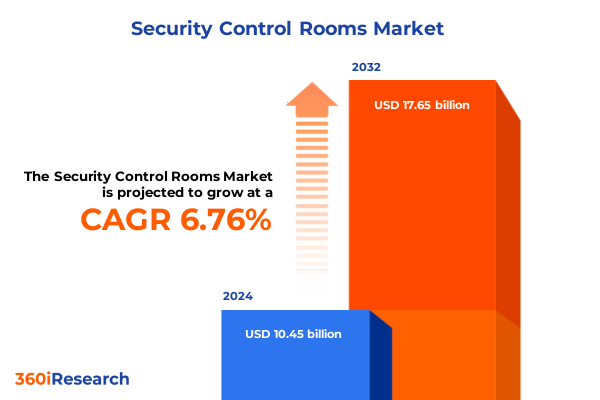

The Security Control Rooms Market size was estimated at USD 11.15 billion in 2025 and expected to reach USD 11.91 billion in 2026, at a CAGR of 7.61% to reach USD 18.65 billion by 2032.

Unveiling the Critical Role of Modern Control Rooms in Protecting Infrastructure and Ensuring Operational Continuity Across Diverse Industries

The modern security control room has emerged as an indispensable nerve center for organizations seeking to safeguard critical infrastructure and maintain seamless operational continuity. With threat landscapes evolving at a rapid pace, control rooms now consolidate vast streams of data from diverse sensors, video feeds, and communication channels into unified command interfaces. This convergence empowers operators to make rapid, informed decisions that mitigate risks and preempt incidents before they escalate. Beyond simply monitoring, today’s control rooms facilitate incident response coordination, real-time collaboration across departments, and post-event analysis that drives continuous improvement in security protocols.

In response to growing complexity and heightened regulatory demands, this analysis delves into the foundational elements shaping the control room domain. It explores the transformative technological advancements, examines the ripple effects of recent tariff policies on procurement strategies, and unpacks how segmentation categories reflect distinct operational requirements. Through regional and competitive landscapes, we illuminate the nuanced opportunities and challenges that organizations must navigate. This introduction sets the stage for a detailed exploration of the forces redefining the way enterprises design, deploy, and manage their security control hubs, ensuring leaders can align investments with evolving risk profiles and strategic objectives.

Exploring the Technological and Operational Transformations Redefining Control Room Architectures and Security Management Paradigms Today

The landscape of security control rooms is undergoing a profound transformation driven by rapid technological innovation and shifting operational paradigms. Traditional command centers that relied exclusively on physical infrastructure and legacy systems are now integrating advanced software platforms, cloud computing, and artificial intelligence to deliver predictive threat detection and automated response workflows. The rise of the Internet of Things has multiplied data sources, from environmental sensors to connected access control devices, enabling a holistic situational awareness that was previously unattainable.

Moreover, the proliferation of virtual control room solutions has challenged the notion that centralized, on-site command centers are the only viable option. Organizations increasingly adopt hybrid architectures that blend on-premise hardware with virtualized environments, furnishing scalability and remote accessibility without sacrificing reliability. This dynamic shift has been accelerated by remote work imperatives and budget constraints, prompting security teams to reevaluate their control room strategies in favor of agile configurations that can adapt to emerging threats and evolving regulatory frameworks. Consequently, control room deployments today reflect a balance between physical presence and digital flexibility, empowering enterprises to respond swiftly across distributed operations.

Analyzing How United States Tariff Measures Enacted in 2025 Are Reshaping Supply Chains and Procurement Strategies in Security Control Environments

In 2025, a series of tariff measures instituted by the United States government have exerted significant pressure on the procurement and supply chains of security control room equipment. Levies imposed on imported hardware components, particularly those sourced from regions with lower production costs, have translated into inflated capital expenditures for organizations reliant on high-performance servers, network switches, and specialized control consoles. As a result, procurement teams have been compelled to reassess vendor contracts, negotiate volume discounts, and explore alternative suppliers that can offer domestic manufacturing capabilities to mitigate tariff burdens.

These financial headwinds have also accelerated the shift towards cloud-based control room solutions, where software-centric models reduce the dependency on heavy physical infrastructure. By leveraging managed service providers, organizations can amortize their expenses through subscription models and avoid upfront hardware costs subject to tariff escalations. At the same time, maintenance and support agreements have been restructured to account for potential supply chain disruptions, ensuring that critical spares and upgrade services remain available despite global trade frictions. Collectively, these measures illustrate how tariff policies have reshaped strategic procurement, compelling security leaders to balance cost containment with operational efficacy.

Deriving Actionable Insights from Segmentation of Control Room Solutions by Type Deployment Model Products and End User Verticals in Depth

Segmenting the control room security market reveals precise insights into how organizations tailor their solutions to unique operational requirements. When categorizing by control room type, purely physical installations still dominate environments where on-site presence is non-negotiable, yet virtual command centers are gaining momentum for their ability to support distributed teams and provide geospatial coverage across remote locations. Hybrid configurations have emerged as the optimal compromise, combining tangible control hardware with virtualized overlays that grant scalability and risk isolation.

