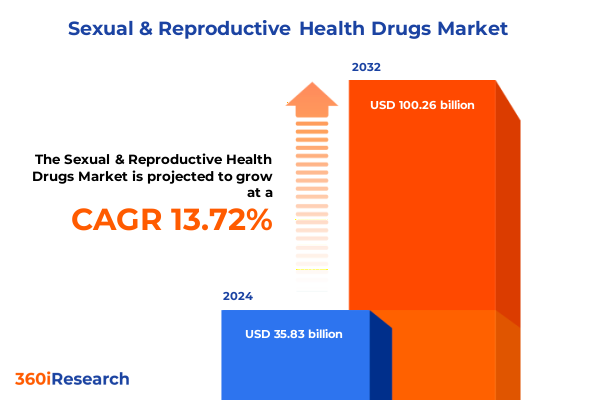

The Sexual & Reproductive Health Drugs Market size was estimated at USD 40.72 billion in 2025 and expected to reach USD 46.00 billion in 2026, at a CAGR of 13.73% to reach USD 100.26 billion by 2032.

Comprehensive Overview of Evolving Sexual and Reproductive Health Drug Landscape Highlighting Core Market Dynamics and Unmet Medical Needs

The landscape of sexual and reproductive health pharmaceuticals is undergoing a period of profound transformation driven by evolving patient demographics, unmet clinical needs, and breakthroughs in drug delivery technologies. For decades, oral contraceptives and antiretroviral therapies formed the backbone of this therapeutic segment, but recent years have seen an influx of novel modalities-from long-acting implants to targeted hormonal treatments-reshaping how healthcare providers and patients engage with preventive and therapeutic options. Against this backdrop, stakeholders must navigate increasingly complex regulatory environments while addressing cost pressures, supply chain disruptions, and the imperative for patient-centricity.

In today’s environment, the convergence of artificial intelligence-enabled formulation development and digital health platforms has accelerated time to patient access, enabling manufacturers to tailor regimens to individual risk profiles and life stages. Concurrently, evolving regulatory frameworks in key markets such as the United States and Europe are placing greater emphasis on real-world evidence and patient-reported outcomes, prompting biopharmaceutical companies to reevaluate trial designs and post-market surveillance strategies. As the demand for personalized solutions intensifies, the balance between innovation and affordability remains paramount, necessitating strategic collaborations across the value chain. This executive summary presents an integrated overview of market dynamics, regulatory catalysts, and competitive maneuvers that define the sexual and reproductive health drug sector today.

Critical Transformative Forces Reshaping the Sexual and Reproductive Health Drug Sector Through Technological and Regulatory Breakthroughs

The sector has witnessed several transformative shifts that have redefined therapeutic paradigms and patient expectations. Technological advancements such as microarray-based hormone screening and sustained-release polymer coatings have unlocked new possibilities for once-a-year contraceptive implants and depot formulations, moving beyond the traditional daily or monthly dosing schedules. These innovations are supplemented by precision medicine approaches that leverage genomic data to predict treatment response in fertility therapies, thereby enhancing both efficacy and safety profiles.

Meanwhile, regulatory agencies are increasingly adopting accelerated approval pathways for therapies addressing unmet needs, particularly in areas such as HIV pre-exposure prophylaxis and male infertility. This regulatory agility has encouraged pharmaceutical firms to invest in robust post-launch evidence generation programs, facilitating earlier access while safeguarding public health. Coupled with rising telehealth adoption for consults and prescription management, these shifts have collectively democratized access to critical therapies, empowering patients to participate actively in care decisions and reinforcing a shift toward decentralized clinical trials.

Analyzing the Cumulative Effects of Recent United States Tariff Adjustments on Accessibility Cost Structures and Supply Chains in Reproductive Health

In 2025, a series of tariff adjustments implemented by the United States on active pharmaceutical ingredients and finished drug imports have exerted a measurable impact on cost structures and the accessibility of reproductive health medications. These policy shifts have prompted manufacturers to reevaluate sourcing strategies, particularly for components derived from markets with high import duties. As a result, supply chain resilience has become a strategic priority, with leading companies establishing dual-sourcing agreements and qualifying alternative manufacturing sites in tariff-friendly jurisdictions.

The ripple effects of these tariff changes extend to distributors and pharmacies, where increased procurement costs have tested margins and fueled discussions around reimbursement policy adaptations. In response, payers and providers are exploring value-based contracting and risk-sharing frameworks to mitigate patient out-of-pocket burdens while maintaining sustainable industry economics. This dynamic interplay between trade policy and healthcare delivery underscores the necessity for agile decision-making and collaborative engagement among government agencies, manufacturers, and healthcare ecosystems to ensure uninterrupted patient access to essential sexual and reproductive health therapies.

