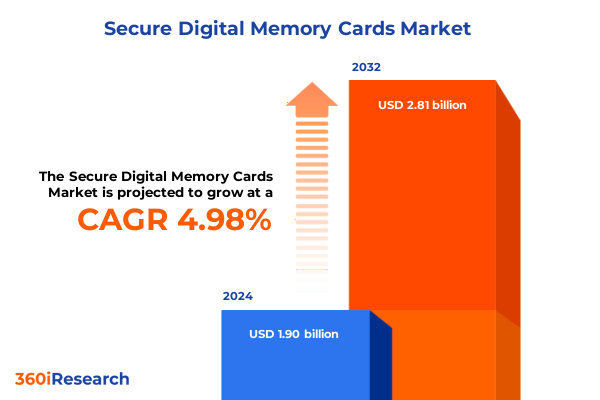

The Secure Digital Memory Cards Market size was estimated at USD 1.99 billion in 2025 and expected to reach USD 2.08 billion in 2026, at a CAGR of 5.04% to reach USD 2.81 billion by 2032.

Unlocking the Integral Role of Secure Digital Memory Cards in Modern Data-Driven Applications and Emerging Technological Demands

The digital era’s unceasing demand for reliable data storage has positioned Secure Digital (SD) memory cards as indispensable components across a broad spectrum of devices. From everyday smartphones capturing fleeting moments to advanced professional imaging equipment recording cinematic-quality footage, these compact modules have evolved into critical enablers of data mobility and preservation. The maturation of digital ecosystems-spanning consumer electronics, automotive systems, industrial automation, and beyond-has intensified requirements for greater capacity, faster transfer rates, and enhanced durability. Consequently, industry stakeholders are navigating a landscape defined by both unprecedented opportunities and intensifying competition.

Against this backdrop, stakeholders require a clear understanding of the market’s underlying drivers, structural shifts, and emerging risks. This executive summary synthesizes the most salient developments shaping the SD memory card sector, highlighting transformative technological advances, regulatory influences, and segmentation-driven growth patterns. It also examines the ripple effects of recent U.S. tariff measures on supply chains and pricing dynamics, offering an informed perspective to guide strategic planning. By consolidating key regional and competitive insights, this overview equips decision-makers with the foundational intelligence necessary to craft resilient product strategies and forge lasting partnerships in an evolving marketplace.

Revolutionary Technological Advancements and Evolving User Expectations Shaping the Future of Secure Digital Memory Cards

Over the past two years, the secure digital memory card market has undergone a radical metamorphosis driven by breakthroughs in semiconductor fabrication and evolving end-user behaviors. Innovations such as the adoption of the Ultra High Capacity (SDUC) standard have expanded maximum capacities well beyond terabyte thresholds, empowering content creators and industrial systems to manage ever-larger datasets without compromise. Meanwhile, the proliferation of high-frame-rate video capture and real-time data logging in autonomous vehicles has elevated performance benchmarks, fueling robust uptake of advanced speed classes like V60 and V90. These capabilities are unlocking new applications-ranging from 8K professional cinematography to in-vehicle telematics-that were previously infeasible due to hardware limitations.

Simultaneously, shifting consumer expectations around instant data access and on-the-go storage have catalyzed a renaissance in device design. Manufacturers are integrating SD Express interfaces that leverage PCIe and NVMe protocols, closing the performance gap with embedded flash. This harmonization of form factor familiarity and cutting-edge throughput is accelerating adoption across flagship smartphones and ultraportable laptops. In parallel, the emergence of host-managed SD cards is redefining firmware-level optimization, enabling dynamic wear leveling and encryption that meet stringent enterprise security standards.

Technological progression is also intersecting with environmental imperatives. Industry consortia are collaborating on eco-friendly materials and end-of-life recycling programs, reflecting a broader commitment to sustainability. As a result, product roadmaps now emphasize both raw performance metrics and lifecycle responsibility, positioning the secure digital memory card industry at the heart of a digital ecosystem that values speed, capacity, security, and ecological stewardship.

