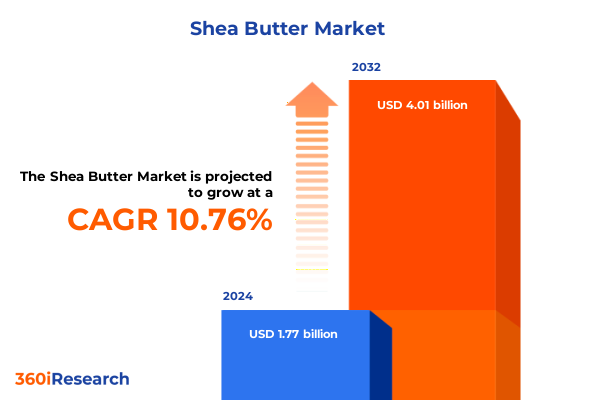

The Shea Butter Market size was estimated at USD 1.96 billion in 2025 and expected to reach USD 2.15 billion in 2026, at a CAGR of 10.77% to reach USD 4.01 billion by 2032.

Unlocking the Multifaceted Potential of Shea Butter Across Industries with Insight into Origins Characteristics and Growth Drivers

Shea butter has emerged as a cornerstone ingredient across a diverse array of industries, prized for its versatile functionality, natural origin, and nourishing properties. This rich, creamy lipid extract is derived from the karité nuts of the Vitellaria paradoxa tree native to West Africa, where traditional extraction methods have been refined over centuries. Today, commercial processing harmonizes artisanal techniques with modern technologies, delivering consistent quality that meets stringent global standards. Moreover, its molecular profile-characterized by high stearic and oleic acid content-underpins its stability and emollient effectiveness, fueling demand from food, cosmetics, pharmaceuticals, and industrial manufacturers alike.

As consumer awareness of sustainability and ingredient transparency grows, shea butter has solidified its standing as a preferred natural alternative in formulations. Ethical sourcing initiatives and fair-trade practices have become fundamental drivers, aligning supply chain partners from rural cooperatives to multinational corporations. Consequently, the shea butter landscape is evolving beyond raw material procurement into a story of socioeconomic empowerment, community development, and environmental stewardship. This narrative resonates deeply with conscious consumers, establishing shea butter as more than a commodity, but as a catalyst for positive impact.

This executive summary provides a concise yet robust exploration of the market environment, transformative forces, regulatory influences, segmentation breakdowns, regional dynamics, competitive profiles, and strategic considerations shaping the global shea butter landscape. It equips decision-makers with an integrated view of current trends and actionable insights that will inform high-impact strategies and foster resilient growth trajectories.

Tracing the Evolutionary Shifts Redefining the Shea Butter Industry as Innovations Sustainability and Consumer Preferences Drive New Market Horizons

The shea butter sector is experiencing transformational shifts driven by innovation, regulatory evolution, and changing consumer paradigms. Advances in extraction technologies have reduced processing times and preserved bioactive compounds, enabling producers to deliver both conventional deodorized butter and specialized lightly refined variants with superior sensory profiles. At the same time, liquid shea oil formulations are gaining traction for applications requiring rapid absorption, while raw butter is celebrated for its full-spectrum nutrient composition. These product advancements are reshaping formulation strategies across personal care and industrial applications.

Concurrently, an intensified regulatory focus on natural product labeling and ingredient traceability has prompted companies to implement blockchain and digital certification tools, elevating transparency throughout the value chain. This shift has compelled suppliers to adapt, forging partnerships with certification bodies to validate organic cosmetic grade and food grade classifications. Sustainability initiatives, including regenerative agriculture practices and community empowerment programs, have become foundational, influencing how botanical raw materials are sourced and processed.

Moreover, evolving consumer preferences toward multifunctional, clean-label ingredients have sparked innovative product launches that integrate shea butter into hair care systems-ranging from conditioners that leverage rich fatty acids to shampoos formulated for gentle cleansing-and skin care regimes where moisturizers, body lotions, and face creams harness its restorative benefits. These transformative shifts underscore a dynamic market landscape, where innovation and authenticity converge to define the next frontier of shea butter applications.

