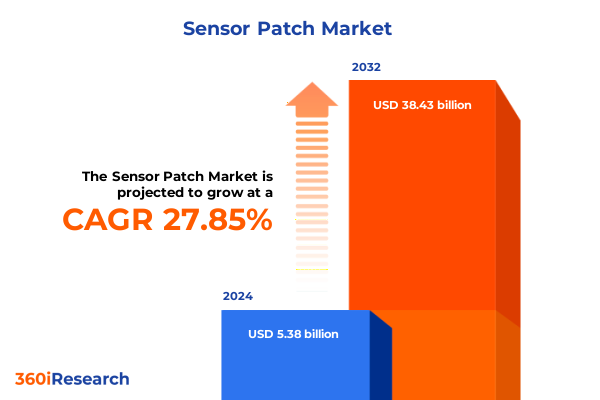

The Sensor Patch Market size was estimated at USD 6.79 billion in 2025 and expected to reach USD 8.58 billion in 2026, at a CAGR of 28.08% to reach USD 38.43 billion by 2032.

Emerging Wearable Sensor Patch Technologies Are Redefining Patient Monitoring And Data-Driven Healthcare Paradigms Across Multiple Medical Settings

Recent breakthroughs in wearable sensor patch technology have transformed patient monitoring by enabling continuous, non-invasive data capture in real time. By integrating microneedle arrays, optical sensors, and wireless connectivity, these patches deliver medical-grade precision while enhancing patient comfort. For instance, the emergence of microneedle-based hydration monitors capable of penetrating the skin to measure biosignals exemplifies this shift, offering elite athletes instantaneous feedback on hydration status without traditional blood draws. Concurrently, advances in surface plasmon resonance nanowire substrates have facilitated non-invasive sweat glucose detection, demonstrating detection limits down to 0.12 mM and showcasing the integration potential of nanophotonic sensors with consumer-friendly wearable formats.

As a result, healthcare providers are adopting sensor patches across diagnostic and therapeutic applications, leveraging their ability to continuously monitor key physiological metrics such as glucose, oxygen saturation, and biomarkers for early disease detection. Moreover, these devices are being designed for seamless integration with mobile applications and telehealth platforms, promoting data-driven care models that reduce hospital readmissions and support proactive intervention. Regulatory bodies are increasingly recognizing the importance of standardized performance testing and post-market surveillance to ensure patch reliability in diverse patient populations. Therefore, the initial chapter of this report establishes the scope of innovations in wearable sensor technology, setting the stage for an examination of transformative shifts, regulatory influences, and market segmentation that will shape the sensor patch landscape through 2025.

Cutting Edge Innovations And Cross-Industry Collaborations Are Propelling Rapid Evolution In Sensor Patch Technologies And Patient Engagement

In recent years, the convergence of bioelectronics, nanotechnology, and wireless communications has catalyzed an unprecedented wave of innovation in sensor patch design. Investigators at the University of Chicago demonstrated the incorporation of living cells within a flexible electronic matrix, creating “living bioelectronics” that can monitor and respond to skin inflammation by releasing therapeutic agents when needed. Parallel efforts at MIT introduced ultrasonic-driven transdermal drug delivery patches that leverage piezoelectric transducers to generate microjets, enabling painless and localized administration of therapies for dermatological applications. Furthermore, machine-knitted e-textiles supporting body-scale near-field communication have extended sensor networks beyond discrete patches, enabling battery-free, whole-body monitoring frameworks that maintain robust data transmission under motion.

Alongside hardware breakthroughs, research is advancing security and intelligence within wearable sensors. Novel noise-driven architectures employing Physical Unclonable Functions (PUFs) have demonstrated enhanced data integrity and machine learning robustness, achieving over 98 percent fingerprint uniqueness while improving arrhythmia detection accuracy by eight percent under a stringent 50-microwatt power budget. Simultaneously, biocompatible e-skin patches developed by leading biomedical institutes are integrating multi-parameter sensing for temperature, hydration, and metabolic markers within biodegradable substrates, ensuring both high-fidelity monitoring and patient comfort in long-term deployments. Together, these cross-industry collaborations and disruptive research initiatives underscore a landscape in which sensor patches are evolving into multifunctional platforms that not only collect data but also interact therapeutically with the human body.

