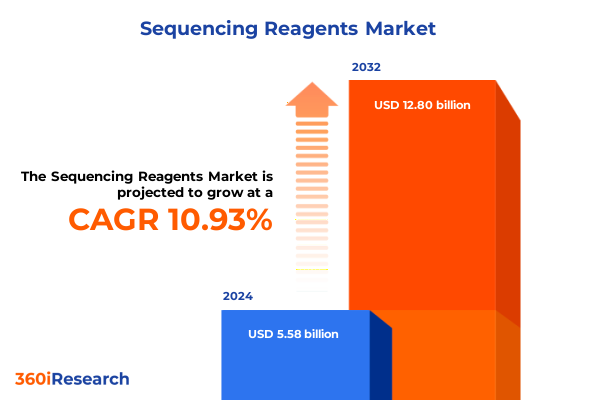

The Sequencing Reagents Market size was estimated at USD 6.20 billion in 2025 and expected to reach USD 6.89 billion in 2026, at a CAGR of 10.91% to reach USD 12.80 billion by 2032.

Introduction to the Dynamics and Significance of the Sequencing Reagents Landscape in Modern Genomics Research

The sequencing reagents market has emerged as a cornerstone of modern genomics research, fueling breakthroughs across life sciences, clinical diagnostics, and biotechnological innovation. From foundational polymerases that drive DNA amplification to specialized labeling reagents that enhance detection sensitivity, these critical inputs underpin a vast array of sequencing workflows. As laboratories worldwide intensify their focus on applications such as whole genome sequencing and transcriptome profiling, the demand for high-performance reagents continues to accelerate.

Against this backdrop, understanding the evolving landscape requires a nuanced view of supply chain resilience, regulatory influences, and technological advancements. This executive summary delves into the major shifts that are redefining reagent portfolios, examines the cumulative impact of recent tariff policies in the United States, and unpacks the segmentation insights that reveal where growth is strongest. By framing the market through multiple lenses-including product type, application, technology, end user, and platform-stakeholders can pinpoint strategic priorities and identify untapped opportunities.

In synthesizing these diverse factors, the summary lays the groundwork for industry leaders to formulate data-driven strategies that align with emerging market realities. Whether you are a reagent supplier refining your R&D roadmap or a diagnostic laboratory optimizing procurement, the insights presented here offer a clear view of how to navigate complexity and drive innovation in the sequencing reagents arena.

Exploring the Transformational Shifts Reshaping the Sequencing Reagents Ecosystem and Driving Next-Gen Innovation

Over the past several years, the sequencing reagents arena has undergone transformative shifts propelled by breakthroughs in high-throughput technologies and an expanding portfolio of genomic applications. The advent of third-generation platforms has redefined expectations for read length and accuracy, encouraging reagent developers to innovate new enzymes and solutions that maximize throughput while reducing error rates. Meanwhile, the maturation of next-generation sequencing platforms has created demand for versatile adapters, refined buffers, and advanced labeling chemistries engineered for streamlined library preparation.

Concurrently, an intensifying focus on personalized medicine has fueled adoption of targeted and whole genome sequencing in clinical settings, driving diagnostic laboratories to seek reagents that meet stringent quality standards and regulatory requirements. Contract research organizations have similarly expanded service offerings around metagenomics and RNA sequencing, prompting suppliers to design cost-effective, high-yield kits tailored to specific assay workflows. This convergence of academic, clinical, and industrial drivers has elevated reagent innovation as a critical differentiator.

As a result, the competitive landscape has shifted from a handful of established players toward a more dynamic ecosystem that includes specialty biotech firms, academic spin-outs, and integrated life sciences conglomerates. These market participants are forming strategic collaborations and channel partnerships to co-develop next-generation chemistries and streamline global distribution. Such alliances have become instrumental in accelerating time-to-market and ensuring consistent reagent quality across diverse geographic regions.

Assessing the Combined Effects of 2025 United States Tariffs on the Sequencing Reagents Market and Supply Chains

In 2025, the imposition of new United States tariffs on a broad array of imported scientific reagents and raw materials has exerted cumulative pressure on sequencing reagent costs and supply chain dynamics. These measures, targeting key inputs such as specialized enzymes and chemically modified nucleotides, have created ripple effects throughout the value chain. Manufacturers reliant on offshore production have had to absorb higher duties or pass on increased prices to customers, prompting laboratories to reevaluate sourcing strategies and inventory planning.

