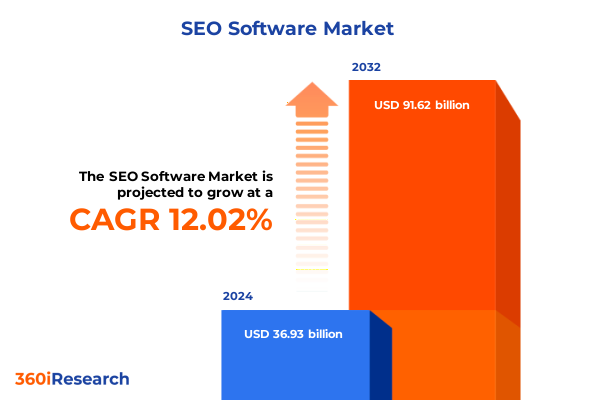

The SEO Software Market size was estimated at USD 41.34 billion in 2025 and expected to reach USD 45.90 billion in 2026, at a CAGR of 12.04% to reach USD 91.62 billion by 2032.

Unveiling the Dynamic Evolution of the SEO Software Landscape to Empower Strategic Decision-Making with Key Insights on Innovations, Challenges & Opportunities

SEO software has evolved into a strategic cornerstone for organizations striving to enhance digital visibility, cultivate meaningful audience engagement, and derive measurable business outcomes. As digital ecosystems expand across channels-search engines, social media, voice and visual assistants-software solutions have transitioned from simple keyword trackers to enterprises’ decision-support engines that deliver real-time intelligence and actionable recommendations. In this dynamic environment, executives require a thorough understanding of technology trajectories and competitive dynamics to inform investment decisions.

Historically, the SEO landscape was defined by standalone tools focused on keyword research and basic rank tracking. Over time, leading providers have matured into all-in-one platforms that seamlessly integrate analytics, reporting, competitor analysis, and optimization features. Consequently, marketing teams today rely on these consolidated solutions to orchestrate multi-faceted campaigns and to maintain alignment with evolving search engine algorithms.

Moreover, the proliferation of cross-channel marketing strategies has elevated the need for consolidated dashboards and unified data repositories. Decision-makers now demand end-to-end visibility into content performance and user behavior across organic search, social referrals, and paid media. This convergence of disciplines has positioned SEO software at the nexus of marketing, IT, and data science.

As digital transformation accelerates, emerging technologies like artificial intelligence, machine learning, and natural language processing are redefining core capabilities. Privacy regulations and data localization requirements further emphasize the need for platforms that balance advanced analytics with robust compliance frameworks. Consequently, the decision to adopt or upgrade an SEO solution now hinges on a vendor’s ability to demonstrate both innovation and governance.

This executive summary sets the stage for a comprehensive exploration of the market’s transformative shifts, tariff-driven influences, segmentation insights, regional dynamics, and actionable recommendations. By distilling complex research into clear takeaways, this report empowers industry leaders and decision-makers to navigate a rapidly evolving SEO software landscape with confidence and precision.

Mapping the Pivotal Transformations Redefining SEO Software Capabilities from AI-Driven Automation to Privacy-Centric Compliance Across Digital Channels

Over the past several years, transformative shifts in technology and regulatory environments have fundamentally altered the SEO software landscape. As enterprises strive to differentiate in saturated markets, AI-driven automation has emerged as a critical capability, enabling platforms to generate predictive keyword suggestions and automated on-page optimizations. Meanwhile, privacy-centric compliance has become non-negotiable; software solutions increasingly incorporate built-in consent management and data anonymization to address global regulations and safeguard user trust.

Furthermore, the integration of SEO platforms with broader marketing and customer relationship management ecosystems has enabled seamless data exchange, providing marketers with a holistic view of content performance. This interoperability trend responds to the growing demand for end-to-end campaign orchestration, where SEO insights inform paid search budgets, content strategy, and customer experience initiatives.

In parallel, the rise of voice and visual search modalities has encouraged providers to augment their capabilities with natural language understanding and image recognition. These innovations facilitate the optimization of content for long-tailed conversational queries and visual discovery, ensuring brands remain visible as search behaviors diversify. Moreover, real-time analytics and alerts are now standard features, empowering marketing teams to respond instantly to algorithmic updates or emerging competitor activities.

Additionally, the democratization of machine learning has lowered barriers to entry; small and medium enterprises can leverage cloud-based models for trend detection and anomaly identification without investing in in-house data science teams. As a result, market competition has intensified, driving vendors to differentiate through specialized modules, vertical-specific enhancements, and advanced training and support services.

