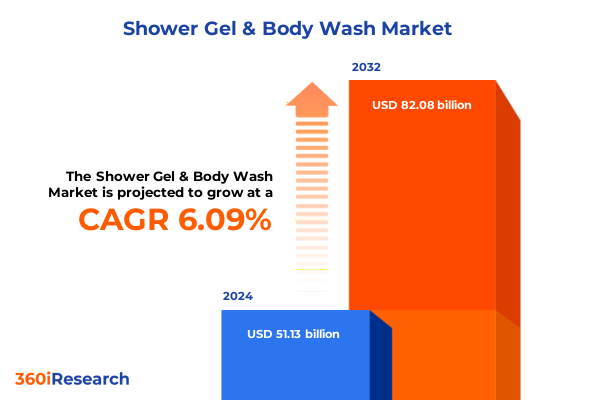

The Shower Gel & Body Wash Market size was estimated at USD 54.11 billion in 2025 and expected to reach USD 57.31 billion in 2026, at a CAGR of 6.13% to reach USD 82.08 billion by 2032.

Setting the Stage for Transformation in the Shower Gel and Body Wash Market Landscape with Emerging Consumer Preferences and Innovation Drivers

The shower gel and body wash industry is experiencing an era of rapid transformation fueled by evolving consumer lifestyles, heightened hygiene awareness, and an unwavering appetite for innovation. In recent years, the convergence of wellness trends and ecological consciousness has reshaped product development priorities, compelling brands to integrate functional ingredients with sustainable packaging. Moreover, the digital revolution has redefined how consumers discover and purchase personal care products, amplifying the importance of seamless online experiences and omnichannel fulfillment strategies. As a result, market participants are compelled to recalibrate their value proposition to resonate with increasingly discerning shoppers.

Against this backdrop, the narrative of shower gels and body washes is no longer confined to cleansing efficacy alone. Instead, formulations are evolving to deliver sensorial experiences-ranging from mood-enhancing aromatherapy to skin microbiome–balancing complexes-providing multifunctional benefits that extend beyond basic hygiene. Additionally, regulatory landscapes are tightening around ingredient transparency and environmental impact, further influencing formulation choices and supply chain configurations. Against this dynamic tableau, brands and manufacturers must navigate both opportunities for differentiation and challenges of compliance to secure market leadership.

Unveiling the Pivotal Shifts Redefining Shower Gel and Body Wash Dynamics through Consumer Behavior and Technological Advancements

In the quest to remain relevant, industry stakeholders are embracing transformative shifts that span from ingredients sourcing to delivery mechanisms. Sustainability has emerged as a defining theme, prompting the substitution of petrochemical surfactants with biodegradable alternatives and the advent of refillable dispensers that mitigate single-use plastic waste. Concurrently, personalization has moved from buzzword status to tangible reality, with brands leveraging digital platforms and AI-driven diagnostics to recommend bespoke formulations based on individual skin needs and lifestyle factors.

Concurrently, technological advancements are driving novel formats, such as encapsulated fragrance beads that release scent upon friction and smart dispensers that dispense precise doses to reduce product overuse. The intersection of microbiome science and body care has led to prebiotic- and probiotic-infused washes designed to support skin flora. Furthermore, the growing enthusiasm for sensorial self-care rituals has sparked collaborations between personal care brands and wellness influencers, injecting lifestyle narratives into traditional marketing channels. Collectively, these shifts are dismantling commodity perceptions and reshaping competitive dynamics.

Analyzing the Multifaceted Effects of 2025 United States Tariff Policies on Cost Structures Supply Chains and Competitive Positioning

The introduction of new United States tariffs in early 2025 on imported surfactants, essential oils, and packaging components has exerted upward pressure on input costs and compelled brands to reassess their supply chain strategies. Many manufacturers reliant on global procurement have encountered elevated landed costs that compress margins, prompting a pivot toward domestic sourcing and increased collaboration with regional chemical suppliers. This recalibration, however, has introduced trade-offs between cost, ingredient diversity, and product differentiation.

Moreover, import duties on secondary materials have affected packaging innovation by raising the cost thresholds for eco-friendly alternatives, delaying the transition to post-consumer recycled plastics and refill models. Consequently, brands are negotiating complex cost pass-through dynamics, balancing the risk of price escalations against the imperative to maintain consumer loyalty. Simultaneously, the tariff environment has intensified competitive pressure from companies with vertically integrated operations or those that secured long-term fixed-price contracts prior to the tariff enactments. Overall, the cumulative impact of these trade policies is reshaping procurement, pricing, and partnership models throughout the value chain.

