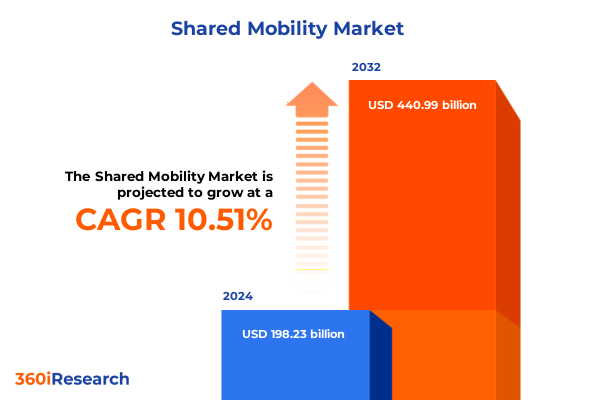

The Shared Mobility Market size was estimated at USD 217.80 billion in 2025 and expected to reach USD 239.30 billion in 2026, at a CAGR of 10.60% to reach USD 440.99 billion by 2032.

Setting the Stage for a New Era of Urban Mobility by Contextualizing Shared Services, Consumer Expectations, and Emerging Technological Drivers

Shared mobility has rapidly evolved from a peripheral convenience to a transformative pillar in urban transportation systems, redefining how people and communities navigate metropolitan landscapes. This introduction delves into the convergence of shifting consumer expectations, technological advancements, and sustainability imperatives that have catalyzed the proliferation of bike sharing, car sharing, microtransit, ride sharing, and ride-hailing services. As regulators, city planners, and private operators converge on integrated mobility frameworks, the traditional paradigms of vehicle ownership and public transit are being reimagined through on-demand and subscription-based models.

Furthermore, the proliferation of electric vehicles, blockchain-enabled payment solutions, and Internet of Things–driven asset tracking has created a fertile environment for experimentation and rapid iteration. Against this backdrop, consumer affinity for seamless user interfaces and customizable service experiences has fostered a highly competitive landscape, compelling stakeholders to innovate across service models-from docked and dockless docked bicycles to one-way car-sharing platforms and shuttle-based microtransit loops. This introduction sets the stage for an in-depth exploration of market drivers, cross-sector collaborations, and the strategic priorities that will shape the next generation of shared mobility ecosystems.

Navigating the Disruption of Traditional Transport through Electrification, On-Demand Services, Blockchain Integration, and Evolving User Expectations

Urban transportation landscapes are undergoing a profound metamorphosis driven by electrification, automated systems, and evolving consumer behaviors. The shift from fossil fuel–dependent fleets to electric vehicles and hybrid propulsion strategies reflects a broader commitment to decarbonization and regulatory compliance. Simultaneously, advancements in mobile application interfaces and real-time data analytics have elevated consumer expectations for reliability and responsiveness, transforming on-demand ride-sharing services into seamless digital experiences.

In parallel, blockchain technology has emerged as a disruptive enabler for secure identity verification and transparent payment solutions, fostering trust between users and service operators. These technological integrations are redefining traditional service boundaries, allowing for dynamic pooling of resources and multimodal trip planning. As cities adapt to these innovations, policy frameworks are being recalibrated to support infrastructure investments, such as expanded charging networks and dedicated microtransit corridors, ensuring that transformative shifts translate into sustainable operational models.

Assessing the Multifaceted Impact of 2025 United States Tariffs on Shared Mobility Supply Chains, Pricing Dynamics, and Service Viability

The introduction of tariffs by the United States in early 2025 has exerted multifaceted pressure on shared mobility operators, suppliers, and end users alike. Imported components for electric bicycles, charging stations, and specialized fleet vehicles now face elevated cost structures, compelling manufacturers to reassess sourcing strategies and negotiate alternative supply chain routes. This recalibration has had a cascading effect, as upstream cost increases translate into unit pricing adjustments and margin compressions for fleet operators.

Moreover, the tariff landscape has galvanized efforts to onshore manufacturing capabilities and establish regional production hubs, thereby insulating service providers from future policy volatility. Operators embracing vertically integrated models are leveraging domestic partnerships to streamline procurement, while others are exploring strategic alliances with local assemblers and technology vendors. As these shifts gain momentum, a renewed focus on operational efficiency, modular design, and total cost of ownership analyses has become imperative for sustaining service viability in a high-tariff environment.

Unveiling Comprehensive Segmentation Insights to Decode the Diverse Service Types, Business Models, Usage Patterns, and Technological Drivers in Shared Mobility

A nuanced understanding of service type segmentation reveals that docked and dockless bicycle sharing solutions coexist alongside one-way and round-trip car sharing schemes, on-demand and shuttle-based microtransit, and both peer-to-peer and business-to-consumer ride-hailing models, each tailored to specific urban use cases and deployment contexts. These service offerings are complemented by diverse usage patterns, ranging from instant on-demand access to reserved scheduling and subscription-based access tiers that foster customer loyalty.