Collectively, these shifts underscore a pivotal evolution: SEO software is no longer a collection of disparate tools but a strategic engine that harnesses automation, compliance, and cross-channel intelligence to drive ROI and sustain competitive advantage.

Assessing the Ripple Effects of 2025 United States Tariffs on Global SEO Software Procurement Costs, Vendor Strategies, and Market Accessibility Dynamics

The introduction of new United States tariffs in 2025 has introduced a significant inflection point for global SEO software procurement strategies. Tariffs targeting software components and associated services imported into the U.S. have driven a reassessment of on-premise deployments, which often rely on foreign-developed analytics engines and optimization modules. Consequently, enterprises dependent on locally hosted solutions are now evaluating cloud-based alternatives to mitigate added costs and potential supply chain disruptions.

As a result, software vendors have adjusted their packaging and licensing models to account for elevated duty rates. Some have incorporated tariff surcharges directly within subscription fees, while others have sought to localize development and hosting operations to preserve price competitiveness. This shift has compelled marketing and procurement teams to revisit long-term contracts, renegotiate pricing structures, and assess total cost of ownership under the new trade policy environment.

Moreover, the cumulative impact of tariff-induced price adjustments has led to more rigorous vendor selection processes. Organizations are placing increased emphasis on transparent cost breakdowns and the flexibility to switch deployment models without incurring prohibitive transition fees. In turn, vendors are expanding service-oriented offerings, such as consulting, implementation, and support, to justify the premium associated with on-premise suites while highlighting the scalability advantages of cloud-hosted solutions.

Furthermore, regional data sovereignty considerations intersect with tariff effects; enterprises with strict compliance mandates are balancing the trade-offs between duty-affected on-premise deployments and potentially higher cloud subscription fees. Consequently, the tariff landscape has accelerated the shift toward multi-cloud architectures and hybrid models that allow organizations to optimize for both cost efficiency and regulatory alignment.

Ultimately, the 2025 United States tariffs have served as a catalyst for both buyers and sellers to innovate in contracting, deployment, and service delivery, underscoring the strategic importance of agility in an increasingly complex global trade environment.

Illuminating Critical Segmentation Insights Revealing How Component, Deployment, Organization Size, and Vertical Dynamics Shape SEO Software Adoption and Value

A nuanced examination of market segmentation reveals the diverse pathways through which organizations derive value from SEO software. When analyzing the component dimension, two primary categories emerge: services and solutions. The services pillar encompasses strategic consulting engagements that shape search optimization roadmaps, along with implementation and integration projects designed to align platforms with existing IT ecosystems. It also includes training and support offerings that empower marketing teams to adopt advanced features and best practices effectively. In contrast, the solutions segment comprises a suite of specialized modules: analytics and reporting tools that surface performance insights; competitor analysis utilities that benchmark positioning; keyword research engines that guide content strategy; off-page optimization instruments that manage link-building programs; and on-page optimization features that refine metadata, structure, and user experience.

Based on deployment preferences, the market differentiates between cloud and on-premise models. Cloud environments continue to gain traction for their rapid scalability and minimal upfront investment, whereas on-premise solutions appeal to enterprises with stringent data residency and customization requirements. Regarding organization size, a clear divide exists between large enterprises-often requiring robust multi-user governance and APIs for complex integrations-and small and medium enterprises seeking user-friendly interfaces and preconfigured workflows to maximize efficiency without extensive IT support. Finally, vertical segmentation highlights distinct adoption patterns across financial services, e-commerce and retail, healthcare and life sciences, information technology and telecommunications, and media and entertainment sectors. Each of these verticals imposes unique regulatory, performance, and user experience demands, driving vendors to tailor feature sets accordingly. This multifaceted segmentation analysis equips decision-makers with a refined lens to select solutions and services that align precisely with their operational context and strategic objectives.

This comprehensive research report categorizes the SEO Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- Organization Size

- Vertical

Comparing Regional Growth and Strategic Opportunities Across Americas, Europe Middle East & Africa, and Asia Pacific Markets Influencing SEO Software Trends

Regional dynamics play an instrumental role in shaping the adoption and evolution of SEO software, with distinct drivers and preferences characterizing the Americas, Europe Middle East & Africa, and Asia-Pacific markets. In the Americas, North American enterprises lead digital marketing sophistication, leveraging advanced AI-driven analytics and automated optimization at scale. Marketing teams prioritize platforms that integrate seamlessly with leading CRM and advertising ecosystems, while Latin American organizations are rapidly embracing mobile-first SEO strategies to capitalize on growing smartphone penetration and shifting consumer behaviors.

