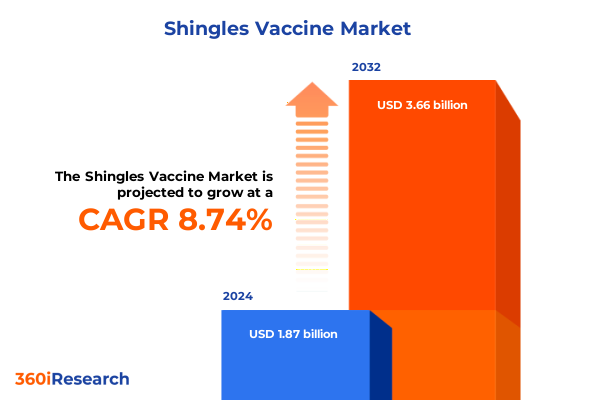

The Shingles Vaccine Market size was estimated at USD 2.02 billion in 2025 and expected to reach USD 2.19 billion in 2026, at a CAGR of 8.80% to reach USD 3.66 billion by 2032.

Landscape and Strategic Imperatives in the Evolving Shingles Vaccine Arena: An Overview of Key Drivers, Challenges, and Opportunities

The resurgence of herpes zoster, commonly known as shingles, among aging populations has underscored the critical role of vaccination in reducing both individual suffering and healthcare burdens. Shingles, a reactivation of the varicella-zoster virus, affects nearly one in three adults during their lifetime and can lead to debilitating complications such as post-herpetic neuralgia and severe vision loss. As global demographics shift toward older age brackets, the imperative for robust preventive measures intensifies, prompting renewed focus on vaccine efficacy, safety, and accessibility.

Over the past decade, recombinant adjuvanted vaccines have supplanted live-attenuated predecessors owing to their superior immunogenicity and broader applicability among immunocompromised individuals. Shingrix, the leading recombinant zoster vaccine, demonstrated over 90% efficacy in pivotal clinical trials and has become the standard of care in many high-income countries. This superior performance profile sets a high bar for both incumbent and emerging competitors, driving continuous innovation in adjuvant systems and antigen design.

As regulatory bodies streamline approval pathways for next-generation formulations, stakeholders must navigate evolving guidelines, pricing pressures, and distribution challenges. Moreover, burgeoning research suggests broader benefits of zoster vaccination, including potential reductions in cardiovascular and neurodegenerative risks, further elevating its strategic importance within preventive healthcare portfolios. Against this backdrop, the Shingles Vaccine market presents a dynamic convergence of scientific progress, policy shifts, and shifting patient expectations.

Key Technological, Regulatory, and Patient Engagement Shifts Reshaping the Shingles Vaccine Landscape and Driving Future Market Dynamics

The Shingles Vaccine sector is experiencing a confluence of technological breakthroughs, regulatory milestones, and patient empowerment initiatives that are reshaping its competitive terrain. On the technological front, mRNA-based varicella-zoster virus vaccine candidates have entered mid-stage clinical evaluation, promising the potential for rapid manufacturing cycles and enhanced immunogenic durability. Early data from Moderna’s mRNA-1468 Phase 1/2 trial indicate robust CD4+ T-cell responses comparable to existing recombinant platforms, signaling a possible inflection point in vaccine innovation.

Regulatory bodies are concurrently responding to industry demands for streamlined access and administration convenience. In July 2025, the U.S. FDA approved a pre-filled syringe formulation of the recombinant zoster vaccine, simplifying logistics and reducing potential administration errors in clinical settings. Across the Atlantic, the European Commission finalized withdrawal of the live-attenuated shingles vaccine in mid-2025, cementing the recombinant option’s dominance and clarifying future market entry requirements.

Meanwhile, heightened patient engagement is bolstering vaccination rates through targeted education campaigns, digital reminder systems, and expanded immunization recommendations for immunocompromised cohorts. In the United Kingdom, eligibility has broadened to include all severely immunosuppressed adults aged 18 and above, reflecting a proactive shift toward inclusive preventive care models and facilitating earlier intervention for high-risk populations. Collectively, these transformative shifts are forging a more resilient and patient-centric Shingles Vaccine ecosystem.

