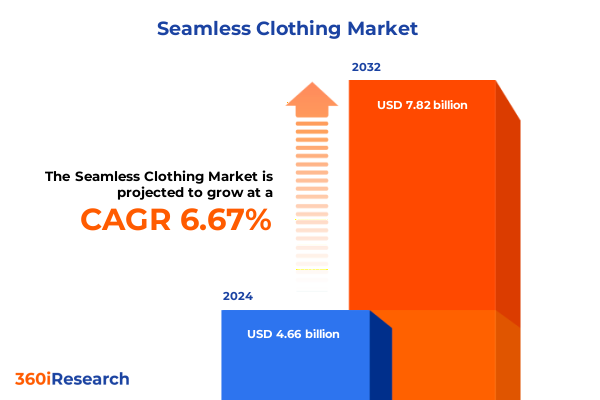

The Seamless Clothing Market size was estimated at USD 4.95 billion in 2025 and expected to reach USD 5.27 billion in 2026, at a CAGR of 6.73% to reach USD 7.82 billion by 2032.

Discover How Seamless Clothing Is Redefining Apparel Comfort and Performance Through Cutting-Edge Technologies and Sustainable Innovations

Seamless clothing represents a pivotal shift in apparel design, marrying cutting-edge technology with consumer demands for unparalleled comfort. At its core, the concept eliminates traditional seams through advanced knitting and bonding techniques, enabling garments to conform more naturally to the human body. This results in superior stretchability, breathability, and a second-skin feel that resonates with both performance athletes and everyday wearers.

Over the last decade, the integration of three-dimensional knitting machinery has accelerated innovation by allowing manufacturers to produce fully shaped garments in a single process. This advancement not only reduces production time and material waste but also unlocks new design possibilities for contouring, targeted support, and integrated ventilation channels. As a result, seamless techniques have transcended their original focus on high-performance activewear and are now reshaping loungewear, innerwear, and even outerwear segments.

Equally transformative is the alignment between seamless manufacturing and sustainability. By knitting a garment in one pass, fabric off-cuts are virtually eliminated, significantly cutting down on waste contributions to landfills. Furthermore, manufacturers are increasingly adopting recyclable and bio-based yarns to meet rising consumer expectations for eco-friendly products. These innovations collectively position seamless clothing not only as a technical breakthrough but also as a greener alternative, setting the stage for a holistic apparel evolution.

Exploring the Transformative Convergence of Technology Sustainability and Customization That Is Transforming the Seamless Clothing Landscape

The seamless clothing sector is undergoing a remarkable transformation driven by the convergence of digital design tools, sustainable manufacturing processes, and personalized consumer experiences. Advances in three-dimensional knitting technology have made it possible to eliminate traditional stitching, enabling the creation of complex forms and integrated features without additional material loss. This shift has reduced lead times and minimized waste across the supply chain, aligning production with on-demand models that limit overproduction while offering rapid prototype iterations.

On the sustainability front, brands are pioneering zero-waste manufacturing techniques that weave entire garments directly to customer specifications. These methods slash the environmental footprint by negating fabric cut-offs and harnessing renewable resources. Collaborations between textile innovators and dye houses are also advancing plant-based alternatives to petroleum-derived fibers, reinforcing a shift toward compostable and recyclable seamless solutions.

Concurrently, artificial intelligence is revolutionizing personalization within seamless apparel. AI-driven platforms now leverage body-scanning data and machine learning to deliver tailored fit recommendations, boosting both customer satisfaction and return on investment for brands. Such systems are further enhancing production efficiency through predictive analytics, enabling precise demand forecasting and inventory optimization.

In parallel, the rise of micro-factories and localized on-demand manufacturing hubs is redefining supply chain agility. By situating production closer to end markets, leading companies are reducing transit times, mitigating tariff exposure, and rapidly responding to emerging trends, ultimately democratizing high-performance apparel.

