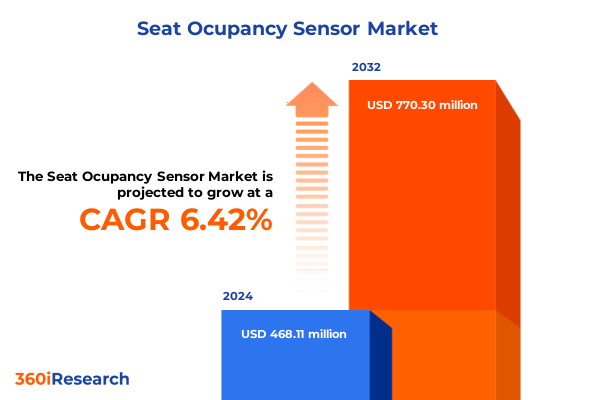

The Seat Ocupancy Sensor Market size was estimated at USD 495.80 million in 2025 and expected to reach USD 529.79 million in 2026, at a CAGR of 6.49% to reach USD 770.30 million by 2032.

Revealing the Critical Role of Seat Occupancy Sensors in Driving Safety and Comfort in Modern Automotive Environments to Shape Vehicle Intelligence

In today’s rapidly evolving automotive ecosystem, seat occupancy sensors have emerged as a cornerstone technology that underpins both safety protocols and passenger comfort enhancements. Initially deployed to ensure airbag deployment accuracy and seat belt reminder activation, modern seat occupancy sensing solutions now contribute to a wide array of advanced safety, comfort, and vehicle-intelligence applications.

Over the past decade, original equipment manufacturers have escalated investment in sensor sophistication to meet stringent safety regulations and to respond to consumer demands for seamless in-vehicle experiences. As automotive platforms transition towards electrification, autonomy, and connected services, the integration of highly reliable and precise occupancy detection systems becomes imperative. Stakeholders across the value chain-from semiconductor manufacturers to automotive tier-one suppliers-are collaborating to refine sensor designs that can reliably distinguish between adults, children, and inanimate objects under a broad spectrum of conditions and seating configurations.

Exploring the Paradigm Shifts Propelling Seat Occupancy Sensor Technology Across Autonomous Driving Connectivity and Smart Seating Innovations

Recent years have witnessed transformative technological shifts that are redefining the landscape of seat occupancy sensing. The advent of advanced driver assistance systems and the pursuit of fully autonomous vehicles have elevated the requirements for real-time occupant detection accuracy and classification. Sensor solutions are increasingly leveraging machine-learning algorithms and sensor fusion techniques to harmonize data from capacitive, infrared and pressure-based modalities. Consequently, providers are now focusing on ensuring robustness against electromagnetic interference, temperature variations and complex seating materials.

Meanwhile, the convergence of vehicle connectivity platforms and smart cabin architectures has spurred demand for multi-functional seating systems that communicate occupancy data to vehicle control units, HVAC modules, and safety management systems. As a result, occupancy sensors are no longer standalone components but essential elements within a broader ecosystem. Regulatory bodies in key markets are also raising the bar on occupant protection standards, compelling sensor vendors to adopt more rigorous validation protocols and real-world testing scenarios.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Seat Occupancy Sensor Manufacturing Supply Chains and Cost Dynamics

The introduction of new tariffs by the United States in 2025 has created a ripple effect throughout the seat occupancy sensor supply chain, influencing component sourcing, manufacturing locations and procurement strategies. Semiconductor wafers, printed circuit boards and specialized raw materials have all experienced altered cost structures, compelling tier-one suppliers to reevaluate supplier contracts and renegotiate terms. In response, some manufacturers have accelerated efforts to localize production within North America, reducing exposure to cross-border duties and shortening lead times.

These policy changes have also prompted a shift towards diversified sourcing strategies. Companies are increasingly building strategic partnerships with local fabricators and exploring nearshore facilities to maintain price competitiveness and mitigate supply disruptions. Over time, the cumulative impact of these adjustments is expected to reshape manufacturing footprints and spark new alliances across the automotive electronics industry.

Unlocking Profound Market Segmentation Insights across Vehicle Types Sensor Modalities Seating Positions Applications and Advanced Technologies

An in-depth examination of segmentation reveals that vehicle category remains a primary determinant of sensor design. Commercial applications span bus, heavy commercial and light commercial vehicle platforms, where sensor housings and ruggedness parameters differ significantly from those required in passenger cars, which encompass electric vehicles, hatchbacks, multipurpose vehicles, sedans and sports utility vehicles. The diverse seating architectures across these segments drive bespoke calibration needs and influence sensor form factors.

