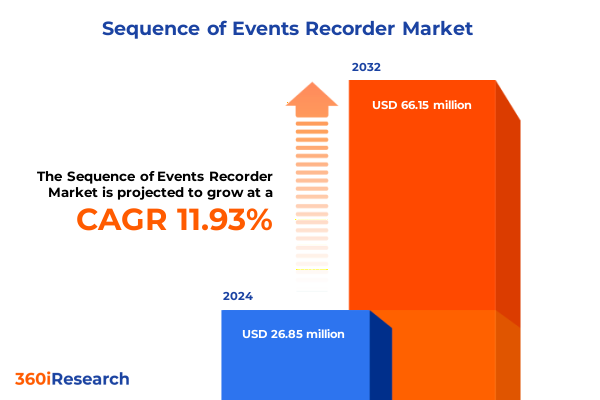

The Sequence of Events Recorder Market size was estimated at USD 28.77 million in 2025 and expected to reach USD 35.51 million in 2026, at a CAGR of 12.63% to reach USD 66.15 million by 2032.

Navigating the Evolving Global Trade Environment Amid Geopolitical Tensions, Technological Innovations, and Shifting Supply Chain Paradigms

In an era characterized by accelerating geopolitical tensions, rapid technological innovation, and evolving supply chain imperatives, businesses face an increasingly complex global trade landscape. The intersection of rising tariff measures, particularly those enacted by the United States in 2025, and transformative digital trends has fundamentally altered cost structures, manufacturing strategies, and consumer expectations. With tariffs on critical inputs-ranging from solar wafers to advanced semiconductors-reaching unprecedented heights, organizations must navigate a multilayered environment where trade policy and technology advancement are inextricably linked. The recent United States Trade Representative announcement, which elevated tariffs on certain solar wafers and polysilicon to 50 percent and imposed new levy rates of up to 25 percent on tungsten products effective January 1, 2025, exemplifies these shifts and underscores the strategic urgency confronting industry leaders.

Against this backdrop, companies are reconfiguring their sourcing strategies, adapting distribution models, and reevaluating product portfolios to mitigate cost pressures and maintain market competitiveness. As tariffs reframe the economics of international trade, stakeholders require a nuanced understanding of policy drivers, segment-specific dynamics, and regional variances. This Executive Summary provides a consolidated overview of key market forces, segmentation insights, regional perspectives, and strategic recommendations designed to equip decision-makers with the clarity needed to thrive in a tariff-influenced ecosystem.

Unprecedented Supply Chain Realignments and Strategic Diversification Initiatives Reshaping Competitive Dynamics Across Global Technology Markets

The global technology sector has entered a period of unprecedented transformation, driven by a confluence of trade policy recalibrations and emergent industry imperatives. With the inauguration of the America First Trade Policy memorandum on January 20, 2025, the United States commenced an ambitious series of studies aimed at reshaping trade relations and leveraging tariffs as policy instruments to advance national objectives. This directive signaled a renewed emphasis on protecting domestic manufacturing, incentivizing nearshore production, and deploying sector-specific tariffs to address perceived imbalances.

In response to persistent tariff alerts and the specter of further escalations, leading companies have accelerated supply chain realignment efforts. Nvidia’s announcement of plans to invest hundreds of billions of dollars in U.S.-based manufacturing capacity over the next four years illustrates a strategic pivot away from Asia, positioning operations closer to core demand centers and mitigating exposure to import duties. This approach resonates with a broader trend among semiconductor and electronics firms seeking to secure local partnerships and optimize production footprints in politically stable jurisdictions.

Simultaneously, consumer technology giants have diversified their manufacturing bases to attenuate the impact of tariff fluctuations. Apple, Logitech, and SharkNinja, among others, have shifted significant portions of their assembly lines to India, Vietnam, and Mexico over the past two years, a strategy catalyzed by prior tariff impositions and further inflamed by the pandemic-induced supply disruptions. This proactive migration illustrates an accelerated adoption of “China Plus One” strategies, enabling firms to maintain production continuity even as trade relations between the U.S. and China remain unsettled.

