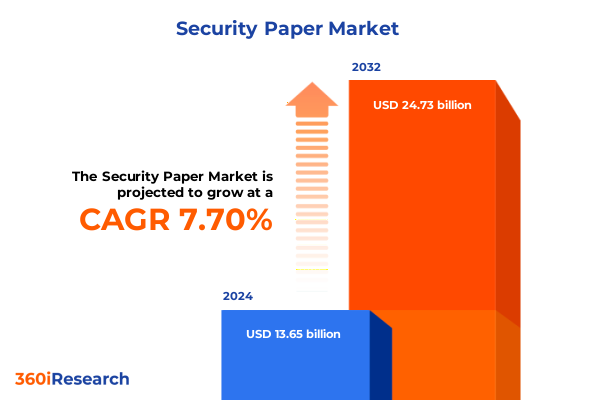

The Security Paper Market size was estimated at USD 14.48 billion in 2025 and expected to reach USD 15.37 billion in 2026, at a CAGR of 7.93% to reach USD 24.73 billion by 2032.

Unveiling the Critical Role of Security Printing Solutions in Safeguarding National and Corporate Assets Amid Evolving Global Threats While Reinforcing Trust

The landscape of security printing solutions has evolved dramatically over the past decade, driven by a heightened global focus on safeguarding sensitive documents, currency, and secure packaging against sophisticated counterfeiting techniques. Governments and private organizations alike recognize that traditional security measures are no longer sufficient to combat emerging threats. From enhanced identity documents used in border control to tamper-evident packaging in pharmaceuticals, the scope of security printing has broadened, necessitating innovative materials, advanced features, and integrated digital solutions. This introduction outlines the critical importance of these developments and provides a foundation for understanding how market participants are responding to shifting requirements.

In today’s environment, security printing serves as a cornerstone of trust across financial, governmental, and corporate spheres. Advanced inks, microfeature printing, and embedded digital markers are redefining the capabilities of physical media, merging traditional craftsmanship with cutting-edge technology. As threats become increasingly digital and decentralized, the industry is compelled to integrate multifactor authentication and real-time verification methods directly into printed materials. This convergence of physical and digital paradigms underscores the urgency for stakeholders to stay informed on the latest innovations and regulatory trends, setting the stage for deeper analysis in the subsequent sections.

Witnessing the Transformative Shifts Redefining Security Printing Landscape Through Technological Innovations Regulatory Changes and Emerging Threat Vectors

As the security printing industry matures, transformational shifts are reshaping every facet of how secure documents and packaging are created, authenticated, and distributed. Advances in nanotechnology and materials science have enabled the development of ultra-fine microprinting and next-generation color shifting inks that are virtually impossible to replicate without sophisticated equipment. Meanwhile, blockchain-based traceability solutions are gaining traction, offering immutable records of provenance for high-value documents and secure packaging applications. These technological breakthroughs are complemented by an evolving threat landscape in which organized crime syndicates and state-sponsored actors leverage AI to attempt large-scale forgery and document tampering.

Regulatory frameworks are also in flux, with many jurisdictions ramping up compliance requirements for identity documents and secure financial instruments. Standards bodies are issuing stricter guidelines on watermark quality, thread integration, and tamper-evident features to address documented vulnerabilities. At the same time, regional trade agreements and international treaties are harmonizing specifications, creating new opportunities for vendors capable of meeting diversified compliance mandates. Combined, these technological and regulatory forces are driving an unprecedented pace of innovation, compelling established manufacturers and emerging disruptors to continuously adapt their strategies and offerings.

Exploring the Cumulative Impact of United States Tariff Measures in 2025 on Import Dynamics Supply Chains and the Security Printing Industry

In 2025, a series of United States tariff measures targeting imported printing substrates, specialized synthetic papers, and advanced security inks has generated cascading effects throughout the security printing ecosystem. These duties have elevated input costs across the value chain, prompting many printers to reevaluate supplier relationships and negotiate bulk agreements to mitigate the financial impact. At the same time, end users such as central banks and government agencies are facing extended lead times for critical components, leading to cautious stockpiling strategies to ensure uninterrupted issuance of currency, passports, and secure certificates.

Beyond direct cost pressures, the tariffs have accelerated a shift toward regional sourcing and nearshoring. Suppliers and converters in key markets are expanding capacity to capture demand that would have otherwise flowed through established import channels. This dynamic has opened the door for new entrants in domestic markets while forcing legacy players to invest in localized production and integrated logistics solutions. As a result, the industry is witnessing a reconfiguration of global supply chains that balances cost management with the imperative for robust, high-availability operations in security printing.