Assessing the Far-Reaching Effects of 2025 United States Tariffs on Shingles Vaccine Supply Chains, Costs, and Strategic Sourcing Decisions

In early 2025, the United States instituted a blanket 10% tariff on imported goods, encompassing active pharmaceutical ingredients and finished vaccine products. This measure, intended to bolster domestic production, has directly impacted the Shingles Vaccine supply chain, driving up procurement costs for raw materials and finished doses. Vaccine manufacturers are reassessing sourcing strategies to mitigate these cost headwinds while maintaining production continuity and pricing stability.

A more pronounced disruption stems from tariffs of up to 245% on Chinese-sourced pharmaceutical components, including key adjuvants and antigen precursors used in recombinant zoster vaccines. Given China’s substantial share of global API supply, manufacturers face increased production expenses and potential delays in vaccine availability, particularly for generic and alternative vaccine producers operating on slim margins. These dynamics risk exacerbating access disparities among vulnerable populations if cost pressures are passed through to healthcare providers and payers.

To navigate this evolving landscape, stakeholders are diversifying supply networks by exploring alternative API producers in India and Europe, and expediting onshoring of critical manufacturing processes. Concurrently, they are engaging with policymakers to advocate for targeted tariff exemptions on essential healthcare products. Such proactive measures aim to safeguard affordability and accessibility while aligning with broader national goals of supply chain resilience and health security.

Deep-Dive Segmentation Analysis Reveals Critical Patient Demographics, Distribution Preferences, and Dosage Patterns Fueling the Shingles Vaccine Market

Segmentation in the Shingles Vaccine market reveals a landscape defined by distinct product modalities, patient demographics, delivery channels, and dosage regimens. Vaccine type differentiation remains paramount: recombinant zoster vaccines, exemplified by glycoprotein E adjuvanted formulations, dominate due to their high efficacy and suitability for immunocompromised individuals, while live-attenuated vaccines occupy specialized niches in markets where regulatory frameworks or cost considerations permit.

Age stratification underscores shifting clinical priorities as adults aged 50 to 59 represent an expanding cohort seeking proactive immunization. This is followed by robust uptake among those aged 60 to 69, who benefit from broad insurance coverage, and continued vaccination efforts for individuals aged 70 and above, where the risk of severe complications is greatest.

Healthcare delivery settings further delineate market dynamics: community clinics and private practices drive routine adult vaccination programs, while general and specialty hospitals serve as critical hubs for high-risk and inpatient populations. Accessibility through distribution channels such as hospital, online, and retail pharmacies ensures comprehensive coverage, with digital pharmacies and e-commerce platforms offering convenience for tech-savvy patients, and chain and independent pharmacies maintaining essential community reach.

Finally, the choice between multi-dose and single-dose regimens impacts both patient adherence and inventory management, highlighting the importance of regimen flexibility in addressing diverse patient needs and healthcare infrastructure capabilities.

This comprehensive research report categorizes the Shingles Vaccine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vaccine Type

- Dosage

- Age Group

- Distribution Channel

- End User

Comparative Regional Insights Highlighting Growth Drivers, Healthcare Infrastructure Variations, and Access Dynamics Across Major Global Markets

Regional landscapes for Shingles Vaccines reflect divergent healthcare infrastructures, policy environments, and demographic trends across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, robust public and private immunization initiatives, combined with strong reimbursement frameworks under Medicare and private insurers, have driven high adult vaccination rates. Recent pre-filled syringe approvals and educational campaigns further enhance convenience and uptake among older adults.

In Europe, the withdrawal of live-attenuated formulations and uniform recommendations for recombinant vaccines have created a cohesive market structure, albeit with variability in national procurement policies and pricing negotiations. The European Medicines Agency’s streamlined authorization processes and expanded guidelines for immunosuppressed cohorts underscore a commitment to equitable access, despite differing health system capacities and funding models across member states.

