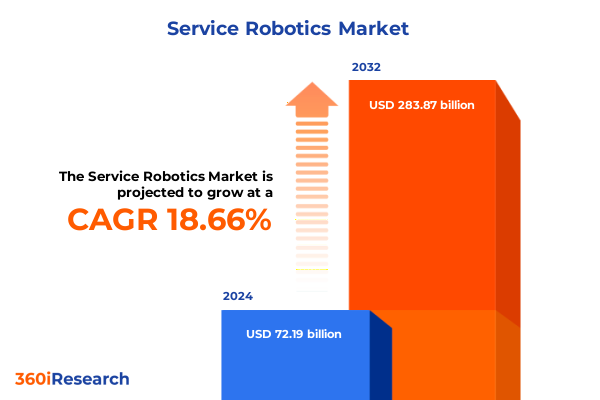

The Service Robotics Market size was estimated at USD 84.82 billion in 2025 and expected to reach USD 100.00 billion in 2026, at a CAGR of 18.83% to reach USD 283.87 billion by 2032.

Navigating the Dawn of a New Era in Service Robotics Where Intelligent Machines Are Poised to Transform Daily Operations Across Industries

The service robotics sector stands at the dawn of a revolutionary era where intelligent machines are transitioning from novelty to indispensable partners across diverse industries. Fueled by rapid advancements in artificial intelligence, sensor technologies and machine learning algorithms, these autonomous systems are increasingly capable of navigating complex environments, interacting safely with humans and executing tasks with unprecedented precision. In healthcare, collaborative robotic assistants streamline surgical procedures and patient care, while in logistics warehouses deploy autonomous mobile robots to optimize order fulfillment. Meanwhile, personal service robots are entering homes to support elderly care and household chores, signaling a shift in consumer expectations regarding convenience and quality of life.

Amid evolving labor dynamics and growing pressures on operational efficiency, organizations are turning to service robotics to address workforce shortages, enhance productivity and maintain competitiveness. This shift is further propelled by digital transformation initiatives where robotics ecosystems integrate seamlessly with enterprise software and cloud platforms, creating intelligent networks that adapt and learn from real-time data. As regulatory bodies update safety and certification standards to accommodate these emerging technologies, stakeholders are presented with both challenges and opportunities in compliance and innovation.

Within this evolving landscape, businesses must develop a nuanced understanding of the technological, economic and policy drivers shaping service robotics adoption. This introduction lays the foundation for a deeper exploration of transformative shifts in the industry, the impact of recent tariff measures, granular segmentation insights, regional nuances and best practices for capitalizing on this dynamic market.

Remarkable Technological Advancements Are Reshaping Service Robotics Capabilities and Redefining Industry Boundaries Across Multiple Market Verticals

The service robotics landscape is undergoing transformative shifts driven by breakthroughs in autonomy perception and connectivity. Cutting-edge innovations in computer vision and deep learning are enabling robots to interpret unstructured environments with human-like acuity, vastly expanding their applicability beyond controlled factory floors into dynamic spaces such as hospitals, retail stores and public infrastructure. Moreover, the integration of collaborative robotic arms with force-sensing capabilities allows safe human–machine interaction, paving the way for symbiotic work cells in both manufacturing and service scenarios.

Simultaneously, the emergence of cloud-based robotics platforms empowers remote monitoring, predictive maintenance and fleet coordination at scale. By leveraging edge computing and 5G connectivity, robots can exchange data instantaneously, self-optimize their performance and benefit from real-time software updates. Digital twin technologies further enhance these capabilities by creating virtual replicas of physical systems, enabling simulation-driven design and continuous performance refinement. These converging developments are redefining traditional robotic use cases, fostering novel business models such as Robotics-as-a-Service (RaaS) that lower adoption barriers and provide flexible deployment options.

As technology barriers decline, market adoption accelerates in sectors that demand precision, reliability and adaptability. From autonomous drones conducting infrastructure inspections to legged robots traversing uneven terrains in disaster response operations, service robotics is expanding its footprint. Yet with these opportunities come challenges in data security, interoperability standards and upskilling workforces to manage increasingly intelligent systems. Understanding these transformative forces is crucial for industry players seeking to harness the full potential of emerging robotic technologies.

