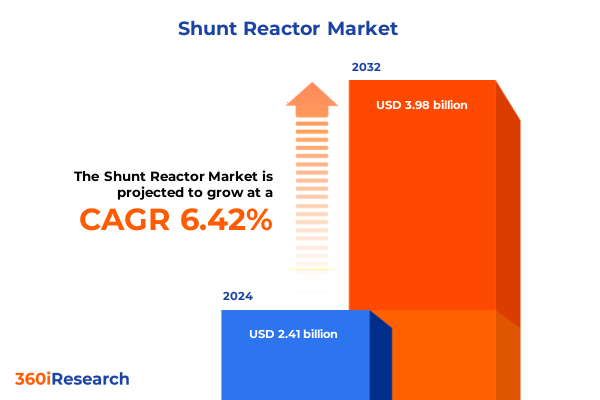

The Shunt Reactor Market size was estimated at USD 2.56 billion in 2025 and expected to reach USD 2.71 billion in 2026, at a CAGR of 6.50% to reach USD 3.98 billion by 2032.

A clear, authoritative primer on shunt reactor fundamentals connecting device architectures, operational trade-offs, and procurement realities for grid stakeholders

Shunt reactors are fundamental grid devices engineered to absorb reactive power, regulate voltage on long transmission lines, and stabilize networks that increasingly host variable generation sources. This executive summary synthesizes technical fundamentals, sector shifts, trade-policy impacts, segmentation intelligence, regional dynamics, supplier positioning, and pragmatic recommendations for infrastructure owners and procurement teams. It frames the complexity of today’s operating environment and the specific constraints that affect specification, sourcing, and lifecycle management for both fixed and variable shunt reactor solutions.

Readers will find a concise orientation to device architectures-air-core dry designs versus oil-immersed constructions-and the operational trade-offs for cooling, installation flexibility, and phase and voltage class selection. The intent is to provide utility planners, substation engineers, and supply-chain leaders with a single narrative that connects engineering choices to procurement realities and policy headwinds, while setting the stage for deeper technical annexes and supplier evaluations included in the full study.

Transformative shifts reshaping shunt reactor relevance driven by renewables, grid digitization, and the move from bespoke to standardized interoperable solutions

The power system landscape is undergoing structural change driven by electrification, rapid distributed renewable deployment, and the increasing speed of large-scale digital loads. Traditional synchronous generation is being replaced by inverter-based resources that change the grid’s reactive power profile and reduce inherent system inertia. As a result, grid operators are prioritizing technologies that provide fast, reliable voltage control and that integrate smoothly with advanced control systems and grid-forming devices. Variable shunt reactors and electronically coordinated reactive compensation are emerging as practical complements to other grid-stabilizing technologies.

At the same time, digitalization across substations is enabling condition-based operations and predictive maintenance for heavy electrical equipment. Modern shunt reactor designs incorporate tap-changers, real-time control interfaces, and lower-loss core materials to improve efficiency and reduce lifecycle operating expense. These technical advances are complemented by a strategic push toward standardized specifications and modular architectures that ease interchangeability and shorten procurement cycles. In short, the landscape is shifting from a one-off, bespoke procurement model toward interoperable solutions that can scale with changing load patterns and regulatory expectations. This confluence of evolving load profiles, device intelligence, and standardization is redefining how utilities plan reactive power assets and how suppliers design product families for multi-voltage, multi-application portfolios.

How evolving United States tariff measures and trade policy dynamics in 2025 have reshaped procurement risk, lead-time exposure, and sourcing calculus for electrical equipment

Trade policy and tariff activity in recent years have added a new, persistent variable to procurement and lifecycle cost considerations for high-voltage substation equipment. Targeted tariff actions on raw materials and intermediate goods, combined with broader duties that have at times expanded to finished electrical equipment, have created cost and timing uncertainty that permeates procurement cycles for shunt reactors and related apparatus. These measures alter the calculus for sourcing critical components such as grain-oriented electrical steel, copper conductor material, and specialized manufacturing inputs, and they have ripple effects across supplier margins, manufacturing investment decisions, and the relative attractiveness of domestic production versus import strategies.

