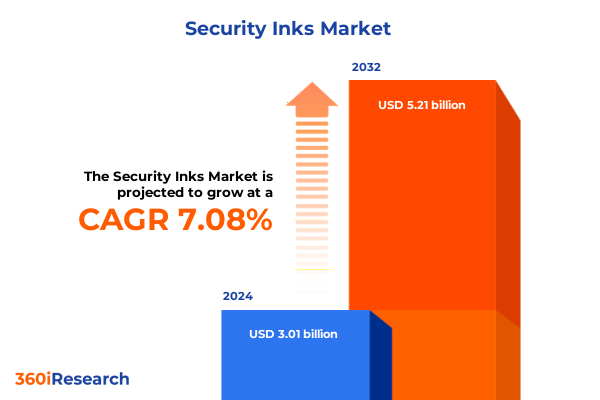

The Security Inks Market size was estimated at USD 3.23 billion in 2025 and expected to reach USD 3.42 billion in 2026, at a CAGR of 7.06% to reach USD 5.21 billion by 2032.

Unlocking the Strategic Importance of Security Inks Across Financial Documents, Identity Credentials, and Brand Protection in a Risk-Prone Environment

Security inks serve as a critical bulwark against the soaring tide of counterfeiting and fraud, safeguarding the integrity of banknotes, identity credentials, and branded products worldwide. According to the International Chamber of Commerce, intellectual property theft and counterfeiting cost legitimate businesses approximately €700 billion in lost sales each year, underscoring the urgent need for robust anti-counterfeiting solutions. As global trade expands and digital channels proliferate, bad actors increasingly exploit vulnerabilities in security printing, driving demand for advanced ink formulations that combine covert and overt features to deter forgery.

Navigating the Pivotal Transformative Shifts Redefining Security Ink Technologies in a Rapidly Evolving Authentication Landscape

The security inks landscape has undergone remarkable transformations, propelled by breakthroughs in digital printing technologies and the integration of smart materials. Over the past three years, manufacturers have embraced digital inkjet and laser printing processes to enable variable data printing, allowing each document to carry a unique, tamper-evident pattern seamlessly at scale. Simultaneously, innovations in thermochromic and UV-fluorescent inks have enhanced authentication protocols, enabling ink formulations that react dynamically to external stimuli such as temperature changes or ultraviolet exposure. These trends reflect a shift toward multifunctional security inks that not only prevent counterfeiting but also support traceability and supply chain monitoring.

Assessing the Comprehensive Cumulative Impact of 2025 United States Tariffs on the Security Inks Supply Chain and Cost Structures

In 2025, the United States enacted sweeping tariff measures that have reshaped the security inks supply chain, driving a recalibration of procurement strategies and cost structures. Under the second Trump administration, average applied import duties climbed from around 2.5% to an estimated 27% between January and June 2025, marking the highest level in over a century and triggering revised duties on specialty pigments, functional polymers, and printing substrates. These policy shifts have imposed new cost burdens on ink formulators reliant on imported chemical intermediates, prompting many to near-shore operations or diversify supplier bases across Asia and Europe to mitigate risk.

Uncovering Key Segmentation Insights by Application, Ink Type, End User, Technology, and Security Level Shaping Market Dynamics

A nuanced examination of security ink market segmentation reveals distinct demand patterns across applications, ink types, end-user industries, printing technologies, and security levels. Application-wise, protection of bank checks and financial documents remains foundational, while currency and banknotes require specialized infrared-active and diffractive pigment inks. ID documents, including driver’s licenses, passports, and residence permits, call for a combination of covert and forensic inks to counter increasingly sophisticated forgery techniques. The product authentication segment has surged recently, with electronics and luxury goods demanding both overt UV-fluorescent inks and magnetic formulations to ensure brand integrity.

This comprehensive research report categorizes the Security Inks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ink Type

- Technology

- Security Level

- Application

- End User

Dissecting Critical Regional Dynamics Across Americas, Europe Middle East & Africa, and Asia-Pacific Driving Security Inks Adoption

Regional dynamics further underscore the complexity of the security inks marketplace. In the Americas, stringent anti-counterfeiting regulations and a large financial services sector drive demand for high-security inks, while manufacturing hubs in Mexico and the United States enable flexible near-shoring of pigment and polymer supplies. Europe, Middle East & Africa benefit from established central bank initiatives and unified standards that foster widespread adoption of optically variable and forensic inks for banknotes and official documents. In Asia-Pacific, buoyed by government mandates in China and India to curb currency and product counterfeiting, growth is most pronounced, with many nations integrating advanced security inks into national ID programs and pharmaceutical packaging.

