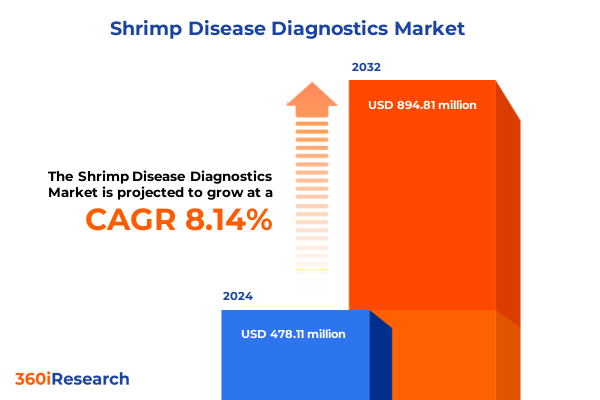

The Shrimp Disease Diagnostics Market size was estimated at USD 507.54 million in 2025 and expected to reach USD 539.33 million in 2026, at a CAGR of 8.43% to reach USD 894.80 million by 2032.

An urgent industry framing describing why diagnostics are now a core operational capability for shrimp producers, laboratories, and trade stakeholders

Shrimp disease diagnostics sits at the intersection of urgent animal health needs, accelerating technological capability, and shifting global trade pressures. The introduction you are reading frames an executive-level view of the diagnostic landscape, describing why diagnostic accuracy, speed, and field readiness now determine not only animal health outcomes but also trade access and commercial resilience. This section synthesizes the principal diagnostic modalities, the operational contexts in which they are applied, and the strategic consequences for stakeholders across broodstock suppliers, hatcheries, farms, laboratories, and policymakers.

Over the last five years, the industry has moved from a narrow reliance on laboratory-bound histopathology and conventional PCR to a layered diagnostic architecture that incorporates isothermal methods for field screening, quantitative assays for regulatory compliance, and sequencing-based approaches for pathogen discovery and surveillance. This hybrid architecture reflects a pragmatic balance: rapid, lower-complexity tests are used at the pond and hatchery level to triage and contain, while higher-resolution molecular methods provide confirmation, genotype typing, and detection of emerging threats. As a result, diagnostic decision-making is no longer a purely laboratory activity; it is an operational capability embedded in production workflows and procurement strategies.

The introduction also recognizes that disease diagnostics influence wider system behavior. Effective early detection reduces the need for reactive therapeutics and mass culling, supports traceability demands from buyers and auditors, and underpins biosecurity protocols that enable access to higher-value markets. Consequently, an integrated diagnostic strategy-one that aligns assay selection with sample logistics, end-user capacity, and regulatory requirements-becomes a core risk-management tool for the sector. This report’s opening perspective is intentionally practice-oriented: it is written to help executives translate diagnostic science into decisions that protect animal health, supply continuity, and market access.

How technological democratization, validation advances, and buyer-driven expectations have reshaped diagnostic strategy and operational surveillance practice

The landscape for shrimp disease diagnostics has shifted profoundly as diagnostic platforms, data flows, and stakeholder expectations have evolved in parallel. Technological democratization has lowered barriers to molecular testing: portable isothermal assays and simplified sample-prep workflows allow screening at the pond edge, while quantitative and multiplex PCR platforms continue to provide the confirmatory backbone for regulatory and export testing. At the same time, next-generation sequencing has transitioned from a niche research tool into a strategic surveillance instrument that identifies novel pathogens, tracks pathogen evolution, and informs targeted mitigation measures. These capabilities create an operational gradient where frontline screening reduces outbreak velocity and centralized molecular analytics deliver actionable intelligence for breeding, biosecurity, and supply-chain decisions. The cumulative effect is a diagnostic ecosystem that is faster, more granular, and better integrated with production and trade systems than in prior years.

Concurrently, expectations from buyers, auditors, and regulators have hardened. Traceability demands and food-safety due diligence mean diagnostic results no longer reside solely with producers; they form part of documentary evidence used by importers and certification bodies. That shift has driven investment in standardized protocols, third-party laboratory accreditation, and interoperable reporting formats that enable rapid validation across jurisdictions. Diagnostic companies and contract laboratories have responded by packaging assays with training, quality controls, and remote-support services to accelerate adoption among farms and regional labs.