In Europe Middle East & Africa, stringent data protection regulations and localized privacy mandates exert a profound influence on deployment choices. Organizations often opt for hybrid models that combine cloud agility with on-premise control, ensuring compliance across varied legal jurisdictions. Vendor differentiation in this region frequently hinges on the ability to offer multi-language support and to navigate regional search engine nuances, thereby catering to markets that demand both technical rigor and cultural localization.

Asia-Pacific markets exhibit one of the fastest rates of digital transformation, driven by substantial investments in e-commerce and digital infrastructure. Brands prioritize SEO solutions that address complex multilingual search queries and optimize for visual and voice-driven discovery. Moreover, smaller regional players are emerging with specialized tools focused on local search engines and social media integrations, intensifying competition and fostering innovation across the broader software ecosystem.

These regional insights underscore the necessity for vendors and end users alike to adopt market-specific strategies that reconcile global best practices with local realities. By understanding how each region’s regulatory, technological, and cultural factors influence SEO software requirements, stakeholders can more effectively tailor their approaches to maximize impact and ROI.

This comprehensive research report examines key regions that drive the evolution of the SEO Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Strategic Positioning and Innovation Trajectories of Leading SEO Software Vendors Driving Competitive Differentiation in a Rapidly Evolving Market

The competitive landscape of SEO software features a diverse array of vendors, each differentiating through innovation, specialization, and go-to-market strategies. Established market leaders excel at offering comprehensive platforms that marry advanced analytics, competitor benchmarking, and deep integration capabilities. These vendors have invested heavily in R&D, leveraging machine learning to automate routine optimization tasks and to surface predictive insights that guide content strategy and technical SEO improvements.

Simultaneously, a cohort of challenger firms has gained traction by focusing on niche functionalities or vertical-specific enhancements. Certain providers have introduced specialized modules for e-commerce catalog optimization, while others concentrate on enterprise-level governance, offering sophisticated permissioning controls and audit trails. These distinct approaches resonate with organizations that seek tailored solutions rather than broad-brush platforms.

Partnership ecosystems further enrich the competitive dynamics, as vendors forge alliances with digital agencies, technology integrators, and analytics specialists. Such collaborations enable more seamless deployment and customization, accelerating time-to-value and deepening vendor stickiness. Additionally, several firms have adopted a freemium model to expand user bases and to drive organic growth, converting trial users into paid subscribers through premium feature unlocks and personalized support packages.

Looking ahead, the battle for market share is likely to hinge on the ability to embed advanced AI capabilities, to simplify user experiences, and to extend real-time collaboration features. Vendors that can demonstrate measurable impact on search performance while maintaining robust compliance and support services will be best positioned to capture the next wave of enterprise and midmarket demand.

This comprehensive research report delivers an in-depth overview of the principal market players in the SEO Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AgencyAnalytics Inc.

- Ahrefs Pte. Ltd.

- Airscarp LLC

- BrightEdge Technologies, Inc.

- BrightLocal Ltd

- Conductor GmbH

- Google LLC

- HubSpot, Inc.

- SE Ranking Limited

- SEMrush Inc.

- SEO PowerSuite

- Sitechecker

- Softtech Unlimited Ltd.

- SpyFu, Inc.

- Web.com Group, Inc.

Empowering Industry Leaders with Actionable Roadmaps to Leverage Tech Innovation, Optimize Operations, and Drive Sustainable Growth in SEO Software Adoption

In light of the market’s evolving complexity, industry leaders are advised to embrace a set of actionable strategies that align technology adoption with organizational objectives. First, prioritizing investments in AI-driven predictive analytics can unlock deeper insights into keyword trends, content performance anomalies, and emerging competitive threats. By integrating these capabilities into decision workflows, marketing teams can shift from reactive optimizations to proactive search strategies.

Second, establishing robust vendor partnerships and governance frameworks will ensure that solution deployments remain aligned with compliance mandates and evolving regulatory requirements. This includes negotiating flexible licensing terms that accommodate shifts between cloud and on-premise models, as well as securing bundled consulting and support packages to maximize total value.

Third, fostering cross-functional collaboration between marketing, IT, and data science teams is essential for realizing the full potential of SEO platforms. By developing internal centers of excellence, organizations can codify best practices, streamline training and support processes, and accelerate platform adoption across business units.

