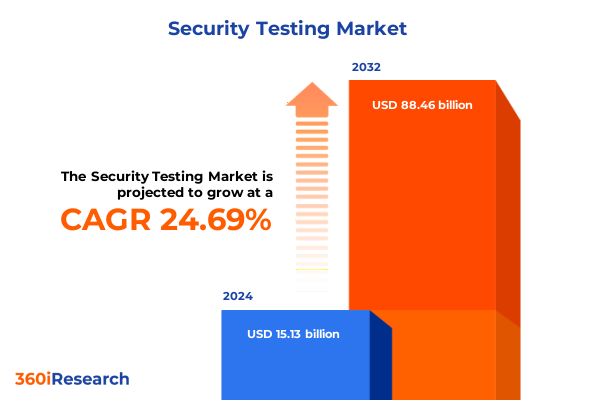

The Security Testing Market size was estimated at USD 18.57 billion in 2025 and expected to reach USD 22.93 billion in 2026, at a CAGR of 24.97% to reach USD 88.46 billion by 2032.

Piloting a Unified Path to Fortify Digital Ecosystems through Integrated Security Testing and Proactive Risk Mitigation Strategies for Today’s Enterprises

The rapid evolution of digital infrastructures has underscored the imperative for comprehensive security testing protocols that ensure resilience and continuity across enterprise environments. As organizations integrate cloud-native applications, microservices architectures, and hybrid networks, the scope and complexity of vulnerabilities have expanded dramatically. Transitioning from siloed assessment models to a unified security testing framework demands a strategic alignment of tools, methodologies, and stakeholder objectives.

Moreover, cyber adversaries are employing increasingly sophisticated techniques, leveraging artificial intelligence and automation to identify and exploit weaknesses at unprecedented speed. Against this backdrop, embedding security testing throughout the software development lifecycle has become mission critical. Continuous testing, supported by both manual expertise and automated solutions, empowers teams to detect and remediate issues early, thereby reducing risk, minimizing remediation costs, and protecting brand reputation.

In addition, regulatory requirements and compliance standards have intensified global demand for rigorous security validation. From data protection mandates in financial services to critical infrastructure guidelines in energy and utilities, the convergence of governance and technology has heightened expectations for demonstrable risk assurance. As a result, enterprise leaders are prioritizing end-to-end security testing investments, fostering cross-functional collaboration between development, operations, and risk management teams, and establishing metrics-driven frameworks to quantify security performance.

This executive summary outlines foundational insights into the current security testing landscape. It examines transformative industry shifts, the ramifications of evolving policy measures, and the nuanced segmentation driving market differentiation. Key regional trends and competitive company developments are explored, followed by actionable recommendations and an overview of the research methodology. Together, these insights equip decision makers with the clarity needed to navigate emerging threats and capitalize on strategic opportunities

Uncovering How Rapid Technological Advances and Regulatory Demands Are Redefining Security Testing Paradigms Across Cloud, AI, and Network Environments

The security testing landscape is undergoing a period of unprecedented transformation driven by several converging forces. Cloud migration, accelerated by the demand for scalability and agility, has redefined perimeter defenses and introduced new attack surfaces that require tailored testing strategies. Simultaneously, the proliferation of distributed architectures and containerized environments has elevated the importance of API and microservices testing, compelling organizations to adopt contextualized vulnerability assessment methods that extend beyond traditional network scanning.

Artificial intelligence and machine learning capabilities have also reshaped testing paradigms, enabling predictive analytics and adaptive threat modeling that proactively identify potential exploit vectors. These technologies are not only enhancing dynamic analysis tools but are also being embedded within static analysis and runtime protection solutions to streamline detection and response times. Consequently, security teams are leveraging integrated platforms that unify these capabilities, fostering a proactive posture instead of reactive firefighting.

Furthermore, the shifting regulatory and geopolitical landscape has amplified the need for compliance-driven testing frameworks. Data sovereignty concerns, cross-border privacy regulations, and emerging cybersecurity directives have led to region-specific testing requirements that must be addressed through customized test suites and reporting mechanisms. This convergence of technological innovation and evolving policy imperatives is redefining how organizations conceptualize and operationalize their security testing programs.

At the same time, supply chain integrity has emerged as a critical focus, with dependency analysis and vendor risk assessments becoming integral components of comprehensive testing strategies. Organizations are conducting third-party security evaluations to identify and remediate risks that originate from external software components and service providers. By integrating supply chain validation into core testing workflows, enterprises are enhancing overall resilience and reducing the likelihood of cascading breaches. In this context, security testing has evolved from a periodic exercise to a continuous, integrated lifecycle function that drives both innovation and trust across digital ecosystems.

