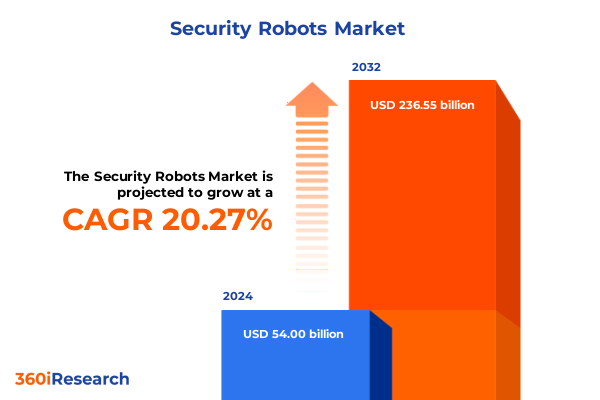

The Security Robots Market size was estimated at USD 64.88 billion in 2025 and expected to reach USD 77.94 billion in 2026, at a CAGR of 20.29% to reach USD 236.55 billion by 2032.

Setting the Stage for a New Era of Security Robotics Driven by Technological Innovation and Heightened Operational Demands

The security robotics sector stands at a pivotal crossroads, blending cutting-edge autonomy with an expanding range of real-world applications that redefine both public safety and private security paradigms. Over the past decade, breakthroughs in artificial intelligence, sensor miniaturization, and advanced mobility architectures have converged to push robotic platforms beyond traditional surveillance and patrol functions. From agile multirotor drones scanning critical infrastructure to legged ground units navigating complex terrain, the industry’s trajectory has been shaped by an escalating demand for cost-effective, reliable systems that minimize human exposure to hazardous environments.

Amid global challenges such as urbanization, supply chain vulnerabilities, and evolving threat profiles, organizations across defense, industrial, and commercial sectors are integrating security robots into layered protection strategies. This surge in adoption is driven by the promise of persistent monitoring, data-rich intelligence, and rapid response capabilities that far exceed manual patrol limitations. As such, the foundational technologies underpinning advanced navigation, real-time analytics, and secure communications have become strategic imperatives for stakeholders seeking to safeguard people, assets, and infrastructure at scale.

Evolving Synergies Between Autonomous Intelligence and Service Ecosystems Reshaping Security Robotics Market Dynamics

The landscape of security robotics is undergoing transformative shifts fueled by synergies between hardware advancements and algorithmic sophistication. Recent leaps in autonomous navigation, powered by deep learning and sensor fusion, have enabled systems to self-adapt to dynamic environments without constant human oversight. Meanwhile, modular chassis designs and open architecture standards are democratizing system integration, allowing end users to tailor payloads and software stacks for specialized missions-from perimeter intrusion detection to precision reconnaissance.

Concurrently, the industry is witnessing a reconfiguration of collaboration models among defense contractors, technology innovators, and service integrators. Traditional turnover of off-the-shelf platforms is giving way to subscription-based robotics-as-a-service offerings that bundle hardware, software, and maintenance under flexible procurement frameworks. This shift is lowering barriers to entry for mid-market adopters and fostering new ecosystems of third-party developers. As a result, the security robotics market is evolving into a dynamic arena where agility, interoperability, and continuous upgrade pathways determine long-term resilience and value creation.

Recalibrating Supply Chains and Cost Structures Under Expanded United States Tariffs on Security Robotics in 2025

In early 2025, the United States broadened its tariff framework on imported robotics components and complete security platforms, aiming to bolster domestic manufacturing while addressing perceived supply chain dependencies. These policy adjustments have reverberated across the value chain, prompting platform providers and integrators to reassess sourcing strategies and revalidate total cost of ownership models. Organizations that previously relied on lower-cost aerial sensor arrays and chassis modules from overseas suppliers are now exploring nearshoring options within North America to mitigate tariff-induced price pressures.

While some established vendors reported incremental margin compression, innovative approaches have emerged to offset these headwinds. Collaborative development agreements between U.S. robotics manufacturers and allied technology firms have accelerated technology transfer and joint assembly initiatives, enabling localized production of key electronics, actuators, and navigation subsystems. Moreover, integrators are increasingly bundling tariff impacts into full-solution service contracts, smoothing budgeting for end users and preserving platform deployment timelines despite regulatory complexity. Looking ahead, the 2025 tariffs serve as a catalyst for strengthening regional supply networks and fueling investment in domestic research, development, and production capabilities.

