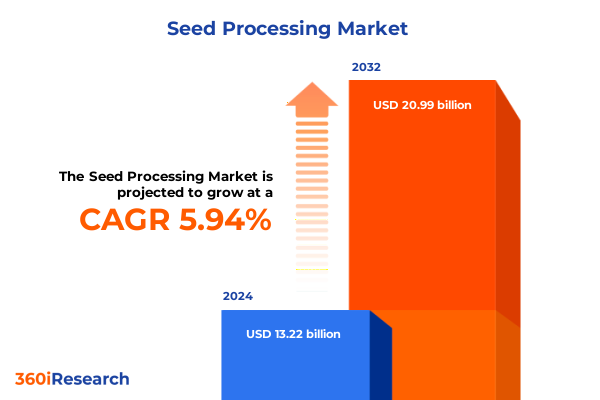

The Seed Processing Market size was estimated at USD 13.99 billion in 2025 and expected to reach USD 14.81 billion in 2026, at a CAGR of 5.96% to reach USD 20.99 billion by 2032.

Unveiling a Comprehensive Overview of the Dynamic Seed Processing Market Shaping the Future of Global Agricultural Value Chains and Food Security

Seed processing sits at the heart of agricultural value chains, serving as the critical bridge between raw harvests and high-quality, market-ready seeds. Innovations in cleaning, sorting, drying, and shelling have elevated the precision and efficiency of seed handling, directly impacting germination rates and crop yields. As the agricultural sector grapples with resource constraints, population growth, and climate volatility, the demand for optimized seed processing solutions has never been more pronounced.

Understanding the complexity of seed processing requires a holistic view of the technologies, stakeholders, and global trends shaping this industry. Equipment manufacturers are integrating digital tools such as sensor-based sorting, IoT-enabled monitoring, and AI-driven predictive maintenance to reduce downtime and enhance throughput. Concurrently, sustainability has emerged as a core driver, with industry participants prioritizing energy-efficient machinery and water-conserving drying methods. This introduction sets the stage for a deep dive into the transformative forces redefining seed processing across the value chain, equipping decision-makers with the insights necessary to navigate an evolving landscape.

Identifying Critical Technological Disruptions and Sustainability Drivers Revolutionizing Seed Processing Operations Across Global Value Chains

The seed processing landscape is undergoing rapid transformation driven by technological breakthroughs and evolving regulatory frameworks. Automation has moved beyond simple mechanization, leveraging robotics and machine vision to conduct highly refined color sorting and foreign material removal. These systems now boast sub-millimeter accuracy, enabling processors to meet stringent quality standards without sacrificing throughput.

Moreover, sustainable practices have catalyzed innovation in drying and cleaning processes, leading to a surge in low-temperature belt dryers and gravity-fed aspiration systems designed to reduce energy consumption. Advanced data analytics platforms are enabling operators to monitor moisture levels, throughput rates, and equipment health in real time, fostering a shift from reactive maintenance to proactive asset management. Consequently, the intersection of digitalization and sustainability is not only enhancing operational efficiency but also strengthening supply chain transparency-a key priority for processors and end users alike.

Examining the Far-Reaching Consequences of United States Tariff Measures Introduced in 2025 on Seed Processing Equipment Imports and Supply Chains

In 2025, the United States introduced sweeping tariff measures that have significantly impacted the importation of seed processing machinery. Under Section 301, elevated duties on select components have driven equipment manufacturers to reassess supply chain configurations and component sourcing strategies. Concurrently, Section 232 steel tariff adjustments have reverberated through the sector, increasing raw material costs for heavy-duty cleaning and drying machinery.

These cumulative tariffs have prompted a hybrid response: international firms are enhancing domestic assembly capabilities to mitigate duty escalations, while processors are re-evaluating procurement timelines to account for extended lead times. As a result, the industry has witnessed a shift towards modular equipment designs that facilitate on-site component installation, thereby reducing cross-border shipment volumes. Furthermore, local service networks have expanded to support accelerated maintenance schedules, ensuring equipment uptime remains consistent despite supply chain disruptions.

Uncovering Deep Market Segmentation Insights by Seed and Machinery Characteristics Revealing Growth Opportunities and Operational Efficiencies

A deep analysis of market segmentation reveals that seed type distinctions are fundamental to technology deployment. Cereal grains such as barley, maize, rice, and wheat continue to command the bulk of processing volume, prompting targeted enhancements in heavy-duty cleaning and graduated screen separations. Oilseed varieties-including canola, rapeseed, soybean, and sunflower-require specialized pre-treatment to remove oil residues, driving demand for integrated washing and centrifuge systems. Meanwhile, pulses like beans, chickpeas, lentils, and peas are experiencing growth due to rising plant-based protein consumption, leading to bespoke color sorting solutions that maximize purity. Vegetable seed niches encompassing cucumber, melon, and pumpkin call for delicate handling protocols that minimize kernel damage and preserve viability.

