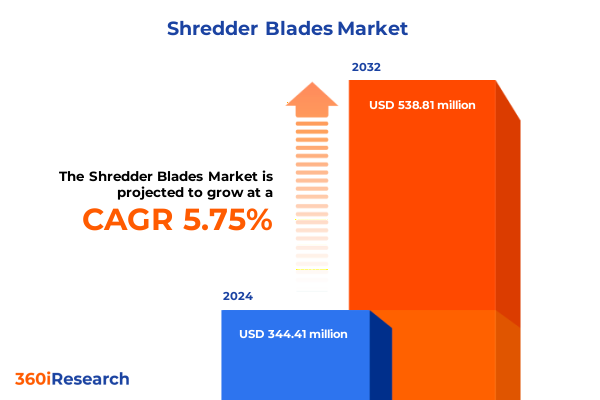

The Shredder Blades Market size was estimated at USD 361.89 million in 2025 and expected to reach USD 382.32 million in 2026, at a CAGR of 5.85% to reach USD 538.80 million by 2032.

Unveiling the Cutting Edge of Shredder Blade Dynamics as Markets Evolve with Security Demands and Material Innovations for Future Growth

The shredder blade market has emerged as a cornerstone in the broader framework of information security and operational resilience. In a business environment characterized by heightened data protection mandates and increasingly sophisticated cyber threats, the humble shredder blade now occupies a strategic position. Organizations spanning financial services, healthcare, legal practices, and government agencies rely on precision cutting tools to ensure that sensitive documents are irreversibly destroyed. As a result, manufacturers and end users alike are prioritizing blades that deliver both exceptional longevity and consistent performance under the rigors of high-volume shredding cycles.

Moreover, material engineers have made significant strides in developing proprietary steel alloys and advanced coatings that resist wear and corrosion. These innovations extend blade service life and reduce maintenance intervals, enabling facility managers to optimize uptime and total cost of ownership. Simultaneously, the integration of smart sensor technologies within shredding equipment is beginning to influence blade design, leading to predictive replacement models that further enhance process efficiency and operational visibility.

This executive summary offers a panoramic view of the current landscape, beginning with an exploration of transformative technological and regulatory shifts. It then assesses the cascading effects of recent trade policies on supply chains, followed by a deep dive into segmentation and regional market insights. Subsequent sections profile leading industry players and outline actionable recommendations designed to guide strategic decision making. Finally, an overview of the research methodology underpins the credibility of these findings, culminating in a concise conclusion that underscores strategic imperatives for stakeholders.

Navigating a New Frontier Where Automation Sustainability and Smart Technologies Redefine Shredder Blade Performance and Market Expectations

The shredder blade landscape is undergoing rapid transformation as automation and sustainability rise to the forefront of operational priorities. Advanced manufacturing processes, including robotic honing and laser calibration, enable blade geometries with unprecedented precision. These enhancements translate into finer cut tolerances and smoother operation, reducing heat generation and minimizing stress on mechanical components. Consequently, enterprises can achieve higher throughput with lower energy consumption, aligning shredding activities with broader corporate environmental goals.

At the same time, environmental stewardship initiatives have spurred demand for recyclable blade materials and eco-friendly packaging solutions. Leading suppliers are investing in closed-loop manufacturing programs that recover spent blades for material reclamation and reintegration into production cycles. This circular approach not only reduces waste but also responds to regulatory pressure on industrial emissions and landfill diversion targets.

Digital intelligence is further reshaping market expectations. Internet of Things connectivity and embedded sensors now enable real-time blade health monitoring, alerting operators to potential wear and preventing unplanned downtime. Data analytics platforms leverage this sensor data to generate predictive maintenance schedules, optimizing blade replacement timing and extending equipment lifecycle. As a result, the industry is shifting from reactive maintenance to proactive asset management, unlocking new opportunities for service-based revenue models and subscription offerings.