A third transformative vector is the maturation of assay design and validation. Advances in primer/probe design, awareness of endogenous viral elements that can confound interpretation, and improvements in immunoassay specificity have increased confidence in molecular and immunological readouts. At the same time, the proliferation of field-deployable rapid immunochromatographic tests and low-cost LAMP-based solutions has altered sampling strategies: producers increasingly adopt layered testing protocols in which quick screens guide targeted confirmatory testing. The result is an industry that is shifting from episodic, reactive testing to continuous, risk-based surveillance that is better suited to preventing large-scale disease losses and maintaining market access.

Why 2025 tariff developments have turned diagnostics into a trade-enabling credential and reshaped sourcing, testing frequency, and laboratory demand across supply chains

The cumulative impact of United States tariff actions during 2025 has exerted immediate and structural pressure across the shrimp value chain, with clear implications for diagnostic demand, sourcing strategy, and regulatory scrutiny. As tariffs and antidumping decisions were announced and adjusted through the year, importers and processors responded by prioritizing supply-chain certainty and supplier compliance. That response increased demand for third-party testing capacity and drove importers to require enhanced documentary proof of disease-free status, validated testing protocols, and chain-of-custody assurances for consignments destined for U.S. buyers. In practice, this meant that exporters seeking to preserve access to U.S. markets had to produce higher-frequency testing records and, in many cases, invest in accredited confirmatory assays to satisfy buyer and customs requirements. The tariff environment therefore amplified the premium on robust diagnostics as a non-tariff mechanism to sustain trade relationships and reduce shipment-level rejection risk.

The tariff landscape also reconfigured sourcing patterns. Some buyers accelerated diversification toward suppliers perceived as lower tariff risk or with greater traceability infrastructure, prompting suppliers in contested origins to adopt more aggressive surveillance and certification workflows. For many processing firms and exporters, that translated into increased procurement of multiplex PCR and quantitative PCR assays to provide both pathogen detection and quantitative load data that purchasers increasingly demanded. In parallel, upstream producers faced commercial pressure to adopt routine screening regimes for broodstock and post-larvae as processors tightened acceptance criteria to mitigate the risk of costly rejections or returns. In short, tariff policy in 2025 did not simply change cost structures; it elevated diagnostics from a farm-level biosecurity input to a trade-enabling credential.

Finally, the policy-induced market disruptions reshaped investment priorities for diagnostic service providers and contract laboratories. Demand for rapid turnaround times and accredited reporting grew sharply, expanding commercial opportunities for laboratories able to demonstrate validated methods and interoperable reporting. This created a near-term bottleneck in some regions where laboratory capacity and skilled personnel lagged demand, accelerating conversations about remote training, capacity-building partnerships, and regional centers of testing excellence that could service both export and domestic supply chains more reliably. These dynamics underline a core insight: trade policy influences not only price and volume but also the content and intensity of diagnostic activity across the entire shrimp supply chain.

Practical segmentation insight showing how technology, method, application, end-user, and disease type determine diagnostic priorities and deployment pathways

Examining segmentation through the lens of technology, diagnostic method, application, end user, and disease type reveals practical pathways for prioritizing investment and deployment. On the technology axis, polymerase chain reaction remains the confirmatory backbone and is used in quantitative real-time formats, multiplex implementations that detect multiple targets in a single run, and reverse transcription approaches where RNA viruses are implicated; loop-mediated isothermal amplification has matured as a low-complexity field screen for rapid detection, and enzyme-linked immunosorbent assays provide targeted protein-level confirmation and surveillance in contexts where antibody or antigen detection is appropriate. Next-generation sequencing complements these approaches by enabling pathogen discovery, genome-level surveillance, and microbiome profiling that informs long-term herd-health strategies. Together the technologies form a coherent stack: isothermal and immunoassays for rapid triage, PCR variants for confirmation and regulatory compliance, and sequencing for strategic surveillance and research.