Uncovering Deep Insights Across Operation Modes, Mobility Architectures, Applications, End Uses, Components, and Payload Capacities

Insights drawn from operation mode classifications reveal a nuanced demand spectrum: fully autonomous platforms are commanding interest among organizations prioritizing persistent surveillance without reliance on remote control, while semi-autonomous and tele-operated solutions maintain appeal where human oversight remains critical. Analysis of mobility segmentation uncovers that aerial systems-split between fixed-wing and multirotor configurations, the latter further encompassing hexacopter and quadcopter variants-are widely deployed for rapid area coverage, whereas ground robots leveraging wheeled differential drive, skid steer, tracked, and legged locomotion excel in close-quarters inspection and perimeter patrol. Underwater applications using AUV and ROV designs are gaining traction in port security and subsea infrastructure inspection.

When viewed through the lens of application segmentation, consumer-focused robotic security appliances cater to residential perimeter monitoring, while defense and military deployments emphasize combat support and reconnaissance roles. Inspection tasks span pipeline inspection and structural integrity assessments, and logistics use cases cover both last-mile delivery and warehouse operations. Surveillance objectives bifurcate into intrusion detection and perimeter control. End-use segmentation delineates commercial, industrial, military and defense, and residential adoption patterns, underscoring distinct procurement drivers and budgetary cycles. Component-level analysis spotlights robust demand for actuators, chassis frameworks, sensors, AI analytics modules, control systems, and navigation software, alongside integration, maintenance, and training services. Payload categorization differentiates heavy-duty platforms used in hazardous materials handling from medium and light-duty units optimized for rapid deployment and endurance.

This comprehensive research report categorizes the Security Robots market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Operation Mode

- Mobility

- Component

- Payload

- Application

- End Use

Comparative Adoption Trends across the Americas, Europe Middle East and Africa, and Asia-Pacific Regions

Regional analysis highlights divergent adoption trajectories. In the Americas, widespread infrastructure modernization and strong defense budgets are driving investments in both aerial and ground robotic platforms for border control, facility security, and logistics optimization. North American integrators are advancing lab-to-field transitions for AI-driven detection technologies, while Latin American markets are gradually embracing turnkey robotics-as-a-service offerings to address urban crime hotspots.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts under EU directives and GCC cybersecurity frameworks are shaping interoperability standards, prompting multinational operators to deploy standardized fleets across national borders. Demand is particularly pronounced for perimeter surveillance in critical infrastructure and petrochemical facilities, with regional consortia funding proof-of-concept projects that blend aerial multirotor systems with ground legged units. In sub-Saharan Africa, pilot deployments focus on wildlife protection and remote border monitoring.

The Asia-Pacific region exhibits rapid uptake fueled by smart city initiatives, port automation programs, and domestic manufacturing incentives. China’s leading drone manufacturers are scaling production of multirotor platforms for integrated logistics and emergency response, while Japan and South Korea are advancing legged and tracked ground robots for industrial inspection. Australia’s remote operations drive increasing use of ROVs for offshore energy asset surveys.

This comprehensive research report examines key regions that drive the evolution of the Security Robots market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading System Providers and Service Integrators Are Shaping Competitive Dynamics in Security Robotics

Leading enterprises are redefining competitive dynamics through strategic partnerships, portfolio diversification, and platform interoperability. Major defense contractors are extending robotics portfolios by acquiring niche startups specializing in advanced perception algorithms and ruggedized chassis systems. Simultaneously, pure-play robotics manufacturers are forging alliances with cloud analytics providers to integrate real-time threat detection and predictive maintenance functionalities.

Service integrators with domain expertise in surveillance and facility management are leveraging these partnerships to deliver end-to-end solutions that encompass system design, deployment, and lifecycle support. At the same time, innovative entrants are distinguishing themselves by offering modular payload architectures that can be rapidly reconfigured from thermal imaging and LiDAR scanning to non-lethal crowd management tools. These developments underscore an industry in flux, where rapid innovation cycles and ecosystem collaboration determine market leadership and long-term differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Security Robots market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aethon Inc.

- BAE Systems plc

- Boston Dynamics, Inc.

- Cobalt Robotics, Inc.

- Cobham plc

- DJI Technology Co., Ltd.

- ECA Group

- Elbit Systems Ltd.

- Endeavor Robotics Holdings, Inc.

- FLIR Systems, Inc.

- General Dynamics Corporation

- iRobot Corporation

- Knightscope, Inc.