This comprehensive research report examines key regions that drive the evolution of the Security Inks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Security Ink Innovators and Industry Titans Driving Competitive Differentiation and Technological Advancement

Market leadership resides with companies that combine deep chemical expertise, global distribution networks, and ongoing R&D investment. SICPA, the Swiss security ink specialist responsible for more than 85% of global currency inks, anchors the landscape with proprietary polymer carriers and diffractive pigment technologies. Sun Chemical, operating under DIC Corporation, leverages its extensive color and graphics portfolio to supply security inks for packaging and identity documents across multiple continents. Microtrace differentiates through forensic analysis solutions, while CTI and Gleitsmann Security Inks emphasize thermo-chromic and magnetic formulations for document security. Emerging players like Petrel and Kao Collins are challenging incumbents by co-developing custom ink chemistries with electronics and pharmaceutical partners to address application-specific needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Security Inks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ANY Security Printing Company PLC

- Chroma Inks USA

- Chromatic Technologies Inc.

- DIC CORPORATION

- Eastman Kodak Company

- Flint Group

- FUJIFILM Holdings America Corporation

- FX Pigments Pvt. Ltd.

- Gans Ink & Supply Co.

- Gleitsmann Security Inks GmbH

- Hologramas de México, S. de R.L. de C.V.

- INK TEC INC.

- JN Arora Group

- Kao Collins Corporation

- Microtrace, LLC

- Mingbo Anti-forgery Technology (Shenzhen) Co., Ltd,

- Naigai Ink Mfg. Co. Ltd

- NanoMatriX Technologies Limited.

- NovaVision,LLC

- Petrel Security

- PingWei Anti-forgery Ink Limited

- SAKATA INX CORPORATION.

- Shriram Veritech Solutions Pvt. Ltd.

- SICPA HOLDING SA.

- Siegwerk Druckfarben AG & Co. KGaA

- Sun Chemical

- The Cronite Company

- VILLIGER SECURITY SOLUTIONS AG

- Westtek Enterprises Private Limited

- Wikoff Color Corporation

Implementing Actionable Strategic Recommendations to Fortify Supply Chains, Enhance Innovation, and Navigate Evolving Trade Regulations Effectively

To navigate the evolving security inks environment, industry leaders should first secure strategic alliances with domestic chemical producers to stabilize raw material sourcing and hedge against tariff volatility. Investment in proprietary chemistries, such as nanoparticle-enhanced and biometric-reactive inks, can establish high barriers to entry and deliver premium pricing power. Additionally, expanding digital printing capabilities for variable data and real-time authentication will position organizations at the forefront of bespoke security solutions. Finally, proactive engagement with policymakers and standards bodies will help shape favorable trade policies and unlock opportunities for government procurement contracts, reinforcing long-term market resilience.

Revealing a Robust Research Methodology Combining Multi-Source Data, Expert Validation, and Triangulation to Deliver Insightful Analysis

This analysis draws on a rigorous methodology combining comprehensive secondary research, expert interviews, and data triangulation. Secondary sources included peer-reviewed journals, industry whitepapers, and reputable business publications to chart technological trends and tariff developments. Subject-matter experts across security printing, chemistry, and supply chain management were consulted through structured interviews to validate findings and uncover emerging use cases. Finally, data triangulation ensured consistency across fragmented sources, enabling robust cross-validation of qualitative insights and thematic analysis.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Security Inks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Security Inks Market, by Ink Type

- Security Inks Market, by Technology

- Security Inks Market, by Security Level

- Security Inks Market, by Application

- Security Inks Market, by End User

- Security Inks Market, by Region

- Security Inks Market, by Group

- Security Inks Market, by Country

- United States Security Inks Market

- China Security Inks Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Summarizing Core Findings to Illuminate Future Directions and Stakeholder Opportunities Within the Security Inks Ecosystem

In conclusion, the security inks sector stands at a crossroads characterized by rapid technological innovation, shifting trade policies, and evolving regulatory frameworks. While 2025 tariffs have introduced near-term supply chain challenges, they also catalyze domestic manufacturing partnerships and drive R&D in alternative chemistries. Segmentation insights highlight the need for tailored solutions across applications and security levels, while regional dynamics underscore diverse growth trajectories. By executing the recommended strategies, stakeholders can transform these dynamics into competitive advantages and ensure the integrity of critical documents and products in an increasingly risk-laden global market.

Engage Directly with Ketan Rohom to Secure Access to the Comprehensive Security Inks Market Report and Accelerate Strategic Decisions

If you are ready to leverage comprehensive insights and strategic guidance on the security inks market, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the full research report and gain a competitive edge in this transformative industry

- How big is the Security Inks Market?

- What is the Security Inks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?