Evaluating the Far-Reaching Consequences of 2025 United States Tariff Adjustments on Secure Digital Memory Card Supply Chains and Pricing

In early 2025, the United States implemented a suite of tariff adjustments targeting a range of imported electronic components, including memory modules and storage devices. These measures, levying additional duties on goods originating from key manufacturing hubs, have introduced layerable costs that reverberate throughout the secure digital memory card value chain. Contract manufacturers and branded vendors are grappling with recalibrated pricing models to preserve margin integrity while remaining competitive in price-sensitive end markets.

The tariff-induced cost pressures have prompted many suppliers to reassess sourcing strategies, with nearshoring options gaining traction. North American assembly facilities are being evaluated to mitigate the duty burden, though these alternatives often involve higher labor inputs and capital expenditures for tooling and validation. Some manufacturers are pursuing dual-sourcing frameworks, balancing Chinese production efficiencies with localized backup capacity in Southeast Asia and Mexico. This hedging approach aims to preserve supply continuity amid geopolitical flux.

Meanwhile, distributors and channel partners are adjusting their inventory policies to buffer against volatility. Longer lead times and broadened safety stocks are becoming commonplace, supporting uninterrupted product availability despite fluctuating import schedules. On the pricing front, retailers are exploring tiered loyalty programs and bundled offers to offset incremental costs for end users. As the tariff environment evolves, companies that proactively diversify their supply chains and optimize inventory management will be best positioned to maintain market share and safeguard profitability.

Deep Dive into Capacity Type Application Speed Class and Distribution Channel Segmentation Revealing Strategic Market Dynamics

Examining secure digital memory cards through the lens of capacity reveals a kaleidoscope of user requirements. At the lower end, segments up to 2GB and between 2 and 32GB remain relevant for budget-friendly consumer electronics and industrial controller applications. Midrange brackets spanning 32 to 64GB and 64 to 128GB capture the bulk of mainstream smartphone and tablet usage, where users demand a blend of ample storage and cost efficiency. The 128 to 256GB segment caters to advanced hobbyist photographers and drone operators who require greater image and video reserves. Meanwhile, the expansive 256GB-plus category-encompassing both 512GB to 1TB and above 1TB tiers-is driving adoption among professional imaging studios and data-intensive industrial systems seeking high-throughput bulk storage.

Type-based segmentation further nuances this picture. Standard SD cards continue to serve baseline functions, while the Secure Digital High Capacity (SDHC) standard addresses midlevel performance demands. The Secure Digital eXtended Capacity (SDXC) category has become the workhorse for high-definition video and advanced computing tasks, offering significant capacity hikes. Most recently, SDUC cards have emerged to push the boundaries of maximum storage, supporting next-generation applications that generate terabytes of data per operation cycle.

Diversity of application underscores the industry’s breadth. In the automotive arena, memory cards power infotainment systems, advanced driver assistance module data logging, and over-the-air firmware updates. The consumer electronics sector spans digital cameras, drones, smartphones, and tablets, each segment exhibiting its own performance and capacity preferences. Industrial adoption includes robotics controllers, automation sensors, and remote monitoring devices, where resilience and data integrity are paramount. Professional imaging remains a cornerstone, with DSLRs, mirrorless cameras, and cinematic rigs demanding the highest speed classifications to ensure flawless capture.

Speed class distinctions play an equally critical role in buyer decisions. Class 2, Class 4, Class 6, and Class 10 cards delineate baseline performance bands, while Ultra High Speed categories U1, U3 and Video Speed Classes V30, V60, V90 serve specialized high-definition and burst-capture requirements. Finally, distribution channel segmentation shapes accessibility and service experience. Direct sales channels nurture key account relationships, whereas e-commerce pathways-split between third-party e-retailers and manufacturer-owned websites-deliver broad reach and digital convenience. Offline retail outlets remain indispensable for emergent markets and impulse purchases, blending tactile evaluation with immediate availability.

This comprehensive research report categorizes the Secure Digital Memory Cards market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Capacity

- Type

- Application

- Speed Class

- Distribution Channel

Analyzing Regional Demand Patterns and Innovation Drivers in the Americas EMEA and Asia Pacific Secure Digital Card Markets

Regional demand for secure digital memory cards varies significantly across the Americas, reflecting mature consumer markets and advanced automotive ecosystems. In North America, widespread adoption of high-definition video devices and robust professional photography communities drive a consistent appetite for premium cards. Latin American markets display a dual character, with urban centers embracing smartphones and point-and-shoot cameras while remote areas continue to rely on offline retail networks for basic storage needs.

