Technologies, Strategic Partnerships, and Sustainable Practices in Equipment Manufacturing

Within this competitive landscape, several leading equipment manufacturers are setting benchmarks through continuous innovation, strategic partnerships, and sustainability initiatives. Some companies have consolidated their market positions by acquiring niche firms to broaden their product portfolios and enter adjacent application segments. These strategic moves have enabled them to integrate specialized peeling or sorting modules into broader processing solutions, creating seamless value chains for high-volume customers.

Other industry players focus on proprietary technology development, investing heavily in R&D to advance sensor-based inspection systems and adaptive control algorithms. This commitment to in-house innovation positions these firms as preferred partners for processors seeking bespoke solutions that can handle unique species or processing requirements. Their collaborative approach with academic and government laboratories further fuels specialized advancements, reinforcing their leadership in pilot-scale and high-precision applications.

Sustainability-focused equipment providers are differentiating themselves by offering energy-efficient and water-saving designs certified by recognized environmental standards. These companies leverage third-party validations to strengthen their market propositions, appealing to processors under mounting pressure to reduce carbon footprints and water consumption. Their integrated service models, which include performance monitoring and optimization consulting, help end users maximize resource efficiency and comply with emerging environmental regulations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Seafood Processing Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BAADER

- Bettcher Industries Inc,

- CTB Inc. (Berkshire Hathaway Company)

- JBT Corporation

- KM Fish Machinery A/S

- Marel,

- Pisces Fish Machinery Inc.

- SEAC AB

- Seafood Technology Limited

- Subzero (Grimsby) Limited

- Uni-Food Technic A/S

Action-Oriented Roadmap for Industry Leaders to Capitalize on Emerging Trends, Mitigate Risks, and Drive Operational Excellence in Seafood Processing Equipment

To thrive amid dynamic market conditions, industry leaders should embark on targeted innovation roadmaps that prioritize modular automation technologies and IoT integration. By collaborating closely with R&D institutions, companies can pilot advanced robotics and AI-driven inspection systems that enhance yield and quality control. This co-development approach not only accelerates time to market but also ensures that equipment solutions remain at the cutting edge of operational excellence.

In parallel, firms must diversify their supplier networks to mitigate tariff-related disruptions and material shortages. Establishing regional partnerships with alternative equipment vendors and forging long-term procurement contracts will enhance supply chain resilience. Additionally, embracing flexible financing models such as equipment-as-a-service can distribute capital expenditure over equipment lifecycles, reducing financial strain and enabling rapid scalability when demand surges.

Sustainability must be embedded into every facet of strategic planning. Organizations should conduct comprehensive lifecycle assessments to identify energy and water intensity hotspots, then collaborate with equipment manufacturers that offer certified eco-friendly solutions. Implementing performance monitoring platforms will facilitate real-time insights into resource consumption, enabling continuous optimization and regulatory compliance.

Finally, executives should invest in workforce upskilling to bridge the gap between legacy operations and digital transformation. Training programs that focus on automation system maintenance, data analytics, and quality assurance will empower personnel to manage complex processing lines effectively. By combining technological innovation with human capital development, companies will be well positioned to capture emerging opportunities and maintain competitive advantage.

Unraveling the Research Framework by Employing Robust Qualitative and Quantitative Methods to Ensure Rigorous Analysis and Unbiased Market Insights

This analysis employs a blend of qualitative and quantitative research methods, starting with extensive primary interviews conducted with C-level executives, plant managers, and R&D heads across major processing hubs. Insights gained through these discussions provided contextual understanding of operational challenges, technology priorities, and investment drivers. Secondary research leveraged peer-reviewed journals, regulatory filings, and industry association reports to validate primary findings and ensure alignment with broader market trends.

Data triangulation was a key component of the methodology, combining input from equipment shipment records, trade statistics, and financial disclosures. This multi-source approach enhanced the robustness of segmentation analysis, ensuring that equipment type, technology, capacity, application, and end user categorizations accurately reflect market realities. Regional insights were corroborated through import-export data, policy reviews, and infrastructure investment reports, providing a comprehensive view of geographic dynamics.

Further analytic rigor was achieved through scenario modeling and sensitivity analyses, which evaluated the impact of variables such as tariff changes, energy price fluctuations, and evolving regulatory standards. These models enabled stress-testing of strategic recommendations and ensured that actionable insights remain valid under a range of potential future conditions. Throughout the research process, strict adherence to ethical standards and data integrity protocols safeguarded impartiality and credibility.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Seafood Processing Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Seafood Processing Equipment Market, by Equipment Type

- Seafood Processing Equipment Market, by Technology

- Seafood Processing Equipment Market, by Capacity

- Seafood Processing Equipment Market, by Application

- Seafood Processing Equipment Market, by End User

- Seafood Processing Equipment Market, by Region

- Seafood Processing Equipment Market, by Group

- Seafood Processing Equipment Market, by Country

- United States Seafood Processing Equipment Market

- China Seafood Processing Equipment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Consolidating Key Takeaways to Reinforce Strategic Imperatives and Future Outlook for Stakeholders in the Seafood Processing Equipment Sector

In summary, the seafood processing equipment market is being reshaped by technological innovation, shifting regulatory demands, and evolving consumer preferences. Automation and digitalization stand out as pivotal drivers, fostering efficiency gains and quality improvements while enabling predictive maintenance and enhanced traceability. Concurrently, regional variations in infrastructure maturity and policy frameworks necessitate tailored approaches to equipment selection and deployment.

Tariff adjustments in the United States have underscored the importance of agile supply chain strategies and flexible financing arrangements. Processors that diversify procurement, leverage equipment-as-a-service offerings, and pursue strategic supplier partnerships will be better equipped to navigate policy shifts and cost pressures. Sustainability emerges as a non-negotiable imperative, requiring collaborative efforts between equipment providers and end users to optimize resource use and comply with environmental regulations.

Ultimately, success in this dynamic landscape hinges on integrating advanced technologies with human capital development, underpinned by rigorous market insights and adaptive strategic planning. Stakeholders who embrace modular automation, invest in workforce training, and maintain a forward-looking posture will secure competitive advantage and accelerate growth in the seafood processing equipment sector.

Engage with Our Associate Director to Secure Comprehensive Market Intelligence Tailored to Your Strategic Objectives in the Seafood Processing Equipment Industry

Don’t miss your opportunity to transform strategic planning with the most comprehensive analysis available. Engage directly with Ketan Rohom, the Associate Director, Sales & Marketing at 360iResearch, to explore how this report can address your unique challenges and guide your next strategic moves. With customized insights and personalized support, you’ll gain the clarity needed to drive ROI and stay ahead of the competition.

Reach out today to arrange a consultation or to secure early access to the full market research report. By partnering with Ketan Rohom, you’ll ensure your investment in market intelligence delivers maximum impact, empowering your organization to navigate complexity, seize emerging opportunities, and achieve sustained growth in the seafood processing equipment sector.

- How big is the Seafood Processing Equipment Market?

- What is the Seafood Processing Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?