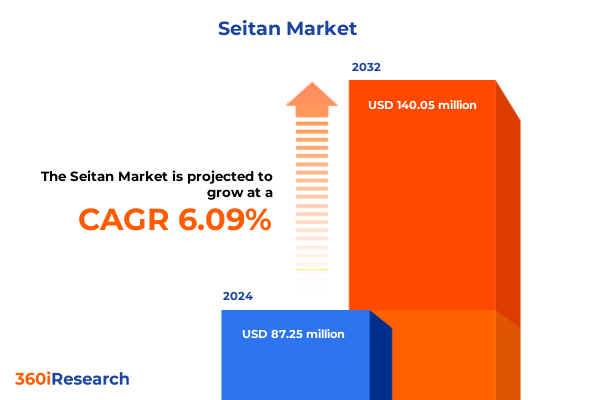

The Seitan Market size was estimated at USD 92.49 million in 2025 and expected to reach USD 98.25 million in 2026, at a CAGR of 6.10% to reach USD 140.05 million by 2032.

Setting the Stage for Seitan’s Rise Across Diverse Channels and Applications as Consumers Seek Plant-Based Alternatives and Innovative Protein Solutions

Seitan has emerged as a versatile plant protein alternative that resonates with health-conscious consumers and culinary innovators alike. Its unique gluten structure offers a meat-like chew and adaptability across a spectrum of recipes, from ethnic cuisines to avant-garde vegan gastronomy. Against the backdrop of rising interest in environmental sustainability and nutritional optimization, seitan has gained traction as a primary ingredient in vegetarian and flexitarian diets. This trend is driven by shifting consumer sentiment toward minimizing processed meats without compromising on texture or taste, and it is further fueled by broader awareness of the carbon and water footprints associated with animal-derived proteins.

Moreover, the accessibility of seitan across diverse retail formats has widened its appeal. From artisanal fresh options in local butcher-style markets to convenient frozen portions in supermarket aisles, and long-shelf-life dried forms for e-commerce fulfillment, seitan’s distribution channels reflect a maturing supply chain. As culinary experimentation becomes an integral part of meal planning, home cooks and foodservice operators turn to seitan for its customizable nature. Consequently, manufacturers are investing in novel flavor infusions and fortified variants, responding to demand for both indulgence and functional nutrition.

Consequently, this analysis delivers a thorough view of the current landscape for seitan. It examines the catalytic forces reshaping the market, evaluates trade policy impacts, and then uncovers insights across diverse segmentation criteria. By presenting regional dynamics, profiling leading companies, and offering actionable recommendations, it furnishes industry stakeholders with a strategic roadmap for seitan’s next phase of growth.

Examining How Culinary Innovation Cultural Shifts and Supply Chain Advancements Are Redefining the Seitan Market and Accelerating Consumer Adoption Globally

Over the past several years, consumer eating habits have evolved dramatically, driven by a blend of lifestyle aspiration, health stewardship, and culinary curiosity. The surge in flexitarian diets, which blends plant-centric meals with occasional animal proteins, has propelled seitan into the mainstream. Chefs in upscale restaurants and casual dining outlets alike are reimagining seitan as the centerpiece of global fusion recipes, pairing it with bold spices or incorporating it into plant-based charcuterie boards. This culinary innovation has, in turn, reshaped retail assortments, prompting grocery chains to allocate higher-visibility shelf space and invest in premium seitan launches.

Additionally, supply chain advancements and production technology have crystallized seitan’s market potential. High-throughput extrusion processes and automated formulation lines now enable manufacturers to maintain consistent texture profiles and integrate novel ingredients such as ancient grains or vegetable concentrates. Simultaneously, digital traceability systems track gluten sourcing and processing, bolstering transparency and food safety credentials. These technological strides not only streamline operations but also enable faster responsiveness to flavor trends and dietary regulations.

Furthermore, shifting consumer perceptions regarding protein sustainability have catalyzed partnerships among plant-protein producers, packaging innovators, and distribution platforms. Online marketplaces dedicated to specialty foods, as well as traditional retailers, have forged collaborations with ingredient suppliers, co-developing private-label seitan products tailored to local taste preferences. By aligning innovation with evolving consumer values around health, ethics, and environmental stewardship, the seitan market is undergoing a transformative shift that extends well beyond niche segments.

