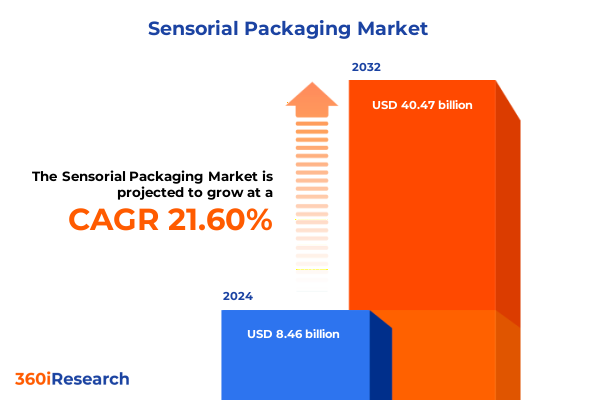

The Sensorial Packaging Market size was estimated at USD 10.26 billion in 2025 and expected to reach USD 12.44 billion in 2026, at a CAGR of 21.65% to reach USD 40.47 billion by 2032.

Unlocking the Power of Sensorial Packaging to Enhance Consumer Engagement Through Multi-Modal Sensory Stimuli and Unforgettable Brand Experiences

Sensorial packaging represents the convergence of tactile, visual, olfactory, gustatory, and auditory elements to create immersive consumer experiences at the point of sale. In an era where shoppers demand greater interactivity and emotional resonance, packaging has transformed from a protective shell into a powerful brand touchpoint. By integrating technologies such as NFC-enabled labels, printed electronics, and specialty materials, manufacturers are able to deliver multilayered stimuli that heighten product appeal and forge memorable connections. This introduction provides an essential overview of why sensorial packaging has surged to the forefront of innovation and how it reshapes the journey from shelf to sentiment.

As brands and retailers seek to differentiate in saturated markets, understanding the sensory triggers that motivate purchase decisions becomes critical. From the subtle whisper of a textured carton to a fragrance capsule that releases a signature scent, these thoughtful design interventions influence perception, drive trial, and foster loyalty. This opening discussion underscores the significance of observing consumer interactions through a sensory lens, setting the stage for a more comprehensive exploration of the dynamics, strategies, and best practices that industry leaders are leveraging today.

Exploring Transformative Industry Shifts in Sensorial Packaging Fueled by Technological Innovation, Sustainability Demands, and Shifting Consumer Behaviors Worldwide

Market dynamics in sensorial packaging have shifted dramatically under the influence of rapid technological advances, growing environmental consciousness, and evolving consumer engagement models. The proliferation of printed electronics technology now enables flexible OLED displays and integrated sensors that yield real-time data on freshness or authenticity, marking a departure from static labels. Simultaneously, the ubiquity of smartphones and the rise of QR codes and NFC/RFID tags usher in new layers of digital interaction, transforming packaging into seamless portals to augmented brand narratives and personalized content.

Alongside technological innovation, sustainability imperatives have sparked a renaissance in material science, driving research into recyclable glass variants, bio-based plastics, and fiber-based substrates that support interactive elements without compromising environmental targets. As consumer values pivot toward transparency and ecological stewardship, brands are recalibrating their packaging strategies to balance sensory sophistication with circular economy principles. In turn, this dual focus on technology and sustainability has catalyzed collaborative ecosystems among material suppliers, tech providers, and design agencies, accelerating the pace of innovation across sectors.

Examining the Cumulative Impact of United States Tariffs in 2025 on Sensorial Packaging Costs, Supply Chain Resilience, and Strategic Sourcing Decisions Across Sectors

In 2025, the imposition of new tariffs on imported materials and smart labeling components by the United States government introduced a new set of complexities for sensorial packaging producers and brand operators. Cost pressures arising from levies on aluminum, specialized polymers, and electronic subcomponents prompted many companies to reassess their global sourcing strategies. As a result, some enterprises diversified supplier portfolios by forging relationships with North American fabricators, thereby mitigating exposure to tariff volatility while supporting regional economic growth.

Beyond financial implications, these policy changes influenced supply chain resilience and inventory management approaches. Forward-thinking organizations implemented strategic inventory buffers and leveraged predictive analytics to anticipate delays or cost fluctuations. Moreover, tariff-driven cost increments spurred innovation in alternative material research, with an emphasis on domestically produced glass bottles, paperboard substrates, and passive NFC/RFID tags manufactured within tariff thresholds. Consequently, the evolving trade environment compelled industry participants to blend agility and adaptability into their operational blueprints.