Evaluating the Widespread Economic and Operational Consequences of Recent United States Tariff Measures on Security Testing Infrastructure and Services

The introduction of significant tariff measures in 2025 has had far-reaching economic and operational consequences for security testing providers and end users. Key hardware components essential for data center and on-premises testing environments-most notably semiconductors, networking equipment, and advanced memory modules-have seen tariff rates rise sharply under new policy frameworks. A sustained 25 percent tariff on semiconductor imports alone is projected to slow U.S. economic growth by 0.76 percent over the next decade and impose a cumulative $1.4 trillion GDP loss, equivalent to approximately $4,208 per American household by year ten. These increased costs have reverberated across testing infrastructure investments, leading to deferred procurement cycles and elevated operating expenses for both managed service providers and in-house security teams.

In addition to semiconductors, tariffs levied on essential metals such as copper and steel have increased data center construction and maintenance costs. Proposed 50 percent duties on copper, crucial for high-density server environments, and 10 percent baseline tariffs on all imports have disrupted supply chains and discouraged new data center expansions. This has resulted in a strategic recalibration among test lab operators, with many opting to extend equipment lifecycles and optimize existing assets through advanced software-based testing solutions to mitigate capital expenditure pressures.

Consumer technology products, integral to application and device security testing, have also experienced pronounced price escalations. Tariffs on popular imports like smartphones, laptops, and gaming consoles are estimated to reduce American purchasing power by $123 billion overall, with average retail price increases of up to 34 percent for laptops and tablets and 69 percent for video game consoles. This pattern has influenced how organizations procure and deploy testing devices, often prioritizing cross-platform virtualization and emulation to reduce reliance on physical hardware.

Finally, the broader macroeconomic effects of universal tariffs have translated into reduced discretionary budgets for technology infrastructure across industries. Studies indicate that a 10 percent universal tariff on all imports could add one percentage point to consumer price inflation by the fourth quarter of 2025 and shave 1.2 percentage points off U.S. GDP growth in both 2025 and 2026, exacerbating budgetary constraints for security testing programs. As a result, most security and IT leaders are adopting more cost-effective testing methodologies while actively engaging with policymakers to seek clarity and potential exemptions for critical security technologies.

Delving into Precise Market Segmentation Dynamics That Reveal Critical Insights Across Testing Types, Components, Methodologies, Verticals, Deployment, and Organization Sizes

The market’s segmentation reveals a multifaceted testing terrain that spans diverse security disciplines and organizational contexts. Within the spectrum of testing types, application security testing remains a cornerstone, encompassing dynamic application security testing for active runtime evaluation, interactive testing methods that blend static and dynamic analysis, runtime application self-protection for real-time threat interception, and static analysis to inspect code for vulnerabilities before deployment. At the same time, cloud security testing has emerged as a specialized domain, subdivided into Infrastructure as a Service assessments for virtual resource configurations, Platform as a Service evaluations to ensure container and orchestration security, and Software as a Service audits focused on multi-tenant application environments. Device security and network security testing further extend the landscape, addressing the vulnerabilities inherent in edge endpoints and complex network topologies.

Component segmentation differentiates between services and tools, where managed and professional services deliver expert support, strategic advisory, and programmatic oversight, while a broad suite of tools-from dynamic analysis engines and interactive testing frameworks to network scanners, static analysis platforms, and vulnerability management solutions-enable security teams to automate and scale testing operations. Methodology segmentation highlights the ongoing shift toward automated testing driven by AI and ML, although manual testing remains indispensable for nuanced threat modeling and targeted penetration exercises.

Vertical segmentation underscores varied industry requirements, as sectors such as financial services and insurance demand robust compliance testing, education and government sectors prioritize risk mitigation within legacy systems, and technology, healthcare, manufacturing, retail, and logistics all impose unique testing criteria based on regulatory and operational imperatives. Deployment mode segmentation captures the dichotomy between cloud-based testing platforms that afford rapid scalability and on-premises solutions offering deeper infrastructure control. Finally, organizational size segmentation distinguishes between large enterprises with mature security programs and small to medium enterprises that often seek flexible, cost-effective testing solutions aligned with growth objectives. Together, these segmentation insights inform differentiated go-to-market strategies and product roadmaps that resonate with specific customer needs.

This comprehensive research report categorizes the Security Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Testing Methodology

- Vertical

- Deployment Mode

- Organization Size

Analyzing Regional Variations and Growth Drivers Shaping Security Testing Adoption Trends Across the Americas, Europe Middle East Africa, and Asia Pacific Markets

In the Americas, security testing demand is driven by the concentration of major technology hubs and financial centers that prioritize advanced risk management frameworks. The United States continues to lead adoption of cloud-based testing platforms, supported by robust venture capital investment in cybersecurity innovation, while Canada places emphasis on data sovereignty considerations that shape local testing requirements. Latin America is witnessing steady growth in managed testing services, as organizations seek external expertise to bridge talent shortages and navigate emerging data protection regulations.

