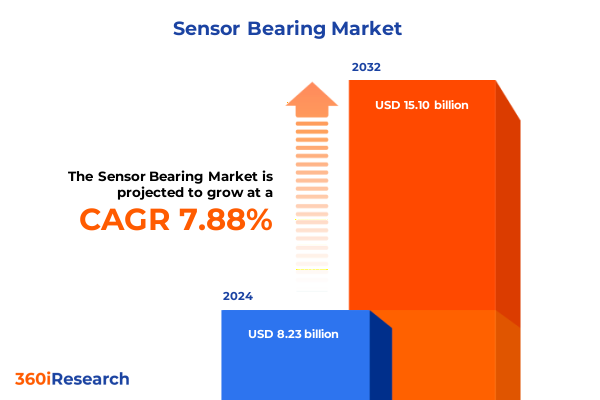

The Sensor Bearing Market size was estimated at USD 8.87 billion in 2025 and expected to reach USD 9.44 billion in 2026, at a CAGR of 7.89% to reach USD 15.10 billion by 2032.

Unveiling the Strategic Importance of Sensor Bearings in Driving Operational Excellence and Enabling Predictive Maintenance Across Critical Industrial Applications

Sensor Bearing assemblies represent a pivotal advancement in mechanical systems by integrating sensing elements directly into rotational interfaces to capture real-time data on vibration, temperature, rotational speed, and load. These intelligent bearing units serve as the frontline of condition monitoring and predictive maintenance, delivering crucial insights that transform traditional reactive repair models into proactive asset management practices. By embedding sensors within bearing components, end users benefit from continuous health diagnostics, enabling early detection of anomalies and reducing unplanned downtime across diverse applications, from manufacturing equipment to transportation systems.

The growing adoption of Sensor Bearings is driven by the increasing demand for operational efficiency and enhanced reliability in high-performance industries. As manufacturers seek to optimize maintenance schedules and extend equipment life, sensor-embedded bearings provide the data foundation for advanced analytics, facilitating detailed trend analysis and forecasting. This shift toward data-driven decision making supports asset managers in prioritizing resources and planning maintenance interventions precisely, thereby lowering total cost of ownership and improving throughput.

Transitioning from conventional bearing solutions to Sensor Bearing technologies also aligns with broader industrial trends toward automation, digitalization, and electrification. In electric vehicles, sensor bearings enable accurate control of anti-lock braking systems and powertrain components, improving safety and energy efficiency. In industrial robotics and automation, they deliver the instant feedback necessary for precise motion control and load management. The convergence of these capabilities underscores the strategic importance of Sensor Bearings in modern mechanical ecosystems, positioning them as essential enablers of Industry 4.0 initiatives and next-generation smart manufacturing benchmarks.

Embracing Industry 4.0 and Digitalization to Transform Sensor Bearing Innovation, Integration, and Interoperability for Next-Generation Smart Mechanical Systems

The Sensor Bearing landscape is undergoing a profound transformation fueled by the convergence of digital technologies, advanced analytics, and evolving application demands. Industry 4.0 frameworks now emphasize seamless data integration, connectivity, and interoperability, compelling manufacturers to develop Sensor Bearing platforms that can support standardized communication protocols and plug-and-play integration. This imperative addresses long-standing fragmentation in sensor interfaces and positions Sensor Bearings as key nodes within end-to-end asset performance management systems, bridging the gap between mechanical components and enterprise analytics platforms.

Meanwhile, the electrification of mobility and the rise of smart, autonomous systems have spurred demand for sensor bearings capable of withstanding stringent performance requirements. Electric vehicles demand high-speed, low-friction Sensor Bearings with robust thermal management to support both drivetrains and electronic braking systems. In response, leading developers have introduced miniaturized sensor modules, hybrid material solutions, and specialized lubricants that ensure reliability under dynamic loads and extreme temperatures. These advancements are complemented by additive manufacturing techniques that allow for custom geometries and rapid prototyping of bearing housings, accelerating time-to-market for specialized applications.