Evaluating the Emerging Landscape of United States Tariff Policies During 2025 and Their Complex Ramifications for Domestic Service Robotics Supply Chains

In 2025 the United States implemented a series of tariff adjustments aimed at bolstering domestic manufacturing of advanced technologies including robotics components. These measures, which target imported actuators, sensors and specialized power systems, have introduced additional cost layers for original equipment manufacturers relying on global supply networks. As a result, procurement teams are recalibrating their sourcing strategies to balance the higher duties on foreign parts against the premium pricing of domestically produced alternatives.

This policy shift has catalyzed nearshoring initiatives with companies redirecting component production to North American partners in Mexico and Canada where trade agreements like USMCA offer preferential terms. While these localization efforts alleviate tariff pressures, they also necessitate investments in supplier development, quality assurance and logistics infrastructure to ensure continuity of supply and performance consistency. Furthermore, higher import duties on fully assembled professional service robots have prompted some end users to consider modular, locally assembled platforms that can be customized post-import, thereby mitigating the financial impact of heavy tariff slabs.

Simultaneously, stakeholders are engaging policymakers and industry consortia to advocate for tariff carve-outs on critical components and to establish clear guidelines for classification of robotic assemblies. This collaborative approach aims to reduce regulatory ambiguity and enable smoother international trade flows. As organizations adjust to the new tariff landscape, those that proactively reengineer their supply chain architectures and forge strategic partnerships with domestic suppliers gain resilience and maintain competitive cost structures amidst evolving trade dynamics.

Uncovering Critical Market Segmentation Insights That Illuminate the Multifaceted Dynamics of Product, Component, Mobility and Diverse End User Applications

A comprehensive analysis of service robotics reveals that market dynamics vary substantially across product categories component types mobility profiles and end-user industries. Within product segmentation, personal service robots designed for consumer applications emphasize intuitive interfaces compact footprints and affordability, whereas professional service robots targeted at industrial environments prioritize payload capacity durability and integration with enterprise systems. These distinct value propositions shape purchasing criteria and deployment strategies across different use cases.

The component landscape further differentiates market opportunities. Hardware elements such as actuators, sensors, control systems and power supplies form the physical backbone of robotic platforms. Simultaneously, professional services offerings including consulting system integration and support and maintenance services add layers of expertise and ensure operational reliability over the equipment lifecycle. Software solutions spanning operating systems, AI-driven analytics and fleet management platforms are equally pivotal, driving autonomy and enabling continuous performance optimization.

Mobility segmentation illuminates the diverging paths of aerial, legged, wheeled and tracked designs within mobile robotics compared to stationary counterparts such as automated workstations and robotic arms. Mobile robots capture opportunities in logistics, inspection and field services by navigating dynamic environments, whereas stationary robots excel in repetitive high-precision tasks within defined work cells. Finally end-user segmentation underscores the breadth of applications ranging from aerospace and defense to healthcare agriculture and hospitality. Each industry presents unique operational requirements regulatory frameworks and integration challenges, demanding tailored robotic solutions and specialized support models.

This comprehensive research report categorizes the Service Robotics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component Type

- Mobility

- End-User

Highlighting Regional Variances and Opportunities Across the Americas Europe Middle East Africa and Asia Pacific as Catalysts for Service Robotics Growth

Regional nuances profoundly influence service robotics adoption and strategic priorities across the Americas, Europe Middle East and Africa, and Asia-Pacific markets. In the Americas, the United States and Canada spearhead investment in warehouse automation healthcare robotics and on-demand service platforms. North American enterprises benefit from robust infrastructure, flexible financing arrangements and supportive regulatory frameworks that lower barriers to pilot deployments. Conversely Latin American markets exhibit growing demand for agricultural robots designed to optimize crop yields under variable climatic conditions and to address labor shortages.

Within Europe Middle East and Africa, Germany, France and the UK drive uptake in collaborative robots for automotive manufacturing and precision assembly applications, supported by strong engineering ecosystems and government incentives. The region also explores service robotics solutions for energy and utilities, particularly in remote asset monitoring and maintenance tasks. Meanwhile Middle Eastern economies are investing in hospitality and retail robotics to meet evolving consumer expectations and to diversify away from traditional energy sectors, and emerging African markets show early-stage pilot projects in healthcare delivery and educational robotics.