Analyzing the Cumulative Impact of 2025 United States Tariff Policies on Seamless Clothing Supply Chains Consumer Costs and Strategic Responses

The introduction of sweeping U.S. tariff policies in early 2025 has reverberated across global apparel supply chains, compelling companies to reassess sourcing strategies and cost structures. Historically, the United States has imported nearly ninety-five percent of its apparel, with primary origins in China, Vietnam, India, Bangladesh, and Indonesia. Recent tariff hikes have elevated rates for these key suppliers into the thirty-eight to sixty-five percent range, up from roughly eleven to twelve percent in prior years, creating a significant cost barrier for importers.

These new duties have translated directly into higher consumer prices. Basic articles such as cotton T-shirts, underwear, and socks-items that consumers purchase year-round-have experienced the steepest increases, with some estimates indicating price hikes exceeding sixty-five percent in the short term. Retailers are compelled to pass through a majority of these added costs, driving apparel expenditures upward and prompting shifts toward premium or domestic alternatives.

Average tariff rates on apparel climbed from approximately fourteen point seven percent at the start of 2025 to nearly twenty-three point eight percent by May, the highest level in decades. This escalation has not only reduced the volume of imports but also accelerated diversification of sourcing strategies, as brands explore alternative production locations or onshore options. However, higher labor costs and capacity constraints pose challenges to reshoring, underscoring the importance of supply chain resilience and strategic partnerships in mitigating tariff headwinds.

As a result, industry leaders must balance the imperatives of cost management with the agility to navigate shifting trade policies. Strategic investments in near-shoring, tariff optimization, and advanced manufacturing technologies will be critical to sustaining profitability and ensuring uninterrupted product flow in a complex global environment.

Unearthing Multifaceted Segmentation Insights That Illuminate How Different Product Types Materials and Audiences Shape Seamless Clothing Demand

Segmentation analysis reveals that the seamless clothing market spans multiple layers of consumer need and product innovation. In terms of product categorization, innerwear, loungewear, and outerwear each leverage seamless construction differently; innerwear emphasizes skin-like comfort and unobtrusive support, whereas loungewear focuses on all-day flexibility and breathability, and outerwear integrates technical performance with environmental protection.

Material classification further deepens insight, as the choice between natural and synthetic fabrics dictates both sustainability narratives and performance criteria. Natural fibers such as cotton, silk, and wool have gained traction for their biodegradability and tactile appeal, particularly in premium segments. Synthetic alternatives like nylon, polyester, and spandex dominate performance categories, offering high elasticity, moisture management, and rapid-dry properties.

Looking at product types, the seamless approach has expanded into accessories, dresses, footwear, outerwear, pants, and T-shirts, each demanding distinct structural and aesthetic considerations. In accessories, seamless knitting enables streamlined silhouettes and integrated features such as glove touchscreen compatibility. Dresses benefit from contouring and sculpted support zones, while footwear incorporates single-piece uppers for lightweight durability.

Gender-focused segmentation highlights divergent preferences among men and women, driving tailored designs and fit profiles. Style stratification into activewear, casual, formal, streetwear, and workwear underscores the versatility of seamless techniques across lifestyle contexts. Audience targeting including kids, teens, and unisex lines reflects opportunities for eclectic and youth-oriented collections, while subsegments such as outdoor enthusiasts, urban consumers, fitness aficionados, and professional women demand specialized performance attributes.

Finally, end-user distinctions between commercial and personal applications, coupled with the duality of offline and online distribution channels, shape go-to-market strategies and the overall customer experience.

This comprehensive research report categorizes the Seamless Clothing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material Type

- Product Type

- Gender

- Style

- Target Audience

- End User

- Distribution Channel

Revealing Key Regional Insights Into How the Americas EMEA and Asia Pacific Regions Drive and Adapt to Seamless Clothing Innovations

Regional dynamics in seamless clothing reveal distinct market drivers and maturation curves. In the Americas, robust retail infrastructure and high consumer awareness have catalyzed demand for both performance-oriented and lifestyle seamless apparel. North American brands are leading in digital retail innovation, exploiting rich e-commerce platforms to offer customized fit solutions and interactive shopping experiences.

