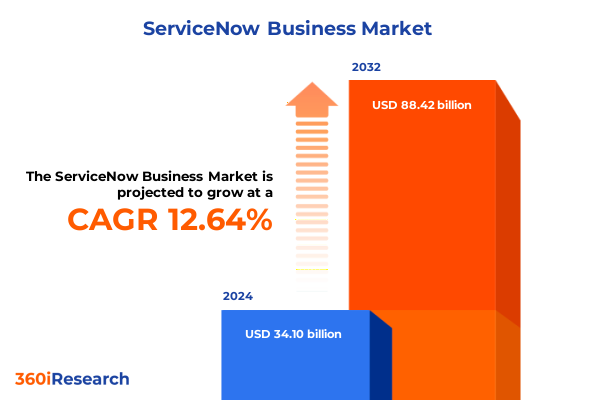

The ServiceNow Business Market size was estimated at USD 38.33 billion in 2025 and expected to reach USD 43.14 billion in 2026, at a CAGR of 12.68% to reach USD 88.42 billion by 2032.

Unveiling the Future of ServiceNow Business: A Comprehensive Synopsis of Market Dynamics, Opportunities, and Strategic Imperatives

ServiceNow has established itself as a cornerstone platform for digital workflow transformation, enabling enterprises to streamline and automate processes across IT, HR, customer service, security operations, and beyond. The convergence of cloud computing, artificial intelligence, and enterprise service management has elevated expectations for seamless, end-to-end business operations. As organizations strive to enhance productivity and deliver exceptional experiences, ServiceNow’s integrated suite of cloud-based solutions offers a unified environment for digitizing workflows and breaking down functional silos. This report delves into the dynamics shaping the ServiceNow business landscape, spotlighting key drivers, market shifts, and strategic imperatives that will define success in the years ahead.

Building on a clear understanding of current challenges around legacy systems, resource constraints, and rising demand for agile service delivery, this executive summary frames a forward-looking perspective. The analysis integrates insights across multiple dimensions such as service portfolios, organization size categories, vertical end-user adoption patterns, and deployment models. It also examines geographic nuances spanning the Americas, Europe Middle East & Africa, and Asia-Pacific regions. By grounding the discussion in these foundational pillars, readers gain a 360-degree view of emerging opportunities and potential hurdles. This introduction sets the stage for a deep dive into transformative shifts, policy impacts, segmentation intelligence, regional dynamics, and actionable recommendations for industry leaders.

Navigating a Sea of Transformation Where Digital Acceleration, Artificial Intelligence, and Converged IT Strategies Redefine the ServiceNow Business Ecosystem

As the digital era continues its rapid acceleration, ServiceNow business environments are experiencing a fundamental evolution driven by breakthroughs in artificial intelligence, machine learning, and converged cloud architectures. Enterprises no longer perceive service management platforms as standalone tools; they now expect intelligent workflow engines that can anticipate operational bottlenecks, deliver prescriptive recommendations, and orchestrate cross-functional processes in real time. This shift is leading to the proliferation of AI-powered virtual agents, automated incident response mechanisms, and advanced analytics dashboards that transform raw data into strategic insights.

Simultaneously, the migration to hybrid and multi-cloud infrastructures is prompting organizations to revisit their integration strategies, ensuring that ServiceNow deployments seamlessly interface with legacy on-premise systems and next-generation cloud applications. There is also a clear trend toward the convergence of IT operations and security operations, where unified platforms can detect, respond, and remediate threats within the context of broader business processes. Together, these transformative shifts are redefining the ServiceNow business landscape, creating new vectors of value creation that extend far beyond traditional IT service management.

Assessing the Collective Impact of Recent United States Tariff Policies on ServiceNow Business Operations, Cost Structures, and Strategic Resilience in 2025

In 2025, an array of tariff measures imposed by the United States on technology imports has had a cumulative effect across the ServiceNow business ecosystem, influencing everything from hardware procurement to cloud infrastructure costs. While ServiceNow’s software-as-a-service model inherently mitigates direct exposure to hardware tariffs, its channel partners and system integrators often rely on imported servers, network components, and specialized appliances that are subject to elevated duties. These additional levies have translated into higher operating expenses for implementation projects, particularly for enterprises deploying on-premise modules or hybrid configurations.

Moreover, the broader trade policy environment has spurred organizations to reassess supply chain resiliency and localization strategies. In response, many ServiceNow customers have accelerated cloud migration roadmaps, shifting workloads away from high-cost on-premise deployments toward more predictable subscription-based models. At the same time, regional data sovereignty requirements and the desire to reduce dependence on cross-border supply chains are influencing deployment model decisions. Collectively, these factors underscore the need for service providers and end users to adapt pricing models, renegotiate contractual terms, and invest in automation to counterbalance the operational headwinds created by tariff policies in 2025.

