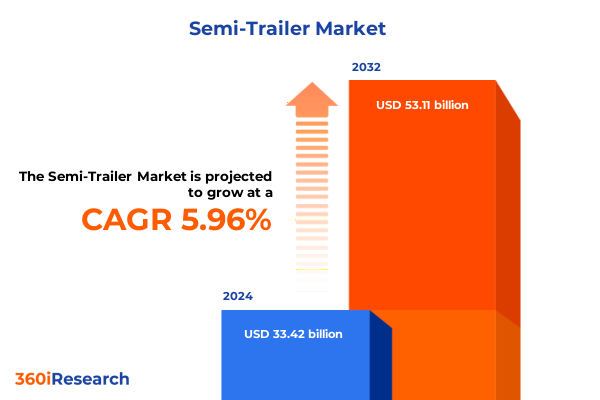

The Semi-Trailer Market size was estimated at USD 35.36 billion in 2025 and expected to reach USD 37.40 billion in 2026, at a CAGR of 5.98% to reach USD 53.11 billion by 2032.

Exploring the Core Drivers, Emerging Trends, Regulatory Milestones, and Strategic Opportunities Defining the Modern Semi-Trailer Industry Landscape

In today’s rapidly evolving logistics ecosystem, semi-trailers stand at the nexus of freight movement, supply chain optimization, and infrastructure modernization. Rising global trade volumes, combined with the explosive growth of e-commerce and just-in-time delivery models, have intensified demand for reliable, efficient, and specialized trailer solutions. Meanwhile, tightening environmental regulations and a collective push toward decarbonization are driving innovation in lightweight materials, aerodynamic designs, and advanced telematics. Amid these forces, industry participants are re-evaluating fleet compositions, reshaping procurement strategies, and forging strategic alliances to capture competitive advantages. As a result, the semi-trailer market is experiencing a paradigm shift in how value is delivered from manufacturing floors to end-user operations.

Against this backdrop, original equipment manufacturers, component suppliers, and service providers are embracing digitalization to unlock new levels of operational efficiency. The integration of predictive maintenance capabilities, remote diagnostics, and data-driven asset management is rapidly becoming table stakes in modern fleet management. Additionally, supply chain uncertainties triggered by recent geopolitical events and logistics bottlenecks have underscored the importance of procurement agility and diversification of sourcing. Stakeholders are increasingly investing in resilient networks, bringing production closer to key-demand regions, and exploring strategic inventory buffers to mitigate disruptive cost pressures.

Ultimately, success in the semi-trailer domain hinges on the ability to navigate a complex interplay of macroeconomic trends, technological breakthroughs, and regulatory imperatives. This introduction establishes the critical context for understanding how the market is being reshaped by converging drivers, and sets the stage for a deeper examination of transformative shifts, policy impacts, segmentation insights, and strategic pathways forward.

Uncovering the Technological Innovations, Digital Transformations, and Sustainability Imperatives Reshaping Semi-Trailer Manufacturing and Operations

The semi-trailer sector is undergoing a fundamental transformation propelled by a wave of technological innovation and heightened environmental expectations. Advanced materials science has unlocked new possibilities in weight reduction and durability, with next-generation composites and high-strength aluminum alloys challenging traditional steel architectures. Concurrently, digital integration is revolutionizing operational processes, as telematics platforms capture real-time performance metrics, enabling predictive maintenance and dynamic route optimization. These developments are not only enhancing uptime and reducing total cost of ownership but also laying the groundwork for autonomous platooning and eventually driverless road trains.

Moreover, sustainability imperatives are accelerating the adoption of hybrid and fully electric traction systems in conjunction with optimized trailer designs. Manufacturers are investing in modular architectures and scalable component platforms that can be rapidly reconfigured to meet diverse customer requirements, from refrigerated loads to bulk liquid transport. Blockchain-based supply chain transparency solutions are also emerging as a critical enabler, ensuring traceability of materials and compliance with stringent global emissions standards. As a result, companies are forging strategic partnerships with technology providers, startups, and research institutions to co-develop integrated ecosystems rather than isolated hardware offerings.

This confluence of digitalization, electrification, and advanced manufacturing techniques is reshaping traditional business models. Subscription-based service offerings, outcome-based leasing arrangements, and integrated fleet management solutions are fast gaining traction among end users seeking to shift capital expenditures to predictable operating expenses. As these transformative shifts accelerate, stakeholders must recalibrate their strategic roadmaps to harness the full potential of smart, sustainable, and connected semi-trailer solutions.