In Europe, the Middle East, and Africa, a strong legacy of textile craftsmanship and a growing sustainability ethos are propelling seamless offerings in both luxury and mid-market segments. European manufacturers are rapidly adopting eco-friendly feedstocks and circular production models, leveraging established supply chain clusters to optimize resource use and reduce lead times.

Asia-Pacific serves as the primary manufacturing hub for seamless garment technologies, thanks to its concentration of advanced knitting machinery and low-cost production capabilities. Rising disposable incomes and expanding digital penetration across markets like China, India, and Southeast Asia are stimulating domestic consumption, with online marketplaces accelerating the distribution of innovative seamless products.

Each region’s unique regulatory environment, trade agreements, and infrastructure maturity inform strategic priorities. Understanding these geographical nuances enables industry players to tailor product portfolios, align sourcing networks, and optimize distribution strategies to local market conditions.

This comprehensive research report examines key regions that drive the evolution of the Seamless Clothing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Strategic Moves and Innovations of Leading Companies Shaping the Seamless Clothing Ecosystem Through Technology and Sustainability

Leading companies across the seamless clothing ecosystem are deploying diverse strategies to remain competitive. At the forefront, athletic brands are embedding proprietary seamless technologies within flagship products. One global sportswear giant has scaled its signature Flyknit process to a broader portfolio, integrating ultra-light silhouettes with targeted compression zones.

Simultaneously, premium activewear purveyors are collaborating with chemical innovators to develop bio-based stretch fibers that meet rigorous performance standards while aligning with environmental objectives. These partnerships extend beyond fiber supply to include end-to-end R&D alliances, enabling brands to bring novel seamless offerings to market more rapidly.

Retailers with vertically integrated supply chains are investing in on-site 3D knitting capabilities, granting them full control over design iterations and inventory management. By harnessing real-time data analytics, they can adjust production schedules based on consumer behavior insights, reducing stockouts and markdowns.

Meanwhile, pure-play technology providers are advancing seamless knitting platforms for both large manufacturers and niche artisanal studios. Their solutions range from modular hardware that retrofits existing knit machines to cloud-based software suites that facilitate digital patterning and remote collaboration. Through these collective innovations, companies are forging new paradigms of speed, accuracy, and sustainability in garment manufacturing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Seamless Clothing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adidas AG

- American Eagle Outfitters, Inc.

- ASICS Corporation

- Brooks Sports, Inc.

- Columbia Sportswear Company

- Cosmo Lady (China) Holdings Co Ltd.

- FILA Luxembourg, S.a.r.l.

- Gap Inc.

- H&M Hennes & Mauritz Retail Pvt. Ltd.

- HANESBRANDS INC.

- INDITEX, S.A.

- L Brands Inc.

- Levi Strauss & Co.

- Li Ning Company Limited

- Lululemon Athletica Inc.

- New Balance Athletics, Inc.

- NIKE, Inc.

- Patagonia, Inc.

- Phillips-Van Heusen Corporation

- Puma SE

- Reebok International Limited

- Under Armour, Inc.

- Uniqlo Co., Ltd.

Delivering Actionable Recommendations to Harness Seamless Clothing Innovations Overcome Tariff Challenges and Adapt to Evolving Consumer Expectations

To capitalize on the seamless clothing evolution, industry leaders should prioritize strategic investments in advanced manufacturing infrastructure. By deploying next-generation 3D knitting equipment, brands can enhance production flexibility and reduce material waste. Equally important is forging partnerships with sustainable fiber developers to secure access to next-wave bio-based and recyclable yarns that resonate with eco-conscious consumers.

Leaders must also fortify supply chain resilience by diversifying sourcing footprints and establishing agile near-shoring or on-demand manufacturing nodes. This approach mitigates tariff exposure and logistical volatility, ensuring continuity in product flow even amid shifting trade policies.