Furthermore, discerning between active and passive sensor types uncovers a spectrum of power consumption profiles and signal processing complexities, with active systems offering higher sensitivity at the cost of increased energy demands, while passive devices excel in low-power environments. Positioning also plays a crucial role: front seat installations typically prioritize driver monitoring and airbag control, whereas rear seat solutions must accommodate center, left and right configurations, each presenting distinct ergonomic and safety considerations.

Applications extend beyond crash mitigation to include airbag control, HVAC optimization, occupant classification and seat belt reminder activation, necessitating diverse firmware and algorithmic approaches. Complementing these factors, technology choices-ranging from capacitive and infrared to piezoelectric, pressure-sensor and ultrasonic techniques-influence integration complexity, response time and long-term reliability. Together, these segmentation insights offer a nuanced perspective on how each vector shapes product development and market positioning.

This comprehensive research report categorizes the Seat Ocupancy Sensor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Type

- Position

- Technology

- Application

Illuminating Distinct Regional Dynamics Influencing Seat Occupancy Sensor Adoption across Americas Europe Middle East Africa and Asia Pacific Terrain

The Americas region has historically driven early adoption of advanced safety features, with stringent federal regulations and active consumer safety advocacy groups accelerating the uptake of seat occupancy sensors. In the United States and Canada, OEMs are prioritizing the integration of high-precision sensing solutions to meet evolving occupant protection standards and to differentiate flagship vehicle models. As a result, strategic partnerships between automakers and sensor vendors have intensified, fostering collaborative development efforts.

Within Europe, the Middle East and Africa, diverse regulatory regimes and varied economic conditions present unique challenges and opportunities. Western European nations lead in mandating real-time occupant monitoring, while emerging markets in Eastern Europe and parts of the Middle East demonstrate growing interest, albeit with a focus on cost-effective sensor platforms. Africa represents a nascent market where infrastructure limitations and price sensitivity require tailored approaches, often centered on low-cost passive solutions that deliver acceptable performance without extensive calibration.

Asia-Pacific encompasses a broad spectrum of market maturity levels, from established automotive hubs in Japan and South Korea to rapidly growing production centers in China and India. Local content requirements and national “new energy vehicle” initiatives are driving substantial local manufacturing volumes, compelling global sensor providers to forge joint ventures and technology transfer agreements. Across all markets in this region, the race towards electric mobility and autonomous capabilities underscores the criticality of reliable occupancy sensing.

This comprehensive research report examines key regions that drive the evolution of the Seat Ocupancy Sensor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Footprints and Innovation Trajectories of Leading Seat Occupancy Sensor Manufacturers Pioneering Market Excellence

Leading global manufacturers are pursuing differentiated strategies to secure market leadership in seat occupancy sensing. Tier-one electronics specialists with a history in safety systems are investing in next-generation sensor fusion platforms and forging alliances with semiconductor innovators to embed artificial intelligence at the edge. Simultaneously, automotive component conglomerates are leveraging their deep OEM relationships to accelerate adoption, offering integrated seating modules that incorporate occupancy detection as a standard feature.

Mid-sized firms and agile technology startups are also making their mark by specializing in niche sensing modalities, such as piezoelectric and ultrasonic solutions, and by providing scalable software frameworks for occupant classification. These players often partner with aftermarket integrators to retrofit legacy fleets and to demonstrate proof-of-concept in early adopter programs. As competition intensifies, mergers and acquisitions have become a prominent tactic for expanding regional footprints and supplementing R&D capabilities, leading to an increasingly consolidated vendor landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Seat Ocupancy Sensor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acuity Brands, Inc.

- Aptiv PLC

- Autoliv Inc.

- Continental AG

- DENSO Corporation

- Faurecia SE

- Honeywell International Inc.

- IEE S.A.

- Johnson Controls International plc

- Lear Corporation

- Legrand SA

- Magna International Inc.

- NXP Semiconductors N.V.

- Robert Bosch GmbH

- Schneider Electric SE

- Sensata Technologies, Inc.

- StarrBot Technologies Pvt. Ltd.

- TE Connectivity Ltd.