Deployment models further distinguish strategic choices between cloud and on-premise infrastructures. Cloud-based environments offer dynamic scalability and rapid provisioning of analytical tools, freeing IT teams from hardware lifecycle management. Conversely, on-premise deployments remain favored where data sovereignty, latency, or stringent regulatory compliance necessitate local control. The product landscape spans robust hardware platforms, integrated software suites that consolidate video analytics and threat intelligence, and a comprehensive array of services encompassing installation and integration, ongoing maintenance and support, and specialized training that ensures operators maximize system uptime and capabilities.

Exploring end-user verticals highlights differentiated adoption drivers. Financial institutions, including banks, financial services firms, and insurance companies, leverage control room solutions to protect sensitive transactions and prevent fraud. Educational campuses prioritize safety and emergency response coordination, while energy and utilities operations focus on grid reliability and asset protection. Government and defense agencies ranging from homeland security units to law enforcement and military installations demand hardened infrastructures with enhanced resilience. Healthcare organizations, both clinics and hospitals, integrate monitoring systems to secure patient safety and support telemedicine initiatives. Information technology and telecom providers emphasize secure network operations centers, whereas manufacturing sites focus on process continuity and loss prevention. Retail environments, encompassing hypermarkets, specialty stores, and supermarkets, invest in loss detection and crowd management, and transportation and logistics hubs, from airports to railways and seaports, depend on real-time surveillance to maintain uninterrupted throughput and safety.

This comprehensive research report categorizes the Security Control Rooms market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Control Room Type

- Deployment Type

- Product Type

- End User

Illuminating Regional Dynamics of Control Room Adoption and Security Prioritization across Americas EMEA and Asia Pacific Territories

Regional dynamics play a pivotal role in shaping the adoption and evolution of security control rooms across major global markets. In the Americas, substantial investments in digital transformation and infrastructure modernization have propelled widespread deployment of advanced control room technologies. The United States leads with stringent regulatory standards and high adoption of cloud-enabled command centers, while Canada’s emphasis on cybersecurity regulations drives demand for integrated threat intelligence. Latin American markets, buoyed by urbanization trends, increasingly prioritize scalable hybrid solutions to manage sprawling metropolitan surveillance initiatives.

Europe, the Middle East, and Africa present a heterogeneous landscape. Western European nations implement rigorous data protection frameworks that favor on-premise deployments, yet they progressively integrate analytics-driven software to enhance incident response. In the Middle East, large-scale smart city projects and significant capital inflows into critical infrastructure bolster demand for cutting-edge, AI-powered control rooms. African markets, though nascent in widespread adoption, demonstrate rising interest fueled by public–private partnerships aiming to upgrade legacy security systems and improve emergency services coordination.

The Asia-Pacific region commands the highest growth trajectory, driven by rapid urbanization and government initiatives to bolster national security. China and India invest heavily in centralized command centers to manage urban mobility and public safety, while Japan emphasizes resilience against natural disasters through integrated monitoring platforms. Emerging economies within Southeast Asia exhibit a growing appetite for modular, cloud-based services that can be deployed quickly to meet immediate security requirements, underscoring the versatility of hybrid configurations in diverse regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Security Control Rooms market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Surveying Leading Players and Competitive Strategies Shaping Innovation Adoption in the Control Room Security Market Landscape

An increasingly competitive landscape is defined by both established industrial conglomerates and innovative technology specialists vying for control room market leadership. Traditional automation and building management providers have augmented their security portfolios by embedding advanced video analytics, cybersecurity safeguards, and AI-driven decision support within their control platforms. At the same time, pure-play software firms are forging strategic alliances with hardware manufacturers to deliver fully integrated offerings that reduce deployment complexity and accelerate time to operational readiness.

Market leaders differentiate themselves through sustained investment in research and development, focusing on user-centric interface design, interoperability standards such as open protocols, and modular architectures that enable rapid customization. Partnerships with managed service providers further extend their reach by offering subscription-based control room as a service models. As mergers and acquisitions reshape market dynamics, organizations that demonstrate agility in integrating emerging technologies-such as edge computing and advanced biometrics-gain a distinct advantage. The race to deliver holistic security solutions places a premium on cross-disciplinary collaboration, uniting expertise in IT, cybersecurity, and operations to craft resilient, future-proof control room ecosystems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Security Control Rooms market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adder Technology Ltd.

- Atos SE

- Barco Electronic Systems Pvt Ltd.

- Beckhoff Automation GmbH & Co. KG

- Brand Control Rooms

- BT group

- Contour Advanced Systems BV

- Crime and Fire Defence Systems Ltd.

- Delta Electronics, Inc.