Furthermore, the emergence of an “Anything But China” paradigm has driven corporations to pursue alternative manufacturing destinations with robust infrastructure and favorable trade terms. Countries in Southeast Asia and select Latin American markets have become focal points for electronics and component fabrication, as companies seek to consolidate vendor ecosystems and hedge against policy-driven cost spikes. These strategic diversifications not only bolster operational flexibility but also reinforce the resilience of critical supply chains against geopolitical headwinds.

Comprehensive Assessment of 2025 United States Tariff Measures Illustrating Far-Reaching Impacts on Technology and Energy Supply Chains

The cumulative effect of United States tariff measures enacted in early 2025 has created a ripple across multiple segments of the technology and energy value chains. Effective January 1, 2025, the USTR elevated duties on solar wafers and polysilicon to 50 percent, and imposed new 25 percent levies on certain tungsten products imported from China. These adjustments, the culmination of a statutory four-year review, aim to counteract policies perceived as undermining domestic innovation capacity, particularly in clean energy technologies.

Concurrently, a parallel increase under Section 301 extended to advanced semiconductor components, augmenting duties from 25 percent to 50 percent on items classified under HTS headings 8541 and 8542. This tariff escalation affects a broad spectrum of integrated circuits, processors, and related microassemblies, imposing substantial cost pressures on electronics manufacturers reliant on imported chips.

In practical terms, such tariff escalations have manifested as incremental cost pass-throughs and operational recalibrations. The experience of a pioneering computer manufacturer vividly illustrates this dynamic: an announced 32 percent duty on Taiwan-produced laptops and up to 129 percent on modules from China prompted an immediate, albeit temporary, 10 percent price increase on consumer configurations. Within an hour, this adjustment was reversed following a sudden policy pause, reflecting the volatile nature of tariff enforcement and its direct influence on product pricing and consumer sentiment.

Moreover, the aggregation of duties on electric vehicle imports, battery parts, and polysilicon underscores a broader intent to nurture domestic capacity in strategically vital industries. For electric vehicles and non-lithium-ion battery components, 100 percent and 25 percent tariffs respectively have amplified the imperative for localized manufacturing or alternative sourcing strategies. This constellation of measures has driven companies to reevaluate supplier contracts, accelerate material substitution initiatives, and explore joint ventures designed to circumvent prohibitive import costs.

In-Depth Insights into Operating System, Distribution Channel, and Price Range Segmentation Driving Market Differentiation and Consumer Behavior

A nuanced understanding of consumer and enterprise behavior in the current market requires a deep dive into the segments defined by operating system preferences, distribution channels, and price range sensitivities. Within the operating system domain, the Android ecosystem-anchored by flagship manufacturers-continues to expand its reach, with Samsung leveraging high-performance models and Xiaomi pursuing aggressive price positioning. In parallel, iOS end users demonstrate a pronounced affinity for the latest iPhone iterations, specifically the iPhone 12 and iPhone 13, where incremental upgrades and premium feature sets drive sustained loyalty and upgrade cycles.

Equally important is the distribution channel segmentation, where the traditional offline network-comprising carrier-owned retail outlets and specialty electronics stores-remains a critical touchpoint for hands-on experiences and device activation services. This channel coexists with a rapidly growing online environment that spans third-party e-commerce marketplaces and direct-to-consumer manufacturer platforms, each offering distinct incentives such as bundled services, financing options, and expedited delivery.

Price range delineation further accentuates market stratification, with the entry-level segment targeting sub-USD 300 devices that cater to first-time buyers or budget-conscious consumers seeking essential functionalities. The midrange tier, spanning USD 300 to 700, captures the largest share of the market by balancing performance and affordability, with sub-bands providing granular options for multimedia, gaming, and productivity users. At the upper end, premium models priced between USD 700 and USD 1,000 and beyond USD 1,000 appeal to power users demanding cutting-edge capabilities, advanced camera systems, and extended warranty and service packages.

Together, these segmentation frameworks reveal that competitors must tailor product roadmaps, channel partnerships, and pricing strategies in harmony with consumer priorities. By aligning feature differentiation with distribution efficiencies and cost structures, firms can optimize portfolio performance across diverse market pockets and preempt tariff-induced margin compression.