On the software and analytics front, the integration of edge computing and artificial intelligence is reshaping how sensor data is processed and utilized. Real-time anomaly detection, self-learning algorithms, and digital twin models are enabling predictive maintenance strategies that anticipate failures before they occur. As a result, Sensor Bearings have evolved into smart devices capable not only of data collection but also of preliminary data processing, reducing network bandwidth requirements and latency in mission-critical environments. These cumulative shifts underscore a future where Sensor Bearings are integral to autonomous operational frameworks, driving both mechanical reliability and digital intelligence in a singular component.

Examining the 2025 United States Tariffs Landscape and How Cumulative Trade Measures Influence Import Costs and Supply Chain Strategies for Sensor Bearings

Throughout 2025, a series of trade measures imposed by the United States government has created a complex tariff environment that directly impacts the sourcing and cost structure of Sensor Bearings. In April 2025, a universal 10% tariff on most imports was enacted, establishing a baseline for all countries regardless of trade relationships. This measure was swiftly followed by country-specific reciprocal tariffs in early April, with higher rates applied to nations with significant trade surpluses. Notably, China faced elevated duties that increased import costs by over 120% at the height of reciprocal tariff escalations, though subsequent diplomatic efforts led to a partial rollback to 10% by May 14, 2025, under a Geneva trade agreement.

Beyond reciprocal tariffs, the U.S. has maintained Section 232 measures on steel and aluminum, enforcing a 25% duty on these core materials since March 12, 2025, to protect domestic industries and address overcapacity concerns. For Sensor Bearings, where chrome and steel alloys are critical, these steel and aluminum duties have translated into higher raw material costs and extended lead times as importers navigate additional customs requirements and content reporting guidelines. Meanwhile, the elimination of the $800 de minimis exemption for goods from China and Hong Kong, effective May 2, 2025, has further raised costs for low-value shipments, including samples and small batch orders, affecting inventory management and prototyping cycles.

In the realm of trade remedies, the U.S. International Trade Commission’s affirmative sunset review of antidumping duties on tapered roller bearings from China upheld existing duties, confirming that revocation would likely cause material injury to domestic producers. This decision ensures that certain sensor-bearing imports continue to incur anti-dumping duties beyond standard tariffs, reinforcing the need for supply chain diversification and careful sourcing strategies. Collectively, these cumulative trade measures have compelled Sensor Bearing manufacturers and end users to reassess global procurement strategies, prioritize alternative sourcing regions, and incorporate tariff-driven cost variables into long-term planning.

Delivering In-Depth Segmentation Insights Revealing How Product Types, Materials, Industry Verticals, End Users, and Distribution Channels Shape Sensor Bearing Demand

The Sensor Bearing market is characterized by distinct product type categories that cater to various mechanical performance requirements. Angular Contact Bearings provide high axial load capacity essential for precision motion control, while Cylindrical Roller Bearings deliver superior radial load handling for heavy-duty applications. Deep Groove Bearings remain the workhorse for speed and efficiency in a wide range of systems, whereas Spherical Roller Bearings accommodate misalignment and harsh operating conditions. Tapered Roller Bearings uniquely manage combined axial and radial loads, making them vital in automotive and industrial machinery contexts.

Materials used in Sensor Bearing assemblies play a pivotal role in performance and durability. Steel alloys offer a balance of cost-effectiveness and mechanical strength, dominating applications where standard load capacities are required. Hybrid configurations that integrate ceramic rolling elements enhance speed capabilities and electrical insulation, particularly valued in electric drive systems. Full Ceramic bearings excel in highly corrosive or high-temperature environments, offering exceptional wear resistance, while advanced Chrome materials deliver optimized hardness and fatigue life for mainstream industrial deployments.

