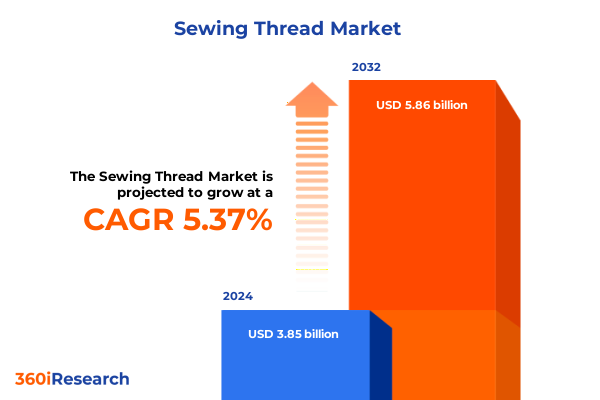

The Sewing Thread Market size was estimated at USD 4.04 billion in 2025 and expected to reach USD 4.25 billion in 2026, at a CAGR of 5.44% to reach USD 5.86 billion by 2032.

Exploring the Dynamics of the Global Sewing Thread Market to Illuminate Opportunities and Risks Facing Stakeholders in a Rapidly Evolving Industry

Sewing thread is the invisible backbone of textile and garment manufacturing, playing a critical role in apparel, footwear, automotive interiors, home furnishings, and technical textiles. This humble yet indispensable material influences product integrity, durability, and aesthetic quality across a wide array of end-use applications. The global prominence of sewing thread is exemplified by leading manufacturers whose products are integrated into one in five garments worldwide.

This executive summary weaves together the essential dynamics of the sewing thread industry, from the diverse array of fiber types spanning natural, synthetic, and blended materials to the sophisticated manufacturing processes that ensure performance and cost-efficiency at scale. It underscores the market’s complex interplay of technological advancements, regulatory developments, and evolving consumer preferences that are driving continuous innovation.

By synthesizing insights on transformative shifts, geopolitical and tariff impacts, segmentation patterns, regional nuances, and competitive strategies, this document equips decision-makers with a clear, authoritative foundation for navigating the challenges and seizing the opportunities within the global sewing thread landscape.

Examining Pivotal Innovations Sustainable Practices and Technological Advances That Are Redefining Production and Value Chains Across the Sewing Thread Landscape

The sewing thread industry is undergoing a profound digital transformation, driven by the widespread integration of artificial intelligence, the Internet of Things, and blockchain technologies. AI-powered predictive analytics are enhancing demand forecasting accuracy, while IoT-enabled sensors provide real-time visibility into production workflows to streamline operations and reduce inefficiencies. Blockchain is increasingly adopted for end-to-end traceability, enabling brands to authenticate material origins and demonstrate compliance with evolving regulatory and sustainability standards.

Concurrently, sustainability has become a core driver of innovation across the industry. Manufacturers are investing heavily in eco-friendly and recyclable fibers, biodegradable finishes, and closed-loop recycling systems that minimize environmental impact. Consumer demand for responsibly sourced, non-virgin oil-based materials is accelerating the shift toward circular economy models and bio-based alternatives that deliver both performance and environmental credentials.

Automation and smart manufacturing technologies are also redefining production paradigms. Robotics, advanced sewing machines, and digital twin simulations are boosting throughput, precision, and quality consistency, while alleviating labor shortages in key manufacturing hubs. As these technologies continue to mature, they are enabling scalable, flexible production capable of meeting increasingly customized orders without compromising on cost or speed.

Assessing the Combined Effects of Recent Section 301 Tariff Actions and Policy Exemptions on Import Costs Supply Chains and Sourcing Strategies in Sewing Thread Sector

U.S. trade policy developments under Section 301 have directly targeted fibers, yarns, and weaves of cotton, wool, nylon, rayon, polyester, and other textile materials. List 3 of these tariffs was increased to 25 percent effective January 1, 2025, imposing higher duties on direct imports of these products from China.

In parallel, the USTR extended exclusions for 164 specific China-origin products-including key thread-related items-to May 31, 2025, in recognition of limited alternative sourcing options and to provide additional transition time for supply chain realignment.

Together, these measures have elevated import costs, prompting many brands to re-evaluate their sourcing strategies, accelerate diversification away from Chinese suppliers, and explore regional nearshoring opportunities. Domestic and third-country production capacities are seeing renewed investment as companies seek to insulate themselves from tariff uncertainties and maintain continuity of supply.

Additional enforcement actions by the Forced Labor Enforcement Task Force and the Uyghur Forced Labor Prevention Act Entity List have further increased compliance complexity for thread manufacturers. As a result, businesses are bolstering their trade compliance functions and prioritizing supplier transparency to mitigate regulatory and reputational risks.