Analyzing the Comprehensive Effects of United States Section 232 and Related Tariffs on Material Costs, Supply Chains, and Competitive Dynamics in 2025

United States trade policy continues to exert significant influence on the global semi-trailer landscape, as cumulative tariffs imposed under Section 232 and related trade actions reshape material costs and supply chain flows. Since 2018, warranted by national security considerations, steel and aluminum imports have faced elevated duties, prompting manufacturers to reassess sourcing strategies and inventory policies. By 2025, these measures have resulted in sustained price inflation for raw materials, forcing OEMs and component suppliers to absorb higher input costs or pass them through to end users. The ongoing uncertainty around tariff renewal and scope has further compounded capital allocation decisions, particularly for those reliant on integrated North American or transatlantic supply networks.

These policy-driven cost pressures have driven a strategic pivot toward regionalization of production footprints. Many manufacturers have responded by relocating or expanding facilities closer to key domestic markets to mitigate duty liabilities and logistics expenses. At the same time, the search for alternative material sources has intensified, with shifts toward regionally available alloys and composite formulations that circumvent traditional import channels. Expanded free trade arrangements with select partners have also played a role, enabling tariff-free movement under negotiated quotas and origin rules. However, the administrative complexity of managing multiple trade regimes has underscored the need for robust trade compliance and digital documentation systems.

Looking ahead, the interplay between tariff measures and broader supply chain trends will continue to shape competitive dynamics. Manufacturers that cultivate agile procurement frameworks, invest in near-shoring initiatives, and adopt adaptive pricing mechanisms will be best positioned to maintain margin resilience. Equally important will be collaboration with policymakers and industry consortia to influence trade policy dialogues and secure more stable, predictable frameworks conducive to long-term capital investment.

Revealing In-Depth Segment Performance Insights Across Trailer Types, Materials, Capacities, Axle Configurations, and End User Verticals Driving Market Nuances

A nuanced understanding of market segmentation reveals critical insights into where value is concentrated and how customer requirements diverge. When dissecting the market by type, Curtain Trailers have emerged as a flexible solution for multi-commodity transport, while Dry Van Semi-Trailers maintain dominance in general freight. The unique attributes of Dump Trailers address bulk material handling, whereas Flatbed Semi-Trailers enable oversized or irregular loads. Specialized configurations such as Lowboy Semi-Trailers facilitate the movement of heavy machinery, Refrigerated Semi-Trailers preserve perishable goods through precise temperature control, and Tankers serve the bulk liquid and gaseous transport sectors.

Material composition also plays a defining role in performance and lifecycle economics. Aluminum Alloy constructions drive fuel efficiency gains through weight reduction, and Composite panels enhance corrosion resistance in harsh operating conditions. Steel remains a cost-effective baseline, valued for its structural integrity and ease of repair. At the same time, the adoption of hybrid material systems is gaining traction as manufacturers seek to balance initial capital outlay with long-term operating savings.

Tonnage capacity segmentation underscores how payload requirements shape fleet investment decisions. Below 25 Tons trailers cater to light commercial applications and urban delivery, while the 25–50 Tons and 51–100 Tons brackets cover a broad swath of domestic and intercity haulage needs. Trailers designed for Above 100 Tons address high-density industrial transport, requiring specialized axle and braking systems. Alongside capacity considerations, axle configuration proves pivotal. Less than 3 Axles setups offer maneuverability in restricted environments, three-four axles represent the industry norm for mid-range loads, and configurations with more than 4 Axles meet stringent regulatory requirements for ultra-heavy cargo.

Finally, end user segmentation highlights the varied demand drivers across verticals. Agriculture operations demand reliability and all-weather durability, while construction fleets prioritize ruggedness and rapid deployment capabilities. Mining enterprises require heavy-duty robustness, retail distributors focus on speed and cost-effectiveness for consumer goods logistics, and transportation & logistics providers emphasize scalability and network optimization. These segmentation dimensions collectively illuminate the multi-faceted dynamics that companies must navigate to deliver tailored semi-trailer solutions.

This comprehensive research report categorizes the Semi-Trailer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Tonnage Capacity

- Axle Configuration

- End User

Highlighting Critical Regional Dynamics Shaping Semi-Trailer Demand and Growth Patterns Across the Americas, EMEA, and Asia-Pacific Market Ecosystems

Regional dynamics exert a pronounced influence on fleet strategies, infrastructure investments, and regulatory adherence. Across the Americas, ongoing enhancements in highway networks, port expansions, and cross-border trade facilitation are fostering heightened demand for semi-trailers capable of supporting diverse load profiles. The region’s emphasis on last-mile delivery efficiency and the maturation of intermodal corridors has accelerated adoption of specialized trailer types that balance payload optimization with fuel economy. These trends are particularly salient in North America, where stringent safety standards and greenhouse gas emissions targets are prompting early adoption of advanced telematics and low-rolling-resistance tire technologies.