Industry vertical segmentation underscores the strategic application of Sensor Bearings across multiple sectors. In Aerospace, bearings with integrated sensors provide mission-critical diagnostics for aircraft engines and actuators under stringent safety standards. The Automotive sector, from high-volume passenger vehicles to specialized commercial and emerging electric vehicles, leverages Sensor Bearings for ABS, traction control, and e-mobility powertrain monitoring. The Consumer Electronics segment is beginning to adopt miniaturized sensor bearings for precision motion in robotics and automation, while Healthcare facilities utilize sensor capabilities in medical imaging and diagnostic equipment. Industrial Machinery spans Agricultural, Construction, and Mining operations, where embedded sensors in bearings enable remote monitoring and predictive maintenance in demanding environments.

End user channels also shape market dynamics, with OEM customers driving specifications for new equipment design and integration, including Automotive OEMs demanding sensor-ready powertrain components and Electronics OEMs requiring compact, high-precision solutions. In parallel, the Aftermarket serves as a critical channel for replacement and upgrade, bifurcated between Automotive Aftermarket service centers and Electronics Aftermarket specialists focusing on routine maintenance and performance retrofits.

Distribution strategies encompass both traditional Offline channels-leveraging authorized distributors and local service partners for installation and support-and Online platforms that provide rapid access to a wide selection of Sensor Bearings and enable just-in-time procurement. This duality ensures that end users can source specialized products quickly while maintaining the technical and logistical support that complex bearing solutions necessitate.

This comprehensive research report categorizes the Sensor Bearing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Industry Vertical

- End Users

- Distribution Channel

Providing Comprehensive Regional Insights Highlighting Sensor Bearing Market Dynamics Across the Americas, Europe Middle East Africa, and Asia-Pacific Regions

The Sensor Bearing market in the Americas is driven by robust automotive manufacturing hubs in the United States, Canada, and Mexico, where stringent safety regulations and the rapid adoption of electric vehicles have created heightened demand for sensor-enabled bearings in anti-lock braking systems and e-mobility powertrains. Industrial automation in the U.S., supported by government incentives for smart manufacturing and infrastructure modernization programs, continues to integrate Sensor Bearings into robotics and assembly applications, reinforcing North America’s position as one of the fastest-growing regional markets.

Europe, the Middle East, and Africa (EMEA) exhibit a diverse market landscape anchored by Germany’s world-leading automotive sector and widespread adoption of Industry 4.0 initiatives. European regulatory frameworks promoting low-carbon mobility and factory digitization have spurred the integration of sensor-based bearing systems into rail, aerospace, and renewable energy equipment. In the Middle East, investments in oil and gas infrastructure are driving demand for sensor bearings in drilling and processing equipment, while Africa’s growing mining sector is increasingly incorporating condition monitoring solutions to enhance asset utilization and safety.

Asia-Pacific remains the largest regional market by volume, fueled by accelerated electrification of vehicles in China, Japan, and South Korea, combined with extensive automation projects across manufacturing hubs. The region’s prominence in electronics manufacturing has also propelled the miniaturization of sensor bearings for consumer and industrial applications. Rapid industrialization in Southeast Asia and India further expands end-use opportunities in power generation, material handling, and heavy-equipment industries, solidifying Asia-Pacific as the epicenter of global Sensor Bearing demand.

This comprehensive research report examines key regions that drive the evolution of the Sensor Bearing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Companies Leveraging Technological Innovations and Strategic Collaborations to Lead Advancements in the Sensor Bearing Market Globally

Key industry players have emerged as pioneers in Sensor Bearing innovation, leveraging advanced materials, embedded analytics, and strategic collaborations. SKF Group introduced a new line of Sensor Bearing Units with integrated condition monitoring tailored for industrial robotics and electric vehicle powertrains. Schaeffler Technologies expanded its smart bearing portfolio by integrating cloud-connectivity and real-time diagnostic capabilities across rail, wind energy, and manufacturing applications. NTN Corporation’s hybrid sensor bearings combine ceramic rolling elements with temperature and rotation detection, targeting high-speed electric motors, while Timken Company has focused on sensor-integrated tapered roller solutions for off-highway equipment and heavy-duty trucks that deliver predictive maintenance insights.

