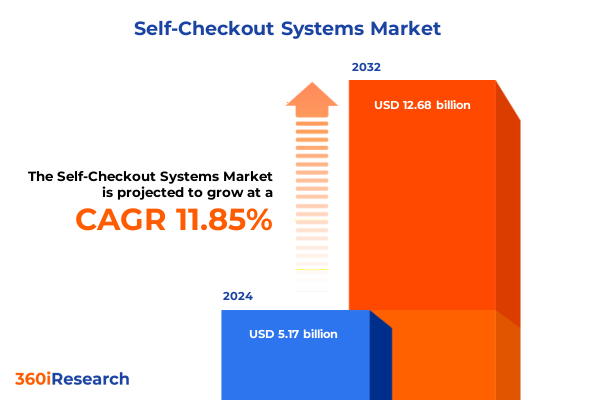

The Self-Checkout Systems Market size was estimated at USD 5.78 billion in 2025 and expected to reach USD 6.43 billion in 2026, at a CAGR of 11.88% to reach USD 12.68 billion by 2032.

Exploring how self-checkout technologies are redefining retail operations and elevating consumer experiences in an increasingly digital commerce environment

In an era defined by digital transformation and shifting consumer expectations, self-checkout systems have emerged as a pivotal force reshaping retail operations and customer experiences. These technologies blend software intelligence, hardware reliability, and seamless integration to reduce transaction friction, accelerate throughput, and offer unparalleled convenience. As brick-and-mortar retailers compete with e-commerce giants, the implementation of self-service checkout stations has become a strategic imperative to enhance in-store efficiency while maintaining high levels of customer satisfaction.

Moreover, the convergence of embedded analytics, intuitive user interfaces, and real-time transaction monitoring is driving a new wave of innovation within the self-checkout domain. Transitioning from basic barcode scanners to advanced computer vision and AI-driven verification, these platforms are not only streamlining payments but also mitigating risks associated with shrinkage and error. Consequently, stakeholders across the retail ecosystem are revisiting traditional cashier workflows and supply chain configurations to capitalize on the operational gains offered by these solutions.

Looking ahead, this report synthesizes the critical trends, tariff implications, segmentation insights, and regional dynamics that define the self-checkout landscape. Through a methodical examination of deployment models, organizational contexts, component architectures, end-user applications, and geographical contours, readers will derive actionable intelligence to guide investments, drive adoption, and realize transformative growth across diverse retail environments.

Uncovering the major transformative shifts that are revolutionizing self-checkout systems through AI integration, contactless interfaces, and omnichannel connectivity

The self-checkout landscape has undergone remarkable evolution as advanced technologies accelerate the shift toward contactless and fully automated retail experiences. Initially conceived to complement traditional cashier stations, these systems have evolved into comprehensive solutions that integrate artificial intelligence, machine learning algorithms, and Internet of Things connectivity. Consequently, retailers now leverage computer vision to enhance item recognition accuracies, while natural language processing modules facilitate guided interactions, reducing the learning curve for a broad spectrum of customers.

Furthermore, the proliferation of mobile wallets, digital coupons, and loyalty program integration has spurred an omnichannel approach, ensuring that in-store experiences remain consistent with online engagements. This convergence has ushered in seamless payment journeys where consumers can authenticate transactions via biometric scans or secure tokenization, thereby reinforcing trust and expediting throughput. Simultaneously, edge computing capabilities embedded in on-premise controllers complement cloud infrastructure, delivering real-time analytics and system health monitoring without compromising latency-sensitive operations.

As these transformative shifts coalesce, retailers are reallocating resources from manual checkout staffing toward value-added services such as personalized promotions and in-store logistics optimization. The resultant paradigm transcends mere transaction automation, positioning self-checkout solutions as catalysts for holistic operational excellence and customer-centric innovation.