Revealing Key Segmentation Insights to Illuminate the Diverse Applications, Technologies, Materials, Sensor Types, and Packaging Forms Driving Sensorial Packaging Adoption

Comprehensive analysis of the sensorial packaging landscape reveals distinct patterns when segmented by application, technology, material, sensor type, and packaging form. In the cosmetics and personal care segment, skin care products have emerged as fertile ground for olfactory-enhanced containers, while hair care brands embrace tactile finishes to evoke premium quality. Meanwhile, in the food and beverage sphere, dairy products utilize printed electronics to signal freshness, and beverages leverage NFC tags for interactive brand storytelling.

From a technological perspective, passive NFC/RFID tags dominate due to their cost-efficiency and compatibility with existing supply chains, though active iterations gain traction in high-value medical devices and pharmaceuticals. Printed electronics advances-particularly OLED displays-are becoming hallmarks of innovation in luxury packaging. Materials selection further influences experience design: corrugated paperboard offers ample real estate for gustatory micro-encapsulation, whereas PET and HDPE plastics provide clarity and strength for sensors embedded in seals and films. Sensor typology underscores this diversity, spanning tactile embossing, visual light-emitting labels, gustatory flavor-releasing inserts, auditory chimes, and olfactory microcapsules. Packaging forms-including bottles, pouches, cartons, and films-serve as canvases upon which these multisensory technologies converge, each combination tailored to the brand’s strategic objectives and consumer touchpoints.

This comprehensive research report categorizes the Sensorial Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Material

- Sensor Type

- Packaging Form

- Application

Unveiling Critical Regional Variations Highlighting Sensorial Packaging Adoption Trends, Market Dynamics, and Innovation Hotspots Across Major Global Regions

Regionally, the Americas lead in early adoption of sensorial packaging solutions, driven by consumer appetite for innovation and robust investment in research and development. North American beverage and healthcare companies frequently pilot interactive labels and smart closures, buoyed by supportive regulatory frameworks for novel materials and digital identifiers. Conversely, Latin American firms are exploring cost-effective tactile and olfactory enhancements in fast-moving consumer goods, capitalizing on local flavor profiles and artisanal packaging trends to foster brand differentiation.

Meanwhile, Europe, Middle East, and Africa demonstrate a strong emphasis on sustainability alignment and circular economy initiatives. European cosmetics conglomerates often partner with recycled paperboard suppliers to integrate gustatory scratch-and-sniff panels without compromising recyclability, whereas Middle Eastern dairy producers experiment with smart labels to track cold-chain integrity. In Asia-Pacific, rapid manufacturing scale-up and government incentives for advanced materials have fuelled expansive deployments of printed electronics in packaged foods, while pharmaceutical companies in key markets have pioneered active NFC-enabled vials to ensure patient safety and combat counterfeiting.

This comprehensive research report examines key regions that drive the evolution of the Sensorial Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Shaping the Sensorial Packaging Landscape Through Strategic Partnerships, Cutting-Edge Technologies, and Market-Defining Innovations

A handful of pioneering companies have emerged as trendsetters in the sensorial packaging market, accelerating the pace of commercialization through strategic alliances, proprietary technologies, and comprehensive service offerings. Leading polymer manufacturers have developed biodegradable films that integrate scent microcapsules, while packaging converters have established dedicated innovation labs to co-create interactive packaging prototypes with brand partners. Technology vendors specializing in printed electronics have scaled production capabilities for sensor-integrated labels, securing partnerships with global cosmetic and pharmaceutical players.

In parallel, design consultancies and material science startups are forging symbiotic relationships to expedite product launches. By offering turnkey sensorial packaging solutions-from concept ideation and prototype engineering to supply chain integration and sustainability certification-these organizations enable even mid-market brands to leverage sophisticated sensory features. Collectively, these key players are shaping the trajectory of the market, setting performance benchmarks, and establishing blueprints for cross-industry collaboration.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sensorial Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amcor Plc

- AptarGroup, Inc.

- Avery Dennison Corporation

- Ball Corporation

- Berry Global, Inc.

- DS Smith Plc

- Gerresheimer AG

- Huhtamaki Oyj

- International Paper Company

- Mondi Group

- Sealed Air Corporation

- Smurfit Kappa Group

- Sonoco Products Company

- Tetra Pak International S.A.