Decoding Critical Segmentation Layers Driving Consumer Selection and Brand Differentiation across Product Texture Formulation Gender and Channel Dimensions

A nuanced examination of product type reveals that traditional shower gels contend with the rising popularity of viscous body wash formulations that emphasize skin hydration. Consumers gravitate toward cream-based textures when seeking deep moisturization, while foam-based variants appeal to users prioritizing a luxurious lather experience. Gel-based options command attention for their cooling sensation, and oil-based textures continue to carve out a niche among those seeking intense nourishment for dry skin.

Formulation preferences further delineate market contours, with natural and organic washes commanding premium positioning, driven by consumer demand for plant-derived actives and minimal synthetic additives. In contrast, synthetic formulations persist in capturing volume sales through established efficacy claims and value pricing. Gender-targeted innovations also guide product development, as female-oriented variants often spotlight fragrance complexity and skin care benefits, whereas male-focused offerings emphasize simplicity, masculinity, and post-exercise cleansing performance.

Finally, distribution channels dictate accessibility and brand-building strategies. While brick-and-mortar outlets remain critical for trial-driven purchases and impulse buys, online channels are rapidly closing the gap by offering direct-to-consumer experiences, subscription models, and e-commerce platform partnerships. Company-owned websites provide opportunities for personalized engagement and loyalty programs, whereas multi-vendor digital marketplaces excel in broad reach and convenience. Together, these segmentation layers underpin strategic decision-making for product portfolios and marketing investments.

This comprehensive research report categorizes the Shower Gel & Body Wash market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Texture Type

- Formulations

- Gender

- Distribution Channel

Exploring Regional Performance Variations and Growth Opportunities across the Americas EMEA and Asia-Pacific Shower Gel and Body Wash Markets

Regional performance differences underscore the importance of localized strategies. In the Americas, mature markets exhibit a pronounced tilt toward premium body wash offerings that integrate advanced skin care benefits, reflecting consumer willingness to invest in holistic wellness rituals. Latin American countries display robust growth in mass-market segments, propelled by expanding retail infrastructures and rising discretionary incomes.

Across Europe, Middle East, and Africa, regulatory stringency around ingredient safety and environmental sustainability heavily influences product launches. Consumers in Western Europe show a strong inclination toward certified natural formulations, while markets in the GCC region demonstrate appetite for fragrance-forward luxury washes aligned with regional scent preferences. Meanwhile, sub-Saharan African markets are at early stages of modern retail development, presenting opportunities for affordable multifunctional formulations.

In Asia-Pacific, urbanization and rising digital connectivity have catalyzed demand for innovative textures and localized ingredients, such as green tea extracts and bamboo charcoal. Rapid e-commerce adoption further fuels growth, as digitally native brands harness social commerce and live-streaming to engage younger consumers. Consequently, this region serves as both a bellwether for emerging trends and a high-potential growth frontier.

This comprehensive research report examines key regions that drive the evolution of the Shower Gel & Body Wash market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Initiatives Shaping Innovation Distribution and Competitive Edge in Personal Care

Market leadership has consolidated around a mix of global conglomerates and agile niche specialists. Major players leverage expansive R&D budgets to pioneer ingredient innovations and to secure strategic partnerships along the supply chain, ensuring a steady flow of proprietary actives and exclusive formulations. Meanwhile, smaller challengers excel in speed-to-market, capitalizing on niche consumer segments with targeted value propositions such as dermatologically focused washes or indulgent scent experiences.

Competitive dynamics are further shaped by strategic collaborations, including co-branding initiatives with beauty influencers and alliances with sustainable packaging firms. Some companies have adopted vertical integration strategies, acquiring ingredient manufacturers or establishing in-house filling facilities to mitigate input cost volatility and ensure quality control. Additionally, the digital era has enabled new entrants to achieve rapid scale through direct-to-consumer channels, supported by data-driven personalization engines and dynamic pricing tools. Collectively, these strategic moves are redefining the competitive hierarchy and intensifying innovation pace across the sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Shower Gel & Body Wash market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.M. Enterprises

- APPAREL GROUP

- Beautycave Cosmetics

- Beiersdorf Global AG.

- Blind Barber LLC.

- Bo International

- Estée Lauder Companies Inc.

- Greenphyll Exim Private Limited

- Harrods Health Private Limited

- Henkel AG & Co. KGaA

- Himalaya Global Holdings Ltd.

- ITC Limited

- Johnson & Johnson Consumer Inc.

- Joy Personal Care

- JS Sloane

- Kimirica Hunter International LLP.

- L'Oréal S.A.

- Merz Apothecary, Inc

- Naturis Cosmetics

- Rangrejs Aromatherapy

- Reckitt Benckiser Group plc

- SGPomades Trading Pte Ltd

- The Body Shop International Limited

- The Procter & Gamble Company

- Truefitt & Hill India.