Unlocking Key Segmentation Insights to Reveal Security Printing Demand Variations Across Product Types Applications Security Features and Grades

A comprehensive segmentation analysis reveals how diverse requirements are driving differentiated demand across the security printing spectrum. When categorized by product type, Certificates and Checks continue to command significant attention for high-assurance applications, while Currency and Id Cards are experiencing surging interest as governments invest in next-generation features. Packaging and Labels are becoming indispensable for brand protection in pharmaceuticals and luxury goods, and Passports are evolving into secure travel credentials embedded with advanced digital markers.

Application-based segmentation underscores distinct market pathways. Financial Instruments such as Bonds and Checks remain a core segment, requiring intricate design and multi-layer security integration. Government Documents, including Certificates and Licenses, rely on tamper-evident substrates and covert features. Identity Documents such as Id Cards and Passports are converging physical security elements with biometric data capture. Product Authentication through Labels and Tags is expanding rapidly to safeguard supply chains against counterfeiting, and Secure Packaging technologies like Seals and Shrink Sleeves are critical in industries where product integrity is non-negotiable.

Examining security features highlights how the market prioritizes Color Shifting Ink, which is available in Metallic Based and Polymer Based formulations, followed by Holograms offered in Embossed Hologram and Foil Hologram variants. Microprinting techniques, encompassing 2D Microprinting and Line Microprinting, remain foundational. Security Thread options, whether Embedded Thread or Windowed Thread, continue to defend against tampering. UV Feature capabilities split between Fluorescent Ink and Invisible Marking, while Watermark technologies utilize Multi Tone and Single Tone designs.

Finally, grading distinctions-Coated, Specialty, Thermal, and Uncoated-affect print quality, substrate compatibility, and feature integration, while Distribution Channel preferences, including Direct Sales, Distributors, and Online Platforms, shape vendor engagement models. End users such as Banking and Financial Institutions, Corporates, Educational Institutions, Government Agencies, and Healthcare Providers each impose unique performance and compliance criteria, resulting in highly tailored security printing solutions.

This comprehensive research report categorizes the Security Paper market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Security Feature

- Grade

- Distribution Channel

- Application

- End User

Illuminating Regional Dynamics Shaping Security Printing Markets with Comparative Perspectives Across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics across the Americas, Europe Middle East Africa, and Asia Pacific illustrate distinct drivers and adoption patterns in the security printing domain. In the Americas, longstanding investments in currency modernization and robust public identity programs have sustained demand for advanced security features. Public agencies and financial institutions prioritize seamless integration of digital verification methods and demand shorter lead times through regional manufacturing partnerships.

Conversely, Europe Middle East Africa is navigating a complex mosaic of regulatory frameworks that span the European Union’s stringent eID directives, Gulf Cooperation Council travel document standards, and diverse African national ID initiatives. This patchwork necessitates flexible platform strategies and modular feature sets that can be customized rapidly to satisfy varied compliance requirements.

Across Asia Pacific, rapid economic expansion and digitization projects are catalyzing the rollout of biometric passports and smart identity cards. Governments and enterprises are partnering with global technology providers to incorporate embedded chips, tamper-evident elements, and multi-factor authentication into printed media. The region’s manufacturing hubs are also leveraging cost efficiencies to serve neighboring markets, consolidating supply chains while fostering innovation in materials and digital integration.

This comprehensive research report examines key regions that drive the evolution of the Security Paper market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Competitive Strategies and Innovation Drivers Among Leading Security Printing Solutions Providers Transforming Industry Standards

Industry leaders and emerging challengers alike are deploying targeted strategies to capture value in this evolving market. Established multinational security printers are leveraging decades of domain expertise and global footprint to offer end-to-end lifecycle services, encompassing design, production, and post-issuance analytics. These incumbents frequently form strategic alliances with specialty ink and substrate manufacturers to co-develop next-generation features that address counterfeit resilience and digital authentication.

At the same time, nimble digital-first entrants are integrating software-driven solutions such as mobile verification apps and cloud-based traceability platforms directly into physical printing workflows. They are forging partnerships with semiconductor firms to embed secure elements into cards and passports, while also exploring AI-driven inspection systems that automate quality control. Cross-sector collaborations, particularly between packaging specialists and pharmaceutical companies, are spurring new use cases for tamper-evident shrink sleeves and serialized label ecosystems.

Moreover, technology conglomerates are entering the security printing space, drawing on their strengths in optics, electronics, and data analytics to create hybrid offerings. By bundling hardware, software, and materials expertise, these players aim to redefine industry benchmarks and challenge traditional business models. Their entry is prompting legacy vendors to accelerate digital transformation initiatives and invest in modular, scalable solutions that meet the growing demand for smart and secure printed products.

This comprehensive research report delivers an in-depth overview of the principal market players in the Security Paper market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bank of Greece

- Bundesdruckerei Gruppe GmbH

- Canadian Bank Note Company, Limited

- China Banknote Printing and Minting Group Co., Ltd.

- Ciotola S.R.L.

- Crane Company

- De La Rue PLC

- Document Security Systems, Inc.

