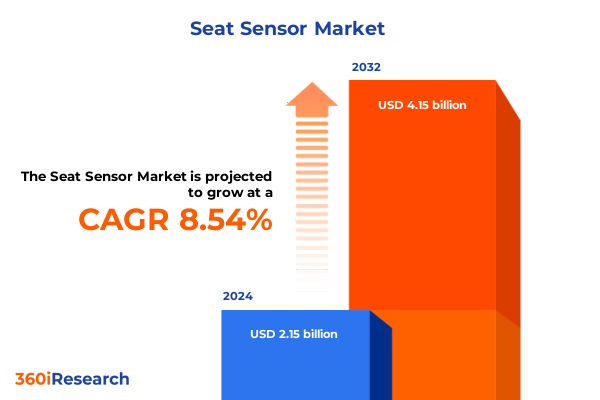

The Seat Sensor Market size was estimated at USD 2.32 billion in 2025 and expected to reach USD 2.53 billion in 2026, at a CAGR of 8.65% to reach USD 4.15 billion by 2032.

Revolutionizing Passenger Safety Through Advanced Seat Sensor Technologies Amidst Evolving Automotive Trends that are shaping occupant safety and connectivity

The passenger safety ecosystem is undergoing a profound transformation, driven by the integration of advanced seat sensor technologies that play a critical role in occupant protection and comfort. Seat sensors have evolved from simple weight-based mechanisms to sophisticated systems capable of classifying occupants, detecting presence in real time, and interfacing with adaptive restraint systems. These innovations are essential in meeting stringent safety regulations while also enabling seamless in-cabin experiences that support emerging autonomous and connected vehicle functionalities. As consumer expectations rise, the ability to accurately monitor seat occupancy and classification underpins a wide range of applications, from airbag deployment optimization to smart climate and comfort adjustments.

Automotive manufacturers and suppliers are responding to these demands by investing heavily in machine learning algorithms and novel sensor materials that enhance detection accuracy and reliability. The confluence of regulatory mandates-such as FMVSS No. 208 requirements consistent with ECE R16 and Euro NCAP protocols for front passenger occupancy detection-and the growing emphasis on software-defined vehicle architectures has elevated the strategic importance of seat sensor technology in the broader automotive value chain. Moreover, projections indicate a rapid increase in electronic content per vehicle, reflecting the shift toward digitized safety systems and heightened integration with advanced driver-assistance systems (ADAS) platforms

Emerging Innovations and Regulatory Pressures Redefining the Seat Sensor Market Dynamics Across the Automotive Ecosystem

The landscape of seat sensor applications is rapidly evolving, marked by breakthroughs in flexible electronics, stretchable printed sensors, and enhanced signal processing algorithms. Innovations such as thin, printed stretchable components now allow seamless integration into seat bases and backrests, enabling finer granularity in pressure mapping and occupant movement analytics. These capabilities are proving invaluable not only for ensuring precise airbag deployment but also for child presence detection-a feature set to become standard across most passenger vehicles following industry commitments for 2025 model year adoption. Meanwhile, driver status monitoring (DSM) is gaining traction under Euro NCAP’s evolving in-cabin evaluation protocols, driving the convergence of occupant classification systems (OCS) with fatigue and distraction detection functions in a unified safety architecture.

In parallel, regulatory pressures are reshaping supplier strategies and product road maps. The introduction of the HOT CARS Act and the alignment of U.S. and European requirements for rear-seat occupant reminders underscore a global mandate toward comprehensive in-cabin monitoring. As regulators move to harmonize performance thresholds and test methods, automakers and tier-one suppliers are reorienting their research investments toward technologies that deliver both robust compliance and scalable production. This synergy between regulatory evolution and sensor innovation is accelerating the pace of change, compelling stakeholders to adopt agile development frameworks and establish strategic partnerships to maintain competitive advantage.

Assessing the Cumulative Impact of New 2025 United States Automotive Tariffs on the Global Seat Sensor Supply Chain and Manufacturing Strategies

The implementation of 25% U.S. tariffs on light-duty vehicle imports, effective April 3, 2025, and on automotive parts beginning May 3, 2025, has introduced significant cost pressures across the global supply chain. For major automakers like General Motors, these levies resulted in a $1.1 billion hit to operating income in Q2 2025, contributing to a 35% year-on-year decline in net income and prompting warning of potential $4–5 billion losses for the full year. Similar headwinds are evident among tier-one suppliers; although some have limited exposure due to localized production under the USMCA, the aggregate impact is driving a strategic shift toward nearshoring and increased sourcing from U.S.-based facilities to mitigate tariff burdens and currency volatility.