Asia-Pacific stands at the forefront of technological leadership with Japan, South Korea and China making substantial strides in both hardware innovation and large-scale deployments. In Japan and South Korea an aging population intensifies demand for eldercare robots, while China’s strategic focus on domestic semiconductor and component production underpins expansive manufacturing of service robots. These regional drivers underscore the importance of tailored market entry strategies that align with local policies, infrastructure capabilities and end-user needs.

This comprehensive research report examines key regions that drive the evolution of the Service Robotics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Corporations Driving Innovation in Service Robotics With Strategies That Define Competitive Advantage and Industry Leadership Trajectories

Leading corporations are charting differentiated paths to capture value in the service robotics arena through innovation partnerships, strategic acquisitions and ecosystem development. Boston Dynamics continues to push boundaries in legged mobility, showcasing versatile robots capable of traversing challenging terrains-an advantage in sectors such as defense and public safety. Meanwhile ABB and FANUC leverage decades of automation expertise to integrate collaborative arm solutions with advanced AI toolkits, enabling seamless human-robot collaboration in manufacturing and laboratory environments.

In the consumer segment, companies like iRobot and SoftBank Robotics focus on intuitive interfaces and cost-effective platforms designed for home use. Their emphasis on user experience and robust after-sales support fosters higher consumer confidence and drives recurring software subscription revenue. In contrast Amazon Robotics capitalizes on existing logistics infrastructure, deploying autonomous mobile robots at scale to accelerate order fulfillment and set new standards for operational efficiency.

Strategic collaborations between hardware OEMs and software start-ups are also emerging as a powerful trend. Open platform initiatives facilitate integration of best-in-class navigation, perception and analytics modules, reducing time-to-market for customized solutions. As competitive pressures intensify, leading players are investing heavily in service ecosystems-offering consulting, integration and maintenance programs-to secure long-term customer relationships and recurring revenue streams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Service Robotics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AB Electrolux

- ABB Ltd.

- Aethon, Inc. by Singapore Technologies Engineering Ltd

- BAE Systems PLC

- Beijing Roborock Technology Co., Ltd.

- Daifuku Co., Ltd.

- DeLaval Group

- Ecovacs Group

- Exail SAS

- GeckoSystems Intl. Corp.

- General Dynamics Corporation

- General Motors Company

- Hajime Research Institute, Ltd.

- Hanson Robotics, Limited

- Honda Motor Co., Ltd.

- Hyundai Motor Company

- Intuitive Surgical Inc.

- iRobot Corporation

- Kawasaki Heavy Industries, Ltd.

- KEENON Robotics Co., Ltd.

- Knightscope, Inc.

- Kongsberg Gruppen ASA

- Kuka AG

- Medtronic PLC

- OmniGuide Holdings, Inc.

- PAL Robotics SL

- Panasonic Holdings Corporation

- Promobot

- Relay Delivery Robots

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd

- Serve Robotics Inc.

- SoftBank Robotics Group

- SZ DJI Technology Co., Ltd.

- Tennant Company

- Tokyo Robotics Inc.

- Toyota Motor Corporation

- Ubtech Robotics Corp Ltd.

- Yaskawa Electric Corporation

- Yujin Robot Co. Ltd.

Delivering Actionable Strategic Recommendations to Empower Industry Leaders to Capitalize on Emerging Trends and Drive Sustainable Competitive Growth

To capitalize on the momentum in service robotics, industry leaders must pursue a multi-pronged strategy that emphasizes flexibility, collaboration and foresight. Investing in open architecture platforms will enable rapid integration of third-party software modules and sensors, minimizing development bottlenecks and future-proofing solutions against evolving technological standards. Concurrently, forging strategic partnerships with component suppliers and logistics providers-particularly within nearshored ecosystems-will strengthen supply chain resilience in the face of tariff-driven cost fluctuations.

Developing in-house talent and offering upskilling programs for engineers and technicians ensures organizations can manage increasingly autonomous systems and maintain continuous improvement cycles. Leaders should also explore Robotics-as-a-Service models to lower entry barriers for end users, thereby expanding addressable markets and unlocking new revenue streams. Equally important is engaging proactively with regulatory stakeholders to shape standards for safety, data privacy and interoperability, fostering an environment that balances innovation with public trust.