Examining the Cumulative Effects of 2025 United States Tariff Measures on Shea Butter Supply Chains Costs and Industry Strategies

The implementation of updated United States tariff measures in early 2025 has exerted a multifaceted impact on the shea butter trade, influencing both cost structures and strategic sourcing decisions. Hitherto, shea butter was predominantly classified under preferential duty regimes, enabling importers to leverage reduced tariffs when adhering to specific origin and certification criteria. However, the 2025 adjustments introduced incremental duties on refined and deodorized products, prompting a recalibration of supplier contracts and pricing models.

Importers and domestic formulators have responded by renegotiating procurement terms, shifting volumes toward raw and lightly refined butter that still benefit from lower tariff brackets. This recalibration has placed premium on vertically integrated supply chains, with companies exploring direct partnerships with West African cooperatives to secure preferential margin structures. At the same time, the increased cost pressure has accelerated the adoption of localized refining capacities in strategic distribution hubs, mitigating tariff exposure and reducing lead times for value-added variants.

These tariff dynamics have also influenced product innovation, as industry players refine formulations to utilize higher ratios of minimally processed shea butter, thereby offsetting incremental duty impacts while meeting consumer demand for unadulterated natural ingredients. Regulatory alignment efforts are now complemented by logistical optimizations, such as consolidated shipping models and duty drawback programs, to preserve competitiveness within the US market. Ultimately, the 2025 tariffs have reshaped procurement and production strategies, driving resilience through supply chain diversification and operational agility.

Deep Diving into Key Segmentation Insights Illuminating How Form Source Grade Application and Distribution Dynamics Shape Shea Butter Demand

In analyzing shea butter demand patterns, form diversity emerges as a critical determinant of application suitability. Deodorized butter, with its neutral scent profile, continues to dominate personal care formulations, whereas raw butter retains favor in niche artisanal and culinary uses for its unfiltered aroma. Liquid oil, valued for its enhanced spreadability and infusion potential, is carving out a distinct segment in specialized hair oils and advanced cosmetic constructs. Refined butter, split between fully refined and lightly refined variants, satisfies strict purity requirements in pharmaceutical excipients and food ingredients.

The source of raw material-whether cultivated plantations or wild-harvested nuts-further distinguishes supply chains in terms of consistency, traceability, and ecological impact. Cultivated shea farms deliver uniform quality metrics that align with large-scale industrial needs, whereas wild-harvested collections enrich biodiversity and community-based economic models, appealing to brands with sustainability narratives. Grade segmentation divides shea butter into cosmetic, food, and pharmaceutical categories, each tailored by sub-classifications. Conventional cosmetic grade meets baseline safety standards, while organic cosmetic grade delivers certifiable purity for premium personal care offerings. Baking and spread applications capitalize on food grade specifications, providing functional fat matrices for pastry and margarine formulations.

Distribution channel differentiation underscores distinct purchase behaviors and logistical frameworks. Offline retail environments like pharmacies and specialty stores offer experiential touchpoints that educate consumers on body care, hair care, lip care, and skin care solutions, supported by in-store demonstrations. Supermarkets and hypermarkets drive mass consumption of convenience products. Conversely, digital channels through company websites and third-party ecommerce platforms facilitate direct engagement, personalized recommendations, and subscription models. This nuanced segmentation landscape reveals how interplay between form, source, grade, application, and distribution orchestrates market growth trajectories and underpins tailored stakeholder strategies.

This comprehensive research report categorizes the Shea Butter market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Source

- Grade

- Application

- Distribution Channel

Decoding Regional Dynamics by Analyzing How Americas Europe Middle East Africa and Asia-Pacific Contribute to the Global Shea Butter Ecosystem

The Americas remain a cornerstone region for shea butter importers and formulators, fueled by robust demand for personal care innovations and clean-label food ingredients. North American markets, in particular, prioritize traceable sources and sustainability credentials, driving brands to forge direct ties with West African cooperatives. Latin American markets show growing interest in nutraceutical applications, integrating shea derivatives into functional foods and dietary supplements.

Europe, the Middle East, and Africa collectively represent a mosaic of mature and emerging opportunities. Western European consumers exhibit high sensitivity to organic certification and fair trade practices, prompting brands to highlight social impact initiatives within their marketing narratives. Regulatory harmonization across the European Union has streamlined import compliance, fostering inward investment in refining and distribution infrastructure. In the Middle East, luxury personal care segments are experimenting with shea-based formulations that deliver premium positioning, while African markets leverage indigenous knowledge and localized processing to develop culturally resonant body care and therapeutic products.