Europe, Middle East, and Africa (EMEA) present a complex tapestry of requirements. Western European countries emphasize sustainability and premium performance, spawning interest in eco-certified materials and high-end professional imaging. The Middle East’s rapid infrastructure development and luxury branding culture foster a robust market for flagship memory card products. In Africa, penetration rates are rising alongside mobile network expansion, yet pricing sensitivity remains a key consideration, sustaining demand for midrange capacity segments and standard SD types.

Asia-Pacific stands as the most dynamic region, driven by manufacturing leadership, technology exports, and a vast consumer base. Major smartphone vendors bundle high-capacity cards with flagship devices to differentiate offerings in crowded markets. Furthermore, the region’s flourishing drone industry and emerging automotive electronics sector generate substantial volumes of SDXC and SDUC cards. Rapid e-commerce adoption accelerates distribution, while local production clusters in Southeast Asia and Japan support innovation in speed class advancements. These regional nuances underscore the importance of tailored go-to-market strategies and supply chain configurations that align with each locale’s unique blend of performance expectations, price sensitivity, and regulatory frameworks.

This comprehensive research report examines key regions that drive the evolution of the Secure Digital Memory Cards market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Dominant and Specialized Players Shaping Competition Innovation and Collaboration across the Secure Digital Memory Card Industry

The competitive landscape for secure digital memory cards is defined by a mix of global conglomerates and specialized innovators. Leading flash memory manufacturers have leveraged economies of scale to deliver cost-competitive mainstream products while reinvesting in research to extend capacity and speed thresholds. Strategic alliances between semiconductor fabricators and storage solution vendors have expedited the rollout of new form factors, ensuring that the latest technological capabilities reach end users swiftly.

Beyond headline brands, agile niche players have carved out strongholds in specific market pockets. Some firms concentrate on ruggedized industrial cards optimized for extreme temperature and vibration environments, securing contracts with automation and defense contractors. Others focus on high-end professional imaging, offering branded partnerships with camera manufacturers to certify cards for peak performance in cinematic workflows. These specialists often set the bar for new speed class certifications and endurance ratings, influencing the broader industry’s roadmap.

Distribution partners and channel integrators also hold considerable sway. Major e-retail platforms not only facilitate global reach but also curate user reviews and performance benchmarks, shaping purchase decisions. Meanwhile, direct sales teams service enterprise accounts, delivering tailored solutions and volume discounts. Partnerships between card manufacturers and device OEMs enable pre-installed storage options that drive enhanced customer convenience and lock in brand loyalty. This interconnected ecosystem underscores that competitive advantage stems not only from raw product performance but also from cohesive go-to-market execution and strategic collaboration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Secure Digital Memory Cards market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADATA Technology Co., Ltd.

- Amazon.com, Inc.

- Delkin Devices, Inc.

- Gigastone Corp.

- HP Development Company, L.P.

- Integral Memory PLC

- KINGMAX Technology Inc.

- Kingston Technology

- Longsys

- Micron Technology, Inc.

- Panasonic Holdings Corp.

- Patriot Memory

- PNY Technologies Inc.

- Samsung Electronics Co., Ltd.

- Silicon Power Computer & Communications Inc.

- Sony Group Corp.

- Strontium

- Super Talent Technology

- Team Group

- Toshiba Corporation

- Transcend Information, Inc.

- Unirex Technologies

- Verbatim Americas LLC

Strategic Recommendations for Enhancing Innovation Supply Chain Agility and Channel Effectiveness in the Secure Digital Card Market

To thrive in this rapidly evolving environment, manufacturers and stakeholders must prioritize strategic differentiation. Investing in next-generation speed and capacity innovations-such as SD Express and host-managed card functionalities-will ensure that products align with emerging application demands. Equally important is expanding sustainability credentials through partnerships focused on recyclable materials and carbon footprint reduction, responding to growing environmental regulations and consumer preferences.