Equally important, machinery type drives operational differentiation. Air screen cleaning units and aspiration systems are optimized for light debris removal, while mechanical separators deliver coarse and fine particulate separation. The evolution of color sorting has progressed from basic optical sensors to hybrid electronic platforms that differentiate by shape, size, and spectral properties. Drying equipment choices span batch, belt, and rotary configurations, each calibrated for seed-specific moisture thresholds. Hulling operations leverage abrasive mills and rubber rollers to gently remove hulls, whereas impact and roller shellers offer robust throughput for hard-coated seeds. By aligning machine architecture with product characteristics, processors achieve more consistent quality and reduced waste.

End-use applications further refine segmentation insights. Facilities focused on animal feed consistently require high-capacity broiler, dairy, and swine formulas, emphasizing durability and uptime. Food processing producers demand strict screen gradients and optical sorting to meet bakery, confectionery, and snack food standards. Oil extraction plants balance mechanical and solvent techniques, necessitating integrated drying and dehulling stages. Certified and hybrid seed producers prioritize traceability systems and contamination controls, integrating advanced cleaning lines with RFID tagging and batch tracking. Capacity remains a pivotal axis of segmentation, as systems rated under one ton per hour cater to boutique enterprises, mid-range units between one and ten tons per hour support regional cooperatives, and high-capacity installations above ten tons per hour serve industrial-scale operations. Recognizing these intersecting dimensions allows stakeholders to tailor technology road maps and investment priorities with granular precision.

This comprehensive research report categorizes the Seed Processing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Seed Type

- Machinery Type

- Capacity

- End Use

Exploring Regional Variations and Strategic Drivers Shaping Seed Processing Demand Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics underscore the divergent trajectories within the seed processing domain. Across the Americas, established agrarian markets in North and South America prioritize scale and integration, driving the adoption of high-throughput modular systems. Latin American producers are increasingly focused on traceability in response to stringent export requirements, while U.S. facilities leverage precision sorters to meet organic and non-GMO certifications. In the EMEA sphere, Europe’s emphasis on sustainability has propelled the integration of renewable energy sources and water-recycling drying units. Meanwhile, Middle East and Africa processors contend with variable infrastructure, favoring portable and low-maintenance equipment capable of operating under challenging environmental conditions.

Asia-Pacific represents a nexus of both mature and emerging markets. Industrialized economies such as Japan and Australia are early adopters of IoT-enabled predictive analytics, integrating remote monitoring to support multi-site operations. Conversely, Southeast Asian and South Asian regions are witnessing a surge in small-scale, localized seed processing units tailored to rice and maize diversification initiatives. Collaborative ventures between technology providers and regional agronomists are fostering innovations in seed cleaning protocols that address high humidity and monsoonal variability. Collectively, these regional profiles demonstrate that technology preferences, regulatory contexts, and resource availability shape unique pathways for processors seeking competitive advantage.

This comprehensive research report examines key regions that drive the evolution of the Seed Processing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives Driving Innovation in Seed Processing Equipment and Services

Leading equipment manufacturers and service providers have intensified their focus on research and development, strategic partnerships, and aftermarket support. Companies renowned for precision sorting have introduced AI-augmented vision systems capable of identifying suboptimal kernels with unprecedented speed. Firms with a legacy in hulling and shelling are collaborating with materials scientists to reduce friction damage through advanced polymer rollers.

Furthermore, major players are expanding global footprints via joint ventures and acquisitions, enabling localized assembly and faster delivery of spare parts. Some industry leaders have launched subscription-based maintenance models that bundle remote diagnostics, predictive spares replenishment, and on-site troubleshooting. By leveraging data-driven insights, these organizations are repositioning themselves as solutions providers rather than equipment vendors, delivering value through end-to-end service agreements.

In parallel, emerging technology startups have introduced modular, plug-and-play processing units designed for rapid deployment in underserved markets. This wave of innovation is fostering a competitive ecosystem where incumbents and new entrants alike vie to offer the most flexible, energy-efficient, and digitally integrated processing platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Seed Processing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adama Agricultural Solutions Ltd.