- Toyota Boshoku Corporation

- ZF Friedrichshafen AG

Delivering High-Impact Strategic Recommendations to Equip Industry Leaders for Competitive Advantage in the Evolving Seat Occupancy Sensor Ecosystem

To maintain a competitive edge, industry leaders should prioritize a sensor-fusion approach, combining complementary technologies to enhance detection accuracy and resilience. This entails forging strategic partnerships with semiconductor suppliers to co-develop AI-enabled sensing architectures that adapt to diverse cabin environments. Equally important is the establishment of local manufacturing or assembly facilities in tariff-impacted regions, which not only mitigates duty liabilities but also ensures rapid response to evolving OEM requirements.

In addition, organizations must invest in comprehensive system validation and calibration frameworks that account for the full spectrum of occupant demographics and seating configurations. By creating robust data-driven feedback loops with end customers and leveraging real-world performance metrics, sensor providers can continuously refine firmware algorithms and drive incremental improvements. Finally, exploring adjacent applications-such as advanced seat-belt engagement analytics or personalized climate control-can unlock new revenue streams and deepen integration into the vehicle ecosystem.

Detailing the Rigorous Research Methodology Underpinning the Comprehensive Analysis of Seat Occupancy Sensor Market Dynamics and Industry Trends

This analysis draws upon a rigorous blend of primary and secondary research methodologies designed to ensure both depth and objectivity. Primary insights were gathered through interviews with executives, R&D heads and procurement specialists from leading automotive OEMs, tier-one suppliers and semiconductor manufacturers. These discussions provided direct perspectives on technological priorities, supply chain risks and regional regulatory influences.

Secondary research involved a systematic review of industry white papers, regulatory filings, patent databases and technical standards documents, complemented by broader literature reviews covering safety regulations, automotive electrification trends and compressed sensing techniques. Data triangulation and cross-validation protocols were applied throughout to reconcile discrepancies, reinforce findings and certify the reliability of all presented insights. Finally, internal quality controls and expert peer reviews were conducted to uphold methodological integrity and to align conclusions with real-world market dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Seat Ocupancy Sensor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Seat Ocupancy Sensor Market, by Vehicle Type

- Seat Ocupancy Sensor Market, by Type

- Seat Ocupancy Sensor Market, by Position

- Seat Ocupancy Sensor Market, by Technology

- Seat Ocupancy Sensor Market, by Application

- Seat Ocupancy Sensor Market, by Region

- Seat Ocupancy Sensor Market, by Group

- Seat Ocupancy Sensor Market, by Country

- United States Seat Ocupancy Sensor Market

- China Seat Ocupancy Sensor Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Insights and Future Directions to Highlight the Essential Strategic Imperatives for Seat Occupancy Sensor Stakeholders

In synthesizing these findings, it becomes clear that seat occupancy sensors occupy a pivotal role at the intersection of safety, comfort and vehicle intelligence. Stakeholders must navigate a complex matrix of technological choices, segmentation demands and regional regulatory landscapes to deliver solutions that meet evolving OEM and end-user expectations. The convergence of electrification, autonomy and smart cabin architectures will continue to propel innovation in sensing modalities, software intelligence and integration frameworks.

Moving forward, the strategic imperatives for sensor providers include embracing sensor fusion, optimizing local supply chains, and fostering collaborative partnerships that drive continuous performance enhancements. By aligning R&D roadmaps with real-world validation data and by capitalizing on adjacent in-vehicle applications, organizations can secure sustainable growth and cement their positions as indispensable contributors to the next generation of automotive experiences.

Engage with Ketan Rohom to Unlock Detailed Insights and Tailored Market Intelligence by Securing Your Comprehensive Seat Occupancy Sensor Report Today

Engaging with Ketan Rohom, Associate Director, Sales & Marketing, will grant your organization direct access to a wealth of in-depth intelligence tailored specifically for the seat occupancy sensor sector. With his strategic guidance, you can explore customized research deliverables, clarify complex market dynamics, and streamline decision-making processes that drive your competitive edge.

Secure your comprehensive report today to unlock an unparalleled understanding of the technological developments, regulatory shifts, and strategic opportunities shaping the future of seat occupancy sensors. Reach out to Ketan Rohom to begin a collaborative partnership that transforms insights into actionable growth initiatives.

- How big is the Seat Ocupancy Sensor Market?

- What is the Seat Ocupancy Sensor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?