Lastly, aligning product roadmaps with high-growth verticals such as healthcare, logistics and hospitality allows companies to tailor solutions to specific operational challenges and regulatory frameworks. By orchestrating these initiatives within a coherent strategic framework, organizations can drive sustainable competitive growth and emerge as frontrunners in the rapidly evolving service robotics domain.

Detailing a Robust Mixed Research Methodology Combining Primary Interviews Secondary Data and Rigorous Analytical Frameworks to Ensure Insight Accuracy

The insights presented in this report are underpinned by a rigorous mixed-methodology approach combining primary and secondary research. Primary data was gathered through in-depth interviews with C-suite executives technology officers and operations managers across leading robotics vendors system integrators and end-user organizations. These conversations elicited firsthand perspectives on adoption challenges, technological preferences and strategic priorities.

Secondary research encompassed a comprehensive review of publicly available sources including patent filings academic journals regulatory publications and corporate financial disclosures. Industry databases were consulted to map competitive landscapes and to validate market dynamics. Findings from both primary and secondary streams were triangulated using a structured analytical framework to identify convergent trends and to resolve any data inconsistencies.

Quantitative analyses of component deployment rates, adoption timelines and integration costs were supplemented by qualitative assessments of user satisfaction and ecosystem maturity. This blended approach ensured that the report delivers robust, actionable intelligence grounded in empirical evidence and expert validation. Throughout the research process, iterative reviews with internal subject matter experts and external advisors enhanced accuracy and impartiality.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Service Robotics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Service Robotics Market, by Product Type

- Service Robotics Market, by Component Type

- Service Robotics Market, by Mobility

- Service Robotics Market, by End-User

- Service Robotics Market, by Region

- Service Robotics Market, by Group

- Service Robotics Market, by Country

- United States Service Robotics Market

- China Service Robotics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing the Strategic Imperatives and Future Trajectories of Service Robotics in a Rapidly Evolving Ecosystem of Automation and Human Machine Collaboration

As service robotics continues to mature, its strategic significance for businesses and societies alike becomes increasingly evident. The convergence of advanced sensing, intelligent autonomy and connected ecosystems is redefining traditional work paradigms and driving the emergence of novel service delivery models. Organizations that master the complexities of segmentation, regional dynamics and evolving policy landscapes will unlock substantial operational efficiencies and competitive differentiation.

The cumulative impact of tariff adjustments in 2025 highlights the imperative for resilient supply chain architectures and agile sourcing strategies. Simultaneously, rapid technological progressions underscore the need for continuous innovation and cross-industry collaboration. By synthesizing these dynamics into coherent strategic roadmaps, companies can tailor solutions that address specific industry pain points while positioning themselves for long-term growth.

Ultimately, the pathway to leadership in service robotics hinges on a balanced approach-an unwavering commitment to technological excellence coupled with a deep understanding of market forces and regulatory frameworks. This report equips decision-makers with the actionable insights required to navigate this dynamic landscape and to harness the transformative potential of service robotics.

Engage with Ketan Rohom Today to Unlock Comprehensive Service Robotics Market Insights and Propel Your Strategic Decisions with a Leading Research Report

Unlock unrivaled intelligence on technological trajectories competitive benchmarks and strategic imperatives in service robotics by connecting with Ketan Rohom. As Associate Director of Sales & Marketing at our firm he stands ready to guide your organization toward optimally leveraging the insights within this comprehensive report. Engage in a personalized consultation to explore how the report’s content on advanced automation trends, regional market dynamics, tariff impacts, segmentation breakdowns and leading company strategies can directly inform your strategic roadmap. Discover tailored opportunities to accelerate innovation in product development and service delivery while mitigating supply chain and policy risks. Through this interaction you will gain exclusive access to deep market intelligence, proven actionable frameworks and proprietary analysis designed to empower confident decision-making. Secure your competitive advantage today by initiating a dialogue with Ketan Rohom and embark on a journey to transform your approach to service robotics.

- How big is the Service Robotics Market?

- What is the Service Robotics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?