Assessment Of The Cumulative Effects Of Recent United States Tariff Policies On Global Supply Chains And Cost Structures In Sensor Patch Manufacturing

Throughout 2025, the United States enacted a series of tariff measures targeting imported medical equipment, semiconductors, and related raw materials, aiming to bolster domestic manufacturing capacity. Tariffs on steel and aluminum-containing products rose to twenty-five percent effective March 12, 2025, while duties on semiconductors, syringes, and needles doubled from twenty-five to fifty percent. Concurrently, a baseline ten percent tariff was imposed on most goods from China, with variable higher rates for select trading partners. These cumulative duties have reshaped the cost inputs for sensor patch production, which frequently relies on precision electronic components, specialty polymers, and microfabrication services sourced internationally.

As a result, manufacturers of medical sensors and related devices have reported increased material costs and supply chain uncertainties, with industry analysts projecting one-time earnings adjustments for leading companies. Medical device stocks, including Boston Scientific and Medtronic, experienced notable declines in trading following the tariff announcements, reflecting investor concerns over rising input costs and contracted profit margins. Hospital administrators and trade groups have also warned of potential delays in equipment procurement, as rising prices forced some health systems to postpone upgrades to critical monitoring tools. This environment has heightened apprehension around access to advanced sensor patches, with end-users bracing for cost-push inflation.

To mitigate these challenges, many sensor patch producers have explored shifting assembly and component sourcing to Mexico and Canada, leveraging USMCA provisions to secure tariff exemptions for North American manufacturing. While such strategic realignments can partially offset cost pressures, they introduce new logistical complexities and require stringent quality controls to ensure consistent device performance. Consequently, stakeholders are prioritizing diversified supplier networks and exploring near-shoring options to preserve affordability and supply resilience within the sensor patch ecosystem.

In-Depth Examination Of Product, Type, Positioning, Applications And End-User Industries Reveals Nuanced Dynamics In Sensor Patch Market Segmentation

The sensor patch landscape encompasses a diverse spectrum of product formats, each engineered to monitor specific physiological parameters. Blood glucose sensor patches facilitate continuous glycemic management for diabetic patients, while blood oxygen and ECG patches underpin critical respiratory and cardiac surveillance in clinical and home environments. Blood pressure or flow-sensitive skin adhesives extend cardiovascular monitoring beyond traditional cuffs, and dedicated heart rate patches cater to both fitness enthusiasts and patients requiring non-stop cardiac insights. Innovations also include pain-relieving patches that deliver transdermal analgesia, position sensors embedded in wearable textiles for mobility assessment, advanced sweat analyzers for real-time biomarker profiling, and temperature patches that provide precise febrile and thermoregulatory data. This breadth of product specialization enables providers to select solutions aligned with patient needs, treatment pathways, and care settings.

Beyond product diversity, the market is further stratified by device type, placement, functional application, and end-use industry. Self-adhesive patches offer ultra-thin profiles for discrete, single-use applications, whereas more complex wearable systems integrate reusable modules for extended diagnostics and interactive feedback. Placement across bodywear, footwear, neckwear, and wristwear informs design considerations for comfort, signal fidelity, and user engagement. Functionally, sensor patches serve diagnostic workflows, medical therapeutics delivery, and continuous health monitoring, reinforcing their role in both point-of-care and remote management paradigms. Key end-user industries encompass fitness and sports sectors focusing on performance optimization, alongside healthcare systems prioritizing clinical-grade data acquisition and telehealth integration. Collectively, this granular segmentation elucidates how differentiated offerings address specific market demands, enabling stakeholders to navigate the evolving sensor patch ecosystem with precision.

This comprehensive research report categorizes the Sensor Patch market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Type

- Position

- Application

- End-User Industry

Comparative Analysis Of Sensor Patch Adoption Trends And Regulatory Environments Across The Americas Europe Middle East Africa And Asia-Pacific Regions

In the Americas, the United States has emerged as a pivotal market for sensor patches, propelled by expansive telehealth initiatives, payer incentives, and hospital digitization efforts. Government advocacy for domestic manufacturing and post-market surveillance enhancements has intersected with rising healthcare supply costs, compelling institutions to seek cost-effective monitoring solutions. According to the American Hospital Association, tariffs have elevated expenses for key medical supplies, underscoring the need for resilient procurement strategies to sustain patient access to wearable devices. Concurrently, US federal regulations are evolving to support the integration of sensor patch data into electronic health records, fostering continuity of care and enabling value-based reimbursement models that reward preventive monitoring over acute intervention.

In Europe, the regulatory framework governing medical devices has undergone significant reform, with the phased roll-out of the European Database on Medical Devices (Eudamed) modules and the enforcement of updated post-market surveillance requirements across Great Britain as of June 2025. These measures reinforce transparency, traceability, and safety monitoring for sensor patch manufacturers, while the impending alignment under the EU Health Technology Assessment Regulation aims to harmonize digital device evaluations and expedite patient access. Across the Middle East and Africa, disparate regulatory landscapes present both challenges and opportunities, with leading Gulf Cooperation Council states adopting EU-inspired frameworks that facilitate market entry but require localized compliance expertise.