Europe, Middle East, and Africa markets exhibit a heterogeneous security testing landscape shaped by diverse regulatory regimes and digital maturity levels. The European Union’s stringent data privacy laws and the Cyber Resilience Act have catalyzed widespread adoption of comprehensive testing solutions, emphasizing compliance and continuous monitoring. In the Middle East, government-led digital transformation initiatives and defense modernization projects are propelling the integration of advanced network and application testing capabilities. Meanwhile, Africa’s burgeoning fintech and telecom sectors are increasingly engaging in security validation efforts, though infrastructure constraints and skill gaps remain challenges.

Asia-Pacific represents the fastest-growing region, propelled by rapid digitization across banking, e-commerce, and manufacturing industries. China’s expansive cloud market and India’s thriving startup ecosystem are both investing heavily in application and cloud security testing to protect large-scale deployments. Japan and Australia maintain high maturity levels in endpoint and device security testing, leveraging automation to address zero-trust requirements. Southeast Asia is emerging as a vital market for security testing services as regulatory frameworks take shape and organizations seek to strengthen resilience against escalating threat vectors. This regional mosaic underscores the necessity of localized approaches that align testing solutions with specific legal, cultural, and technological environments.

This comprehensive research report examines key regions that drive the evolution of the Security Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Security Testing Vendors and Innovative Product Launches That Are Shaping Competitive Positioning and Technology Roadmaps in 2025

Leading security testing vendors are intensifying their efforts to deliver integrated, AI-driven solutions that address evolving threat landscapes. Qualys has recently expanded its TotalAppSec suite, unifying API security, web application scanning, and malware detection into a single risk management platform that accelerates workflow efficiency and prioritizes remediation guidance. The company has also strengthened its cloud and container security posture through strategic integrations with workflow automation platforms, enabling seamless vulnerability tracking across hybrid environments.

Rapid7 continues to bolster its Command Platform with AI-infused features that enhance exposure management and incident response. Its new Sensitive Data Discovery capability delivers real-time visibility into PII and critical assets across multi-cloud infrastructures, while AI-generated CVSS scoring ensures that all vulnerabilities are accurately assessed, even when official ratings are unavailable. Additionally, the launch of Managed Detection and Response for Enterprise underscores Rapid7’s commitment to delivering customizable, SOC-driven services that optimize detection and remediation.

Specialty providers such as Recorded Future and Saviynt are also making strategic advancements. Recorded Future’s Malware Intelligence offering automates threat identification by linking malware samples to actor infrastructures and global attack patterns, thereby accelerating proactive defenses. Saviynt’s newly introduced Identity Security Posture Management solution leverages AI-driven analytics to continuously monitor identity risks across hybrid and cloud ecosystems, aligning zero-trust principles with enterprise-scale governance. Emerging players like Apiiro and Endor Labs are leveraging agentic AI for dynamic application security and software architecture visualization, further enriching the competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Security Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apogee Corporation

- Arrow Electronics

- AT&T Inc.

- Bugcrowd Inc.

- Checkmarx Ltd.

- Cigniti Technologies Ltd.

- Cisco Systems, Inc.

- DataArt Solutions Inc.

- DXC Technology

- Fortra, LLC

- HackerOne Inc.

- HCL Technologies Limited

- ImmuniWeb SA

- International Business Machines Corporation

- Intertek Group plc

- LogRhythm, Inc.

- McAfee, LLC

- NowSecure, Inc.

- OpenText Corporation

- Parasoft Corporation

- PortSwigger Ltd.

- Qualitest Group

- Rapid7, Inc.

- SafeAeon Inc.

- ScienceSoft USA Corporation

- Synopsys, Inc.

Implementing Targeted Strategies and Best Practices to Enhance Security Testing Effectiveness, Streamline Processes, and Drive Continuous Improvement Across Organizations

To maintain and enhance security testing effectiveness, industry leaders should prioritize holistic integration of automated and manual testing methodologies throughout the software development lifecycle. Investing in AI-powered testing platforms will enable organizations to identify critical vulnerabilities more rapidly and allocate remediation resources with precision. At the same time, engaging experienced professional and managed service providers can bridge internal skill gaps, ensuring that specialized tests-such as penetration and threat modeling-are conducted by certified experts.

Organizations must also cultivate strong collaboration between security, development, and operations teams by embedding security testing into DevOps pipelines. This shift-left approach reduces remediation costs and shortens time to detection. To address budgetary and supply chain disruptions from evolving trade policies, decision makers should evaluate virtualization and emulation tools that minimize dependence on high-cost hardware, while actively seeking tariff exemptions for critical security technologies and components.