Assessing the cumulative impact of evolving United States tariff measures in 2025 on the cost structures, supply chains, and adoption rates of self-checkout systems

In 2025, evolving tariff policies in the United States are imposing renewed pressures on self-checkout system providers and their supply chains. The additional duties on imported electronic components, particularly those sourced from key manufacturing hubs, have incrementally increased the landed cost of hardware modules such as barcode scanners, printer mechanisms, and touchscreen controllers. As a result, providers must re-evaluate sourcing strategies and negotiate supplier contracts to absorb or offset these added expenses, thereby safeguarding their competitiveness.

Moreover, the ripple effects of elevated tariffs extend to service and support divisions. With higher costs for spare parts and device replacements, service providers face the challenge of maintaining margin structures without passing disproportionate price hikes to end users. Consequently, many organizations are exploring alternative procurement avenues, including nearshoring assembly operations or partnering with domestic electronics manufacturers to benefit from duty exemptions and reduced transit risks.

Despite these headwinds, some vendors are leveraging the tariff environment as an impetus to accelerate research and development for modular hardware designs that minimize reliance on high-tariff components. By standardizing interfaces and prioritizing firmware-driven features, they aim to streamline inventory management and facilitate rapid field upgrades. Ultimately, navigating the cumulative impact of 2025 tariff adjustments demands agile supply chain orchestration, diversified sourcing portfolios, and forward-looking technology roadmaps.

Revealing critical segmentation insights that illuminate how deployment modes, organization sizes, components, end user industries, applications, and solutions shape market dynamics

A nuanced examination of deployment modes reveals distinct value propositions for both cloud-based and on-premise self-checkout platforms. Cloud implementations deliver centralized updates, scalable resource allocations, and seamless integration with enterprise-wide CRM systems. In contrast, on-premise architectures offer enhanced data sovereignty, low-latency local processing, and offline resilience for locations with intermittent connectivity. Organizations often choose a hybrid approach, aligning system footprints with their IT governance protocols and network capabilities.

When considering organization size, large enterprises benefit from economies of scale by negotiating enterprise-wide licensing agreements and standardized rollout procedures. Meanwhile, small and medium enterprises leverage self-checkout solutions as agile tools to elevate competitiveness against larger peers. Through flexible subscription models and modular hardware kits, vendors cater to varying budgetary constraints and implementation timelines, enabling faster time-to-value across divergent operational scales.

Component segmentation further illuminates the market dynamics underpinning self-checkout deployments. Hardware packages often bundle POS terminals, printer devices, and scanner units with customizable form factors. Meanwhile, services span installation, maintenance, and ongoing support functions critical for sustaining uptime and mitigating operational disruptions. On the software front, application platforms manage transaction workflows, firmware ensures device stability, and middleware bridges communication between peripheral devices and cloud analytics engines.

Across end user industries, adoption trends are most pronounced in high-frequency purchase environments such as convenience stores and grocery chains, where throughput demands justify automated checkouts. Department stores and pharmacies are increasingly integrating self-service lanes to streamline non-prescription items, while hospitality venues deploy kiosks for quick-service ordering. In each case, tailored configurations optimize layout footprints, staffing allocations, and customer engagement strategies.

Application-based analysis underscores the expansive utility of self-checkout innovation. Healthcare facilities utilize contactless terminals for ancillary retail services, transportation hubs deploy fast-track kiosks for ticketing, and retail outfits refine the checkout experience with AI-driven upselling prompts. Solution types vary from counter integrations embedded within existing cashier lanes to standalone fixed kiosks and mobile terminals carried by floor associates, each aligned with specific use-case scenarios.

This comprehensive research report categorizes the Self-Checkout Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Mode

- Organization Size

- Component

- Solution Type

- End User Industry

- Application

Dissecting key regional insights that capture the varying growth trajectories, regulatory influences, and consumer behaviors across Americas, EMEA, and Asia-Pacific markets

Regional dynamics in the self-checkout market are shaped by local regulatory landscapes, consumer behavior nuances, and infrastructure maturity levels. In the Americas, high-speed broadband penetration and a strong appetite for contactless payment have fostered rapid adoption across supermarkets, big-box retailers, and quick-service chains. Tax incentives for digital transformation initiatives further incentivize investments, while domestic manufacturing partnerships mitigate tariff-driven cost pressures.