- EVOSITE, INC.

- Herongrange Group Limited

- INFINOVA GROUP

- Lodge Service Group

- Matrox Electronic Systems Ltd.

- Mistral Solutions Pvt. Ltd.

- Modcon Systems Ltd.

- Motorola Solutions, Inc.

- Planar Systems

- RGB Spectrum

- Skysoft, Inc.

- Solid State Security Ltd.

- SSS Public Safety Limited

- Titan Security Europe

- VuWall Technology Inc.

Recommendation Strategies for Industry Leaders to Advance Control Room Capabilities and Strengthen Security Posture through Strategic Initiatives

Industry leaders seeking to stay ahead of the curve should prioritize investments that balance flexibility with resilience. By adopting modular hybrid architectures, organizations can scale their control rooms in alignment with evolving threat profiles and operational footprints. Incorporating advanced analytics and threat intelligence directly into command interfaces empowers security teams to transition from reactive incident management to proactive risk mitigation, enhancing overall situational awareness and decision accuracy.

Given ongoing trade uncertainties and tariff pressures, decision-makers must diversify their supply chains and cultivate partnerships with domestic and regional vendors capable of delivering critical components without exposure to punitive levies. Strengthening internal capabilities through targeted training programs ensures that personnel remain proficient in both hardware maintenance and software optimization. Cultivating a culture of continuous learning and cross-functional collaboration drives innovation and reduces the latency between threat detection and response.

Actionable roadmaps should include pilot programs that validate new deployment models under realistic conditions, accompanied by clearly defined key performance indicators. Establishing structured feedback loops between operational teams and solution providers accelerates iterative improvements, while governance frameworks that align security, IT, and executive leadership foster accountability and strategic alignment. By embedding agility into control room strategies, enterprises can adapt more swiftly to technological advances and shifting risk landscapes.

Detailing Rigorous Research Methodology Underpinning Analysis of Control Room Security Trends Combining Primary Secondary and Expert Data Sources

This analysis integrates a robust research methodology designed to deliver reliable, actionable insights into the security control room domain. Primary qualitative research included in-depth interviews with senior security executives, technology integrators, and critical infrastructure operators to capture firsthand perspectives on emerging challenges and investment priorities. Complementing these discussions, structured surveys across industry verticals provided quantitative data on adoption rates, deployment preferences, and budget allocation trends.

Secondary research drew from regulatory filings, technical white papers, and publicly available case studies to map technology trajectories and benchmark best practices. Data triangulation techniques were employed to reconcile disparate information sources, ensuring the coherence and validity of thematic findings. Expert panels, featuring thought leaders in cybersecurity, operational risk, and systems integration, reviewed preliminary conclusions to refine recommendations and verify real-world applicability. This mixed-method approach underpins a rigorous analysis that balances empirical evidence with strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Security Control Rooms market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Security Control Rooms Market, by Control Room Type

- Security Control Rooms Market, by Deployment Type

- Security Control Rooms Market, by Product Type

- Security Control Rooms Market, by End User

- Security Control Rooms Market, by Region

- Security Control Rooms Market, by Group

- Security Control Rooms Market, by Country

- United States Security Control Rooms Market

- China Security Control Rooms Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Concluding Perspectives on the Imperative for Adaptive Control Room Strategies to Navigate Emerging Threats Operational Complexities and Growth Opportunities

As organizations navigate an increasingly complex security environment, adaptive control room strategies emerge as a critical differentiator. The convergence of digital and physical domains demands solutions that seamlessly integrate hardware resilience with software intelligence, enabling rapid detection and response to dynamic threats. Decision-makers must maintain a vigilant focus on regulatory compliance, technological interoperability, and cost efficiency to preserve operational continuity and stakeholder trust.

Looking ahead, the successful control rooms of tomorrow will be defined by their agility, scalability, and capacity to harness advanced analytics at the edge. Continuous innovation through modular architectures and strategic partnerships will be essential in addressing both unpredictable risk scenarios and the relentless pace of technological change. By leveraging the insights detailed in this report, industry leaders can chart a proactive course toward fortified security postures, ensuring that control rooms evolve in step with emerging threats and organizational objectives.

Engage with Ketan Rohom to Secure Exclusive Access to Comprehensive Control Room Security Insights and Propel Informed Strategic Decisions

To unlock unparalleled depth in understanding the evolving dynamics and strategic imperatives of security control rooms, engage directly with Associate Director, Sales & Marketing, Ketan Rohom. He will guide you through bespoke insights and demonstrate how the comprehensive market research report can inform and accelerate your organization’s security and operational strategies. Reach out to Ketan to explore detailed modules, expert recommendations, and tailored data visualizations designed to equip decision-makers with actionable intelligence. Secure your competitive edge and ensure resilience against emerging threats by purchasing the full report today

- How big is the Security Control Rooms Market?

- What is the Security Control Rooms Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?