Unraveling Strategic Insights Through a Multi-Dimensional Segmentation Lens Encompassing Services, Organization Size, End-User Verticals, and Deployment Preferences

A nuanced understanding of service portfolio segmentation reveals that enterprises are prioritizing investments in customer service management and IT service management to modernize support functions and drive efficiency gains. Meanwhile, HR service delivery has emerged as a critical area of focus as organizations strive to enhance employee experiences through self-service capabilities and automated workflows. On the governance side, IT business management solutions are gaining traction among large enterprises that require advanced project portfolio and financial management features, whereas security operations platforms are increasingly sought after to address burgeoning cyber threats.

When dissecting adoption patterns by organization size, large enterprises leverage comprehensive, integrated ServiceNow suites to consolidate multiple legacy systems under a single platform and achieve enterprise-wide visibility. In contrast, small and medium enterprises often opt for modular deployments, selectively implementing core modules such as IT service management or customer service management to balance functionality with budget considerations. Across end-user verticals, financial services and telecommunications sectors lead adoption due to their complex regulatory environments and critical uptime requirements, whereas healthcare and government agencies are turning to the platform to enhance compliance, patient services, and citizen engagement. Manufacturing organizations are also recognizing the value of automated incident management to minimize production downtime.

The choice between cloud-based and on-premise deployment models continues to hinge on factors such as data sovereignty, customization needs, and total cost of ownership. Cloud-based implementations offer rapid scalability and lower upfront capital expenditure, appealing to enterprises with dynamic workloads and limited IT infrastructure budgets. Conversely, regulated industries that demand strict data control and tailored configurations may still favor on-premise deployments despite the associated maintenance overhead. By viewing these segmentation dimensions holistically, organizations can tailor their ServiceNow strategies to unlock maximum value.

This comprehensive research report categorizes the ServiceNow Business market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Services Types

- Licensing Models

- End-User

- Organization Size

- Deployment Model

Deciphering Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East & Africa, and Asia-Pacific to Uncover ServiceNow Business Opportunities

The Americas remain a growth engine for ServiceNow business solutions, driven by strong adoption among North American enterprises seeking to digitize customer support, HR processes, and IT operations. The United States market, in particular, benefits from early maturity in cloud adoption and a robust ecosystem of channel partners, while Canada is witnessing increased interest from public sector agencies looking to modernize legacy workflows. Latin America is also gaining momentum, with regional service providers tailoring cost-effective cloud offerings to meet the needs of emerging markets.

In Europe, Middle East & Africa, regulatory complexity and data sovereignty mandates shape deployment patterns, with enterprises in the European Union gravitating toward cloud-based regional data centers that comply with GDPR. The Middle Eastern market is marked by rapid digital transformation initiatives in governmental and oil-and-gas sectors, driving demand for integrated service management platforms. Meanwhile, African enterprises are at an earlier stage of adoption but are poised for accelerated growth as digital infrastructure improvements and mobile-first strategies create new opportunities.

Across the Asia-Pacific region, a diverse tapestry of market maturity levels defines the ServiceNow landscape. Advanced economies like Australia, Japan, and Singapore demonstrate high penetration of enterprise service management, while emerging markets such as India and Southeast Asia prioritize cloud-based deployments to bypass the costs and complexities of on-premise infrastructure. Regional channel partners and consulting firms are playing a pivotal role in localizing the platform, offering language-specific support, integration services, and industry templates to accelerate time to value.

This comprehensive research report examines key regions that drive the evolution of the ServiceNow Business market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Players Driving Innovation, Partnerships, and Competitive Differentiation in the Evolving ServiceNow Business Landscape

ServiceNow’s own trajectory as the foundational platform provider continues to set the pace for innovation, with ongoing enhancements in AI-driven workflow capabilities and expanded industry-specific solutions. Complementing this, global system integrators such as Accenture and Deloitte are building dedicated practice units focused on workflow automation and service management transformation. These consultancies leverage deep domain expertise to orchestrate large-scale deployments and integrate ServiceNow with enterprise resource planning, customer relationship management, and bespoke applications.

Technology partners including IBM and Cognizant have also broadened their alliances with ServiceNow, co-developing joint offerings that embed advanced analytics, robotic process automation, and hybrid cloud management features. Meanwhile, regional players and value-added resellers are carving out niche specializations, providing localized implementation services, custom application development, and post-deployment support tailored to specific industry requirements. This ecosystem synergy is fostering competitive differentiation, as vendors compete on the basis of speed of deployment, vertical expertise, and the ability to deliver end-to-end digital transformation outcomes. Collectively, these market players are driving an intensified focus on continuous innovation and collaborative go-to-market strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the ServiceNow Business market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Atos SE

- Birlasoft Limited

- Capgemini SE

- CDW LLC

- CGI Inc.

- Cognizant Technology Solutions Corporation

- Deloitte Touche Tohmatsu Limited

- DXC Technology Company

- Ernst & Young Global Limited

- Fujitsu Limited

- GlideFast Consulting LLC by ASGN Inc.

- HCL Technologies Limited

- Hexaware Technologies Limited

- Hitachi, Ltd.

- Infosys Limited

- International Business Machines Corporation

- KPMG International Limited

- Kyndryl Inc.

- LTIMindtree Limited

- Microsoft Corporation

- Nagarro SE

- NTT Corporation

- Ondaro LLC

- Oracle Corporation

- Samsung SDS Co., Ltd.