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Northrop Grumman Corporation

- Otsaw Digital Pte. Ltd.

- QinetiQ Group plc

- RoboteX Inc.

- Rokid Corporation Ltd.

- Sarcos Technology and Robotics Corporation

- SMP Robotics Systems Corp.

- Thales Group

Prioritizing Modular Platforms, Strategic Alliances, and Service-Centric Models to Drive Sustainable Growth

Industry leaders should prioritize the development of flexible, upgradeable platforms that support open architecture standards and third-party payload integration to meet evolving user requirements. Cultivating strategic alliances with signal processing and AI analytics specialists will enable the rapid incorporation of advanced detection and classification capabilities. Additionally, stakeholders must invest early in onshore or nearshore manufacturing partnerships to mitigate tariff impacts and strengthen supply chain resilience.

Equally important is the adoption of robotics-as-a-service models that provide transparent total cost of ownership and reduce procurement barriers for mid-market customers. Training and maintenance services should be packaged within long-term support agreements to ensure operational readiness and foster recurring revenue streams. By combining modular design philosophies with service-centric business models, market participants can deliver compelling value propositions that align with customer priorities around reliability, scalability, and cost predictability.

Applying a Comprehensive Multi-Source Methodology Integrating Primary Stakeholder Interviews with Secondary Intelligence and Thematic Analysis

This analysis draws upon a rigorous, multi-phase research process combining primary and secondary data sources to ensure comprehensive coverage of security robotics market dynamics. Primary research included structured interviews with defense procurement officers, facility security managers, and robotics integrators across North America, EMEA, and APAC, providing first-hand insights into deployment drivers, pain points, and procurement frameworks. Secondary sources comprised industry technical publications, patent filings, and regulatory filings to validate technology trajectories and policy impacts.

Data from supplier websites, open-source intelligence on manufacturing partnerships, and tariff documentation were synthesized to assess cost structures and regional supply chain resilience. Advanced text analytics and thematic coding methods were used to identify emerging trends across operation modes, mobility types, and application domains. Through cross-validation between quantitative data points and qualitative expert commentary, the insights presented here achieve both breadth and depth, equipping decision-makers with a robust foundation for strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Security Robots market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Security Robots Market, by Operation Mode

- Security Robots Market, by Mobility

- Security Robots Market, by Component

- Security Robots Market, by Payload

- Security Robots Market, by Application

- Security Robots Market, by End Use

- Security Robots Market, by Region

- Security Robots Market, by Group

- Security Robots Market, by Country

- United States Security Robots Market

- China Security Robots Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3021 ]

Summarizing the Interplay of Innovation, Policy Shifts, and Strategic Partnerships Driving Market Leadership in Security Robotics

The security robotics market stands at the intersection of rapid technological evolution and shifting policy landscapes, presenting both risks and opportunities for stakeholders across defense, commercial, and industrial domains. Autonomous capabilities, modular design, and robotics-as-a-service frameworks are redefining traditional procurement and operational models, while regional regulatory initiatives and tariff policies are reshaping supply chain strategies.

Organizations that embrace open standards, invest in strategic partnerships, and adopt flexible service-oriented business models will be best positioned to capitalize on market momentum. By leveraging the segmentation insights across operation modes, mobility architectures, and application domains, coupled with region-specific intelligence, industry participants can tailor offerings to meet the nuanced requirements of diverse end users. Ultimately, the winners in this rapidly evolving landscape will be those who balance innovation speed with practical deployment readiness, ensuring that security robotics deliver tangible, scalable value.

Unlock Personalized Strategic Intelligence and Schedule a Tailored Briefing with the Associate Director, Sales & Marketing to Secure Your Competitive Edge

As you navigate the complexities and opportunities within the rapidly evolving security robotics arena, take the next step toward gaining a comprehensive, data-driven advantage by exploring the full market research report. Partner with Ketan Rohom, Associate Director, Sales & Marketing, to secure tailored insights, proprietary intelligence, and strategic guidance that will empower your organization to anticipate emerging trends, mitigate risks associated with policy shifts like 2025 U.S. tariffs, and capitalize on growth drivers across segments and regions. Engage Ketan to arrange a personalized briefing, unlock in-depth analysis on segmentation nuances from fully autonomous aerial hexacopters to integrated logistics solutions, and chart a course for market leadership. Reach out today to transform high-level findings into actionable strategies that deliver measurable impact and sustainable competitive differentiation.

- How big is the Security Robots Market?

- What is the Security Robots Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?