Unveiling Critical Customer Segmentation and Material Process Variations That Inform Product Development Marketing and Distribution Strategies for Diverse Sewing Thread Markets

The sewing thread market is studied across core fiber categories-blended fibers, natural fibers, and synthetic fibers-which encompass subsegments such as cotton, linen, silk, wool, nylon, polyester, and rayon. Each fiber type offers distinct performance characteristics, from the tensile strength and chemical resistance of synthetic variants to the tactile appeal and biodegradability of natural threads.

Manufacturing processes further differentiate market offerings, with bonded, core-spun, and covered thread technologies tailored to diverse operational requirements. Bonded threads deliver smooth feed and high stitch density; core-spun constructions combine strength and resilience; covered options provide enhanced abrasion resistance and aesthetic finishes.

Distribution channels are evolving as well. Traditional offline networks-specialty retailers, distributors, and direct sales-remain vital for professional and industrial customers seeking technical guidance and immediate availability. Simultaneously, online platforms are expanding their footprint, offering convenience, broader assortments, and seamless procurement for hobbyists, small-scale tailors, and large enterprise buyers alike.

Applications span from individual crafting and home sewing to a broad industrial spectrum including apparel (children’s, ladieswear, menswear), automotive (airbags, seatbelts, shading systems, steering wheels, trim and interior), home interior (bathroom textiles, mattresses, pillows and quilts, table linen, upholstery), shoes and accessories (bags, belts, shoes, suitcases, luggage), and Techtex segments (filtration fabrics, geotextiles, medical textiles, protective clothing). This diverse application matrix underscores the necessity of fine-tuned product development and go-to-market strategies to effectively address unique performance demands and regulatory contexts.

This comprehensive research report categorizes the Sewing Thread market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fiber Type

- Product Type

- Application

- Distribution Channel

Illuminating Regional Variations in Demand Supply Chain Resilience and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific Markets

In the Americas, a robust automotive and technical textiles industry underpins strong demand for high-performance synthetic threads. North America in particular has seen a surge in polyester and nylon thread usage for automotive interiors and protective fabrics, supported by investments in advanced manufacturing and a thriving e-commerce ecosystem that enhances market accessibility.

Europe, the Middle East, and Africa are characterized by stringent regulatory frameworks and growing consumer emphasis on eco-credentials. European markets favor natural fibers such as linen and wool for premium apparel and interior applications, while the region’s chemicals and sustainability legislation continues to drive investment in recycled and bio-based thread innovations.

Asia-Pacific remains the largest sewing thread market by revenue, fueled by expanding apparel manufacturing hubs, rapid internet penetration, and the growth of online sales channels. In 2024, the global online segment generated nearly USD 952 million, with Asia-Pacific leading in digital distribution as manufacturers and hobbyists alike embrace e-commerce platforms for procurement.

This comprehensive research report examines key regions that drive the evolution of the Sewing Thread market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Manufacturer Strategies Innovation Collaborations and Sustainability Initiatives Shaping Competitive Dynamics in the Global Sewing Thread Industry

Coats Group, the world’s largest thread manufacturer, is nearing a milestone of 50 percent usage of preferred raw (non-virgin oil-based) materials, with 46 percent achieved in 2024. The company has set ambitions to reach 60 percent by the end of 2026 and eliminate virgin oil-based inputs by 2030, while reducing scope 1 and scope 2 emissions by 51 percent since 2022.

AMANN Group has distinguished itself through Cradle to Cradle Certified® Gold sustainable product lines and the opening of a cutting-edge facility in Ranipet, India. This plant operates on zero liquid discharge, powers production exclusively with renewable energy, and embodies AMANN’s circular economy ethos by delivering 100 percent compostable or reprocessable thread materials.

American & Efird (A&E), under the Elevate Textiles umbrella, launched its Anecot Plus SPC and Chroma SPC cotton threads with Gold Level Cradle to Cradle Material Health Certifications in 2023. Complemented by Elevate’s 2025 Sustainability Report detailing progress on greenhouse gas reductions, water consumption targets, and new renewable energy projects, A&E continues to lead the industry toward environmentally responsible solutions.

Smaller innovators are also shaping the competitive landscape by offering digital color matching platforms and advanced simulation tools-such as AMANN’s DMIx Cloud-to optimize thread selection processes, reduce production waste, and meet evolving customer expectations for customization and rapid sampling.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sewing Thread market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMANN & Söhne GmbH & Co KG

- American & Efird LLC

- Apex TransGulf

- AURIFIL Srl

- Coats Group PLC

- Colossustex Private Limited

- Durak Tekstil San. Ve Tic. A.Ş.

- FUJIX Ltd.

- Gunze Limited

- HAPETE

- Jawala Poly Threads

- KDS Accessories Limited

- Maine Thread Company

- Modi Threads

- Ningbo MH Industry Co., Ltd.

- Nishat Mills Limited

- Pacific Tex

- Royal Embroidery Threads Pvt. Ltd.

- Sarla Performance Fibers Limited

- Shenzhen Shunlong Thread Co., Ltd.

- Simtex Industries Ltd.