Assessing How the 2025 Tariff Landscape Has Reshaped Supply Chains Cost Structures and Strategic Sourcing Decisions in the Shredder Blade Industry

The imposition of new tariffs on key raw materials has reverberated across the shredder blade supply chain, compelling manufacturers to reevaluate procurement strategies and cost structures. In early 2025, trade measures targeting steel and alloy imports introduced additional duties that elevated input costs and triggered a ripple effect on production budgets. Suppliers operating within traditional hubs faced increased pressure to curb expenses, prompting many to explore alternative sourcing corridors and negotiate long-term agreements to stabilize pricing.

As a strategic response, firms have accelerated efforts to diversify supplier networks, seeking partnerships in regions with favorable trade arrangements and lower logistical complexities. Domestic steel producers have also benefited from this shift as companies aim to mitigate exposure to cross-border tariff fluctuations. These local mills are expanding capacity and investing in quality improvements to meet stringent specifications for industrial-grade cutting tools.

Tariff-induced cost headwinds have equally driven innovation in material efficiency. Blade designers are optimizing cross-sectional geometries and alloy compositions to maintain cutting performance while reducing overall steel usage. Such engineering advancements help offset higher raw material costs, reflecting the industry’s agility in adapting to external economic pressures. Collectively, these strategic sourcing and material innovation initiatives reinforce resilience within the shredder blade segment amid evolving global trade dynamics.

Extracting Actionable Insights from Type Application and Distribution Channel Dynamics to Illuminate the Shredder Blade Market Segmentation Landscape

Segmentation analysis reveals distinct performance drivers and competitive considerations across the three principal blade types. Cross cut blades, celebrated for producing narrow, confetti-like particles, dominate environments where document confidentiality is paramount, such as legal practices and financial institutions. Micro cut variants cater to ultra-sensitive applications by delivering even finer shredding profiles, though they necessitate more complex manufacturing processes and carry a premium price tag. Meanwhile, strip cut blades emerge as the economical preference for residential use and light commercial tasks, offering straightforward maintenance and lower energy demands.

Turning to end-use applications, commercial shredding services emphasize high-speed, modular blade assemblies designed for rapid on-site replacement, ensuring minimal disruption during peak operational cycles. In industrial settings, from manufacturing plants to archival facilities, heavy-duty blades engineered to handle diverse media types deliver sustained performance under rigorous conditions. Residential users, by contrast, seek intuitive designs that integrate seamlessly with home office environments, valuing ease of installation and clear guidance on blade maintenance.

Distribution channel dynamics play a pivotal role in market reach and customer engagement. Traditional offline outlets, encompassing industrial suppliers and specialty stores, remain vital for bulk purchasers and regionally focused enterprises, offering hands-on technical support and custom abrasion testing. Conversely, manufacturer websites and third-party e-commerce platforms have gained prominence by presenting comprehensive product assortments, interactive configuration tools, and expedited delivery options. As these digital channels mature, they offer manufacturers a conduit for direct customer interactions and data-driven marketing strategies that enhance brand loyalty and repeat purchase rates.

This comprehensive research report categorizes the Shredder Blades market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- Distribution Channel

Unlocking Critical Regional Trends Revealing Growth Drivers and Challenges Across Americas EMEA and Asia Pacific Shredder Blade Ecosystems

Regional analysis underscores unique market dynamics that shape demand patterns and competitive strategies. In the Americas, a firm emphasis on data privacy legislation and corporate compliance mandates sustains robust investment in advanced shredding solutions. North American manufacturers leverage proximity to end users and well-established logistics networks, while Latin American markets witness gradual adoption of premium blade technologies in tandem with urban infrastructure development.

The Europe, Middle East and Africa region presents a multifaceted environment driven by stringent environmental regulations alongside elevated security standards. Western European nations enforce rigorous recycling directives, incentivizing blade producers to integrate recyclable steel alloys and certified end-of-life programs. Middle Eastern economies, diversifying away from resource dependency, are reinforcing information security frameworks through public and private sector collaboration. In Africa, growth opportunities emerge from retrofitting existing office equipment and establishing maintenance service networks to extend blade lifecycles and reduce total cost of ownership.