Assessing the Cumulative Effects of New United States Import Tariffs on Seitan Ingredients and Strategic Responses by Industry Players in 2025

In early 2025, new tariff measures imposed by the United States government targeted key seitan inputs, most notably wheat gluten imports from selected regions. These duties, aimed at safeguarding domestic agriculture, have incrementally raised the cost base for companies reliant on international suppliers. Consequently, seitan producers have reevaluated their ingredient sourcing strategies, balancing the economic appeal of overseas procurement against the security of domestic contracts. This realignment has led to a surge in local partnerships with milling cooperatives and regional grain processors, ensuring continuity of supply amidst a more complex trade environment.

Moreover, the tariff landscape has spurred ingredient innovation. To mitigate cost pressures, some manufacturers have experimented with blended formulations that incorporate legume-based proteins or fermented plant concentrates, thereby diversifying their input portfolios. These hybrid approaches maintain the characteristic texture profile that consumers expect from seitan while incorporating value-added nutritional properties. Concurrently, several industry players have accelerated investments in domestic gluten extraction facilities, moving key production steps closer to end-product manufacturing centers to reduce logistical inefficiencies and import dependencies.

Ultimately, the cumulative impact of these trade policies extends beyond price adjustments. By driving strategic reshoring initiatives and fostering ingredient diversification, the tariffs have inadvertently strengthened domestic supply resilience. Companies that proactively embraced collaborative ventures with local grain cooperatives have positioned themselves to navigate potential future shifts in trade policy while preserving product quality and consumer trust.

Uncovering Critical Segmentation Dynamics Shaping Product Forms Distribution Channels End User Profiles and Application Patterns in the Seitan Market

A nuanced understanding of product form is critical for any stakeholder in the seitan arena. The market comprises dried offerings, fresh preparations, and frozen formats. Dried variants often arrive in the form of flakes or powders, appealing to manufacturers of convenience meals and home-cook enthusiasts who prize shelf stability and rapid hydration. In contrast, fresh seitan is presented in bulk and packaged configurations, targeting foodservice operators who demand ready-to-use volumes for menu integration. Frozen solutions, divided into industrial and retail packs, cater to large-scale processors seeking consistency as well as consumers seeking convenient, long-lasting proteins.

Equally significant is the distribution channel mosaic, which ranges from convenience stores and specialty retailers to online platforms and large grocery formats. Within the online retail sphere, company websites serve as direct-to-consumer channels for premium and customized seitan innovations, while third-party e-commerce marketplaces expand geographic reach through broader assortment and promotional heft. Similarly, supermarkets and hypermarkets operate through national chains and regional strongholds, each fine-tuning seitan assortments to reflect local dietary customs and competitive dynamics.

End user segmentation reveals distinct demand drivers and purchasing behaviors. Food manufacturers leverage seitan as an ingredient in packaged meals and snacks, guided by formulation guidelines and cost targets. Foodservice operators, which include hotels, cafeteria networks, and restaurants, utilize seitan to differentiate menu offerings and appeal to health- and eco-conscious diners. Individual consumers, spanning committed vegetarians through curious omnivores, influence product development through their performance expectations and flavor preferences.

Applications range from foodservice deployments-encompassing catering operations and sit-down dining establishments-to home cooking among flexitarian and vegetarian households, as well as ready-to-eat meals that bridge the gap between convenience and premium positioning. Recognizing these segmentation nuances enables industry participants to craft targeted product portfolios, optimize channel strategies, and align marketing narratives with end-user motivations.

This comprehensive research report categorizes the Seitan market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Distribution Channel

- End User

- Application

Analyzing Regional Variations in Seitan Consumption Production and Market Drivers Across the Americas EMEA and Asia Pacific Growth Hubs and Maturity Landscapes

Regional analysis of the seitan landscape underscores distinct growth levers and market characteristics. In the Americas, a combination of robust retail infrastructure and heightened consumer consciousness around plant-based proteins has cultivated widespread seitan availability. Leading urban centers feature specialty vegan markets and dedicated refrigerated aisles, while digital delivery apps accelerate trial by providing doorstep convenience. This ecosystem supports rapid iteration of novel flavors and collaborative branded experiences within urban communities.