In examining propulsion type, operators are increasingly integrating electric vehicles to meet sustainability criteria, even as internal combustion engine platforms-powered by diesel or petrol-continue to serve markets with limited charging infrastructure. Vehicle type segmentation further underscores the market’s complexity, with four-wheeled assets such as cars and vans fulfilling group and last-mile needs, while two-wheeler configurations encompassing traditional bicycles, motorbikes, and e-bikes address individual commuter segments.

Diving deeper into user demographics, the corporate sector leverages shared mobility for both business travel and employee transportation, whereas individual users encompass daily commuters and leisure travelers. Concurrently, membership-based access models-available as annual or monthly subscriptions-operate alongside pay-per-use options that charge by the hour or per kilometer, supported by technologies like blockchain for secure payments, IoT systems for fleet tracking and charging network monitoring, and intuitive mobile applications for both driver and end-user interfaces. Age-based segmentation highlights strong adoption among young adults aged 18 to 25 and a growing presence in the 26 to 40 demographic, as well as emerging opportunities among consumers older than 40. End-user type segmentation further differentiates corporate shuttle and employee transport solutions, educational institution partnerships, and individual consumer memberships.

This comprehensive research report categorizes the Shared Mobility market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Business Model

- Propulsion Type

- Vehicle Type

- User Type

- Business Model

Unraveling Key Regional Dynamics Shaping Shared Mobility Adoption and Growth Trajectories across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the adoption and evolution of shared mobility solutions, with distinct growth trajectories emerging across the Americas, Europe, Middle East & Africa, and Asia-Pacific geographies. In the Americas, urban centers with advanced infrastructure and progressive regulations have become incubators for electric microtransit and subscription-led bike-sharing innovations, while suburban markets lean on ride-hailing as a complementary transit solution.

By contrast, the Europe, Middle East & Africa region is witnessing a confluence of regulatory incentives and public–private partnerships that accelerate fleet electrification and data-sharing initiatives, particularly in dense metropolitan corridors. Sustainable mobility frameworks are supported by cohesive policy frameworks, enabling service providers to pilot autonomous shuttles and integrated mobility-as-a-service platforms.

Meanwhile, the Asia-Pacific landscape is characterized by rapid urbanization, high population density, and mobile-first consumer behaviors that fuel explosive growth in on-demand ride-sharing and e-bike deployments. Infrastructure constraints in certain markets have spurred creative microtransit networks and electric van-sharing models, demonstrating how regional factors-from regulatory environments to cultural attitudes toward vehicle ownership-influence strategic priorities and investment patterns.

This comprehensive research report examines key regions that drive the evolution of the Shared Mobility market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Pioneering Collaborative Ecosystems, Technological Innovation, and Service Diversification in Shared Mobility

Industry-leading companies have distinguished themselves through the development of open mobility platforms and strategic alliances that foster ecosystem growth. These players are collaborating with automotive OEMs, energy providers, and city agencies to integrate shared services into broader urban mobility frameworks. By leveraging advanced analytics and machine learning, they refine predictive maintenance schedules, optimize vehicle utilization rates, and enhance route planning for microtransit solutions.

Furthermore, partnerships with software developers and network operators have enabled the rollout of seamless user and driver interfaces that support contactless payments, dynamic pricing, and real-time availability updates. The integration of blockchain-based identity management systems has boosted user trust and compliance with data privacy regulations, while investments in electric charging infrastructures underscore a commitment to carbon reduction goals. Through these initiatives, top-tier operators are setting new benchmarks for service reliability, operational resilience, and customer satisfaction in the shared mobility ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Shared Mobility market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avis Budget Group, Inc.

- BlaBlaCar

- BluSmart Mobility

- Bolt Technology OÜ

- Cabify España, SL

- Carzato

- Deutsche Bahn Connect GmbH

- DiDi Global Inc.

- Enterprise Holdings, Inc.

- Free2Move

- Getaround, Inc.

- GreenGo

- Hertz System, Inc.

- Lyft, Inc.

- Mahindra Logistics

- movmi Shared Transportation Services Inc.

- Revv

- Ridecell Inc.

- Superpedestrian, Inc.

- Uber Technologies Inc.

- WunderCar Mobility Solutions GmbH

- Yulu

- Zoomcar Ltd.