- WestRock Company

Delivering Actionable Recommendations to Empower Industry Leaders to Optimize Product Design, Streamline Supply Chains, and Maximize Return on Sensorial Packaging Investments

To capitalize on the momentum in sensorial packaging, industry leaders should prioritize cross-functional collaboration between marketing, R&D, and supply chain teams, thereby ensuring that sensory ambitions align with operational feasibility. Early-stage consumer testing, leveraging virtual and in-person sensory labs, can validate tactile finishes, scent intensity, and interactive elements before large-scale rollout. Furthermore, companies should evaluate the total cost of ownership for advanced label technologies and seek partnerships with electronics integrators to streamline implementation and cost management.

Equally important is the adoption of a modular design approach that decouples sensor components from core packaging structures. This flexibility enables rapid iteration, regional customization, and easier recycling or reuse. Brands can also establish sustainability roadmaps that specify recycled or bio-based feedstocks for primary containers while maintaining sensory performance. Finally, continuous monitoring of regulatory developments-ranging from electronic waste mandates to labeling requirements-will empower organizations to anticipate compliance challenges and maintain first-mover advantage in emerging markets.

Outlining Rigorous Research Methodology Employed to Analyze Sensorial Packaging Trends, Incorporating Primary Interviews, Secondary Data Analysis, and Analytical Frameworks

This research combines qualitative and quantitative methodologies to deliver a comprehensive assessment of the sensorial packaging ecosystem. Primary interviews were conducted with senior executives from brand owners, packaging converters, technology developers, and material suppliers to garner firsthand insights into adoption drivers and barriers. These conversations informed a deep-dive analysis of strategic initiatives, innovation pipelines, and partnership models. In parallel, secondary research synthesized data from industry journals, patent filings, trade association reports, and regulatory bulletins to contextualize market dynamics and validate trends.

Analytical frameworks, including technology readiness assessments and supply chain sensitivity models, were applied to evaluate segment-specific growth potential and risk exposure. A rigorous segmentation approach examined the interplay between applications, technologies, materials, sensor types, and packaging forms to identify high-opportunity intersections. Data triangulation ensured accuracy by cross-referencing multiple data points, while scenario planning exercises highlighted potential futures under varying tariff, regulatory, and consumer-behavior scenarios.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sensorial Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sensorial Packaging Market, by Technology

- Sensorial Packaging Market, by Material

- Sensorial Packaging Market, by Sensor Type

- Sensorial Packaging Market, by Packaging Form

- Sensorial Packaging Market, by Application

- Sensorial Packaging Market, by Region

- Sensorial Packaging Market, by Group

- Sensorial Packaging Market, by Country

- United States Sensorial Packaging Market

- China Sensorial Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Summarizing Key Findings and Strategic Imperatives to Guide Decision-Makers Through the Evolving Terrain of Sensorial Packaging Innovation and Market Dynamics

The evolution of sensorial packaging has underscored the growing imperative for brands to engage consumers on multiple sensory dimensions. Technological breakthroughs and sustainability imperatives have reshaped material and sensor selections, while new tariff regimes and regional dynamics have influenced supply chain strategies. Together, these forces have propelled the market into a phase characterized by heightened collaboration among material scientists, electronic specialists, and brand marketers.

Moving forward, success will hinge on companies’ ability to integrate sensory innovation with clear sustainability roadmaps, robust compliance postures, and agile operational models. Decision-makers who harness data-driven insights to balance cost, performance, and environmental impact will secure competitive advantage. Ultimately, sensorial packaging is no longer a novelty but a strategic imperative for brands seeking to deepen consumer loyalty, elevate perceived value, and differentiate in an increasingly crowded market.

Take the Next Step with Associate Director Ketan Rohom to Secure In-Depth Sensorial Packaging Insights and Propel Your Strategies Forward Today

Ready to explore how sensorial packaging can redefine consumer engagement and elevate your brand’s impact? Reach out to our Associate Director, Sales & Marketing, Ketan Rohom, to discuss tailored strategies, exclusive insights, and actionable intelligence that address your unique business challenges and opportunities in the sensorial packaging landscape. Ketan’s expertise in guiding enterprise clients through complex market environments ensures that you receive bespoke recommendations and priority access to our in-depth research deliverables.

Secure your copy of the comprehensive sensorial packaging market research report today and empower your organization with the knowledge to stay ahead of emerging trends, navigate evolving regulations, and drive innovation across your product portfolio. Contact Ketan Rohom via LinkedIn or schedule a consultation to unlock the full potential of sensorial packaging and convert these insights into measurable competitive advantages.

- How big is the Sensorial Packaging Market?

- What is the Sensorial Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?