Supply chain resilience is another critical imperative. Companies should diversify their production footprint by blending low-cost manufacturing hubs with regional assembly options to offset tariff impacts and logistical disruptions. Establishing transparent supplier ecosystems and leveraging advanced inventory analytics can minimize stockouts and optimize working capital. Collaborative planning with key distributors and OEM partners will further stabilize demand forecasting and support rapid scaling when new product introductions occur.

Finally, firms should refine their channel strategies to maximize end-user engagement. Enhancing direct-to-customer digital platforms enables richer data collection on user preferences and usage patterns, informing targeted marketing and product development. At the same time, nurturing strong relationships with e-commerce marketplaces and select offline retail partners ensures broad market coverage. By coupling these efforts with flexible pricing models and value-added service bundles, organizations can capture incremental revenue streams and cement long-term customer loyalty.

Comprehensive Research Methodology Integrating Primary Interviews Secondary Data and Multi-Source Triangulation for Market Insight Validation

The insights compiled in this summary derive from a structured research methodology combining primary and secondary sources. Primary research included in-depth interviews with hardware manufacturers, key distributors, and end-user representatives across consumer electronics, automotive, industrial, and professional imaging segments. These discussions provided firsthand perspectives on technology adoption, procurement challenges, and evolving performance requirements.

Secondary research encompassed a rigorous review of technical standards documentation, industry white papers, and regulatory publications. Analysis of patent filings and product certification data offered a forward-looking view of emerging speed class and form factor developments. Additionally, domestic and international trade statistics were examined to quantify shifts in import-export flows, particularly in light of recent tariff adjustments.

Data triangulation was applied to reconcile divergent inputs and validate conclusions, ensuring that findings reflect both macro trends and granular market realities. Quantitative observations on pricing, shipment volumes, and adoption rates are contextualized with qualitative commentary from sector specialists. Together, this multifaceted approach underpins the reliability and actionability of the strategic insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Secure Digital Memory Cards market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Secure Digital Memory Cards Market, by Capacity

- Secure Digital Memory Cards Market, by Type

- Secure Digital Memory Cards Market, by Application

- Secure Digital Memory Cards Market, by Speed Class

- Secure Digital Memory Cards Market, by Distribution Channel

- Secure Digital Memory Cards Market, by Region

- Secure Digital Memory Cards Market, by Group

- Secure Digital Memory Cards Market, by Country

- United States Secure Digital Memory Cards Market

- China Secure Digital Memory Cards Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Innovation Drivers Strategic Imperatives and Market Dynamics Defining the Secure Digital Memory Card Landscape Today

The secure digital memory card industry stands at a pivotal juncture where technological innovation, shifting trade policies, and diverse end-use requirements converge to redefine market contours. Organizations that remain attuned to the trajectory of capacity expansion, speed class evolution, and regional demand variations will be best positioned to seize new growth avenues.

As tariff landscapes fluctuate, resilient supply chain designs and agile procurement strategies will become increasingly vital. Simultaneously, the pursuit of sustainable product credentials and direct customer engagement strategies will differentiate market leaders from the field. Through the lens of segmentation and competitive profiling, stakeholders can identify high-potential niches-ranging from professional imaging to automotive telematics-and calibrate their investments accordingly.

In summary, the interplay of innovation, regulation, and consumer expectations is accelerating the reinvention of secure digital memory card solutions. By leveraging the insights and recommendations distilled in this executive summary, industry participants can navigate complexity with confidence and drive long-term value creation.

Engage Directly with Ketan Rohom to Access Comprehensive Secure Digital Memory Card Market Insights and Accelerate Your Strategic Success

For customized insights and detailed analysis tailored to your strategic needs, we invite you to reach out to our team’s Associate Director of Sales & Marketing, Ketan Rohom. Leveraging deep expertise in secure digital memory card technologies and market dynamics, Ketan will guide you through the report’s comprehensive findings and help you identify the most relevant opportunities and risk mitigation strategies for your organization’s success.

Secure your competitive advantage today by connecting with Ketan Rohom to obtain the full market research report. Our dedicated analytics and advisory team stands ready to support your decision-making process with data-driven recommendations, ensuring you stay ahead in this rapidly evolving industry landscape.

- How big is the Secure Digital Memory Cards Market?

- What is the Secure Digital Memory Cards Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?