Moreover, organizations should optimize for emerging search modalities-voice, visual, and mobile-by ensuring that content frameworks, metadata schemas, and technical architectures are designed for seamless discoverability. Coupled with ongoing performance monitoring and agile testing methodologies, this approach will enhance organic visibility and sustain competitive advantage.

Finally, committing to continuous learning and certification programs will empower in-house teams to master advanced platform features and to maintain alignment with search engine algorithm updates. By adopting these recommendations, leaders can transform SEO software from a tactical cost center into a strategic growth engine.

Detailing the Robust Research Methodology Blending Primary Interviews, Secondary Sources, Data Triangulation, and Validation Processes to Ensure Comprehensive SEO Software Market Insights

This research employs a rigorous methodology designed to ensure the reliability, relevance, and depth of its insights. Initially, primary research was conducted through structured interviews with senior marketing and IT executives across diverse industries, supplemented by targeted surveys of in-house digital marketing practitioners. These engagements provided first-hand perspectives on platform requirements, implementation challenges, and anticipated technology investments.

Concurrently, an extensive secondary research phase involved analyzing company reports, regulatory filings, technology whitepapers, and industry publications. This was complemented by a systematic review of vendor collateral, product roadmaps, and public product demonstrations. Data triangulation techniques were applied to reconcile disparate viewpoints, identify prevailing trends, and mitigate potential biases.

To validate findings, an expert panel comprising digital marketing consultants, software engineers, and trade policy specialists reviewed the draft insights, providing critical feedback on tariff implications, regional variations, and segmentation nuances. Quantitative data underwent stringent quality assurance processes, including outlier detection and consistency checks across multiple data sets.

Finally, all conclusions and recommendations were refined through iterative stakeholder workshops designed to test the applicability of insights against real-world use cases. This multi-phased approach-blending primary and secondary research with expert validation-ensures that the report’s conclusions are both actionable and grounded in empirical evidence, offering confidence to decision-makers in deploying SEO software solutions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our SEO Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- SEO Software Market, by Component

- SEO Software Market, by Deployment

- SEO Software Market, by Organization Size

- SEO Software Market, by Vertical

- SEO Software Market, by Region

- SEO Software Market, by Group

- SEO Software Market, by Country

- United States SEO Software Market

- China SEO Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concluding Strategic Observations Highlighting Key Themes, Market Drivers, and Critical Considerations to Guide SEO Software Decision-Making in an Accelerating Digital Ecosystem

In summary, the SEO software market is undergoing a period of profound transformation driven by AI-enabled automation, stringent privacy requirements, and shifting global trade policies. Executives must navigate tariff-induced cost pressures by exploring hybrid deployment models and by scrutinizing vendor packaging for transparency and flexibility. At the same time, segmentation analysis highlights the importance of aligning component choices-spanning services and solution modules-with organizational size and vertical-specific demands.

Regional insights underscore the necessity of tailoring approaches to local realities: North America remains a hotbed of advanced analytics adoption, Europe Middle East & Africa demands rigorous compliance and localization, and Asia Pacific exemplifies rapid digital innovation and multilingual search optimization. Competitive dynamics continue to evolve, with established leaders integrating end-to-end capabilities while challenger firms target niche market needs and deliver specialized enhancements.

Actionable recommendations emphasize the importance of investing in predictive analytics, forging robust partner ecosystems, and embedding cross-functional collaboration to maximize platform value. Continuous learning programs and agile testing frameworks will be crucial for sustaining organic visibility as search behaviors diversify and algorithms evolve.

By leveraging the comprehensive insights presented in this report, industry leaders can transform SEO software from a tactical toolset into a strategic growth engine. Armed with a clear understanding of market shifts, regulatory influences, and competitive tactics, decision-makers are positioned to optimize their technology footprints and to secure lasting competitive advantage in an accelerating digital ecosystem.

Engage with Ketan Rohom to Secure Your Comprehensive SEO Software Market Research Report and Drive Strategic Growth with Expert Guidance

To access the full market research report and gain unparalleled visibility into the evolving SEO software industry, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive experience guiding enterprises through complex technology purchases and customizing insights to align with your strategic priorities. Engage with Ketan to explore flexible licensing options, request a tailored demonstration, or inquire about enterprise-wide subscriptions designed to ensure your organization stays ahead of emerging trends and competitive pressures. Seize this opportunity to empower your decision-making process with actionable data and expert support. Contact Ketan Rohom today to secure your copy of the comprehensive SEO software market research report and unlock the intelligence needed to drive sustainable growth and competitive advantage.

- How big is the SEO Software Market?

- What is the SEO Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?