- DREWSEN SPEZIALPAPIERE GmbH & Co. KG

- EPLHOUSE

- Fedrigoni S.p.A.

- FNMT-Real Casa De La Moneda

- Giesecke+Devrient GmbH

- GOZNAK

- HG Technology Sdn Bhd

- Oberthur Fiduciaire SAS

- Orell Füssli AG

- Polska Wytwórnia Papierów Wartościowych SA

- Pura Group

- Royal Joh. Enschedé (RJE)

- SECURIKETT Ulrich & Horn GmbH

- Simpson Security Papers, Inc.

Empowering Industry Leaders with Actionable Recommendations to Strengthen Security Printing Resilience Drive Innovation and Navigate Regulatory Complexities

Industry leaders must prioritize a tripartite approach that balances technological innovation, supply chain resilience, and regulatory alignment. First, investment in advanced material sciences and digital verification technologies can help differentiate offerings and future-proof product portfolios. Stakeholders should collaborate with specialized research institutions and technology startups to pilot novel features such as nano-optic threads and blockchain-enabled authenticity tokens.

Second, diversifying sourcing strategies across multiple geographies reduces exposure to tariff fluctuations and logistics disruptions. Establishing dual or multi-sourcing agreements for critical substrates and inks enables rapid procurement pivots when trade policies or transportation networks become constrained. This proactive procurement approach should be complemented by real-time supply chain monitoring tools that provide early-warning indicators of emerging bottlenecks.

Finally, engaging directly with regulatory bodies and standards organizations can accelerate time to market and ensure compliance. Industry participants are encouraged to participate in standards committees, contribute to draft specifications, and advocate for harmonized guidelines that streamline cross-border issuance. By combining these actions into a cohesive roadmap, security printing providers can strengthen market positioning, mitigate risk, and deliver differentiated value to end users.

Detailing Rigorous Research Methodology Employed to Assess Security Printing Market Dynamics Validate Data Quality and Ensure Comprehensive Analytical Rigor

The research methodology underpinning this analysis integrates primary and secondary approaches to ensure depth, reliability, and analytical rigor. In the primary phase, structured interviews were conducted with senior executives from leading security printers, technology developers, and end-user organizations across multiple regions. These discussions provided nuanced perspectives on emerging feature requirements, procurement challenges, and strategic priorities.

Secondary research drew upon a curated corpus of technical publications, patent filings, regulatory guidelines, and company disclosures. Data triangulation techniques were applied to reconcile information from diverse sources, validate trend indicators, and identify inconsistencies. Vendor and competitor benchmarking involved profiling product portfolios, partnership announcements, and investment activity to map the competitive landscape comprehensively.

Quantitative data on trade flows, import/export volumes, and tariff structures were analyzed to quantify the impact of macroeconomic and policy variables on market dynamics. Finally, all insights were subjected to peer review by an advisory panel of subject-matter experts to confirm validity and applicability. This rigorous methodology ensures that the findings and recommendations presented reflect the most current and credible information available.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Security Paper market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Security Paper Market, by Product Type

- Security Paper Market, by Security Feature

- Security Paper Market, by Grade

- Security Paper Market, by Distribution Channel

- Security Paper Market, by Application

- Security Paper Market, by End User

- Security Paper Market, by Region

- Security Paper Market, by Group

- Security Paper Market, by Country

- United States Security Paper Market

- China Security Paper Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

Concluding Thoughts on Advancing Security Printing Solutions to Address Emerging Threats Enhance Operational Efficiency and Support Regulatory Compliance

The evolving complexity of counterfeit threats, regulatory mandates, and technological possibilities underscores the critical importance of advancing security printing solutions. Organizations that adopt a holistic approach-integrating cutting-edge materials, digital verification, and resilient supply chains-will be best positioned to meet the dual mandates of secure issuance and operational efficiency. Collaboration with standards bodies and strategic partnerships with technology pioneers can accelerate innovation cycles and improve market responsiveness.

As threats continue to evolve, stakeholders must remain vigilant and agile, leveraging the insights presented here to inform strategic decision-making. By combining rigorous segmentation analysis, regional intelligence, and competitive benchmarking, this report serves as a roadmap for navigating a landscape defined by both opportunity and risk.

Take the Next Step in Strengthening Your Security Printing Strategy by Partnering with Ketan Rohom to Access Exclusive Market Insights and Drive Business Growth

To explore comprehensive insights into the security printing market and equip your organization with the strategic intelligence necessary to navigate complex regulatory environments and technological disruptions, reach out to Ketan Rohom. As Associate Director of Sales & Marketing, he can guide you to the most relevant sections of the report that align with your organization’s priorities, ensuring you derive maximum value from the findings. Engage directly to discuss tailored options, unlock exclusive data, and swiftly integrate these market insights into your strategic planning processes to drive growth and resilience.

- How big is the Security Paper Market?

- What is the Security Paper Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?