Facing these headwinds, some reagent suppliers have accelerated their efforts to localize manufacturing and diversify raw material procurement networks. Investments in domestic biomanufacturing facilities and joint ventures with regional partners have emerged as pivotal responses designed to mitigate tariff exposure. Simultaneously, companies are optimizing formulation processes to reduce reliance on high-duty components by exploring alternative substrates and more efficient enzyme engineering techniques.

These adjustments are not without trade-offs; shorter lead times and reduced tariff costs often necessitate upfront capital investments and complex technology transfers. Yet, the strategic shift toward supply chain resilience has begun to yield benefits in the form of more predictable pricing and enhanced continuity of reagent availability. As stakeholders adapt to the new tariff regime, the market is poised to reconcile short-term cost volatility with long-term gains in operational flexibility and strategic autonomy.

Unveiling Critical Segmentation Insights to Illuminate Market Opportunities and Demand Drivers Within Sequencing Reagents

When examined through the lens of product type, the sequencing reagents market reveals distinct performance tiers. Adapters and tags have seen rising demand as multiplexed library preparations become standard practice, while buffers and solutions continue to command stable volumes thanks to their role in ensuring reaction fidelity. Labeling reagents that facilitate fluorescence-based detection have gained prominence in applications requiring high sensitivity, and nucleotides remain foundational to virtually all sequencing workflows. Particularly dynamic is the polymerases and enzymes category: conventional DNA polymerases, ligases critical for library construction, and reverse transcriptases pivotal to RNA-based assays are each witnessing targeted innovations that enhance speed, specificity, and thermostability.

Across different applications, metagenomics sequencing has expanded beyond environmental analysis to include microbiome-based diagnostics, driving demand for reagents optimized for complex sample matrices. RNA sequencing workflows are spurring tailored reverse transcription chemistries, while targeted sequencing panels are catalyzing the development of high-fidelity polymerases. Whole genome sequencing, with its broader coverage requirements, underpins a diverse reagent mix that emphasizes uniformity and throughput.

Technological segmentation shows that next-generation sequencing dominates in terms of reagent consumption, yet Sanger sequencing maintains a niche for specialized validation and clinical sequencing assays. Third-generation sequencing, led by long-read platforms, is carving out a premium reagents segment focused on high-molecular-weight DNA preparation and novel enzyme formulations.

Diverse end users shape the market landscape: academic research institutions prioritize flexibility and cost-effectiveness, contract research organizations demand scalability and consistency, healthcare and diagnostic laboratories require regulatory-grade quality, and pharmaceutical and biotechnology companies seek customized reagent solutions to accelerate R&D pipelines.

Platform-specific insights further refine the picture: Illumina systems, including MiSeq, NextSeq, and NovaSeq, drive volume reagent sales through their broad installed base; Oxford Nanopore’s MinION and PromethION offerings command a specialized reagent segment for long-read sequencing; PacBio’s RS II and Sequel instruments rely on high-purity enzyme kits; and Thermo Fisher’s Ion Torrent and QuantStudio platforms require dedicated chemistries tuned to semiconductor-based and qPCR-linked workflows. These intersecting layers of segmentation underscore the need for reagent suppliers to adopt a tailored, multi-pronged product strategy.

This comprehensive research report categorizes the Sequencing Reagents market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Analyzing Strategic Regional Variations and Growth Catalysts Across Americas EMEA and Asia-Pacific Sequencing Reagents Markets

The Americas region stands at the forefront of sequencing reagent consumption, buoyed by substantial public and private R&D investments in genomics, robust infrastructure in clinical diagnostics, and a strong network of contract research organizations. The United States drives the majority of demand, supported by well-established regulatory pathways and a vibrant biotech ecosystem that continuously expands the scope of genomic applications. Canada’s growing focus on personalized medicine and agricultural genomics further complements the regional outlook, establishing North America as a critical hub for both reagent innovation and distribution.