Asia-Pacific presents dynamic growth prospects driven by rising disposable incomes, evolving beauty standards, and expanding food service sectors. East Asian markets, led by Korea and Japan, are pioneering high-performance cosmetic derivatives incorporating shea butter for anti-aging and barrier-strengthening benefits. Southeast Asia demonstrates increasing adoption in mass-market skincare and hair care segments, supported by e-commerce expansion. Australia and New Zealand emphasize sustainable ingredient sourcing and product transparency, consistently integrating shea butter into organic personal care portfolios. Together, regional dynamics underscore heterogeneous demand drivers, requiring tailored market approaches and supply chain configurations.

This comprehensive research report examines key regions that drive the evolution of the Shea Butter market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Leading Industry Players and Their Strategic Initiatives That Are Shaping Competitive Landscapes in the Expanding Shea Butter Market

Leading companies in the shea butter arena are deploying distinct strategies to capture value and reinforce competitive positioning. Global personal care conglomerates have integrated vertically by investing directly in extraction facilities and community programs, thereby securing preferential access to high-quality raw materials and reinforcing sustainability credentials. Meanwhile, specialty ingredient suppliers are expanding into application-specific derivatives, such as fractionated oils tailored for advanced cosmetic serum formulations and pharmaceutical-grade excipients designed for controlled release matrices.

Collaborations and joint ventures between multinational corporations and local cooperative networks have become commonplace, fostering innovation in traceability and fostering socioeconomic development within producer regions. Companies with robust research and development capabilities are piloting enzyme-assisted processing methods to enhance nutrient retention and deliver next-generation product offerings. Concurrently, small-to-medium enterprises are capitalizing on niche positioning, differentiating through organic certifications and artisanal branding that resonate with discerning consumers seeking authenticity.

Technology providers and logistics partners are also augmenting the competitive landscape by introducing digital supply chain platforms, enabling end-to-end visibility from nut collection to final formulation. This integration enhances quality assurance protocols and accelerates time to market. Ultimately, the confluence of vertical integration, strategic alliances, process innovation, and digital enablement is driving the competitive framework, prompting established players and new entrants alike to continuously refine their value propositions within the expanding shea butter market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Shea Butter market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.G Organica Private Limited

- Alaffia

- Aloe Oil and Butter

- AOS Products Private Limited

- Arjun Bees Wax Industries

- Atomm Botanicals

- Au Natural Organics Company

- Baraka Shea Butter

- Better Shea Butter

- Bulk Apothecary

- Catalynt Solutions, Inc.

- ChemQuest International

- CREMER ERZKONTOR North America Inc.

- Devsar Enterprises LLP

- Diversified Trade Int'l

- Elchemy

- Enmiya USA LLC

- Essential Wholesale

- GLG Industries

- Gustav Heess

- Hallstar Beauty

- James Wild Herbs

- Jedwards International, Inc.

- Manorama Industries Ltd

- Naasakle International

Actionable Strategic Recommendations for Industry Leaders to Optimize Value Chains Enhance Sustainability and Capitalize on Emerging Shea Butter Trends

To thrive in a rapidly evolving shea butter landscape, industry leaders should prioritize forging deeper partnerships with rural cooperatives and invest in regenerative agricultural practices that secure long-term raw material availability while uplifting local communities. By embedding sustainability at the core of supply chain operations, companies can differentiate their brand messaging and meet escalating consumer expectations for ethical sourcing. Simultaneously, expanding localized refining capabilities in key import markets will mitigate the financial impact of tariff fluctuations and reduce lead times for high-value product variants.

Investing in product innovation to develop concentrated fractions and derivative ingredients offers opportunities to address specific functional demands, from barrier-enhancing skincare formulations to stable pharmaceutical carriers. Aligning these innovations with robust clinical validation and clear consumer education initiatives will strengthen market acceptance and premium positioning. To capitalize on shifts in distribution, companies should enhance omnichannel strategies, leveraging direct-to-consumer platforms to deliver personalized experiences and subscription models, while maintaining strong relationships with pharmacies, specialty outlets, and mass retailers for broader market reach.