Furthermore, enterprises should align testing strategies with industry-specific compliance requirements and regulatory changes, leveraging customizable reporting and audit capabilities to facilitate transparent governance. Implementing continuous monitoring and real-time analytics will provide visibility into evolving threat landscapes, enabling proactive adjustments to testing scopes. Finally, fostering a culture of continuous learning-through regular skill assessments, secure coding workshops, and tabletop exercises-will strengthen organizational resilience and embed security as a core business capability.

Outlining a Comprehensive Research Methodology That Ensures Data Integrity, Expert Validation, and Rigorous Analysis for Trustworthy Security Testing Market Insights

This research employs a rigorous, multi-phased methodology to ensure comprehensive and reliable market insights. Secondary research began with the collection of published data from credible government agencies, industry associations, and peer-reviewed journals to establish foundational knowledge of security testing frameworks, tariff policies, and technology adoption trends. Publicly available financial reports and product release announcements provided context on vendor strategies, while regulatory and macroeconomic analyses informed assessments of policy impacts.

Primary research complemented these efforts through structured interviews with senior security architects, CISO advisory councils, and key decision makers across target industries. These expert engagements yielded qualitative insights into evolving testing practices, budget allocation drivers, and regional nuances. A series of in-depth surveys captured quantitative data on tool adoption rates, service preferences, and methodology utilization across organizational sizes and verticals.

Data triangulation was applied by cross-validating secondary statistics with primary findings to ensure accuracy and consistency. Segmentation analyses were conducted using a bottom-up approach, mapping individual use cases to broader market categories-such as testing type, component, methodology, vertical, deployment mode, and organization size-to identify distinct demand patterns. Finally, an advisory panel of external experts reviewed preliminary conclusions, providing validation and recommendations for refining the research narrative.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Security Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Security Testing Market, by Type

- Security Testing Market, by Component

- Security Testing Market, by Testing Methodology

- Security Testing Market, by Vertical

- Security Testing Market, by Deployment Mode

- Security Testing Market, by Organization Size

- Security Testing Market, by Region

- Security Testing Market, by Group

- Security Testing Market, by Country

- United States Security Testing Market

- China Security Testing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing the Executive Summary’s Core Insights to Illuminate Critical Takeaways and Empower Decision Makers with Strategic Security Testing Roadmaps

The security testing landscape is in the midst of transformative shifts driven by emerging technologies, evolving regulatory mandates, and dynamic geopolitical factors. Organizations that embrace integrated, AI-enhanced testing architectures and agile methodologies will be better positioned to detect and remediate threats before they escalate. The cumulative impact of recent tariff measures highlights the importance of strategic supply chain management and cost containment through virtualization and optimized resource utilization. Meanwhile, granular segmentation insights reveal that tailored approaches-aligned with specific testing types, components, deployment models, and industry requirements-are critical to achieving measurement-driven security outcomes.

Regional variations further underscore the need for localized strategies that address distinct regulatory and technological contexts. Leading vendors are responding with innovative solutions that blend managed services, automated tools, and AI-driven analytics to meet diverse organizational demands. By following the actionable recommendations outlined herein-prioritizing continuous integration, investing in skill development, and fostering cross-functional collaboration-industry leaders can reinforce resilience and unlock new efficiencies. Ultimately, this executive summary equips decision makers with a comprehensive framework to navigate the complexities of security testing and to future-proof their programs against an ever-changing threat environment.

Engage Directly with Ketan Rohom to Unlock Exclusive Access to Comprehensive Security Testing Research for Informed Decisions and Strategic Market Positioning

To gain a deeper, tailored understanding of the security testing market and to access the full suite of insights, data, and strategic recommendations, you are invited to connect with Ketan Rohom, Associate Director of Sales & Marketing. Ketan can provide details on how the comprehensive market research report delivers actionable intelligence to inform procurement decisions, optimize testing frameworks, and enhance cybersecurity resilience. Schedule a discussion to explore customized executive briefings, in-depth segmentation analyses, and priority-setting workshops designed for your organization’s unique needs. Reach out today to secure your access to the definitive security testing research that drives informed strategy and competitive advantage.

With this investment, your organization will benefit from benchmarking tools, peer group comparisons, and scenario planning modules that help anticipate future market shifts. Engage with our research team to unlock exclusive subscription options, training sessions, and advisory support that accelerate your security testing maturity. Contact Ketan Rohom now to transform insights into action and to chart a definitive path toward robust, proactive cybersecurity strategies

- How big is the Security Testing Market?

- What is the Security Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?