Global diversification of offerings is further exemplified by a range of specialized solutions introduced by leading and emerging companies. JTEKT’s encoder-integrated bearings for anti-lock braking and electronic stability systems underscore the strategic importance of safety applications in automotive markets, while ABB Group’s smart sensor modules complement its high-performance ball bearings for industrial powertrain and process equipment. Fersa Bearings and Wafangdian Bearing have developed wheel hub and cylindrical roller models with integrated sensors, expanding options for cost-sensitive segments and after-market retrofit scenarios. Collectively, these players are reshaping the competitive landscape through continuous product enhancements and targeted market entry strategies.

Strategic partnerships between bearing manufacturers, sensor technology firms, and software providers are accelerating the adoption of integrated solutions. Collaborations with edge computing and analytics platforms enable in-bearing preprocessing of data, reducing latency and enabling more sophisticated predictive maintenance algorithms. These alliances also facilitate compliance with evolving industry standards, ensuring interoperability and providing end users with turnkey solutions that streamline deployment and support across global operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sensor Bearing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AST Bearings LLC

- Boca Bearing Company

- BSC Bearing and Supply Co.

- C&U Group

- Federal Bearings Co.

- GMN Bearing USA

- GRW Bearing GmbH

- JTEKT Corporation

- Lily Bearing

- MinebeaMitsumi Inc.

- NB Corporation

- NKE Austria GmbH

- NSK Ltd.

- NTN Corporation

- RBC Bearings Incorporated

- Schaeffler AG

- SKF AB

- Timken Company

Offering Actionable Recommendations for Industry Leaders to Navigate Market Challenges, Capitalize on Technological Shifts, and Strengthen Competitive Positioning

Industry leaders should diversify supply chains by qualifying multiple suppliers across different regions to mitigate risks associated with fluctuating tariff regimes and geopolitical uncertainties. Engaging with near-shoring partners and exploring trade agreements can help maintain competitive cost structures while safeguarding material availability. Integrating tariff projections into procurement strategies enables more accurate budgeting and proactive contract negotiations, ensuring smoother sourcing operations despite evolving trade policies.

Investing in research and development to advance miniaturization and material hybridization will be critical to meet the performance demands of electric mobility and compact industrial systems. Companies should prioritize cross-functional teams that align mechanical, electronic, and software expertise to accelerate the development of plug-and-play Sensor Bearing modules. Embracing additive manufacturing for custom housings and rapid prototyping can shorten development cycles and support agile response to emerging application requirements.

To foster widespread adoption, industry stakeholders must collaborate on standardization efforts that define communication protocols, mechanical interfaces, and data security guidelines. Active participation in industry consortia and standard-setting bodies will drive interoperability and reduce integration costs for end users, unlocking new markets and facilitating large-scale deployments.

Partnering with software and analytics providers to deliver end-to-end predictive maintenance solutions will differentiate offerings and create recurring value streams. Bundling Sensor Bearings with cloud-based monitoring dashboards, mobile alerts, and analytics services enhances the proposition for OEMs and after-market customers, driving deeper customer engagement and long-term service relationships.

Finally, investing in customer education and support infrastructure-including demonstration centers, digital training modules, and localized technical teams-will ensure that end users fully realize the benefits of Sensor Bearing technologies. Tailored onboarding and ongoing advisory services will strengthen customer loyalty and position providers as trusted partners in the transition toward smart, data-driven operations.

Detailing Rigorous Research Methodology Combining Primary Research, Secondary Data Sources, and Robust Data Triangulation to Ensure Comprehensive Market Insights

This research leverages a robust methodology combining primary insights from in-depth interviews with C-level executives, design engineers, and procurement specialists at leading Sensor Bearing manufacturers and end users. Secondary data collection encompassed industry white papers, trade publications, government trade records, and publicly available tariff notifications to construct a holistic view of market dynamics.

