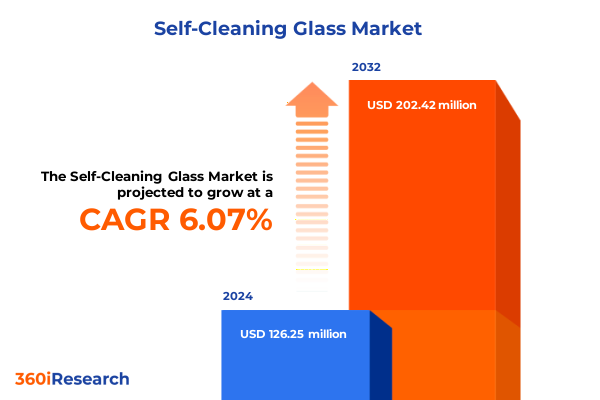

The Self-Cleaning Glass Market size was estimated at USD 133.86 million in 2025 and expected to reach USD 147.24 million in 2026, at a CAGR of 6.08% to reach USD 202.41 million by 2032.

Revolutionary Introduction to Self-Cleaning Glass and Its Role in Redefining Surface Maintenance Standards for Modern Architectural Innovations

Self-cleaning glass represents a pioneering leap in surface maintenance that combines advanced materials science with everyday practicality. By integrating specialized coatings and nanostructures directly onto glass surfaces, these innovative products harness natural environmental forces to maintain clarity and reduce manual cleaning. This capability addresses persistent challenges in modern architecture and transportation applications, where maintenance downtime and labor costs can erode operational efficiency and aesthetic standards.

Moreover, the expansion of sustainability mandates and water conservation initiatives has propelled self-cleaning glass into the spotlight. Property developers and facility managers increasingly prioritize environmentally responsible building materials, driven by rigorous green building certifications and evolving regulatory frameworks. Consequently, the self-cleaning glass segment has emerged as a cornerstone of high-performance façade design, as it not only enhances visual appeal but also contributes to reduced chemical use and operational overhead. As decision-makers explore mechanisms to differentiate their projects and meet stakeholder expectations, understanding the fundamentals and applications of self-cleaning glass becomes essential.

Unveiling the Transformative Technological and Environmental Shifts Revolutionizing the Self-Cleaning Glass Market Landscape Dynamics

The self-cleaning glass industry has undergone transformative shifts driven by breakthroughs in hydrophobic coatings, nanocoating engineering, and photocatalytic technologies. Hydrophobic approaches leverage surface chemistry to repel water and dirt, whereas nanocoatings introduce atomic-scale features that minimize particulate adherence. Photocatalytic solutions, particularly those based on titanium dioxide and zinc oxide, further extend performance by catalyzing the breakdown of organic matter under ultraviolet exposure. These technical advancements have significantly elevated durability and self-cleaning efficiency, reshaping product development roadmaps across leading manufacturers.

Furthermore, rising awareness of environmental sustainability and circular economy principles has exerted pressure on material suppliers and system integrators to innovate responsibly. Regulatory shifts such as stricter water discharge limitations and eco-design directives have encouraged adoption of low-volatility, solvent-free processes, catalyzing next-generation formulations. In parallel, the integration of smart window functionalities and embedded sensor capabilities is paving the way for convergence between self-cleaning and energy management systems. Consequently, the industry is witnessing a paradigm where multifunctional glazing solutions converge to meet evolving building performance criteria.

Assessing the Comprehensive Cumulative Impact of 2025 United States Tariffs on Self-Cleaning Glass Industry Operations and Supply Chains

The introduction of new U.S. tariffs in 2025 has exerted material pressure on the global self-cleaning glass supply chain. These measures, targeting key raw materials and coated glass imports, have increased landed costs, complicated sourcing strategies, and prompted re-evaluation of pricing models. Supply bottlenecks have emerged as international suppliers recalibrate production volumes to navigate higher duty structures, resulting in extended lead times for treated glass products. Domestic fabricators and coating formulators are responding by exploring alternative sourcing corridors and accelerating local production investments to mitigate tariff exposure.

Moreover, downstream stakeholders are facing downstream pricing pressures as original equipment manufacturers and architectural contractors pass through elevated component costs. This cascade effect has triggered strategic partnerships and alliance negotiations aimed at sharing risk and optimizing logistics. While some companies have pursued tariff exclusion petitions and engaged in compliance audits to limit duty liabilities, others have accelerated research into tariff-free technological substitutions. Consequently, the 2025 tariff landscape has underscored the critical importance of agile supply chain frameworks and scenario-driven procurement strategies within the self-cleaning glass ecosystem.