Utilities and project owners must now evaluate not only technical fit but also supply-chain resilience. Lead-time risk has become a primary procurement constraint, encouraging owners to re-examine stock strategies, standardize specifications to enable multiple qualified suppliers, and embed tariff contingency allowances in contract terms. Simultaneously, manufacturers face difficult capacity decisions: expanding domestic production can buffer trade risk but demands significant capital and specialized workforce development. Where tariffs affect upstream commodities, both imported and domestically produced units can carry higher input costs, while legal and policy flux can create episodic windows of relief or renewed constraint. For asset owners, the result is a more active role in trade-aware procurement planning: aligning specification windows with policy timelines, prioritizing supplier certifications that limit rework during customs scrutiny, and building contractual protections that address material-cost pass-throughs and lead-time escalation.

Actionable segmentation insights linking shunt reactor design choices to application-specific trade-offs across type, cooling, installation flexibility, phase, voltage, and end-use contexts

Segmentation analysis must inform technical choices and procurement routes because the diversity of shunt reactor types and operating contexts produces materially different risk profiles. Choice of Type-air-core dry designs versus oil-immersed reactors-drives footprint, environmental permitting, maintenance cadence, and noise and fire-safety strategies; these considerations become decisive when deploying in dense urban substations, data-center hubs, or remote renewable collector systems. Cooling selection-dry cooled compared with oil-cooled-intersects with lifecycle risk and site access for routine servicing, so the decision should be anchored in total cost-of-ownership modeling that includes outage costs and maintenance logistics.

Installation architecture-whether a fixed shunt reactor or a variable shunt reactor with on-load tap-changing capability-defines operational flexibility. Fixed units offer simplicity and lower initial complexity, while variable solutions reduce switching transients and better accommodate daily and seasonal variation in reactive power demand. Phase configuration, whether single-phase or three-phase, is a specification decision driven by the point of connection and by harmonics and protection coordination considerations. Voltage-range choices determine insulation levels, core materials, and transport constraints; selecting among lower-voltage up to 132 kV, intermediate 132–220 kV and 220–400 kV classes, or above 400 kV requires an early alignment between system planners and substation designers.

End-user applications shape priority trade-offs: commercial and urban infrastructure applications-such as data centers, large commercial complexes, and smart-city deployments-prioritize compact footprint, low noise emissions, and fast response to dynamic load swings. Industrial applications including chemicals and petrochemicals, mining and cement operations, oil and gas refineries, and steel and metallurgy require robustness, high short-time withstand capability, and straightforward maintenance access in harsh environments. Transport electrification projects for railways and metros demand high reliability and often modular designs to match trackside and depot constraints. Renewable energy integration favors variable shunt reactors and tighter control integration to smooth voltage excursions at high penetration levels. Utilities and power transmission companies typically value design modularity, proven reliability, and lifecycle service agreements that include condition monitoring and spare-parts strategies.

This comprehensive research report categorizes the Shunt Reactor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Cooling

- Installation

- Phase

- Voltage Range

- End-User / Application

Key regional implications for shunt reactor procurement showing how Americas, Europe–Middle East–Africa, and Asia–Pacific dynamics shape sourcing, standards, and capacity choices

Regional dynamics are shaping procurement strategy and vendor selection in ways that no longer allow a one-size-fits-all approach. In the Americas, grid modernization priorities, accelerated electrification demands from hyperscale data centers and manufacturing, and the constrained domestic transformer and reactor manufacturing base have combined to increase emphasis on supply-chain resilience, domestic capacity expansions, and accelerated standardization to reduce lead times. This context pushes buyers toward multi-sourced procurements and early engagement with manufacturers to lock production slots and align technical acceptance testing timelines.

Across Europe, the Middle East & Africa, regulatory emphasis on system stability and large-scale offshore and onshore wind integration is driving demand for variable reactive power assets and sophisticated control integration. Procurement in these markets frequently stresses lifecycle environmental performance and circularity of materials, with buyers preferring lower-loss core technologies and designs that simplify end-of-life recycling. In the Middle East, large-scale grid projects linked to industrial hubs demand high-reliability designs with custom cooling and earthing solutions to suit local climatic and site conditions.