The Middle East and Africa exhibit uneven vaccine penetration due to disparities in healthcare infrastructure, supply chain capabilities, and funding. However, targeted partnerships with global health organizations and domestic investments in cold-chain logistics are beginning to close immunization gaps in urban and peri-urban centers.

Asia-Pacific emerges as the fastest-growing region, driven by strategic collaborations that extend vaccine availability through extensive provider networks. In China, a landmark co-promotion partnership has unlocked over 30,000 vaccination points nationwide, while Japan’s decision to include Shingrix in its national immunization program for adults aged 65 and over highlights proactive public health policy measures that secure long-term market growth.

This comprehensive research report examines key regions that drive the evolution of the Shingles Vaccine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profiles of Leading Biopharma Innovators Driving Shingles Vaccine Advancements Through Diversified Portfolios, Collaborations, and R&D Investments

Leading biopharma firms are spearheading innovation and market development in the Shingles Vaccine sector through strategic R&D investments, partnerships, and portfolio diversification. GlaxoSmithKline has cemented its market leadership with the recombinant zoster vaccine, enhancing administration convenience by launching a pre-filled syringe format that streamlines clinical workflows and reduces dosing errors. In China, GSK’s partnership with a major domestic biotech company operationalizes broad distribution across more than 30,000 vaccination points, reinforcing market penetration and co-development potential for future vaccine candidates.

Merck & Co. continues to leverage its legacy live-attenuated vaccine, albeit in niche markets, while focusing R&D efforts on next-generation adjuvant platforms and combination schedules. Concurrently, emerging players such as Dynavax are advancing CpG 1018 adjuvant-enhanced candidates through Phase 1/2 trials that target differentiated tolerability profiles without compromising immunogenicity. Early data from their Z-1018 program indicate strong CD4+ T-cell responses and favorable safety metrics relative to current standards, with top-line results expected in late 2025.

Moderna’s mRNA-based varicella-zoster candidate underscores the broader shift toward nucleic acid platforms, with interim analyses demonstrating robust antigen-specific T-cell induction and organizational commitment to pivotal Phase 3 trials. These diversified approaches reflect a competitive ecosystem where established pharmaceutical giants and agile biotech innovators are jointly expanding the technological envelope and geographic reach of shingles prevention solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Shingles Vaccine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AIM Vaccine Co., Ltd.

- Bavarian Nordic A/S

- Beijing Institute of Biological Products Co., Ltd.

- Bharat Biotech International Limited

- Biological E. Limited

- CanSino Biologics Inc.

- CanSinoBIO

- Changchun BCHT Biotechnology Co., Ltd.

- Chengdu Institute of Biological Products Co., Ltd.

- Daiichi Sankyo Company, Limited

- Dynavax Technologies Corporation

- GeneOne Life Science

- GlaxoSmithKline plc

- Green Cross Corporation

- Jiangsu Recbio Technology Co., Ltd.

- Johnson & Johnson

- Merck & Co., Inc.

- Moderna, Inc.

- Serum Institute of India Pvt. Ltd.

- Sinovac Life Sciences Co., Ltd.

- SK chemicals

- Vaccitech plc

- Valneva SE

- Vaxart, Inc.

- Yuxi Walvax Biotechnology Co., Ltd.

Actionable Strategic Recommendations for Stakeholders to Enhance Resilience, Optimize Supply, and Accelerate Uptake in the Competitive Shingles Vaccine Market

Industry leaders must fortify supply chain resilience by diversifying active pharmaceutical ingredient sourcing and accelerating onshore manufacturing investments to mitigate tariff-related cost pressures. By establishing regional production hubs and leveraging public-private partnerships, companies can reduce reliance on high-tariff import routes and ensure uninterrupted access for vulnerable populations facing elevated shingles risks.

To sustain market growth, organizations should prioritize patient-centric initiatives that streamline vaccine administration, such as pre-filled syringe technologies and digital appointment systems. These innovations not only enhance clinical efficiency but also address adherence challenges among older adults who may face mobility or access constraints.