This comprehensive research report categorizes the Sequence of Events Recorder market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Operating System

- Price Range

- Distribution Channel

Critical Regional Perspectives Highlighting Unique Market Trends, Tariff Effects, and Growth Drivers Across Major Global Geographic Zones

The Americas region remains a bellwether for tariff-driven market adjustments, where close proximity to production hubs and favorable trade agreements have historically fostered robust consumer electronics adoption. However, the introduction of elevated duties has reshaped supply chain routes, with many OEMs redirecting assembly operations to Mexico and neighboring countries to maintain competitive landed costs. In this context, regional trade pacts such as the United States-Mexico-Canada Agreement continue to offer mitigation pathways, buffering some of the immediate impact of punitive tariff rates.

In Europe, the Middle East, and Africa, a heterogeneous policy landscape intersects with varying degrees of tariff pass-through and domestic content requirements. While European Union member states share a common external tariff schedule, local value-added tax regimes and national incentives for green technologies influence procurement strategies for solar and semiconductor products. Meanwhile, emerging markets in the Middle East and Africa prioritize infrastructure development, often leveraging concessional financing to procure advanced technologies despite higher import levies.

The Asia-Pacific market exhibits a dual dynamic: established manufacturing giants maintain substantial investment flows in semiconductor fabrication and electronics assembly, while certain ASEAN countries benefit from corporate expansions seeking tariff relief and logistical efficiencies. Regional trade agreements, including the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, continue to facilitate preferential treatment for member states, shaping route-to-market decisions for technology players navigating tariff complexities.

Collectively, these regional insights underscore the importance of customizing market approaches to navigate divergent regulatory regimes, optimize cross-border flows, and harness localized incentives in the face of a global tariff architecture that increasingly rewards strategic regionalization.

This comprehensive research report examines key regions that drive the evolution of the Sequence of Events Recorder market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Insights into Key Industry Players’ Adaptive Measures, Supply Chain Responses, and Competitive Positioning Amid Tariff Pressures

Major industry participants have adopted a spectrum of adaptive measures to address the multifaceted challenges presented by 2025 tariff policies. Apple, leveraging its extensive manufacturing partnerships in India and Vietnam, has progressively shifted production volumes outside China, thereby mitigating direct exposure to heightened duties on electronic components and finished devices. This strategic reallocation has enabled the company to preserve margin integrity while continuing to deliver flagship releases to its global customer base.

Similarly, Samsung has accelerated diversification of its smartphone production footprint, expanding assembly lines and component sourcing agreements across Southeast Asia and Latin America. By embracing multi-regional manufacturing hubs and integrating locally sourced materials, the company has insulated its supply chain from tariff-related cost surges and maintained a competitive edge in both premium and mid-tier segments.

Nvidia’s commitment to invest hundreds of billions of dollars in U.S. semiconductor and electronics facilities exemplifies a deliberate onshoring strategy designed to enhance supply chain resilience and secure domestic capacity for next-generation AI chip production. This approach aligns with broader government incentives under the CHIPS Act and reflects a growing trend among chipset developers to co-locate manufacturing with key consumer and enterprise markets.

Emerging players such as Xiaomi have responded to tariff pressures by renegotiating supplier contracts and accelerating product launches in markets with preferential trade terms. Through agile procurement practices and localized inventory management, these companies sustain competitiveness despite fluctuating import duties and shifting global trade contours.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sequence of Events Recorder market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Cyber Sciences, Inc.

- Delphin Technology GmbH

- Emerson Electric Co.

- General Electric Company

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Phoenix Contact GmbH & Co. KG

- Qualitrol Corporation

- Rockwell Automation, Inc.

- Ronan Engineering Co., Inc.

- Schneider Electric SE

- Schweitzer Engineering Laboratories, Inc.

- Siemens AG

- Yokogawa Electric Corporation

Actionable Strategic Recommendations for Industry Leaders to Enhance Resilience, Optimize Supply Chains, and Navigate Tariff-Driven Market Volatility

To fortify market positions and thrive amid sustained tariff volatility, industry leaders must implement a multipronged strategic agenda. First, diversifying supplier ecosystems through the establishment of multi-geographic partnerships reduces single-point dependencies and enhances the ability to reroute production in response to sudden policy shifts. Engaging with both established and emerging vendors allows organizations to create redundancy without compromising on quality standards.