In-Depth Segmentation Insights Revealing Diverse Patient Needs and Market Trends Across Therapeutic Classes and Delivery Channels

A nuanced understanding of the segment hierarchy reveals distinct growth trajectories and patient priorities across therapeutic classes and administration routes. Contraceptives, for instance, now encompass a spectrum from oral tablets to subdermal implants, each offering unique advantages in terms of dosing frequency and adherence. Injectable hormonal therapies have surged in popularity among populations seeking extended duration, whereas transdermal patches cater to patients prioritizing noninvasive administration and minimized systemic peaks.

Equally, erectile dysfunction treatments continue to evolve with next-generation phosphodiesterase inhibitors, supported by digital adherence tools that reinforce dosing schedules. Fertility drugs demonstrate a rich tapestry of pharmacologic mechanisms, from GnRH analogues designed for controlled ovarian stimulation to targeted ovulation inducers that improve cycle predictability. In the domain of HIV prevention, emtricitabine- and tenofovir-based antiretrovirals have set new standards for safety and tolerability, complemented by combination therapies that simplify regimens. Across all categories, distribution channels vary widely-from hospital pharmacies to e-commerce platforms-impacting patient access and channel economics. Moreover, segmentation by prescription status underscores the growing prominence of over-the-counter options in hormonal therapies, while the dichotomy of home care versus clinic-based administration continues to shape adoption patterns.

This comprehensive research report categorizes the Sexual & Reproductive Health Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Mechanism Of Action

- Prescription Status

- Route Of Administration

- Distribution Channel

- End User

Strategic Regional Dynamics Uncovered Demonstrating Variations in Demand Innovation Adoption and Healthcare Infrastructure Across Major Geographies

Geographic disparities play a pivotal role in determining market access strategies and innovation diffusion. In the Americas, a mature healthcare infrastructure and favorable reimbursement environment have fostered rapid uptake of long-acting contraceptive platforms and telemedicine-enabled consultation services. By contrast, Europe, the Middle East, and Africa exhibit heterogeneous regulatory regimes, where advanced economies lead in biosimilar and generic adoption, while emerging markets navigate the balance between affordability and the introduction of novel branded therapies.

Shifting focus to the Asia-Pacific region, robust private-sector investment and favorable population demographics have accelerated demand for fertility treatments and HIV prophylaxis. Local government incentives supporting manufacturing capacity expansion have further driven regional supply chain optimization. In this context, culturally tailored patient education programs and digital outreach campaigns have proven effective in raising awareness and enhancing adherence. Understanding these regional nuances is essential for designing targeted go-to-market strategies and ensuring equity in access to critical sexual and reproductive health medications across diverse healthcare environments.

This comprehensive research report examines key regions that drive the evolution of the Sexual & Reproductive Health Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Landscape Analysis Highlighting Key Players’ Strategic Alliances Innovations and Market Positioning within Sexual and Reproductive Health Pharma

The competitive landscape is marked by dynamic alliances, acquisitions, and cross-sector partnerships that reinforce market positioning and accelerate innovation. Legacy pharmaceutical giants have strengthened their portfolios through targeted acquisitions of niche biotech firms specializing in hormonal formulation patents and novel delivery technologies. Simultaneously, emerging players are leveraging digital health platforms and artificial intelligence-driven patient support tools to differentiate their offerings.

In the generics arena, companies with scalable manufacturing capabilities are vying for leadership in oral contraceptive and antiretroviral segments, capitalizing on patent expirations to secure volume contracts with payers and government programs. Meanwhile, specialty pharma entities are forging collaborations with contract development and manufacturing organizations to co-develop advanced injectable and transdermal systems. These strategic maneuvers underscore a competitive ethos focused on both breadth of portfolio and depth of technological expertise, ultimately shaping the future contours of the sexual and reproductive health drug market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sexual & Reproductive Health Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Amneal Pharmaceuticals, Inc.

- Aurobindo Pharma Limited

- Bayer AG

- Cipla EU Limited

- Cipla Limited

- Dr. Reddy's Laboratories Ltd.

- GlaxoSmithKline plc

- Hikma Pharmaceuticals PLC

- Johnson & Johnson

- Lupin Limited

- Mayne Pharma Group Limited

- Merck & Co., Inc.

- Mithra Pharmaceuticals SA

- Novartis AG

- Pfizer Inc.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

- Theramex HQ UK Limited

- Viatris Inc.