Strategic Segmentation Insights Illuminating Technology Product Type Application End User Installation and Distribution Channel Dynamics

A granular examination of market segmentation reveals distinct dynamics across six strategic dimensions. Based on technology, hydrophobic treatments remain prevalent due to cost-effectiveness, while nanocoating deployments are accelerating in premium architectural applications. The photocatalytic segment, subdivided into titanium dioxide and zinc oxide coatings, demonstrates robust innovation pipelines, especially where enhanced photoactivity yields superior dirt degradation. Shifting focus to product type, traditional float glass continues to dominate volume, although insulated glazing has gained traction as energy efficiency becomes imperative. Laminated and tempered variants are finding niche use in safety-critical installations, particularly within high-rise curtain wall applications.

Application-driven insights highlight that architectural applications-spanning facades, roofing, and windows-constitute the largest demand pool, supported by green building mandates. Automotive integration persists in sunroofs and windshields, with ongoing research into durability under harsh weathering. In the solar sector, photovoltaic panels utilize self-cleaning coatings to preserve power output, while thermal collectors benefit from reduced soiling losses. When considering end users, commercial segments including hospitality, offices, and retail venues prioritize low-maintenance façades, whereas industrial adopters focus on operational continuity. In residential markets, multi-family complexes and single-family homes exhibit growing retrofit activity. Installation patterns reveal a balance between new construction deployments and retrofit applications, each demanding tailored logistical and technical approaches. Distribution channels bifurcate into offline direct sales and distributor networks, alongside online channels through company websites and e-commerce platforms, reflecting an omnichannel trend that expands market reach and customer engagement.

This comprehensive research report categorizes the Self-Cleaning Glass market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

- Installation

- Distribution Channel

Comprehensive Regional Insights Highlighting Market Trends and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific

Regional analysis uncovers divergent drivers and adoption rates across the Americas, Europe Middle East Africa, and Asia Pacific markets. In the Americas, strong sustainability mandates in the United States and Canada have accelerated uptake in commercial and residential projects, while Latin American economies are beginning to recognize self-cleaning glazing as a means to reduce water consumption in regions prone to drought. Renewable energy initiatives, particularly in photovoltaic solar installations, further underpin demand for self-cleaning solutions across the hemisphere.

Conversely, the Europe Middle East Africa region is characterized by stringent environmental regulations and robust green building standards across Western Europe, with Gulf Cooperation Council countries investing in landmark architectural projects that emphasize low-maintenance façades. African markets, although nascent, are leveraging pilot installations to validate the technology’s efficacy in arid climates. In the Asia Pacific, high-growth construction activity in China and India is driving mass-market adoption, supported by government incentives for energy-efficient infrastructure. Japan and South Korea continue to lead in automotive glazing integration, reflecting mature OEM partnerships, while Australia’s solar industry leverages self-cleaning coatings to maximize panel efficiency in remote installations.

This comprehensive research report examines key regions that drive the evolution of the Self-Cleaning Glass market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Key Company Profiles and Competitive Strategies Shaping the Self-Cleaning Glass Industry’s Innovation and Market Presence

Industry participants are shaping a competitive landscape through differentiated technology portfolios, strategic partnerships, and targeted geographic expansions. Leading float glass producers have integrated self-cleaning coatings directly into their furnace lines, leveraging scale to offer cost-competitive solutions, while specialty chemical companies are championing advanced nanocoating formulations that promise extended durability. Cross-sector collaborations between glass manufacturers, chemical formulators, and automation engineers have yielded proprietary application processes that enhance coating uniformity and reduce operational throughput times.

In parallel, several agile market entrants are focusing on end-to-end services, encompassing on-site retrofitting, performance monitoring, and lifecycle management to strengthen customer-value propositions. These organizations are investing in localized coating facilities to navigate tariff complexities and shorten delivery windows. Mergers and acquisitions continue to facilitate access to novel chemistries and regional distribution networks, underscoring the strategic importance of scale and innovation integration. Consequently, the competitive arena is marked by a dual emphasis on technological leadership and supply chain agility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Self-Cleaning Glass market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- Atis Group

- Balconette

- Cardinal Glass Industries

- Diamon-Fusion International, Inc.

- Fenzi Group

- Fuyao Glass Industry Group Co., Ltd.

- Guardian Industries Corp.

- Huizhou Hopson Glass Group Co., Ltd.

- Kuraray Co., Ltd.

- Morley Glass & Glazing Ltd.

- Nanovations Pty Ltd

- New Glass Technology

- Nippon Sheet Glass Co., Ltd.