Asia-Pacific markets exhibit pronounced variability, as China’s expansive manufacturing ecosystem continues to drive global sensor patch production, even as exporters grapple with fluctuating tariff policies that have disrupted U.S. orders and liquidity at major trade fairs. Simultaneously, innovation hubs in Australia, Japan, and South Korea are advancing microneedle hydration sensors and multifunctional e-skin platforms, leveraging strong government R&D support to commercialize next-generation wearables. This dichotomy of production scale and pioneering research defines the Asia-Pacific region as both a manufacturing powerhouse and a hotbed for technological breakthroughs.

This comprehensive research report examines key regions that drive the evolution of the Sensor Patch market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning Of Leading Sensor Patch Innovators Spotlighting Competitive Strategies Partnerships And Technological Differentiation In The Industry

Leading players in the sensor patch domain are leveraging strategic partnerships, proprietary sensor architectures, and integrated analytics platforms to differentiate their offerings. For example, Dexcom has integrated continuous glucose monitoring patches with cloud-based data ecosystems, fostering adherence among diabetic populations and supporting predictive glycemic algorithms. Similarly, iRhythm’s Zio XT cardiac patch exemplifies a convergence of extended-duration ECG monitoring and sophisticated arrhythmia detection software, yielding diagnostic yields that surpass traditional Holter devices. Biopharmaceutical titan Abbott has also expanded its footprint through collaborations with textile manufacturers, embedding multimodal sensors into smart garments for comprehensive metabolic and cardiovascular tracking.

At the same time, multinational medical majors such as Medtronic and Boston Scientific have reconfigured their manufacturing and sourcing strategies to mitigate recent tariff pressures, shifting components to North American facilities under USMCA provisions. Siemens Healthineers, an innovator in imaging technologies, is exploring synergistic platforms that combine CT and wearable sensor data to refine diagnostic workflows, although ongoing tariff uncertainties pose cost-containment challenges. Meanwhile, emerging entrants such as WearOptimo are capitalizing on cutting-edge microneedle technology to introduce hydration and biomarker patches tailored to athletic markets, illustrating how niche innovators can disrupt established incumbents by targeting specific use cases. Across the board, these companies are investing in robust clinical validation, securing regulatory clearances, and forging key alliances with software providers to enable seamless integration of sensor patch data into broader healthcare delivery frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sensor Patch market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- accensors GmbH

- Beneli AB

- Blue Spark Technologies, Inc.

- Boston Scientific Corporation

- Boyd Corporation

- Covestro AG

- Dexcom, Inc.

- DuPont de Nemours, Inc.

- G-Tech Medical Inc.

- GE HealthCare Technologies, Inc.

- Gentag, Inc.

- GTECH Corporation

- iRhythm Technologies, Inc.

- Isansys Lifecare Ltd.

- Kenzen, Inc.

- Koninklijke Philips N.V.

- LifeSignals, Inc. by Renew Health Limited

- Masimo Corporation

- Medtronic PLC

- NanoSonic, Inc.

- Nemaura Medical Inc.

- Nitto Denko Corporation

- PolarSeal Tapes & Conversions Ltd.

- Resonetics

- Sensium Healthcare Limited by The Surgical Company group

- Smith+Nephew PLC

- VitalConnect

- VivaLNK, Inc.

- Vpatch Cardio Pty Ltd.

Pragmatic Strategies And Strategic Roadmaps To Enable Industry Leaders To Capitalize On Emerging Opportunities And Navigate Regulatory Complexities In Sensor Patch Ecosystem

To thrive in an environment marked by rapid innovation and evolving regulatory landscapes, industry leaders should prioritize the establishment of agile supply chains that balance cost-efficiency with quality assurance. This entails diversifying component sourcing across multiple geographies, including near-shore options in North America and Southeast Asia, to hedge against tariff fluctuations and geopolitical disruptions. Additionally, organizations must invest in modular manufacturing capabilities that allow for quick reconfiguration of production lines in response to changes in demand across product segments-whether for glucose monitoring, ECG diagnostics, or wearables catering to fitness applications. In doing so, companies can align production capacity with specific application requirements and end-user preferences, thereby optimizing asset utilization and minimizing downtime.