Quantitative analysis was conducted through data triangulation across multiple sources, including import/export statistics, corporate financial disclosures, and industry association reports. This ensured that market drivers, segmentation splits, and regional trends were validated against real-world data points.

Expert panels and advisory councils provided qualitative feedback on evolving technology trends, regulatory developments, and competitive strategies. Their insights informed scenario planning and sensitivity analyses, enabling a nuanced understanding of potential market shifts under variable tariff and trade policy conditions.

All data points and assumptions underwent rigorous verification through cross-reference checks, with conflicting information reconciled via direct follow-up with subject-matter experts or through validated secondary sources. The result is a comprehensive, structured report that delivers actionable insights and strategic guidance with a high degree of confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sensor Bearing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sensor Bearing Market, by Product Type

- Sensor Bearing Market, by Material

- Sensor Bearing Market, by Industry Vertical

- Sensor Bearing Market, by End Users

- Sensor Bearing Market, by Distribution Channel

- Sensor Bearing Market, by Region

- Sensor Bearing Market, by Group

- Sensor Bearing Market, by Country

- United States Sensor Bearing Market

- China Sensor Bearing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Summarizing Critical Findings and Strategic Implications of the Sensor Bearing Market to Guide Stakeholders toward Informed Decision-Making and Sustainable Growth

Sensor Bearings have emerged as indispensable components at the nexus of mechanical motion and digital intelligence, reshaping maintenance paradigms across diverse industries. The integration of advanced sensing, connectivity, and analytics capabilities within bearing assemblies is enabling unprecedented levels of asset visibility and predictive upkeep, driving efficiency gains while reducing operational risks.

Segmentation analysis reveals that no single application or material dominates the market; instead, a balanced ecosystem of product types-from Angular Contact to Tapered Roller Bearings-and materials-from Steel to Hybrid and Ceramic-caters to specialized requirements across Aerospace, Automotive, Consumer Electronics, Healthcare, and Industrial Machinery segments.

The cumulative impact of successive tariff measures in 2025 has underscored the importance of strategic sourcing and supply chain resilience. Manufacturers and procurement leaders are recalibrating their approaches to incorporate diverse vendor networks, near-shoring options, and trade policy insights into cost modeling and contract planning.

Regionally, the Americas, EMEA, and Asia-Pacific exhibit differentiated growth trajectories tied to local regulatory environments, infrastructure investments, and industrial priorities. Understanding these nuances is critical for market entry strategies and localization of product offerings.

Key industry pioneers-such as SKF, Schaeffler, NTN, and Timken-continue to lead through product innovation and strategic partnerships, while emerging players expand the competitive landscape with niche solutions and targeted after-market initiatives. These dynamics highlight the need for ongoing collaboration across manufacturers, technology providers, and end users to accelerate standardization and broaden adoption.

As organizations align on unified data standards and invest in integrated platforms, Sensor Bearings will play a central role in realizing the promise of smart, autonomous operations. The insights provided in this report serve as a strategic compass for navigating the complexities of the current market and capitalizing on the transformative potential of Sensor Bearing technologies.

Encouraging Direct Engagement with Ketan Rohom to Secure Your Sensor Bearing Market Research Report and Unlock Essential Insights for Strategic Growth

To obtain the full Sensor Bearing market research report and gain access to comprehensive data, tailored insights, and strategic guidance, we invite you to connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan will guide you through the report contents, discuss bespoke licensing options, and ensure that you receive the critical market intelligence needed to make confident strategic moves. Engage directly with him to explore pricing, delivery timelines, and any specific requirements you may have, and empower your team with the detailed analysis essential for navigating the evolving Sensor Bearing landscape.

- How big is the Sensor Bearing Market?

- What is the Sensor Bearing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?