- ServiceNow, Inc.

- T-Systems International GmbH by Deutsche Telekom AG

- TATA Consultancy Services Limited

- Tech Mahindra Limited

- TEKsystems Global Services, LLC

- Unisys Corporation

- Virtusa Corporation

- Wipro Limited

- World Wide Technology, LLC

Empowering Industry Leadership with Actionable Strategies to Capitalize on ServiceNow Business Innovations and Accelerate Digital Transformation Outcomes

To remain at the forefront of ServiceNow adoption and capitalize on emerging opportunities, industry leaders should prioritize the integration of AI and machine learning capabilities into existing workflow frameworks. By deploying predictive analytics for incident management and proactive service optimization, organizations can reduce resolution times and free up valuable resources for strategic initiatives. It is also imperative to strengthen cybersecurity posture by unifying IT operations and security operations data streams, enabling a contextualized response to threats and vulnerabilities without disrupting business continuity.

In parallel, enterprises should cultivate a center of excellence dedicated to ServiceNow governance, ensuring best practices for change management, data quality, and solution scalability. This includes establishing clear performance metrics, continuous training programs, and a feedback loop to capture user experience insights. Collaboration with channel partners and technology vendors can accelerate the implementation of industry-specific accelerators and integration modules, thus shortening time to value. Finally, aligning ServiceNow projects with broader digital transformation roadmaps-such as enterprise adoption of low-code development platforms, Internet of Things integrations, and customer experience initiatives-will amplify ROI and solidify the platform’s role as the operational backbone for the modern enterprise.

Demonstrating Rigorous Research Methodology Integrating Qualitative and Quantitative Approaches to Ensure Comprehensive ServiceNow Business Market Analysis

This analysis is underpinned by a rigorous research methodology that amalgamates both qualitative and quantitative approaches to ensure robustness and accuracy. Primary research encompassed in-depth discussions with a spectrum of stakeholders, including C-level executives, IT heads, procurement officers, and end-users across diverse industries. These interviews provided nuanced perspectives on deployment drivers, adoption challenges, and future requirements.

Secondary research involved a systematic review of company presentations, white papers, government publications, and technology consortium reports. Data triangulation was achieved by cross-validating insights from primary interviews with published financial reports, IT spending databases, and publicly available cloud infrastructure statistics. Market segmentation was defined through patent analysis, service portfolio mappings, and end-user IT budget allocations. Regional insights were informed by local market surveys and regulatory reviews, ensuring that each geographic analysis reflects the latest policy and economic developments. By integrating multiple data sources and expert validations, this report delivers a comprehensive and actionable view of the ServiceNow business market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our ServiceNow Business market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- ServiceNow Business Market, by Services Types

- ServiceNow Business Market, by Licensing Models

- ServiceNow Business Market, by End-User

- ServiceNow Business Market, by Organization Size

- ServiceNow Business Market, by Deployment Model

- ServiceNow Business Market, by Region

- ServiceNow Business Market, by Group

- ServiceNow Business Market, by Country

- United States ServiceNow Business Market

- China ServiceNow Business Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Critical Findings to Chart a Clear Path Forward in the Dynamic ServiceNow Business Ecosystem and Strategic Decision-Making

The investigations presented in this executive summary converge on several pivotal themes that will shape the ServiceNow business trajectory. First, the acceleration of AI-driven service management underscores the growing imperative for predictive and automated workflows that can adapt in real time to evolving enterprise needs. Second, the segmentation analysis highlights the diverse adoption patterns across service lines, organization sizes, vertical industries, and deployment models, emphasizing that there is no one-size-fits-all strategy. Third, the policy landscape-particularly in relation to U.S. tariffs-has accelerated the shift toward cloud-first approaches and prompted organizations to refine their cost management and supply chain strategies.

Regional and competitive insights reveal that the path to success lies in forging strong partnerships between platform vendors, system integrators, and regional service providers, leveraging localized expertise to deliver tailored solutions at scale. The convergence of IT operations, HR service delivery, security operations, and customer service management onto a unified platform is not merely a technological upgrade but a strategic enabler for business agility and customer centricity. As organizations continue to navigate digital transformation imperatives, the findings of this report offer a clear path forward-one that balances innovation with operational resilience and positions ServiceNow as the linchpin of modern enterprise workflows.

Taking the Next Step to Unlock Strategic Value with Expert Guidance and ServiceNow Business Market Insights from Our Associate Director of Sales & Marketing

To seize the full strategic potential of your organization’s digital transformation initiatives, reach out to Ketan Rohom, Associate Director of Sales & Marketing, who can provide personalized insights and guide you through the purchase process of the comprehensive market research report. With his deep expertise in ServiceNow business solutions and industry trends, he will ensure that you receive the tailored intelligence necessary to empower your executive decisions, optimize your technology investments, and drive sustained growth across your enterprise operations. Connect with him today to unlock a detailed roadmap for navigating the ServiceNow landscape and accelerating your competitive advantage in today’s rapidly evolving digital ecosystem.

- How big is the ServiceNow Business Market?

- What is the ServiceNow Business Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?