Advancing collaborative research models is essential for accelerating novel vaccine platforms. Engaging in joint development agreements, as seen with CpG 1018 adjuvant candidates and mRNA constructs, enhances pipeline diversification while sharing development risks. Moreover, aligning with health authorities to expand immunization guidelines for immunosuppressed and younger at-risk cohorts can unlock new market segments and reinforce public health objectives.

Finally, targeted educational campaigns delivered through telehealth channels and community outreach will be instrumental in driving uptake among hesitant populations. By integrating behavioral insights and real-world evidence into marketing strategies, stakeholders can foster informed decision-making and cultivate trust in emerging vaccine innovations.

Rigorous Mixed-Methods Approach Integrating Primary Interviews, Secondary Data, and Triangulation to Deliver High-Integrity Insights and Conclusions

This analysis is grounded in a rigorous mixed-methods approach that integrates qualitative and quantitative data to ensure comprehensive coverage. Primary research included in-depth interviews with vaccine developers, regulatory experts, and distribution channel partners, enabling a nuanced understanding of strategic priorities, operational challenges, and market entry considerations.

Secondary research encompassed peer-reviewed literature, regulatory filings, clinical trial registries, and reputable news sources to triangulate insights and validate technological and policy developments. Citations from leading industry publications and official announcements ensure that factual statements reflect the latest developments across global markets.

Data were synthesized through thematic analysis and cross-sector benchmarking to identify emerging trends, competitive dynamics, and regional variances. Triangulation of multiple data streams mitigates bias and enhances the reliability of conclusions, providing stakeholders with an authoritative foundation for strategic planning. This methodology underscores the report’s commitment to analytical rigor and high-integrity intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Shingles Vaccine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Shingles Vaccine Market, by Vaccine Type

- Shingles Vaccine Market, by Dosage

- Shingles Vaccine Market, by Age Group

- Shingles Vaccine Market, by Distribution Channel

- Shingles Vaccine Market, by End User

- Shingles Vaccine Market, by Region

- Shingles Vaccine Market, by Group

- Shingles Vaccine Market, by Country

- United States Shingles Vaccine Market

- China Shingles Vaccine Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Insights on Strategic Imperatives and Future Trajectories in the Shingles Vaccine Field and Their Implications for Stakeholder Decision-Making

The Shingles Vaccine market stands at a strategic inflection point shaped by advanced recombinant and mRNA vaccine platforms, evolving regulatory frameworks, and shifting patient demographics. High efficacy profiles, coupled with broader immunization recommendations for immunocompromised and aging populations, have cemented recombinant vaccines as the standard of care, while novel adjuvant and nucleic acid modalities promise to expand clinical choices.

Tariff-induced cost pressures and supply chain disruptions underscore the necessity of diversified sourcing and localized manufacturing solutions. Meanwhile, segmentation insights reveal the importance of tailored distribution strategies across clinics, hospitals, and digital pharmacies, ensuring optimal reach for distinct patient cohorts.

Leading biopharma entities are capitalizing on strategic collaborations and technology pivots to sustain innovation pipelines, while actionable recommendations emphasize resilience, patient centricity, and research partnerships as key drivers of future growth. As regional dynamics diverge, with Asia-Pacific emerging as a growth hotspot and Europe reinforcing recombinant vaccine dominance, stakeholders must adopt adaptive strategies to navigate complex market conditions.

Collectively, these imperatives outline a roadmap for stakeholders to harness scientific advancements and policy support in delivering effective, accessible, and sustainable shingles prevention solutions worldwide.

Empower Your Strategic Planning: Connect with Ketan Rohom for Exclusive Access to the Comprehensive Shingles Vaccine Market Research Report

We invite decision-makers and strategists seeking unparalleled insights into the Shingles Vaccine landscape to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating granular market intelligence into actionable strategies ensures you can leverage our comprehensive report to inform critical investment, partnership, and product development decisions. Connect with Ketan today to secure your exclusive access to the full market research report, gain early visibility into emerging trends, and stay ahead of competitors in a rapidly evolving vaccine ecosystem

- How big is the Shingles Vaccine Market?

- What is the Shingles Vaccine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?