Across diagnostic methods, conventional histopathology remains indispensable for lesion characterization and retrospective investigations, while immunological diagnostics-including ELISA, lateral flow immunoassays, and western blotting-are increasingly used to detect toxins or antigenic markers that predict virulence. Microbiological diagnostics remain relevant for bacterial and fungal threats, particularly when culture and sensitivity data guide therapeutic choices. Molecular diagnostics span the spectrum from conventional PCR to multiplex and quantitative platforms, and are favored where sensitivity, specificity, and the ability to distinguish closely related genotypes are required. This methodological diversity supports a tiered approach to disease management in which the choice of method is driven by use case: rapid pond-level triage, outbreak investigation, screening of broodstock and post-larvae, and research-driven surveillance.

When considered by application, the segmentation clarifies operational priorities. Monitoring programs use rapid, repeatable assays to identify trends and trigger interventions. Outbreak investigations prioritize high-sensitivity and high-specificity laboratory confirmations to support containment actions and trace-back. Research applications frequently rely on sequencing and multiplex platforms to characterize pathogen biology and host interactions, while screening protocols-especially those tied to trade-demand accredited assays and transparent reporting. End-user segmentation highlights the fact that academic institutions and research institutes invest in high-resolution tools for discovery and method development, whereas aquaculture farms and diagnostic laboratories focus on robust, cost-effective screening and confirmatory pipelines. Disease-type segmentation further refines diagnostic choices: bacterial and fungal issues often require culture and sensitivity workups alongside molecular confirmation, parasitic threats benefit from microscopy and histopathology supported by targeted molecular markers, and viral diseases commonly necessitate RT-PCR, qPCR, or sequencing-based confirmation. Interpreting these dimensions together supports program design choices that match analytical performance to operational need and resource availability.

This comprehensive research report categorizes the Shrimp Disease Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Diagnostic Method

- Disease Type

- Application

- End User

Why regional production structures, regulatory variance, and trade dynamics in the Americas, EMEA, and Asia-Pacific drive distinct diagnostic priorities and supplier approaches

Regional context strongly influences diagnostic strategy and capability, and geographic differences in production systems, regulatory expectations, and trade flows create distinct priorities across the Americas, Europe–Middle East–Africa, and Asia-Pacific. In the Americas, production systems and export-oriented processors have responded to heightened buyer scrutiny and tariff shifts by investing in accredited testing workflows and centralized laboratories capable of handling export certification and rapid confirmatory testing. This has driven capacity expansion in processing hubs and created demand for standardized reporting that aligns with buyer and customs requirements. In contrast, Europe–Middle East–Africa presents a patchwork of regulatory regimes and biosecurity priorities; some markets emphasize stringent residue and certification standards that favor accredited laboratory testing and traceability, while other jurisdictions are focused on capacity building and outbreak response where mobile screening solutions and training are most valuable. The diversity across this region means that suppliers and service providers must offer flexible solutions that can be adapted to regulatory variance and infrastructure constraints.

Asia-Pacific remains the epicenter for production and innovation in shrimp diagnostics. The region hosts a concentration of diagnostic R&D, specialized assay manufacturers, and high-volume hatcheries that often require both rapid field screening and high-throughput confirmatory testing. Because many export-oriented processors in the Asia-Pacific supply a broad set of global markets, they commonly maintain layered testing regimes and place a premium on sequencing-based surveillance for emerging pathogens and genotype monitoring. These regional differences influence procurement and partnership strategies: companies seeking rapid market penetration in the Americas must demonstrate accredited reporting and supply-chain assurances, while success in Europe–Middle East–Africa often depends on adaptable deployment models and training programs. In the Asia-Pacific, the ability to integrate high-throughput molecular workflows with field-deployable screening and data-rich surveillance is a competitive advantage that aligns with the region’s production scale and research capacity.

This comprehensive research report examines key regions that drive the evolution of the Shrimp Disease Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Integrated ecosystem insights explaining why platform providers, kit manufacturers, contract labs, and service organizations jointly define commercial success in shrimp diagnostics

The company landscape in shrimp diagnostics is shaped less by a single dominant vendor and more by an ecosystem of platform providers, kit manufacturers, contract laboratories, and specialized service organizations that together deliver testing, training, and reporting. Platform providers offer the analytical backbone-thermal cyclers, quantitative PCR instruments, isothermal platforms, and sequencers-while kit manufacturers translate validated chemistries into field-ready or laboratory-ready formats. Contract laboratories play a pivotal role as intermediaries, offering accreditation, fast turnaround, and end-to-end sample logistics for exporters and importers that lack in-house capabilities. Specialized service organizations add value by bundling assays with training, digital reporting, and quality-control materials to accelerate uptake among farms and regional labs with limited technical depth.