- Somac Threads Ltd

- Superior Threads

- Tamishna Group

- Threads (India) Private Limited

- Vardhman Yarns & Threads Ltd.

- Well Group

- Yiwu Huading Nylon Co., Ltd.

- Zhejiang Doeast Thread Co.,ltd.

Providing Targeted Actionable Insights and Strategic Imperatives to Help Industry Leaders Navigate Market Disruptions Regulatory Shifts and Evolving Consumer Expectations Effectively

Industry leaders should expand material portfolios to include bio-based, recycled, and blended fibers that align with circular economy principles, capitalizing on growing consumer demand for sustainable sourcing and certifications. Tailoring product lines to meet rigorous environmental standards can unlock premium positioning and long-term differentiation in a crowded marketplace.

Investing in digitalization across manufacturing and supply chain operations will deliver measurable efficiency gains and transparency. AI-driven demand forecasting, IoT-enabled quality control, robotics-driven automation, and digital twin modeling can collectively improve throughput, reduce waste, and ensure compliance with traceability mandates, driving operational resilience and cost competitiveness.

In response to tariff volatility, organizations must diversify sourcing strategies, establish alternate manufacturing partnerships outside of high-duty zones, and vigilantly manage trade compliance. Proactively pursuing tariff exclusions, leveraging free trade agreements, and nearshoring critical production processes will mitigate regulatory exposure and stabilize input costs.

Enhancing e-commerce and direct-to-consumer channels will capture the expanding digital customer segment. Strengthening online platforms, integrating seamless order management, and deploying data analytics for personalized marketing will bolster market reach and fortify customer loyalty in both individual and industrial buyer communities.

Detailing Rigorous Research Design Data Sources and Analytical Frameworks That Ensure Accurate Comprehensive and Reliable Insights Into the Global Sewing Thread Market

This analysis is grounded in a robust research design combining primary and secondary methodologies. Extensive interviews with senior executives across leading thread manufacturers and industry associations provided qualitative insights into strategic priorities and emerging challenges.

Secondary data collection drew from government databases, including USTR tariff documentation, trade association publications, sustainability reports from top industry players, and peer-reviewed academic research to ensure factual accuracy. Key market segmentation frameworks were validated through triangulation of company disclosures and sector-specific statistical databases.

Quantitative analyses employed historical trade flow and production data, while qualitative trend assessments leveraged expert opinions to contextualize technological, regulatory, and consumer behavior shifts. Rigorous cross-verification of findings ensures that the insights presented are both comprehensive and actionable for stakeholders operating in this dynamic market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sewing Thread market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sewing Thread Market, by Fiber Type

- Sewing Thread Market, by Product Type

- Sewing Thread Market, by Application

- Sewing Thread Market, by Distribution Channel

- Sewing Thread Market, by Region

- Sewing Thread Market, by Group

- Sewing Thread Market, by Country

- United States Sewing Thread Market

- China Sewing Thread Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Summarizing Key Findings and Strategic Perspectives to Reinforce Market Context and Guide Stakeholders Toward Informed Decisions in the Fast Changing Sewing Thread Industry

The global sewing thread market is poised at a pivotal intersection of technological innovation, regulatory complexity, and sustainability ambition. Advanced digital tools and automation are enabling unprecedented levels of efficiency and customization, while evolving trade policies and tariffs necessitate agile supply chain strategies.

Segmentation analyses reveal differentiated growth drivers across fiber types, manufacturing processes, distribution channels, and application areas, underscoring the importance of tailored product portfolios and go-to-market approaches. Regional insights highlight the imperative for localized sourcing, compliance readiness, and digital engagement strategies to fully capitalize on market potential across the Americas, EMEA, and Asia-Pacific.

Leading companies are demonstrating that sustainability and profitability are not mutually exclusive, evidenced by significant investments in circular materials, renewable energy, and closed-loop manufacturing systems. To maintain competitive advantage, stakeholders must embrace data-driven decision-making, reinforce trade compliance capabilities, and deepen customer-centric innovation initiatives.

By aligning strategic priorities with emerging trends, manufacturers, suppliers, and brands can confidently navigate market disruptions, fulfill rising customer expectations, and forge a resilient path toward long-term growth in the global sewing thread industry.

Inviting Direct Engagement With Our Associate Director of Sales Marketing for Personalized Guidance and to Secure Comprehensive Access to the Full In Depth Sewing Thread Market Research Report

We invite our readers to initiate a conversation with Ketan Rohom, our Associate Director of Sales & Marketing, to explore how our in-depth market research can address your strategic challenges and unlock growth opportunities in the global sewing thread market. Ketan’s expertise in customizing insights and aligning research deliverables to specific business needs ensures that you receive tailored guidance that drives value. Reach out today to secure your full report, engage in a personalized briefing, and gain the competitive intelligence required to stay ahead in this dynamic industry.

- How big is the Sewing Thread Market?

- What is the Sewing Thread Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?