Within Europe, the Middle East & Africa, regulatory harmonization through initiatives such as Eurovignette reforms and cross-border permit frameworks is streamlining freight movement and encouraging fleet modernization. Sea-to-road logistics in the EMEA region place a premium on durability and multi-modal compatibility, driving manufacturers to tailor regional configurations and service networks. In parallel, Gulf Cooperation Council infrastructure projects and the African Continental Free Trade Area agreement are expanding intra-regional routes, creating new corridors for specialized semi-trailer applications.

Asia-Pacific continues to lead in volume growth, driven by rapid industrialization, urban congestion, and aggressive port capacity expansions. The integration of Chinese manufacturing giants with regional logistics hubs in Southeast Asia and Australia has spurred demand for refrigerated and high-capacity trailers to serve agribusiness exports and e-commerce fulfillment centers. Moreover, government incentives promoting electric vehicle adoption are catalyzing pilot programs for electric semi-trailer combinations, positioning the region at the forefront of electrified freight transport experimentation.

This comprehensive research report examines key regions that drive the evolution of the Semi-Trailer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Initiatives, Collaborative Partnerships, and Innovation Pipelines of Leading Global and Niche Players Elevating the Semi-Trailer Competitive Landscape

Leading global players have adopted a multi-pronged strategy to strengthen market footholds, investing in both organic innovation and strategic acquisitions. Major original equipment manufacturers have unveiled proprietary telematics platforms and modular component architectures to differentiate through value-added services. Some have established dedicated research centers to accelerate development of advanced materials and autonomous driver assistance systems. At the same time, regional specialists are capitalizing on niche applications by offering tailored manufacturing capabilities, expedited lead times, and deep domain expertise in sectors such as cold chain logistics and bulk liquid transport.

Collaborative partnerships between trailer OEMs and technology providers are also emblematic of the current competitive landscape. These alliances are bringing together hardware expertise and software analytics to deliver fully integrated solutions, from real-time fleet intelligence to predictive maintenance protocols. Additionally, aftermarket service networks have expanded, with leading firms offering subscription-based maintenance packages, remote monitoring, and mobile repair units to minimize operational downtime. The rise of rental and leasing providers further underscores the diversification of business models, catering to customers seeking flexible capacity without heavy capital expenditures.

As market competition intensifies, agility in product development and supply chain resilience have emerged as critical differentiators. Companies that can rapidly adjust production volumes, source diversified material inputs, and leverage regional manufacturing footprints are best positioned to respond to shifting demand patterns and policy headwinds. The interplay between innovation, partnership ecosystems, and service excellence will continue to define the performance gap between market leaders and followers in the semi-trailer sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Semi-Trailer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- CIMC Vehicles Co., Ltd.

- Doonan Specialized Trailer LLC

- Facchini S.A.

- Fontaine Trailer Company

- Great Dane LLC

- Hyundai Translead

- Krone GmbH & Co. KG

- Kögel Trailer GmbH & Co. KG

- Lamberet SAS

- MAC Trailer Manufacturing, Inc.

- Manac Inc.

- Randon Implementos e Participações S.A.

- Schmitz Cargobull AG

- Stoughton Trailers LLC

- Strick Trailers LLC

- TALBERT Manufacturing, Inc.

- Trail King Industries, Inc.

- Transcraft Corporation

- Utility Trailer Manufacturing Company

- Vanguard National Trailer Corp.

- Van Hool NV

- Wabash National Corporation

- Wielton S.A.

- Wilson Trailer Company

- XL Specialized Trailers LLC

Formulating Strategic and Operational Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Evolving Market Challenges

To thrive amid accelerating market complexity, industry leaders must adopt a proactive, integrated approach. Prioritizing investment in digital platforms that unify telematics data, maintenance schedules, and operator feedback will unlock new efficiencies and extend asset lifecycles. Simultaneously, expanding research and development efforts in lightweight materials and modular design architectures will enhance flexibility and performance while mitigating the impact of raw material cost volatility. Furthermore, cultivating resilient supply chains through near-shoring initiatives, diversified supplier networks, and trade compliance automation can reduce exposure to tariff fluctuations and logistics disruptions.