Asia Pacific exhibits a landscape of contrasts, encompassing both mature markets and burgeoning growth hubs. Japan and South Korea boast advanced manufacturing ecosystems that emphasize precision blade design and smart factory integration. Australia and New Zealand demonstrate expanding demand for sustainable solutions, leading to partnerships focused on closed-loop material reuse. In contrast, Southeast Asia and India represent high-potential territories where infrastructure investments and an expanding corporate governance landscape drive the adoption of next-generation blade technologies. Tailoring go-to-market approaches to these regional nuances enables companies to optimize resource allocation and unlock localized growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Shredder Blades market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Players Driving Competitive Advantage through Partnerships Technological Advancements and Operational Excellence

Leading industry participants continue to fortify their market positions through targeted research and development, strategic collaborations, and operational excellence initiatives. Established manufacturers leverage decades of metallurgical expertise to refine proprietary blade alloys while forging partnerships with automation and sensor technology specialists to embed real-time performance monitoring within equipment. Collaborative frameworks between original equipment manufacturers and aftermarket service providers enhance end-user experiences by pairing durable blade solutions with comprehensive maintenance offerings.

Several prominent organizations pursue acquisition strategies to broaden geographic reach and diversify their product portfolios. By integrating specialized blade divisions or regional distributors, they streamline supply chains and capitalize on cross-selling opportunities. Investments in state-of-the-art production facilities have elevated precision tolerances for micro cut blade segments, reinforcing premium positioning in security-critical applications. Lean manufacturing and continuous improvement programs further drive operational efficiencies, enabling competitive pricing without sacrificing product quality.

Innovative companies are also revising their commercial models, deploying digital touchpoints to engage directly with end users. Interactive online configurators and virtual consultation services facilitate more informed purchase decisions and shorten sales cycles. Outcome-based service agreements have evolved into subscription-style offerings, where blade health analytics inform predictive replacement schedules and remote troubleshooting. This shift to value-added service models underscores a broader industry evolution toward customer-centric differentiation and sustainable revenue generation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Shredder Blades market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allgaier SE

- ANDRITZ AG

- Bühler AG

- Coperion GmbH

- Eldan Recycling A/S

- Franklin Miller, Inc.

- Metso Outotec Oyj

- SSI Shredding Systems, Inc.

- Vecoplan AG

- Weima Maschinenbau GmbH

Translating Market Intelligence into Strategic Roadmaps for Supply Chain Optimization Innovation Investment and Sustainable Competitive Positioning

Companies aiming to secure a leadership position in the shredder blade market must integrate supply chain optimization, innovation acceleration, and customer-centric service models into a cohesive strategy. Strengthening supply chain resilience begins with supplier diversification and dual-sourcing agreements, which mitigate tariff risks and buffer against logistical disruptions. Implementing collaborative demand-planning frameworks with raw material providers enhances visibility into upcoming requirements, enabling more responsive inventory management and production scheduling.

Innovation agendas should center on modular designs that simplify blade replacement and recyclable material usage that supports circular economy objectives. Interchangeable cartridge systems can reduce the total number of blade variants in inventory, lowering overall logistical complexity. Concurrently, research partnerships with academic institutions and materials science labs accelerate development of advanced alloy compositions and surface treatments, bolstering blade longevity and cutting performance.

Adopting service-based business models and digital engagement platforms fosters sustainable competitive differentiation. Subscription programs that bundle blade replacement, maintenance, and analytics generate predictable revenue streams and deepen client relationships. Customer portals that track blade performance metrics and issue proactive maintenance alerts offer tangible value and justify premium pricing. By marshaling these strategic initiatives within an integrated framework, industry leaders can enhance operational agility, foster continuous innovation, and maintain a commanding market presence amid evolving economic and regulatory conditions.

Detailing a Robust Multi-Stage Research Framework Combining Primary Interviews Secondary Data and Rigorous Validation for In-Depth Insights

The research methodology underpinning this executive summary relies on a comprehensive, multi-stage approach to guarantee both depth and rigor. Initially, an extensive review of secondary sources was undertaken, encompassing trade publications, regulatory filings, academic journals, and industry white papers. This provided a holistic understanding of macroeconomic influences, material science advancements, and policy factors shaping the shredder blade market.