Actionable Strategic Recommendations to Empower Industry Leaders in Navigating Complex Regulatory Landscapes and Accelerating Patient-Centric Drug Development Pipelines

Industry leaders aiming to capitalize on emerging opportunities should prioritize initiatives that foster ecosystem collaboration and accelerate patient-centered innovation. By investing in interoperable digital platforms, organizations can bridge gaps between clinical trial data and real-world evidence, thus facilitating regulatory submissions and payer negotiations. Additionally, pursuing strategic partnerships with contract manufacturing entities in tariff-friendly jurisdictions will mitigate supply chain risk and control cost volatility.

Furthermore, the adoption of value-based contracting frameworks with payers can align incentives around health outcomes, ensuring that pricing models reflect therapeutic impact and long-term adherence. Emphasizing patient education through digital channels and community outreach will strengthen brand trust and improve compliance rates. Lastly, integrating advanced analytics into pharmacovigilance systems will support proactive safety monitoring and reinforce post-market surveillance obligations, thereby enhancing overall public health outcomes and reinforcing corporate reputation in a sensitive therapeutic domain.

Rigorous Multi-Method Research Methodology Ensuring Accurate Data Integrity and Robust Analysis through Diverse Primary and Secondary Approaches

Our research methodology integrates a multi-method approach to ensure data integrity and analytical rigor. Primary research included in-depth interviews with key opinion leaders, endocrinologists, reproductive health specialists, and procurement officers across hospital and retail pharmacy settings. Complementing this qualitative insight, a comprehensive review of regulatory filings, clinical trial registries, and patent databases provided a robust foundation for understanding innovation pipelines and approval trajectories.

Secondary research encompassed a critical analysis of peer-reviewed publications, health economics studies, and digital health adoption reports. Additionally, proprietary data modeling and segmentation frameworks were applied to assess route of administration preferences, prescription status trends, and distribution channel efficiencies. To validate findings, an expert advisory panel convened periodic workshops to challenge assumptions and refine interpretations. This rigorous methodology underpins the credibility of our insights, ensuring that stakeholders can deploy the report’s findings with confidence and precision.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sexual & Reproductive Health Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sexual & Reproductive Health Drugs Market, by Drug Class

- Sexual & Reproductive Health Drugs Market, by Mechanism Of Action

- Sexual & Reproductive Health Drugs Market, by Prescription Status

- Sexual & Reproductive Health Drugs Market, by Route Of Administration

- Sexual & Reproductive Health Drugs Market, by Distribution Channel

- Sexual & Reproductive Health Drugs Market, by End User

- Sexual & Reproductive Health Drugs Market, by Region

- Sexual & Reproductive Health Drugs Market, by Group

- Sexual & Reproductive Health Drugs Market, by Country

- United States Sexual & Reproductive Health Drugs Market

- China Sexual & Reproductive Health Drugs Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Conclusive Reflections Emphasizing Core Findings Imperatives and Overarching Themes Shaping Future Directions in Sexual and Reproductive Health Drug Innovation

Through this executive summary, we have charted the major forces steering the sexual and reproductive health drug market, from technological breakthroughs and regulatory shifts to tariff-induced supply chain realignments. We have unpacked segmentation nuances, regional dynamics, and competitive strategies that collectively define the current state of the sector. Moreover, we have outlined actionable recommendations designed to guide industry leaders in implementing patient-centric, cost-effective, and compliant solutions.

As the therapeutic landscape continues to evolve, the ability to synthesize multifaceted insights into coherent strategies will distinguish market leaders from the rest. The convergence of digital health, precision medicine, and innovative drug delivery platforms presents unprecedented opportunities to enhance patient outcomes and drive sustainable growth. In closing, the insights presented here serve as a strategic compass, equipping decision-makers with the knowledge necessary to navigate a complex and rapidly transforming market environment.

Engaging Call-To-Action Inviting Collaboration with Associate Director Sales and Marketing to Unlock Comprehensive Insights and Drive Strategic Decisions

Unlock unparalleled strategic advantage by partnering directly with Ketan Rohom, Associate Director of Sales & Marketing, to access the full scope of our comprehensive sexual and reproductive health drug market research report. The depth of analysis contained within this report will empower your organization to anticipate market shifts, optimize product portfolios, and drive stakeholder engagement with data-driven confidence. By collaborating with Ketan Rohom, you gain immediate access to tailored insights, bespoke briefings, and ongoing support designed to translate research findings into actionable business strategies that align with your corporate objectives and foster sustainable growth.

- How big is the Sexual & Reproductive Health Drugs Market?

- What is the Sexual & Reproductive Health Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?