Delivering Strategic and Actionable Recommendations to Empower Industry Leaders in Driving Sustainability, Scalability, and Customer-Centric Growth

To capitalize on emerging opportunities, industry leaders should prioritize aligning shared mobility initiatives with net-zero targets and electrification roadmaps, ensuring that fleet transitions dovetail with broader sustainability agendas. Investments in modular vehicle platforms and localized assembly enable rapid adaptation to tariff-induced cost fluctuations and regulatory shifts. Embracing hybrid usage models-combining pay-per-use and subscription-based offerings-can diversify revenue streams and deepen customer engagement by catering to both episodic and frequent riders.

Additionally, partnerships with academic institutions can yield valuable insights into consumer behavior and urban planning trends, thereby informing new service blueprints such as demand-responsive microtransit loops and last-mile electric bike-sharing hubs. Integrating blockchain solutions for secure identity and payment verification will enhance transaction transparency and streamline KYC procedures. Ultimately, cultivating a culture of continuous innovation and stakeholder collaboration will empower operators to scale operations, mitigate risks, and secure a competitive advantage in a rapidly evolving marketplace.

Elucidating Rigorous Mixed-Method Research Methodologies Spanning Quantitative Analysis, Qualitative Interviews, and Data Validation Processes

The research methodology combines quantitative analysis of large-scale mobility usage datasets with qualitative interviews of key stakeholders, ensuring a comprehensive understanding of market dynamics. Primary data collection involved surveying both corporate clients and individual consumers to capture diverse perspectives on service adoption drivers, pain points, and satisfaction metrics. Secondary sources included academic journals, regulatory filings, and proprietary technology performance data to validate emerging trends and benchmark operational benchmarks.

To enhance data integrity, advanced statistical techniques were applied to identify anomalies and outliers, while machine learning algorithms facilitated cluster analysis across user demographics and service types. Expert roundtables with city planners, vehicle manufacturers, and technology providers enriched the contextual insights, revealing implications for infrastructure planning and policy frameworks. This mixed-methods approach ensures rigor, reproducibility, and actionable insights that bridge the gap between theoretical projections and real-world operational considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Shared Mobility market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Shared Mobility Market, by Service Type

- Shared Mobility Market, by Business Model

- Shared Mobility Market, by Propulsion Type

- Shared Mobility Market, by Vehicle Type

- Shared Mobility Market, by User Type

- Shared Mobility Market, by Business Model

- Shared Mobility Market, by Region

- Shared Mobility Market, by Group

- Shared Mobility Market, by Country

- United States Shared Mobility Market

- China Shared Mobility Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Core Conclusions to Illuminate the Future Trajectory, Emerging Opportunities, and Strategic Imperatives in Shared Mobility

In synthesizing the findings, it becomes clear that shared mobility is at an inflection point, poised to deliver significant environmental and social benefits while redefining urban transit ecosystems. The convergence of electric propulsion, digital platforms, and advanced analytics has created a virtuous cycle of innovation, driving efficiency gains and service accessibility. However, external factors such as policy changes and supply chain disruptions underscore the necessity for resilience and adaptive operational models.

Looking ahead, the proliferation of integrated mobility-as-a-service platforms will hinge on interoperability agreements, real-time data exchanges, and consumer-centric design principles. As user preferences evolve, tailored segmentation strategies and flexible pricing mechanisms will be critical for expanding market penetration. Ultimately, the strategic imperatives identified in this study provide a roadmap for stakeholders to navigate complexity, harness emergent opportunities, and chart a sustainable growth trajectory in the shared mobility sector.

Engaging with Associate Director Ketan Rohom to Unlock Exclusive Insights and Secure a Customized Shared Mobility Research Partnership

Interested stakeholders are invited to connect directly with Ketan Rohom, the Associate Director of Sales & Marketing, to explore tailored data-driven solutions and strategic consulting services that align with organizational objectives and growth imperatives. Engaging in a collaborative dialogue unlocks an opportunity for deep-dive discussions on critical market drivers, competitive benchmarks, and customized go-to-market roadmaps designed to accelerate deployment of shared mobility offerings. Through a structured consultation framework, Ketan Rohom facilitates the identification of pivotal insights, risk mitigation strategies, and partnership models that can propel service innovation and operational excellence.

By reaching out, decision-makers gain privileged access to proprietary intelligence, early insights into nascent trends, and a roadmap for integrating advanced analytics into strategic planning. This engagement serves as a catalyst for transforming conceptual initiatives into actionable plans, supported by expert guidance on stakeholder alignment, regulatory navigation, and technological integration. The collaborative exchange culminates in a bespoke partnership proposal, designed to address unique challenges and prioritize high-impact initiatives. Prospective clients and partners are encouraged to initiate contact today to unlock the full potential of shared mobility within their enterprise ecosystems.

- How big is the Shared Mobility Market?

- What is the Shared Mobility Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?