Building on the foundational literature, primary qualitative interviews were conducted with a diverse group of stakeholders, including blade manufacturers, original equipment producers, distribution channel executives, and end-use customers spanning commercial, industrial, and residential segments. These in-depth conversations elucidated critical design preferences, performance criteria, and procurement drivers. Illustrative case studies captured real-world deployment challenges and operational best practices.

To validate and reconcile insights, data triangulation methods aligned findings from primary interviews with secondary data sets and third-party testing protocols. Blade performance indicators such as durability metrics and maintenance cycle durations were corroborated through independent laboratory analyses and service partner records. Multiple rounds of expert review sessions further refined assumptions, ensuring robust interpretation and minimizing subjective bias.

Finally, forward-looking validation workshops with seasoned industry advisors assessed the plausibility of emerging trends and potential market disruptions. This rigorous process underpins the strategic recommendations and actionable insights presented, offering stakeholders a high-confidence resource for informed decision making in the shredder blade arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Shredder Blades market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Shredder Blades Market, by Type

- Shredder Blades Market, by Application

- Shredder Blades Market, by Distribution Channel

- Shredder Blades Market, by Region

- Shredder Blades Market, by Group

- Shredder Blades Market, by Country

- United States Shredder Blades Market

- China Shredder Blades Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Synthesizing Strategic Imperatives and Emerging Trends to Empower Decision Makers in the Complex Shredder Blade Market Environment

This executive summary distills a comprehensive analysis of industry dynamics, emerging trends, and strategic imperatives that define the contemporary shredder blade market. The intersection of rigorous data privacy regulations, advanced material innovations, and digital intelligence has elevated the bar for blade performance, demanding solutions that excel in both precision cutting and lifecycle sustainability. Environmental and regulatory pressures further reinforce the necessity of closed-loop recycling initiatives and circular design philosophies.

Recent trade policy shifts have highlighted the importance of agile sourcing strategies, prompting manufacturers to diversify their supplier portfolios and invest in local production capabilities. Segmentation insights underscore the value of tailored product offerings, ranging from ultra-secure micro cut applications to high-capacity industrial deployments. Regional market analyses reveal that localized regulatory frameworks and infrastructure maturity necessitate bespoke go-to-market models to optimize resource allocation and capture emerging growth opportunities.

The strategic roadmap outlined herein encourages companies to prioritize modular recyclable blade designs, adopt subscription-based service models, and leverage digital platforms for direct customer engagement. By marrying operational excellence with innovation and customer-centric service, stakeholders can unlock new revenue streams, fortify competitive differentiation, and sustain growth. This synthesis of critical insights empowers decision makers to chart clear, actionable paths in an increasingly complex and dynamic market environment.

Engage with Ketan Rohom to Unlock Comprehensive Shredder Blade Intelligence and Secure Your Strategic Advantage with Expert Sales and Marketing Guidance

Discover how deeper insights into blade technology trends, segmentation dynamics, and regional opportunities can drive your organization’s competitive edge. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore tailored solutions that align with your operational objectives and risk management frameworks. Benefit from expert guidance on navigating supply chain complexities, optimizing procurement strategies, and capitalizing on emerging market segments.

By engaging directly with this offer, you will gain exclusive access to granular analysis, in-depth case studies, and bespoke recommendations that extend beyond publicly available summaries. Whether your focus is accelerating new product introductions, refining pricing models, or implementing subscription-based service structures, a strategic dialogue will illuminate the critical decision points needed for success.

Schedule a personalized consultation to secure your copy of the full market research report and partner with a seasoned advisor who understands the nuances of blade performance metrics, tariff impacts, and lifecycle sustainability. Take the next step toward reinforcing your organization’s leadership position in the shredder blade arena and driving measurable growth through informed strategic action.

- How big is the Shredder Blades Market?

- What is the Shredder Blades Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?