Actionable steps include forging cross-industry collaborations to co-develop sustainable, low-emission trailer solutions and to participate in regulatory working groups that shape future emissions standards. Leaders should also implement dynamic pricing frameworks that adjust to material input costs and market demand signals, thereby preserving margin integrity. Equally important is the expansion of value-added services-such as outcome-based leasing, advanced driver assistance integrations, and proactive maintenance offerings-to foster stronger customer relationships and recurring revenue streams.

Lastly, cultivating a culture of continuous improvement and digital literacy across the organization will be paramount. Enabling frontline teams with real-time analytics dashboards and remote diagnostics tools not only accelerates decision cycles but also drives higher utilization rates and greater visibility into operational performance. By executing these recommendations in tandem, semi-trailer providers can position themselves to capture emerging opportunities, pre-empt competitive threats, and deliver sustained growth.

Outlining Robust Research Methodologies, Data Collection Frameworks, and Analytical Approaches Underpinning the Comprehensive Semi-Trailer Market Study

This comprehensive analysis is underpinned by a rigorous, multi-tiered research methodology designed to ensure the highest standard of accuracy, relevance, and strategic insight. Primary research encompassed in-depth interviews with key industry stakeholders, including OEM executives, fleet operators, component suppliers, and regulatory authority representatives. These consultations provided firsthand perspectives on emerging trends, pain points, and growth strategies across major geographic markets.

Complementing the primary insights, extensive secondary research leveraged publicly available corporate reports, trade association publications, regulatory filings, and specialized technical journals. Each data point was subjected to a triangulation process to validate consistency and reliability, while regional market nuances were cross-checked against local industry reports and field surveys. Quantitative modeling techniques were employed to assess comparative performance across segmentation dimensions, ensuring a balanced evaluation of type, material, capacity, axle configuration, and end user criteria.

Analytical rigor was further reinforced through expert panel reviews and peer validation sessions, which refined key findings and stress-tested strategic recommendations. The research team adhered to stringent quality protocols at every stage, from data collection to final synthesis, thereby delivering a robust and actionable framework for decision-makers seeking to navigate the semi-trailer landscape with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Semi-Trailer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Semi-Trailer Market, by Type

- Semi-Trailer Market, by Material

- Semi-Trailer Market, by Tonnage Capacity

- Semi-Trailer Market, by Axle Configuration

- Semi-Trailer Market, by End User

- Semi-Trailer Market, by Region

- Semi-Trailer Market, by Group

- Semi-Trailer Market, by Country

- United States Semi-Trailer Market

- China Semi-Trailer Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Core Findings, Strategic Implications, and Future Outlook Elements to Guide Decision-Making and Investment in the Semi-Trailer Industry

In synthesizing the core findings of this executive summary, several overarching themes emerge. The semi-trailer industry is at an inflection point, driven by an accelerated pace of innovation in materials, digitalization, and sustainability. Trade policy developments, particularly in the United States, have reshaped cost structures and prompted strategic shifts toward regionalized manufacturing footprints. Moreover, the intricate segmentation by type, material, capacity, axle configuration, and end user underscores the importance of tailored solution offerings and value-based service models.

Regionally, the Americas, EMEA, and Asia-Pacific present distinct growth vectors and regulatory landscapes, demanding customized strategies for fleet optimization and market penetration. Leading companies are differentiating through collaborative ecosystems, expanded service portfolios, and agile product development cycles. For decision-makers, the path forward hinges on the ability to integrate advanced telematics, diversify material sourcing, and engage proactively with evolving policy frameworks.

Ultimately, the evolving semi-trailer market presents both significant opportunities and complex challenges. Organizations that blend strategic foresight with operational agility, underpinned by data-driven insights and robust risk management practices, will be best positioned to capture value and secure competitive advantage in this dynamic environment.

Engage with Ketan Rohom to Unlock Comprehensive Semi-Trailer Market Intelligence and Drive Strategic Impact with the Definitive 2025 Research Report

To gain unparalleled access to the in-depth market intelligence and expert analysis that will empower your organization to navigate the evolving semi-trailer ecosystem with confidence, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. This definitive 2025 research report offers a comprehensive deep dive into transformative trends, regulatory influences, segmentation nuances, regional dynamics, and competitor strategies that are shaping the future of the industry. By engaging with Ketan Rohom, you will unlock customized guidance, priority insights, and tailored advisory services designed to align with your strategic goals. Don’t miss the opportunity to leverage this strategic asset to optimize your investment decisions, sharpen your competitive positioning, and drive sustainable growth in an increasingly complex market landscape. Secure your copy of the report today and position your business at the forefront of the semi-trailer revolution.

- How big is the Semi-Trailer Market?

- What is the Semi-Trailer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?