Moving to Europe, Middle East & Africa, the emphasis often centers on compliance with stringent data privacy regulations such as GDPR and emerging digital commerce directives. Retailers in Western Europe prioritize plug-and-play modular solutions that can adapt to multi-language interfaces and meet diverse payment standard requirements. Within EMEA, the Gulf Cooperation Council markets exhibit strong growth in hospitality kiosks as tourist-heavy locales seek to enhance visitor experiences, while African retailers pilot solar-powered self-checkout prototypes to address intermittent grid reliability.

In Asia-Pacific, a combination of smartphone ubiquity and digital wallet proliferation has propelled self-checkout uptake in urban centers throughout East and Southeast Asia. Leading e-commerce ecosystems have seamlessly integrated offline self-service lanes, enabling consumers to reconcile loyalty programs and mobile coupons at checkout terminals. Meanwhile, Australia and New Zealand emphasize unified commerce strategies, leveraging robust point-of-sale networks to bridge inventory management, online order fulfillment, and in-store self-checkout operations. These regional insights offer a comprehensive lens through which stakeholders can craft tailored market entry and expansion blueprints.

This comprehensive research report examines key regions that drive the evolution of the Self-Checkout Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting key competitive company insights that showcase strategic partnerships, product innovations, and market positioning among leading self-checkout system providers

An analysis of leading self-checkout system providers underscores the strategic imperative of collaboration, innovation, and customer-centric design. Several prominent companies have forged partnerships with global technology leaders to integrate advanced AI-driven item recognition engines and cybersecurity modules. Such alliances aim to deliver holistic solutions that preemptively address shrinkage risks while maintaining streamlined transaction flows.

Product portfolios are continually enhanced through iterative hardware revisions that improve durability, reduce form factors, and incorporate sustainable materials. Firmware updates, delivered via over-the-air channels, refine user interfaces and extend device lifecycles. Meanwhile, service divisions are expanding managed services offerings, providing retailers with predictive maintenance schedules, remote device diagnostics, and rapid-response field technicians to minimize downtime.

Strategic positioning also reflects geographic diversification efforts. Many foremost vendors are establishing localized assembly facilities or strategic joint ventures to navigate tariff landscapes and expedite delivery timelines. These initiatives support faster customization cycles for country-specific payment protocols and assist in meeting local certification requirements. Altogether, these company insights highlight a competitive environment driven by continuous innovation, strategic partnerships, and region-aware execution models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Self-Checkout Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cantronic Systems Inc.

- Datalogic S.p.A.

- Diebold Nixdorf, Incorporated

- Epos Now Ltd.

- Fujitsu Limited

- Gilbarco Veeder-Root

- Honeywell International Inc.

- IBM Corporation

- ITAB Shop Concept AB

- MishiPay Ltd.

- Mitsubishi Electric Corporation

- NCR Corporation

- Pan-Oston Co.

- Queueright Ltd.

- Slabb, Inc.

- Standard Cognition Corp.

- Toshiba Global Commerce Solutions, Inc.

- Trigo

- Zippin

Delivering actionable recommendations for industry leaders to optimize technology investments, streamline operations, and gain a competitive edge in self-checkout deployment

Industry leaders seeking to maximize returns on self-checkout investments should first prioritize a comprehensive total cost of ownership analysis. By mapping out acquisition expenses, integration costs, and recurring maintenance fees, organizations can develop accurate ROI projections. Furthermore, negotiating modular pricing structures and volume-based discounts with vendors can help optimize capital allocation and reduce per-unit expenditure.

Following this, developing a phased rollout strategy is essential. Piloting cross-functional deployments in high-traffic stores allows teams to gather user feedback, fine-tune configuration parameters, and establish robust support workflows before broader implementation. Equally important is investing in change management initiatives that prepare staff through targeted training programs and clear communication plans, fostering a culture that values technological adoption.

To strengthen resilience against supply chain disruptions and tariff fluctuations, practitioners should diversify their supplier ecosystem. Engaging multiple hardware and component vendors with regional manufacturing capabilities mitigates geopolitical risk and accelerates inventory replenishment. In parallel, leveraging software-defined updates and cloud-based analytics ensures continuous performance monitoring and accelerates innovation cycles. Through these actionable steps, industry leaders can bolster efficiency, enhance customer experiences, and sustain long-term growth in the self-checkout domain.