- Allrounder Maschinenbau GmbH

- BASF SE

- Bayer AG

- Bühler AG

- Carter Day International, Inc.

- Cimbria Holding A/S

- Corteva, Inc.

- GSI Group, Inc.

- Key Technology, Inc.

- Limagrain Cooperative

- Nufarm Limited

- Ocrim S.p.A.

- Perten Instruments AB

- Petkus Technologie GmbH

- Satake Corporation

- Syngenta AG

- UPL Limited

Delivering Practical and Impactful Recommendations to Accelerate Competitive Advantage and Operational Excellence in Seed Processing Operations

Industry leaders should prioritize investments in modular automation platforms that can be scaled incrementally as processing requirements evolve. Integrating digital twins and IoT sensors will enable proactive maintenance, reduce unplanned downtime, and optimize throughput. Additionally, developing partnerships with data analytics providers can unlock actionable insights into batch performance and seed quality trends, informing continuous improvement initiatives.

To mitigate supply chain disruptions resulting from shifting tariff landscapes, organizations ought to diversify component sourcing and bolster local assembly capabilities. Establishing regional service hubs staffed with trained technicians will accelerate response times and minimize operational interruptions. Emphasizing circular economy principles-such as equipment remanufacturing and component recycling-can not only reduce long-term operational costs but also align with sustainability commitments emerging across global agricultural policies.

Finally, engaging in collaborative pilot programs with agritech startups and research institutions will accelerate the validation of cutting-edge technologies. By supporting co-development of advanced color sorting algorithms or low-energy drying methods, stakeholders can secure early access to disruptive innovations and maintain a competitive advantage.

Detailing Rigorous Research Methodology and Analytical Framework Ensuring Comprehensive and Reliable Insights into the Seed Processing Sector

This report synthesizes a multi-tiered research framework combining primary and secondary methodologies. Primary research involved in-depth interviews with executives from processing facilities, technology providers, and agricultural cooperatives across key regions. Supplementary site visits and operational audits provided firsthand observations of equipment performance and maintenance protocols.

Secondary research encompassed a comprehensive review of industry journals, patent filings, regulatory publications, and trade association reports. Data triangulation techniques were employed to reconcile diverse sources, ensuring consistency and reliability of insights. Quantitative and qualitative analyses were integrated through thematic coding, enabling the extraction of overarching trends and region-specific nuances. Throughout the research cycle, rigorous validation checkpoints-such as expert advisory panels and peer reviews-were implemented to uphold methodological integrity and accuracy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Seed Processing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Seed Processing Market, by Seed Type

- Seed Processing Market, by Machinery Type

- Seed Processing Market, by Capacity

- Seed Processing Market, by End Use

- Seed Processing Market, by Region

- Seed Processing Market, by Group

- Seed Processing Market, by Country

- United States Seed Processing Market

- China Seed Processing Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Summarizing Key Insights and Strategic Imperatives Guiding Stakeholders Toward Sustainable Growth in Seed Processing and Agricultural Value Chains

In concluding, the seed processing sector stands at the confluence of technological innovation, regulatory evolution, and shifting agronomic practices. Stakeholders must remain vigilant of emerging digital tools that promise enhanced sorting accuracy and machine uptime, while proactively adapting to sustainability imperatives and tariff-driven supply chain shifts. The interplay between segmentation factors-spanning seed type, machinery capabilities, end-use requirements, and capacity tiers-underscores the need for finely calibrated strategies tailored to distinct operational contexts.

By leveraging the recommendations and insights presented herein, decision-makers can position their organizations to capture untapped efficiencies, strengthen market resilience, and lead the ongoing transformation of seed processing. As global demand for high-quality seeds intensifies, the ability to integrate advanced technologies, diversify sourcing, and engage in collaborative innovation will differentiate industry frontrunners from followers.

Take Action Now to Secure Your Comprehensive Market Research Report on Seed Processing and Engage with Ketan Rohom for Tailored Insights and Support

For those poised to capitalize on the transformative insights outlined in this executive summary, the next step is clear. Reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure personalized guidance and premium access to the full in-depth report. By engaging directly with Ketan Rohom, organizations gain tailored support designed to align strategic objectives with emerging opportunities in seed processing. This dedicated consultation ensures that stakeholders receive real-time updates on industry shifts, specialized analysis of regional dynamics, and bespoke recommendations for operational excellence. Don’t miss the chance to harness this intelligence and drive your business forward with confidence-connect with Ketan Rohom today to acquire the complete market research report and unlock the full spectrum of actionable insights.

- How big is the Seed Processing Market?

- What is the Seed Processing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?