Data-driven personalization represents another critical lever. Implementing AI-powered body-scanning and fit-recommendation systems will differentiate brand experiences and drive higher conversion rates. To further optimize operations, organizations should leverage predictive analytics for demand forecasting, adjusting inventory levels in line with evolving consumer trends.

Finally, brands should cultivate deep customer engagement through omnichannel platforms that blend digital interactivity with experiential retail. By integrating virtual try-on tools and interactive storytelling, companies can reinforce brand loyalty and unlock new revenue streams.

Detailing the Rigorous Research Methodology Employed to Map Supply Chains Conduct Expert Interviews and Validate Seamless Clothing Industry Insights

This analysis is underpinned by a rigorous multi-stage research methodology. Initial desk research synthesized publicly available information from regulatory filings, industry publications, and scientific journals to map emerging technologies and sustainability initiatives. Trade association reports and government data provided insights into tariff impacts and global trade flows.

To enrich quantitative findings, we conducted in-depth interviews with thought leaders across the value chain, including material scientists, manufacturing executives, and brand strategists. These conversations illuminated practical challenges and validated emerging use cases for seamless technologies.

A parallel supply chain mapping exercise identified critical nodes and risk factors, enabling scenario analysis around tariff fluctuations and capacity constraints. Secondary sources such as conference proceedings and patent filings were triangulated to verify technological roadmaps and partnership strategies.

Finally, cross-functional workshops facilitated stakeholder alignment by testing preliminary insights against real-world operational considerations. Throughout the process, our team adhered to stringent data quality standards, ensuring that conclusions rest on robust evidence and reflect the dynamic landscape of seamless clothing.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Seamless Clothing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Seamless Clothing Market, by Type

- Seamless Clothing Market, by Material Type

- Seamless Clothing Market, by Product Type

- Seamless Clothing Market, by Gender

- Seamless Clothing Market, by Style

- Seamless Clothing Market, by Target Audience

- Seamless Clothing Market, by End User

- Seamless Clothing Market, by Distribution Channel

- Seamless Clothing Market, by Region

- Seamless Clothing Market, by Group

- Seamless Clothing Market, by Country

- United States Seamless Clothing Market

- China Seamless Clothing Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2226 ]

Synthesizing Emerging Trends Tariff Impacts and Strategic Imperatives into a Cohesive Conclusion That Empowers Decision Makers in the Seamless Clothing Sector

The seamless clothing revolution is not a fleeting trend but a structural transformation rooted in technological innovation and changing consumer values. From the adoption of 3D knitting to the emergence of AI-driven personalization, every element of the value chain is being reimagined to deliver superior comfort, functionality, and sustainability.

Simultaneously, the geopolitical environment, particularly U.S. tariff policies, underscores the need for agile supply chain strategies and near-term contingency planning. Brands that embrace manufacturing diversification and tariff optimization will be best positioned to manage cost pressures and maintain market access.

Segmentation analysis has shown that seamless techniques are equally relevant across innerwear, loungewear, outerwear, and accessory categories, while regional variances highlight the importance of localized product and channel strategies. Moreover, leading companies have demonstrated that strategic partnerships and in-house capabilities can accelerate innovation cycles and reinforce brand differentiation.

As the industry moves forward, success will hinge on a balanced approach that fuses advanced manufacturing, sustainable materials, and customer-centric design. By operationalizing the insights and recommendations detailed herein, decision-makers can navigate complexity with confidence and capture the full potential of seamless clothing.

Engage with Ketan Rohom to Secure the Definitive Seamless Clothing Market Research Report and Drive Informed Strategic Growth and Partnerships

To explore the transformative potential of seamless apparel further and secure unparalleled market insights, reach out to Ketan Rohom (Associate Director, Sales & Marketing) to acquire the full detailed report. With this comprehensive intelligence at your fingertips, you can drive strategic growth, forge impactful partnerships, and maintain a competitive edge in the evolving seamless clothing landscape.

- How big is the Seamless Clothing Market?

- What is the Seamless Clothing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?