In Europe, the Middle East, and Africa, regulatory harmonization efforts and pan-regional research initiatives are propelling market expansion. Western Europe benefits from cohesive funding frameworks under Horizon programs, which encourage cross-border collaborations in next-generation sequencing research. Meanwhile, government-backed precision medicine projects in the Middle East are fostering demand for advanced reagent solutions, and South Africa’s genomics centers are elevating sub-Saharan Africa’s role in infectious disease surveillance. Despite heterogeneous economic conditions, EMEA’s aggregated growth potential is reinforced by strategic public-private partnerships.

Asia-Pacific represents the fastest-growing regional segment, driven by significant investments in biotechnology infrastructure in China, Japan, and India. China’s national precision medicine program has catalyzed reagent adoption across clinical and research laboratories, while Japan’s advanced biopharmaceutical sector emphasizes rigorous quality standards. India’s expanding genomics research landscape, supported by academic institutions and emerging biotechs, is creating new opportunities for cost-effective reagent portfolios. Additional markets such as Australia and Singapore contribute to regional diversity, with established genomic centers and favorable regulatory environments that attract cross-border collaborations and technology transfers.

This comprehensive research report examines key regions that drive the evolution of the Sequencing Reagents market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Players and Their Strategic Initiatives Shaping the Future Landscape of Sequencing Reagents

A select group of market players continues to steer innovation and shape competitive dynamics within the sequencing reagents sector. Illumina, long established as a major sequencing platform provider, has extended its reagent portfolio with enhanced chemistries designed for ultra-high throughput applications. Thermo Fisher Scientific maintains a strong reagents presence through its tailored kits for Ion Torrent and QuantStudio systems, complemented by rigorous validation services that appeal to diagnostic laboratories.

Emerging biotech firms are gaining visibility through niche expertise: New England BioLabs is recognized for its proprietary enzyme engineering, delivering high-fidelity polymerases and ligases, while QIAGEN leverages its bioinformatics capabilities to bundle reagents with data analysis pipelines. Oxford Nanopore Technologies and Pacific Biosciences, as purveyors of long-read sequencing platforms, engage in co-marketing collaborations with reagent suppliers to refine sample preparation protocols for high-molecular-weight DNA.

Mergers, acquisitions, and strategic partnerships continue to shape the landscape. Major life sciences conglomerates are integrating specialty reagent providers to broaden product offerings, while focused enzyme developers are forging alliances with platform vendors to accelerate joint R&D. Contract research organizations also play a pivotal role, onboarding exclusive reagent contracts to differentiate service portfolios. These collective moves underscore a growing emphasis on end-to-end solutions, where reagent quality, application expertise, and technical support converge to drive customer loyalty.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sequencing Reagents market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- BGI Genomics Co., Ltd.

- Danaher Corporation

- F. Hoffmann-La Roche Ltd.

- Illumina, Inc.

- Merck KGaA

- MGI Tech Co. Ltd.

- New England Biolabs, Inc.

- Oxford Nanopore Technologies plc

- Pacific Biosciences of California, Inc.

- Promega Corporation

- QIAGEN N.V.

- Takara Bio Inc.

- Thermo Fisher Scientific Inc.

Formulating Strategic Recommendations to Navigate Evolving Market Complexities and Accelerate Sequencing Reagents Innovation

To stay ahead in a rapidly evolving environment, industry leaders must prioritize supply chain diversification by establishing multiple manufacturing sites and sourcing agreements that span geographies. This approach not only mitigates tariff vulnerabilities but also ensures a continuous flow of critical enzymes and specialized nucleotides. In tandem, investing in modular reagent platforms that can be quickly reformulated for emerging applications-such as single-cell sequencing and spatial transcriptomics-will reinforce competitive agility.

Engagement with key end users through collaborative research programs can yield deep application insights, enabling reagent designers to co-develop solutions that address real-world workflow challenges. At the same time, leveraging digital platforms for reagent ordering, inventory tracking, and technical support enhances customer experience and promotes data-driven inventory optimization.