In addition, proposed 25% duties on certain imported semiconductors have heightened concerns over cost inflation in software-defined vehicle platforms, where electronic control unit (ECU) integration is crucial. While approximately one-third of ECUs for U.S. vehicles are domestically produced-reducing the effective chip tariff burden to roughly $65 per vehicle-the remaining two-thirds enter embedded within fully assembled ECUs, subject to higher tariff layers at the ECU level. The net effect of these measures is an elevated emphasis on supply chain resilience, with OEMs exploring tariff credits, increased localization, and alternative sourcing strategies to stabilize production costs and maintain pricing competitiveness.

Uncovering Deep Segmentation Insights Across Occupant Classification Safety Restraint Systems and Seat Occupancy Detection Techniques

The seat sensor market can be examined through distinct segmentation lenses, each revealing nuanced growth patterns and innovation requirements. The occupant classification segment underscores the need for systems capable of distinguishing between adults, children, and unoccupied seats, with advanced algorithms trained on diverse occupant profiles. Safety restraint systems focus on optimizing belt tensioning and airbag deployment timing, demanding high-fidelity force and occupancy data. Meanwhile, seat occupancy detection is bifurcated into machine learning-based solutions, which leverage pattern recognition and predictive analytics to deliver superior accuracy, and threshold-based systems, which offer cost-efficient implementations by triggering alerts upon predefined pressure limits. These overlapping segments highlight the importance of modular sensor platforms that can be tailored to varying performance, cost, and regulatory demands.

In practice, leading OEMs are integrating hybrid sensor architectures that combine threshold triggers for basic occupancy alerts with machine learning cores for more complex classification tasks-striking a balance between affordability and functionality. This trend is fueling a two-track development approach: threshold-based sensors will continue to serve volume models and emerging markets, while machine learning-based systems will gain traction in premium segments and next-generation electric vehicles. By understanding these segmentation dynamics, suppliers and OEMs can align their product road maps to address diverse customer needs and capitalize on shifting regulatory priorities without diluting economies of scale.

This comprehensive research report categorizes the Seat Sensor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Functionality

- Sensor Technology

- End Use Industry

Analyzing Regional Market Trends in the Americas EMEA and Asia Pacific to Inform Strategic Seat Sensor Deployment Decisions

Regional market dynamics for seat sensors reveal divergent trajectories shaped by regulatory frameworks, manufacturing footprints, and consumer adoption rates. In the Americas, the recent implementation of automotive tariffs has heightened the focus on USMCA-compliant production, leading to expanded investments in North American assembly and increased collaboration between OEMs and local suppliers to ensure tariff relief. Despite cost headwinds, demand for advanced occupant safety technologies remains robust, driven by consumer advocacy for comprehensive airbag and seatbelt reminder systems in both light trucks and passenger cars.

Europe, the Middle East, and Africa are characterized by stringent Euro NCAP protocols and harmonized ECE R16 regulations that mandate occupant classification and rear-seat occupant reminders for top safety ratings. Regional suppliers and automakers have accelerated compliance strategies, leveraging innovative sensor integration techniques and cross-industry partnerships to meet evolving standards. Meanwhile, the Asia-Pacific region stands as the manufacturing powerhouse for seat sensor components, with key production hubs in China, Japan, and South Korea. OEMs sourcing from these regions must navigate a complex overlay of export controls, regional content requirements, and emerging trade agreements that influence cost structures and supply chain resilience.

This comprehensive research report examines key regions that drive the evolution of the Seat Sensor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Automotive Sensor Manufacturers and Tier One Suppliers Driving Innovation in Seat Sensor Technology and Commercialization Trends

The competitive landscape for seat sensors is defined by a mix of legacy automotive suppliers and specialized technology innovators. Continental and Bosch are leveraging their deep expertise in sensor fusion and ECU integration to deliver platform-agnostic solutions, while Lear Corporation is expanding its offerings in heated and ventilated seat modules with embedded occupancy detection. At the same time, TE Connectivity continues to broaden its portfolio through targeted acquisitions, enhancing its capability in both threshold-based and adaptive sensor systems. New entrants like Forciot have differentiated themselves by pioneering stretchable printed electronics that overcome traditional form-factor limitations and deliver high-resolution occupancy mapping with minimal intrusion into seat structures.

Tier-one suppliers such as Denso and Hyundai Mobis are forging strategic alliances with semiconductor firms and software developers to integrate machine learning-driven classification engines into production-ready seat platforms. This convergence of hardware and AI has elevated the barrier to entry, prompting industry incumbents to pursue joint development agreements and co-innovation lab models. As OEMs increasingly prioritize holistic in-cabin monitoring solutions-encompassing not only seat occupancy but also driver state assessment-suppliers who can demonstrate seamless interoperability and rapid time-to-market will capture the majority of new contract awards.