Detailing a rigorous research methodology that underpins the comprehensive market analysis, incorporating primary interviews, secondary data sources, and advanced analytical frameworks

The research methodology underpinning this analysis combines qualitative and quantitative approaches to deliver robust market insights. Primary research comprised in-depth interviews with retail CIOs, technology integrators, and operations managers, providing firsthand perspectives on deployment challenges, performance metrics, and strategic priorities. These dialogues were complemented by expert roundtables to validate emerging trends and assess the efficacy of innovative solution architectures.

Secondary research entailed a systematic review of industry publications, regulatory filings, and proprietary data sources to capture tariff developments, standardization roadmaps, and funding initiatives. Information from trade associations and certification bodies further informed the regulatory and compliance aspects. Advanced analytics techniques, including scenario modeling and sensitivity analysis, were applied to evaluate the potential impacts of tariff shifts and technology adoption rates under varying market conditions.

Finally, a rigorous data triangulation process ensured the accuracy and reliability of findings. Cross-referencing multiple data streams, reconciling discrepancies, and conducting consistency checks solidified the integrity of insights. This comprehensive methodology empowers decision-makers with evidence-based intelligence to navigate the complex self-checkout ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Self-Checkout Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Self-Checkout Systems Market, by Deployment Mode

- Self-Checkout Systems Market, by Organization Size

- Self-Checkout Systems Market, by Component

- Self-Checkout Systems Market, by Solution Type

- Self-Checkout Systems Market, by End User Industry

- Self-Checkout Systems Market, by Application

- Self-Checkout Systems Market, by Region

- Self-Checkout Systems Market, by Group

- Self-Checkout Systems Market, by Country

- United States Self-Checkout Systems Market

- China Self-Checkout Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Summarizing the pivotal conclusions derived from the executive summary to underscore the future growth drivers and strategic imperatives for self-checkout adoption

The findings illuminate a self-checkout landscape poised for continued growth, driven by technological advancements, evolving consumer preferences, and strategic supply chain recalibrations. As AI-powered item recognition and contactless payment become standard features, retailers are positioned to deliver rapid, secure, and personalized checkout experiences. Concurrently, tariff-induced cost pressures are prompting innovative hardware designs and regional sourcing strategies that enhance resilience and cost efficiency.

Segmentation insights reveal that hybrid deployment models, flexible subscription plans, and modular component bundles cater to diverse organizational requirements, from global chains to local shops. Regional nuances underscore the need for compliance-minded solutions in EMEA and tourism-driven innovations in the Gulf, while Asia-Pacific’s digital wallet ubiquity showcases the potential for converged online and offline commerce. Competitive company behaviors highlight that strategic partnerships and continuous product evolution are essential to maintaining market leadership.

By synthesizing these insights, decision-makers can chart targeted strategies that balance operational efficiency, customer satisfaction, and financial performance. The convergence of actionable recommendations and data-driven analysis offers a clear pathway to unlocking value and strengthening market positions in the dynamic self-checkout arena.

Encouraging engagement with Ketan Rohom to secure in-depth insights and proprietary data for making informed strategic decisions on self-checkout system investments

To secure your competitive advantage and enrich strategic roadmaps, reach out to Ketan Rohom, Associate Director of Sales & Marketing for a personalized briefing and comprehensive insights. Through an exclusive consultation with him, you will gain access to detailed data sets, proprietary analysis, and scenario planning that align precisely with your organization’s objectives. Engaging directly with Ketan ensures that you receive tailored recommendations on deployment modes, cost mitigation strategies, and innovation pathways. Don’t miss the opportunity to elevate your decision-making with expert guidance that transforms market intelligence into actionable success. Contact Ketan today to obtain the full market research report and unlock the insights necessary for confident investment in self-checkout systems

- How big is the Self-Checkout Systems Market?

- What is the Self-Checkout Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?