In practice, successful market participants demonstrate three core capabilities: method validation and quality control that meet buyer and regulatory expectations, supply-chain reliability for reagents and consumables, and service models that close the gap between laboratory complexity and on-farm usability. Companies that combine accredited reference testing with scalable field solutions are best positioned to capture the new demand created by heightened trade scrutiny and rising expectations for traceable diagnostics. Likewise, organizations that invest in customer success-on-site training, digital result delivery, and data analytics-create value beyond a single assay sale by embedding diagnostic practice into production workflows. This ecosystem perspective clarifies a strategic truth for buyers and investors: the competitive advantage is increasingly derived from integrated service and quality assurance models rather than standalone assay performance alone.

This comprehensive research report delivers an in-depth overview of the principal market players in the Shrimp Disease Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3 Little Fish Sdn Bhd

- Amazing Biotech

- Aquaintech Inc.

- Arachem (M) Sdn Bhd

- Bioneer Corporation

- Blue Aqua International Pte. Ltd.

- CD Genomics

- China Guangzhou BioKey Healthy Technology Co. Ltd

- DSM Austria GmbH

- Forte Biotech

- GeneReach Biotechnology Corp.

- GeneReach Biotechnology Corporation

- Genics Pty. Ltd.

- Illumina, Inc.

- Innocreate Bioscience Co., Ltd.

- Lab-Ind Resource Sdn. Bhd.

- Laboratory Corporation of America Holdings

- Mahesh Aqua Holdings (Pvt) Ltd.

- Mylab Discovery Solutions Pvt. Ltd.

- PT Riset Nusantara Genetika (Nusantics)

- Randox Laboratories Ltd.

- Reagen LLC

- Ring Biotechnology Co Ltd.

- Speedy Assay Sdn. Bhd.

- SUREBIO

- Thermo Fisher Scientific Inc.

Practical, prioritized actions executives should take now to turn diagnostic investments into resilient supply chains, regulatory compliance, and market access advantages

Industry leaders must act deliberately to translate diagnostic capability into durable resilience and market access. First, prioritize a tiered diagnostic architecture that maps assay performance to use case: adopt rapid, low-complexity screens for routine monitoring and pond-level triage; use multiplex and quantitative PCR assays for export testing, outbreak confirmation, and cases where viral load informs management decisions; and reserve next-generation sequencing for surveillance, genotype tracking, and research applications that identify emerging threats. Second, invest in quality and traceability around diagnostic outputs by partnering with accredited laboratories or by seeking accreditation for in-house labs; consistent, auditable reporting will increasingly determine whether consignments clear customs and buyer audits. Third, close capacity gaps with targeted training and remote-support programs that standardize sample collection, maintain chain-of-custody, and reduce false positives and negatives that erode buyer confidence.

Fourth, align procurement and supplier contracts to ensure reagent continuity and rapid replenishment; the 2025 tariff-induced supply shifts demonstrated how quickly buyers can pivot and how fragile supply security can be in the face of policy or logistics shocks. Fifth, embed diagnostics into contractual requirements along supply chains; processors and importers should clearly define acceptable assays, accreditation standards, and reporting formats in commercial agreements to reduce ambiguity and transactional risk. Finally, adopt an evidence-led surveillance posture that uses periodic sequencing and targeted research to preempt pathogen emergence. Taken together, these actions will convert diagnostic investments into operational advantage, improving biosecurity, protecting market access, and reducing the likelihood of costly disruptions.

A mixed-methods research approach combining literature synthesis, stakeholder interviews, and method-level validation to produce actionable, evidence-based diagnostic insights

This report’s research methodology combined structured literature review, primary qualitative interviews, and method-level validation exercises to ensure conclusions are evidence-based and operationally actionable. Secondary research synthesized peer-reviewed literature, technical guidance from animal health authorities, and trade and import data to shape the macro-level context for diagnostics and trade. Primary research included interviews with diagnostic providers, contract laboratories, exporters, processors, and academic researchers to capture real-world constraints related to assay deployment, sample logistics, and accreditation. Method-level validation exercises compared published assay performance with practical turn-around and sample-preparation requirements to identify gaps between theoretically achievable sensitivity and field-level reliability.