Furthermore, engaging proactively with regulatory authorities through dedicated post-market surveillance systems and pre-market consultation pathways will enable manufacturers to maintain compliance while accelerating time-to-market. By integrating real-world performance data into internal development cycles, sensor patch developers can refine adhesive materials, sensor sensitivity, and wireless interoperability ahead of regulatory audits. Collaborations with strategic partners-ranging from academic research institutions pioneering bioelectronic patches to software firms specializing in AI-enhanced data analytics-are essential to bolster technological differentiation and reinforce evidence-based value propositions. Finally, aligning go-to-market strategies with reimbursement trends, particularly in the United States and Europe where payer frameworks increasingly reward remote monitoring initiatives, will secure sustainable revenue streams by demonstrating cost-savings and clinical efficacy to healthcare systems.

Comprehensive Multi-Phase Research Methodology Combining Secondary Analysis Primary Stakeholder Interviews And Rigorous Validation Protocols

The analysis underpinning this report was conducted through a structured, multi-phase approach designed to ensure both breadth and depth of insight. Initially, an extensive secondary research phase encompassed peer-reviewed academic literature on wearable biosensors, including studies on functionalized plasmonic nanowires for sweat glucose detection and noise-driven AI-enabled patches. Regulatory frameworks and policy developments were assessed via official documents from the European Medicines Agency and the U.S. Department of Commerce, combined with data from the American Hospital Association to contextualize cost factors and tariff impacts. Market intelligence reports and industry white papers supplemented these insights to map out competitive dynamics and regional adoption trends.

Subsequently, primary research activities involved in-depth interviews with a cross-section of stakeholders, including R&D leaders at sensor patch manufacturers, supply chain executives, regulatory affairs specialists, and clinical end-users within hospital systems. This qualitative engagement provided frontline perspectives on manufacturing agility, regulatory compliance strategies, and on-the-ground challenges in device deployment. Quantitative validation was achieved through the triangulation of interview findings with market transaction data and pilot program results, reinforcing key themes and dual-checking assumptions. Finally, internal workshops with subject-matter experts facilitated the synthesis of actionable recommendations, ensuring alignment with both strategic imperatives and operational realities across the sensor patch ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sensor Patch market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sensor Patch Market, by Product

- Sensor Patch Market, by Type

- Sensor Patch Market, by Position

- Sensor Patch Market, by Application

- Sensor Patch Market, by End-User Industry

- Sensor Patch Market, by Region

- Sensor Patch Market, by Group

- Sensor Patch Market, by Country

- United States Sensor Patch Market

- China Sensor Patch Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summative Insights And Forward-Looking Perspectives Highlighting Key Takeaways And Emerging Imperatives For Sensor Patch Market Stakeholders

Collectively, the advancements in sensor patch technology, from living bioelectronics to AI-driven security frameworks, have redefined the boundaries of continuous health monitoring. The detailed segmentation analysis reveals how tailored solutions across product types and end-user industries optimize clinical and fitness applications, while regional regulatory reforms-from U.S. tariff adjustments to phased European database roll-outs-underscore the importance of compliance agility. Firms leading the market have demonstrated that strategic diversification of manufacturing location, rigorous clinical validation, and seamless integration with healthcare IT systems are critical success factors that shape both patient outcomes and commercial viability.

Looking ahead, stakeholders must embrace adaptive business models that leverage cross-sector collaborations, enabling the rapid incorporation of emerging materials, sensor modalities, and analytic capabilities. The upcoming alignment under the EU Health Technology Assessment Regulation will streamline digital device evaluations, and ongoing enhancements in post-market surveillance will elevate safety benchmarks. Moreover, as payer frameworks increasingly reward remote monitoring efficacy, manufacturers should articulate clear value propositions supported by real-world evidence. Ultimately, the confluence of technological innovation, regulatory maturity, and data-centric care delivery heralds a future where sensor patches become indispensable tools in personalized medicine and proactive health management.

Engage With Our Specialist Ketan Rohom Today To Unlock Tailored Insights And Secure Your Sensor Patch Market Analysis Report

Our team invites decision-makers and innovation leaders to collaborate directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to gain immediate access to comprehensive market analysis and customized insights. Ketan combines deep industry knowledge with a consultative approach to address your organization’s specific challenges, whether related to supply chain resilience, regulatory strategy, or technology differentiation.

Reach out today to explore bespoke research packages, receive targeted competitive intelligence, and discover actionable strategies designed to accelerate your sensor patch initiatives. Ensure your company is positioned at the forefront of the wearable health revolution by securing the detailed report that will inform critical investment and operational decisions.

- How big is the Sensor Patch Market?

- What is the Sensor Patch Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?