This comprehensive research report delivers an in-depth overview of the principal market players in the Seat Sensor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adient plc

- Aptiv PLC

- Autoliv Inc.

- Continental AG

- CTS Corporation

- Denso Corporation

- Honeywell International Inc.

- IEE S.A.

- Infineon Technologies AG

- Lear Corporation

- Magna International Inc.

- NXP Semiconductors N.V.

- Robert Bosch GmbH

- Sensata Technologies, Inc.

- TE Connectivity Ltd.

- Valeo SA

- ZF Friedrichshafen AG

Strategic Actionable Recommendations for Automotive Executives to Capitalize on Emerging Seat Sensor Market Opportunities and Navigate Regulatory Challenges

Industry leaders must adopt a multifaceted strategy that emphasizes both technological differentiation and supply chain agility. First, prioritizing investment in machine learning-based sensor platforms will ensure competitive advantage in premium vehicle segments, where occupant classification accuracy and adaptive restraint integration are key differentiators. Concurrently, maintaining a robust threshold-based product line will preserve volume access in cost-sensitive markets. Second, forging strategic partnerships with semiconductor foundries and AI software providers can accelerate development cycles and lower development costs, positioning suppliers to respond swiftly to evolving regulatory mandates such as upcoming in-cab monitoring requirements under Euro NCAP and FMVSS updates.

Moreover, nearshoring production capabilities to USMCA-compliant facilities and establishing regional manufacturing hubs in EMEA and Asia-Pacific will mitigate tariff exposure and currency volatility, safeguarding profitability. Complementing this, adopting standardized testing protocols and certification pathways can streamline compliance efforts across jurisdictions, reducing overhead and accelerating time-to-market. By aligning R&D road maps with regulatory timelines and leveraging cross-industry consortiums to shape future standards, companies can preemptively secure market leadership in the rapidly maturing seat sensor landscape.

Comprehensive Research Methodology Leveraging Primary and Secondary Data Sources to Ensure Robust Seat Sensor Market Analysis

This analysis integrates both primary and secondary research methodologies to deliver a comprehensive view of the seat sensor ecosystem. Primary research comprised in-depth interviews with senior executives and engineering leads at OEMs and tier-one suppliers, supplemented by insights from regulatory officials and independent safety testing agencies. These discussions provided firsthand perspectives on technology adoption drivers, compliance challenges, and future roadmap priorities.

Secondary research included a rigorous review of trade association publications, federal regulatory filings, global safety standards documentation, and recent automotive industry news releases. Supply chain mapping was conducted alongside patent landscape analysis to identify emerging sensor technologies and anticipate competitive moves. Quantitative data on production volumes, tariff schedules, and regional manufacturing footprints were cross-verified with publicly available trade data and corporate financial disclosures to ensure robustness and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Seat Sensor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Seat Sensor Market, by Functionality

- Seat Sensor Market, by Sensor Technology

- Seat Sensor Market, by End Use Industry

- Seat Sensor Market, by Region

- Seat Sensor Market, by Group

- Seat Sensor Market, by Country

- United States Seat Sensor Market

- China Seat Sensor Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 2385 ]

Concluding Insights on the Future of Seat Sensor Innovations and Strategic Imperatives for Automotive Stakeholders to Drive Safety and Efficiency

The seat sensor market is poised for significant expansion as regulatory mandates, technological breakthroughs, and evolving consumer expectations converge to elevate in-cab safety and comfort standards. Traditional threshold-based systems will continue to serve core markets, while machine learning-based solutions gain prominence in premium and electrified vehicle segments. Regional dynamics will be shaped by regulatory harmonization in EMEA, tariff mitigation in the Americas, and manufacturing efficiencies in Asia-Pacific.

For stakeholders across the value chain, success will hinge on the ability to navigate complex trade environments, align technology road maps with safety protocols, and foster collaborative innovation models. Companies that can seamlessly integrate occupant detection, classification, and driver state monitoring into unified platforms will command the most attractive contracts and drive the next wave of in-cab safety and connectivity advancements.

Empower Your Decision Making Today by Securing a Tailored Seat Sensor Market Research Report from Our Expert Sales and Marketing Team

Don’t let evolving safety standards and market disruptions leave your organization behind. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure a comprehensive seat sensor market research report tailored to your strategic needs. With expert guidance and a deep understanding of global trends, you can unlock data-driven recommendations, capitalize on emerging opportunities, and navigate regulatory complexities with confidence. Contact Ketan today to elevate your market intelligence and drive growth in this transformative segment

- How big is the Seat Sensor Market?

- What is the Seat Sensor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?