Across Europe, the Middle East, and Africa, seitan’s penetration is uneven yet revealing of localized potential. Western European nations often regulate gluten-based products under strict labeling laws, which has elevated transparency and consumer confidence. In contrast, emerging markets within the region are witnessing nascent demand driven by rising middle-class incomes and increased exposure to vegan cuisines through hospitality and tourism channels. Regulatory frameworks evolve in tandem, with certain jurisdictions introducing clear guidelines for plant-based protein labeling and nutritional claims.

Meanwhile, the Asia-Pacific region presents a tapestry of maturity levels. Established markets such as Japan and Australia boast a history of wheat-based protein consumption, resulting in sophisticated product portfolios and high consumer familiarity. In contrast, emerging economies in Southeast Asia are experiencing an upsurge in vegan and flexitarian dining options, especially within coastal urban centers that host international food festivals and chef-led plant-based pop-ups. Distribution strategies here emphasize e-commerce partnerships and modern trade alliances to accelerate market education and overcome traditional supply chain constraints.

This comprehensive research report examines key regions that drive the evolution of the Seitan market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies Collaborations and Innovation Initiatives Undertaken by Leading Seitan Manufacturers and Emerging Startups

Competitive dynamics in the seitan sector are shaped by both established food manufacturers and nimble startups that drive disruptive innovation. Leading players differentiate through vertically integrated supply models, securing gluten extraction capabilities while maintaining direct consumer engagement through branded product lines. These companies leverage co-manufacturing partnerships to expand regional footprints and optimize production costs, often collaborating with ingredient specialists to introduce enriched formulations that resonate with health-focused audiences.

Emerging brands, in turn, position themselves around artisanal authenticity and niche flavor profiles. By sourcing non-GMO wheat and integrating ancient grains, these innovators appeal to discerning consumers seeking premium experiences. Many have pioneered direct-to-consumer subscription models, curating seasonal flavor releases and culinary kit offerings that foster brand loyalty and data-driven consumer insights. Strategic alliances with meal kit services and boutique hospitality groups have further accelerated their visibility within influential dining circles.

Across the board, M&A activity signals converging interests as larger food conglomerates acquire seitan specialists to complement broader plant-protein portfolios. These transactions often enable legacy food companies to access agile R&D teams and establish footholds in emerging distribution channels. Ultimately, the competitive landscape balances economies of scale with authentic storytelling, underscoring the importance of both operational efficiency and brand narrative in capturing evolving consumer demand.

This comprehensive research report delivers an in-depth overview of the principal market players in the Seitan market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ahold Delhaize USA, Inc.

- Blackbird Foods, LLC

- Commensal Veg ’Etal Inc.

- Field Roast Grain Meat Co.

- Franklin Farms, Inc.

- Garden Protein International, Inc.

- Gusta Foods Inc.

- Lightlife Foods, Inc.

- Manitoba Harvest Hemp Foods ULC

- Michael’s Savory Seitan, LLC

- No Evil Foods, LLC

- ProLaVit GmbH

- Sweet Earth, Inc.

- The BE-Hive, LLC

- The Bridge S.r.l.

- Turtle Island Foods, SPC

- Upton’s Naturals Co.

- VBites Foods Limited

- Vegan Daddy Meats, LLC

- Wegmans Food Markets, Inc.

Strategic Imperatives for Industry Leaders to Drive Seitan Innovation Expand Market Reach and Navigate Regulatory and Supply Chain Challenges

For industry leaders aiming to capitalize on seitan’s momentum, strategic investments in research and development are paramount. Prioritizing pilot lines for flavor diversification and novel ingredient blends can accelerate time to market, while cross-functional teams should collaborate with culinary experts to validate sensory profiles. Strengthening supply chain resilience through dual sourcing arrangements and flexible procurement contracts will mitigate exposure to trade policy shifts and raw-material volatility.