Analytical methods emphasized triangulation: where trade data suggested shifting sourcing patterns, interviews validated how buyers and suppliers adjusted acceptance criteria and testing requirements. Where peer-reviewed literature documented assay sensitivity and specificity, the methodology examined how endogenous viral elements, sample type, and collection techniques affect real-world interpretation. Quality controls were emphasized throughout: sources were assessed for methodological transparency, and industry claims were corroborated by interviews or independent technical literature. Limitations are acknowledged: time-bound tariff policies and episodic outbreak events create dynamic conditions that require periodic reassessment, and the research intentionally avoided speculative market-sizing to focus on operational insights and validated method performance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Shrimp Disease Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Shrimp Disease Diagnostics Market, by Technology

- Shrimp Disease Diagnostics Market, by Diagnostic Method

- Shrimp Disease Diagnostics Market, by Disease Type

- Shrimp Disease Diagnostics Market, by Application

- Shrimp Disease Diagnostics Market, by End User

- Shrimp Disease Diagnostics Market, by Region

- Shrimp Disease Diagnostics Market, by Group

- Shrimp Disease Diagnostics Market, by Country

- United States Shrimp Disease Diagnostics Market

- China Shrimp Disease Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

A concise synthesis underscoring how layered diagnostics, accreditation, and supplier continuity together secure animal health, trade access, and operational resilience

In conclusion, shrimp disease diagnostics has evolved from an episodic, laboratory-centric activity into a distributed, mission-critical capability that enables biosecurity, trade compliance, and operational resilience. Technical progress-spanning isothermal field assays, multiplex and quantitative PCR, validated immunoassays, and sequencing-provides a practical toolkit for layered surveillance and outbreak response. Regional dynamics and 2025 tariff developments have amplified the strategic role of diagnostics by making accredited testing and transparent reporting core elements of market access. The industry’s near-term priorities are clear: invest in tiered testing architectures that match assay capability to operational need, shore up laboratory accreditation and reporting standards, and build supplier relationships that ensure both reagent continuity and technical support.

These conclusions are not theoretical. They reflect a landscape in which on-farm management, processor acceptance criteria, and import controls are converging around demonstrated testing protocols and auditable results. For leaders, the imperative is to align diagnostic investments with contractual and regulatory realities so that disease detection becomes a risk-reduction instrument rather than an incremental cost. Those that succeed will combine practical on-farm screening, reliable confirmatory testing, and periodic sequencing-based surveillance to protect animal health and sustain access to priority markets.

Secure the comprehensive shrimp disease diagnostics market report and a tailored executive briefing by contacting the Associate Director for a customized purchase and onboarding plan

To obtain the full, evidence-based market research report and a tailored briefing that aligns diagnostic strategy with evolving trade and regulatory dynamics, contact Ketan Rohom, Associate Director, Sales & Marketing, to purchase the report and arrange a personalized executive briefing. The report includes detailed method-level assessments, regional risk matrices, and practical playbooks for rapid operationalization of diagnostics across aquaculture value chains. A direct consultation will clarify licensing of data deliverables, customization options for end-user segments, and next-step support for procurement or pilot programs.

A purchase discussion with the Associate Director will also allow prospective buyers to request specific appendices such as validated assay performance tables, WOAH-aligned diagnostic protocols, and a prioritized list of lab- and field-ready suppliers tailored to their geography and end-user requirements. Prospective purchasers will be able to secure timelines for delivery, remote walk-throughs of methodological annexes, and a scope for bespoke research extensions that address organism-specific surveillance, screening workflows, or trade-compliance needs.

Initiating a purchase inquiry will connect you to a sales and research coordination team prepared to support procurement, technical Q&A, and post-purchase onboarding. This route ensures you receive not only the written report but also the implementation guidance needed to translate market intelligence into operational decisions and diagnostic investments across hatcheries, farms, and testing laboratories.

- How big is the Shrimp Disease Diagnostics Market?

- What is the Shrimp Disease Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?