- Unilever PLC

Implementing Strategic Imperatives to Enhance Market Penetration Operational Agility and Consumer Engagement in the Body Wash Sector

To capitalize on evolving market dynamics, industry leaders should prioritize several strategic initiatives. First, embracing flexible sourcing partnerships can buffer against tariff-induced cost fluctuations while preserving access to differentiated ingredients. Concurrently, investing in modular manufacturing capabilities enables rapid product format switches in response to shifting consumer texture preferences.

Furthermore, brands must deepen engagement across digital touchpoints by deploying immersive online experiences, virtual try-on tools, and subscription-based replenishment models. Cultivating loyalty through personalized storytelling and experiential marketing-such as limited-edition scent collaborations-can reinforce emotional connection and drive repeat purchases. Equally important is the commitment to sustainability: transitioning to refillable or PCR packaging solutions and transparently communicating environmental credentials fosters consumer trust and brand equity.

Finally, cross-functional alignment between R&D, marketing, and supply chain teams will expedite innovation cycles and ensure cohesive execution. By integrating consumer intelligence platforms that monitor real-time sentiment and emerging ingredient trends, organizations can swiftly adapt roadmaps, secure first-mover advantages, and sustain long-term relevance in a crowded marketplace.

Detailing a Robust Mixed-Method Research Framework Integrating Qualitative and Quantitative Approaches for Comprehensive Market Analysis

This research employs a rigorous mixed-method approach to deliver a comprehensive market perspective. Primary data collection included in-depth interviews with key opinion leaders, such as formulation scientists, procurement executives, and retail category managers, supplemented by consumer focus groups to validate sensorial and efficacy perceptions. Additionally, proprietary surveys targeting end users across diverse demographics captured evolving purchase drivers and channel preferences.

Secondary research encompassed a thorough review of industry journals, trade association publications, regulatory filings, and public financial disclosures of leading companies. Data triangulation techniques were applied to reconcile variations across sources, ensuring accuracy and consistency. Furthermore, supply chain cost models were developed using input from raw material suppliers and packaging manufacturers to quantify tariff impacts qualitatively.

All findings were subjected to multi-tier validation, including cross-referencing with independent market watchers and reconciling against macroeconomic indicators. This methodological rigor underpins the reliability of insights and empowers stakeholders to make informed strategic decisions in the dynamic shower gel and body wash landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Shower Gel & Body Wash market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Shower Gel & Body Wash Market, by Product Type

- Shower Gel & Body Wash Market, by Texture Type

- Shower Gel & Body Wash Market, by Formulations

- Shower Gel & Body Wash Market, by Gender

- Shower Gel & Body Wash Market, by Distribution Channel

- Shower Gel & Body Wash Market, by Region

- Shower Gel & Body Wash Market, by Group

- Shower Gel & Body Wash Market, by Country

- United States Shower Gel & Body Wash Market

- China Shower Gel & Body Wash Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Market Intelligence to Illuminate Future Growth Pathways and Strategic Priorities for the Shower Gel Industry Ecosystem

In summary, the shower gel and body wash industry stands at the intersection of health-conscious consumer behavior and rapid technological evolution. Amid rising tariff complexities and shifting regulatory frameworks, brands that prioritize agility, sustainability, and personalization will differentiate themselves and capture disproportionate market gains. Segmentation analysis highlights the importance of tailored offerings across textures, formulations, and channels, while regional insights reveal divergent growth pockets requiring customized go-to-market strategies.

As competitive intensity escalates, strategic alignment across sourcing, manufacturing, marketing, and distribution functions becomes imperative. Leaders who harness data-driven intelligence, embrace supply chain resilience, and foster authentic consumer engagement will navigate headwinds effectively and unlock new avenues for innovation. By synthesizing these market imperatives with robust research methodologies, decision-makers are equipped to chart a forward-looking path that balances profitability with purpose in the expanding shower gel and body wash domain.

Connect with Associate Director Ketan Rohom to Secure Access to the Definitive Shower Gel and Body Wash Market Research Report

Engaging with an industry veteran offers unparalleled clarity on nuanced market dynamics and emerging trends. By collaborating directly with Associate Director Ketan Rohom, decision-makers can obtain a tailored deep dive into consumer insights, competitive benchmarking, and strategic growth levers. This personalized consultation paves the way for precise investment decisions, aligning product innovation roadmaps with evolving regulatory and tariff environments. Securing the comprehensive market research report through a direct dialogue ensures organizations unlock actionable intelligence, fine-tune go-to-market strategies, and capitalize on high-growth segments ahead of competitors. Reach out today to transform your strategic planning with data-driven foresight and expert guidance that accelerates performance in the shower gel and body wash domain.

- How big is the Shower Gel & Body Wash Market?

- What is the Shower Gel & Body Wash Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?