Simultaneously, companies must deepen engagement across digital touchpoints. Enhancing e-commerce platforms with interactive recipe content and community feedback loops can drive direct sales while generating actionable consumer insights. Partnerships with meal kit providers and foodservice distributors offer additional channels to introduce premium seitan formats to both home cooks and professional chefs. Transparent storytelling around ingredient origins, production methodologies, and sustainability metrics will resonate with ethically minded audiences.

Finally, regulatory monitoring and proactive policy advocacy will underpin long-term success. By working alongside industry associations to shape clear labeling standards and secure supportive trade agreements, market participants can foster a policy environment conducive to plant-based protein innovation. Through this integrated approach-bridging product excellence, digital amplification, and regulatory collaboration-industry leaders will be well-positioned to navigate emerging challenges and seize new growth opportunities.

Detailing Rigorous Data Collection Qualitative and Quantitative Analyses and Validation Approaches Employed in Crafting the Comprehensive Seitan Market Study

This report’s findings are grounded in a rigorous, multi-phase research methodology designed to deliver robust and actionable intelligence. Primary research involved in-depth interviews with seitan manufacturers, ingredient suppliers, and channel partners, allowing for firsthand insights into production challenges and consumer preferences. Surveys of foodservice operators and individual consumers were conducted to validate usage patterns and emerging application demands across home cooking and out-of-home dining scenarios.

Secondary research encompassed a comprehensive review of industry publications, academic journals on plant-based proteins, trade associations’ white papers, and publicly available corporate disclosures. Financial analyses provided context regarding capital investments in processing technology and M&A trends, while regulatory databases were consulted to track evolving labeling and tariff frameworks. Additionally, observations from major food trade exhibitions informed our understanding of product innovation pipelines and partnership dynamics.

Data triangulation ensured that quantitative trends were corroborated by qualitative stakeholder perspectives. Regional case studies were employed to capture market-specific characteristics and validate distribution channel performance. Lastly, expert panels comprising nutritionists, supply chain analysts, and sustainability advisors reviewed preliminary conclusions to enhance accuracy and ensure the report’s strategic relevance to industry decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Seitan market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Seitan Market, by Product Form

- Seitan Market, by Distribution Channel

- Seitan Market, by End User

- Seitan Market, by Application

- Seitan Market, by Region

- Seitan Market, by Group

- Seitan Market, by Country

- United States Seitan Market

- China Seitan Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Summarizing Key Takeaways and Strategic Outlook for Seitan Stakeholders to Capitalize on Emerging Trends and Strengthen Market Positioning

Throughout this analysis, seitan has emerged as a compelling plant-based protein with robust growth potential and dynamic market drivers. From the intricate shifts in consumer behavior and culinary innovation to the strategic responses necessitated by evolving trade policies, stakeholders are navigating a landscape defined by both opportunity and complexity. Segmentation insights underscore the need for tailored strategies across product forms, channels, end-user categories, and applications, each presenting unique competitive advantages and challenges.

Regional perspectives reveal that growth trajectories vary according to cultural preferences, regulatory environments, and supply chain maturity. Leading companies are demonstrating that agility in product development and channel collaboration is essential for capturing market share, while lean startups drive differentiation through authenticity and targeted innovation. Against this backdrop, strategic imperatives encompass investment in R&D, digital engagement, and policy advocacy to ensure resilience and sustained profitability.

By synthesizing these findings, industry participants can craft informed strategies to harness seitan’s evolving appeal. Whether through partnership formation, portfolio diversification, or enhanced consumer outreach, the insights contained herein offer a roadmap for aligning operational capabilities with market demand. The conclusion is clear: as consumer priorities evolve, seitan will continue to occupy a central role in the broader shift toward sustainable, high-quality plant-based nutrition.

Innovate and Lead with Data Driven Insights Unlock the Full Potential of the Seitan Market by Procuring the Definitive Industry Analysis Today

To explore this definitive market research report and leverage data-driven strategies that will position your organization at the forefront of the evolving seitan landscape, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Let these insights inform your business decisions and help you unlock growth in product innovation, supply chain resilience, and market expansion. Engage today to secure your copy and transform strategic planning into quantifiable success in the seitan sector

- How big is the Seitan Market?

- What is the Seitan Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?