Second, integrating advanced cost-modeling tools into procurement workflows enables real-time scenario analysis of tariff impacts on product economics. By simulating various duty structures and currency fluctuations, leaders can make informed decisions regarding price adjustments, localized assembly, or material substitution, thereby safeguarding margin performance.

Third, fostering collaborative relationships with policymakers and industry associations ensures that corporate voices are represented in trade negotiations. Proactive engagement in public-private dialogues can yield insights into upcoming regulatory changes and open pathways for targeted relief measures or exemption requests.

Finally, investing in continuous innovation-particularly in modular design and supply chain analytics-facilitates rapid adaptation to shifting component availability and duty structures. By prioritizing flexible architectures, companies can expedite new model introductions and tailor feature sets to meet evolving consumer expectations while mitigating the risk of supply disruptions.

Robust Research Methodology Detailing Comprehensive Data Collection, Expert Validation, and Rigorous Analytical Frameworks Ensuring Report Credibility

This research integrates a blend of primary and secondary data collection methodologies to ensure a comprehensive and balanced perspective. Initially, extensive secondary research was conducted across government publications, industry association releases, and reputable news sources to map the latest tariff policies and sector-specific pricing adjustments.

Concurrently, primary qualitative insights were garnered through structured interviews with senior executives from leading manufacturers, distribution partners, and logistics providers. These engagements provided first-hand perspectives on operational adjustments, cost-management strategies, and mid-term investment plans. Additionally, survey data from technology end users and channel specialists enabled triangulation of market sentiment and purchase drivers across defined segments.

Data analysis employed rigorous cross-validation techniques, including comparative benchmarking against historical tariff cycles and scenario-based financial modeling. The application of advanced analytical frameworks-such as Porter’s Five Forces and value chain mapping-facilitated a holistic evaluation of competitive dynamics and strategic imperatives. Periodic expert reviews ensured methodological consistency, data accuracy, and alignment with evolving market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sequence of Events Recorder market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sequence of Events Recorder Market, by Operating System

- Sequence of Events Recorder Market, by Price Range

- Sequence of Events Recorder Market, by Distribution Channel

- Sequence of Events Recorder Market, by Region

- Sequence of Events Recorder Market, by Group

- Sequence of Events Recorder Market, by Country

- United States Sequence of Events Recorder Market

- China Sequence of Events Recorder Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Conclusive Insights Summarizing Core Findings and Highlighting the Strategic Path Forward for Stakeholders in an Evolving Tariff Landscape

The convergence of aggressive tariff regimes, rapid technological innovation, and dynamic supply chain strategies has redefined competitive landscapes across the technology sector. As demonstrated, the cumulative impact of 2025 U.S. tariffs extends far beyond immediate cost escalations, compelling stakeholders to reimagine sourcing networks, segment-specific offerings, and regional market approaches. The insights presented herein illuminate the paths companies have taken to adapt to these pressures and the strategic playbooks that underpin future resiliency.

Looking forward, stakeholders equipped with a thorough understanding of segmentation nuances, regional variances, and policy trajectories will be best positioned to capture emerging opportunities and mitigate unintended risks. By synthesizing these findings, decision-makers can chart a clear course through an evolving tariff matrix, ensuring that their organizations remain agile, competitive, and poised for sustained growth.

Take Immediate Action: Engage with Ketan Rohom to Secure Comprehensive Market Intelligence and Drive Strategic Growth with an In-Depth Research Report

To embark on a transformative journey toward fortified market intelligence and strategic growth, connect directly with Ketan Rohom, an esteemed Associate Director of Sales & Marketing at our firm. Ketan brings a wealth of expertise in translating granular research findings into actionable insights tailored to your organization’s unique priorities. By engaging with him, you unlock the opportunity to explore a comprehensive report that delves deeply into tariff impacts, segmentation dynamics, regional analyses, and bespoke recommendations. This collaboration ensures you stay ahead of market disruptions, capitalize on emerging trends, and craft resilient supply chain strategies in an increasingly complex trade environment. Reach out to Ketan to schedule a personalized consultation, discuss tailored data packages, and secure your access to definitive market research that will empower your leadership team to make confident decisions and achieve sustained competitive advantage.

- How big is the Sequence of Events Recorder Market?

- What is the Sequence of Events Recorder Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?