Finally, adopting digital traceability and quality management solutions will reinforce compliance with evolving regulations and support rapid scalability. By integrating data analytics into procurement and production processes, organizations can optimize cost efficiencies and forecast potential disruptions. These strategic imperatives, when executed in concert, will equip industry leaders to navigate market complexities, drive sustainable growth, and secure competitive advantage in the global shea butter sector.

Comprehensive Overview of Research Methodology Detailing Data Sources Analytical Frameworks and Validation Techniques Underpinning Shea Butter Insights

The insights presented in this report are grounded in a rigorous research methodology that combines qualitative and quantitative approaches to ensure robustness and reliability. Primary data collection involved in-depth interviews with senior executives and supply chain managers across leading shea butter companies, complemented by field visits to cooperative extraction sites in West Africa to validate sourcing practices and quality control measures. Secondary research included a comprehensive review of industry publications, regulatory filings, and technical whitepapers focusing on extraction technologies, product innovations, and tariff regulations.

Analytical frameworks employed include value chain mapping to identify key cost drivers and risk nodes, as well as segmentation analysis to uncover nuanced demand patterns across form, source, grade, application, and distribution channels. Data triangulation techniques were utilized to cross-verify insights from interviews, published literature, and market observations, ensuring consistency and mitigating potential biases. A panel of independent industry experts and academic scholars provided peer review, challenging assumptions and refining the analytical models.

The methodology further integrated scenario analysis to assess the impact of 2025 tariff changes on procurement strategies and cost frameworks, enabling a forward-looking perspective. All data points were examined through a sustainability lens, evaluating environmental and social governance parameters alongside commercial metrics. This comprehensive approach ensures that the findings reflect tangible market realities and offer actionable intelligence for stakeholders seeking a deep understanding of the shea butter ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Shea Butter market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Shea Butter Market, by Form

- Shea Butter Market, by Source

- Shea Butter Market, by Grade

- Shea Butter Market, by Application

- Shea Butter Market, by Distribution Channel

- Shea Butter Market, by Region

- Shea Butter Market, by Group

- Shea Butter Market, by Country

- United States Shea Butter Market

- China Shea Butter Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Perspectives on the Future Trajectory of the Shea Butter Market Emphasizing Key Takeaways and Strategic Imperatives for Stakeholders

As the shea butter industry continues to mature, the convergence of technological innovation, ethical sourcing, and regulatory dynamics will shape its trajectory. Stakeholders who embrace transparency and sustainability will be best positioned to cultivate consumer trust and drive premium brand loyalty. The nuanced segmentation of shea derivatives-across diverse forms, sources, grades, applications, and distribution pathways-underscores the importance of a tailored market approach, ensuring that product development aligns with specific functional and narrative-driven attributes.

Regional market dynamics further highlight the need for strategic adaptation. North America’s emphasis on traceability, Europe’s certification rigor, and Asia-Pacific’s focus on performance-driven formulations demand differentiated go-to-market strategies. The 2025 tariff adjustments serve as a catalyst for supply chain optimization and vertical integration, reinforcing the value of localized processing hubs and direct cooperative partnerships.

Ultimately, companies that integrate data-driven decision-making, invest in sustainable innovations, and maintain agile operational models will thrive amidst evolving consumer and regulatory landscapes. This report’s insights provide a strategic compass for stakeholders to anticipate market shifts, capitalize on emerging opportunities, and establish resilient growth pathways in the global shea butter ecosystem.

Compelling Call to Action Connect with Ketan Rohom to Access the Definitive Shea Butter Market Research Report and Drive Your Strategic Advantage

Seize the opportunity to elevate your strategic decision making with the most comprehensive insights on the shea butter market. Partner directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your copy of the market research report. Designed for executives seeking clarity and precision, this report delivers actionable analysis, competitive intelligence, and trend forecasting that will empower your business to navigate market complexities and capture emerging opportunities. Engage with Ketan to discuss customized package options and gain immediate access to data that can sharpen your competitive edge. Reach out today and transform how you strategize, plan, and grow within the dynamic shea butter ecosystem

- How big is the Shea Butter Market?

- What is the Shea Butter Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?