Strategic alliances with instrument manufacturers and bioinformatics providers can accelerate the creation of integrated ecosystems, where reagents, hardware, and software deliver seamless end-to-end solutions. Companies should also allocate resources toward sustainability initiatives, such as biodegradable reagent packaging and enzyme production methods with lower environmental footprints, aligning with broader industry and regulatory imperatives.

Finally, proactive monitoring of trade and regulatory landscapes-coupled with scenario planning for potential tariff changes-will equip organizations to respond swiftly to policy shifts. This proactive stance, combined with targeted R&D investment and customer-centric partnerships, will drive resilience and unlock new growth avenues.

Outlining Rigorous Research Methodology and Data Collection Framework Underpinning Comprehensive Sequencing Reagents Market Analysis

This analysis is underpinned by a comprehensive research framework that integrates both primary and secondary data sources. Primary research included in-depth interviews with reagent manufacturers, platform vendors, contract research organizations, and end users across academic, clinical, and pharmaceutical settings. These interviews provided nuanced perspectives on workflow requirements, supply chain challenges, and emerging reagent applications.

Secondary research involved an extensive review of peer-reviewed journals, industry white papers, regulatory publications, and company filings to validate market trends and technological advancements. Patent databases and scientific conference presentations were also examined to identify nascent reagent innovations and future development pipelines.

Quantitative data collection drew on global trade statistics, import–export records, and tariff schedules to assess the impact of the 2025 United States tariffs. Market segmentation models were constructed using proprietary algorithms that account for reagent usage intensity across product type, application, technology, end user, and platform. These models were refined through cross-validation techniques to ensure consistency and reliability.

While every effort was made to capture the full breadth of market dynamics, certain limitations apply. Rapid technological shifts and evolving regulatory environments may influence reagent adoption rates beyond the study timeframe. Nevertheless, the methodology’s multi-source approach provides a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sequencing Reagents market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sequencing Reagents Market, by Product Type

- Sequencing Reagents Market, by Technology

- Sequencing Reagents Market, by Application

- Sequencing Reagents Market, by End User

- Sequencing Reagents Market, by Region

- Sequencing Reagents Market, by Group

- Sequencing Reagents Market, by Country

- United States Sequencing Reagents Market

- China Sequencing Reagents Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding Synthesis of Market Dynamics and Strategic Imperatives Driving the Future Growth Trajectory of Sequencing Reagents

The sequencing reagents market is at an inflection point, driven by innovations in next-generation and third-generation sequencing technologies, expanding clinical applications, and evolving supply chain realities propelled by recent tariff measures. Segmentation analysis reveals that while core reagents such as nucleotides and buffers sustain consistent demand, specialized enzyme formulations and advanced labeling chemistries will define the field’s growth frontier. Regional insights underscore the Americas as the incumbent powerhouse, EMEA’s collaborative funding environment, and Asia-Pacific’s rapid expansion fueled by government initiatives.

Leading companies continue to refine their reagent portfolios through strategic partnerships, targeted acquisitions, and co-development models that align product capabilities with customer workflows. For industry leaders, the pathway to sustained success lies in supply chain resilience, modular reagent design, integrated solution offerings, and proactive regulatory monitoring. The research methodology employed ensures that the insights presented are grounded in robust data and expert perspectives.

In synthesizing market dynamics, segmentation insights, regional nuances, and competitive strategies, this report equips stakeholders with the clarity needed to navigate uncertainty, seize strategic growth opportunities, and maintain a competitive edge in a rapidly evolving sequencing reagents landscape.

Discover Comprehensive Sequencing Reagents Insights and Engage with Ketan Rohom for Exclusive Market Intelligence Access

If you’re ready to gain unparalleled clarity across sequencing reagents trends, tariff impacts, segmentation dynamics, regional nuances, and competitive strategies, don’t miss this opportunity to access the full in-depth market research report. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, and he will guide you through the tailored insights and premium data that can inform your strategic roadmap and investment decisions. With a comprehensive understanding of the forces shaping the sequencing reagents landscape, you will be equipped to capitalize on emerging opportunities, mitigate supply chain risks, and outpace the competition. Secure your copy today to harness actionable intelligence and empower your organization’s next phase of growth.

- How big is the Sequencing Reagents Market?

- What is the Sequencing Reagents Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?