- Olympic Glass Limited

- PPG Industries, Inc.

- Qingdao Morn Building Materials Co., Ltd.

- Saint-Gobain SA

- SCHOTT AG

- Taiwan Glass Industry Corporation

- Vitro Architectural Glass

- Xinyi Glass Holdings Limited

- Şişecam Group

Actionable Strategic Recommendations Empowering Industry Leaders to Capitalize on Emerging Opportunities in the Self-Cleaning Glass Sector

Industry leaders should prioritize diversification of raw material sourcing to buffer against tariff volatility. Building strategic alliances with regional coating formulators and glass fabricators will enhance supply chain resilience. Additionally, investing in proprietary nanocoating technologies that leverage eco-friendly chemistries can provide a sustainable differentiation while aligning with tightening environmental regulations.

Furthermore, architects and contractors can be engaged through educational initiatives that demonstrate long-term total cost of ownership benefits, facilitating broader adoption in retrofit projects. Embracing digital sales platforms will expand market access, especially among smaller installation firms. Companies may also explore tariff exemption mechanisms and localized manufacturing investments to minimize duty liabilities. Finally, proactive collaboration with renewable energy developers and automotive OEMs can unlock new application verticals, underpinning sustained growth in the evolving self-cleaning glass landscape.

Rigorous Research Methodology Ensuring Data Integrity and Comprehensive Analysis of the Self-Cleaning Glass Market Study Parameters

This research leveraged a rigorous methodology combining comprehensive primary and secondary techniques to ensure accuracy and depth. Primary research included in-depth interviews with manufacturers, technology providers, end-users, and industry experts, each providing qualitative insights on market dynamics, adoption drivers, and regional nuances. Secondary research entailed systematic review of public filings, technical white papers, patent databases, regulatory documents, and industry conference proceedings to validate technological developments and policy impacts.

Quantitative data collection involved cross-referencing supplier shipment records, import-export statistics, and building permit datasets to triangulate demand indicators. Advanced analytics were applied to segment data across technology types, product forms, application verticals, and distribution channels. Data quality was further ensured through multiple rounds of internal peer review and expert panel validation, establishing a robust foundation for the segmentation framework and strategic recommendations outlined in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Self-Cleaning Glass market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Self-Cleaning Glass Market, by Product Type

- Self-Cleaning Glass Market, by Technology

- Self-Cleaning Glass Market, by Application

- Self-Cleaning Glass Market, by End User

- Self-Cleaning Glass Market, by Installation

- Self-Cleaning Glass Market, by Distribution Channel

- Self-Cleaning Glass Market, by Region

- Self-Cleaning Glass Market, by Group

- Self-Cleaning Glass Market, by Country

- United States Self-Cleaning Glass Market

- China Self-Cleaning Glass Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Compelling Conclusion Highlighting the Future Prospects and Strategic Imperatives in the Evolving Self-Cleaning Glass Industry Landscape

In conclusion, the self-cleaning glass market stands at the convergence of technological innovation, environmental stewardship, and regulatory influence. The interplay of advanced hydrophobic, nanocoating, and photocatalytic chemistries is redefining performance benchmarks, while sustainability mandates and tariff developments shape strategic imperatives. Regional divergences highlight the importance of tailored market entry strategies that address unique regulatory, climatic, and construction dynamics.

Looking ahead, integration with smart glazing and building management systems presents a compelling avenue for differentiation, unlocking added value through data-driven maintenance and energy optimization. Stakeholders who proactively adapt supply chains, align with policy trends, and invest in next-generation coating innovations will be poised to capture expanding opportunities and drive industry transformation. The insights provided herein serve as a guiding framework for decision-makers seeking to navigate complexities and secure competitive advantage in the evolving self-cleaning glass landscape.

Compelling Call-To-Action with Ketan Rohom Inviting Decision-Makers to Secure Comprehensive Market Research Insight Report Purchase

Make the decisive move toward unparalleled market insight with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, by securing your copy of this comprehensive Self-Cleaning Glass market research report. This report equips you with in-depth analysis, cutting-edge technology evaluations, and strategic foresight that empower you to stay ahead of market shifts, optimize supply chain resilience, and identify emerging growth corridors across key segments and regions.

Reach out to Ketan Rohom today to unlock personalized guidance, access exclusive advisory sessions, and obtain the actionable intelligence required to navigate the evolving landscape of self-cleaning glass. Don’t let the opportunities of tomorrow pass you by; invest in rigorous research that drives confident decision-making and positions your organization at the forefront of innovation and sustainable design.

- How big is the Self-Cleaning Glass Market?

- What is the Self-Cleaning Glass Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?