In the Asia-Pacific region, continued infrastructure build-out, rapid expansion of renewable generation, and a dense manufacturing ecosystem produce a bifurcated environment: domestic manufacturers can capture significant regional volume while international suppliers remain essential for advanced high-voltage and variable designs. Utilities in this region often prioritize locally proven designs and regional service footprints, while also seeking technology transfer arrangements that shorten project commissioning timelines. Together, these regional modalities define where technical standardization, local capacity investments, and supplier partnerships will deliver the most value.

This comprehensive research report examines key regions that drive the evolution of the Shunt Reactor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

How supplier engineering depth, regional manufacturing footprint, and services-oriented models determine competitive advantage in the shunt reactor ecosystem

Supplier competitiveness is being redefined by the intersection of engineering capability and supply-chain strategy. Established global manufacturers have been investing in variable reactor technologies, advanced tap-changer designs, and lower-loss core materials to meet the operational demands of higher renewable penetration and more dynamic load profiles. These incumbent firms also bring deep testing infrastructure and long-standing relationships with utilities that reduce project risk during type-testing and commissioning.

A parallel trend is the rise of more regionally focused manufacturers and engineering partners that can shorten logistics timelines and offer local service networks, which hold particular appeal where long lead times for highly customized high-voltage equipment would otherwise derail project schedules. Meanwhile, manufacturers that adopt modular production strategies and that engage early with buyers to harmonize specifications gain advantage by reducing custom engineering cycles and enabling faster production slot allocation. Finally, firms that couple product roadmaps with condition-monitoring services and digital support models create differentiated value because they lower operational risk and provide actionable asset health intelligence throughout the reactor lifecycle.

This comprehensive research report delivers an in-depth overview of the principal market players in the Shunt Reactor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd

- Beijing Power Equipment Group Co., Ltd.

- CG Power and Industrial Solutions Limited

- Elgin Power Solutions

- ENTES Elektronik Cihazlar İmalat ve Ticaret A.Ş.

- Faramax International GmbH

- Fuji Electric Co., Ltd.

- GBE SpA

- General Electric Company

- Getra Power S.P.A.

- Hilkar

- Hitachi Ltd.

- Hyosung Coporation

- Jiangshan Scotech Electrical Co.,Ltd

- JSC SVEL Group

- Kalentel Energy Telecom

- Meidensha Corporation

- Mitsubishi Electric Corporation

- Ningbo Zhongce E.T Electronics Co., Ltd.

- Nissin Electric Co., Ltd.

- Phoenix Electric Corp.

- S.E.A. Società Elettromeccanica Arzignanese S.p.A.

- SGB-SMIT GmbH

- Shrihans Electricals Pvt. Ltd.

- Siemens AG

- Tamura Electronics (M) Sdn. Bhd.

- Toshiba Corporation

- Transformers Manufacturing Company Pty Ltd.

- WEG S.A.

- Zaporozhtransformator PrJSC

Practical, high-impact recommendations for utilities and manufacturers to reduce tariff and lead-time exposure while preserving technical performance and operational resilience

Industry leaders should align capital procurement, specifications, and supplier selection to reduce exposure to lead-time and tariff-driven shocks while preserving technical performance. First, prioritize specification standardization across project portfolios to enable multiple qualified suppliers and to unlock manufacturing efficiencies that shorten lead times. Second, embed contractual terms that explicitly allocate tariff and commodity-cost risk, use staggered procurement windows, and secure production slots through earlier supplier engagement. Third, institute condition-based maintenance and digital monitoring as contract deliverables to reduce unplanned outages and optimize replacement timing.

Additionally, pursue strategic vendor partnerships that include technology transfer, shared training programs, and localized spare-parts depots where feasible. Where projects are critical to operational resilience, consider dual-sourcing strategies that blend domestic and regional manufacturers to balance political risk with delivery certainty. Finally, accelerate internal capability-building so that engineering and procurement teams speak the same technical language during vendor negotiations: harmonized technical specs, standardized factory-acceptance tests, and common acceptance criteria materially reduce rework and testing cycles at commissioning.

Transparent, mixed-methods research methodology combining primary interviews, technical validation, and triangulated secondary sources to underpin actionable recommendations

This research synthesizes a mixed-methods approach combining primary interviews, technical document review, and secondary-source triangulation. Primary inputs include structured interviews with substation engineering leads, procurement officers, and manufacturing executives to surface real-world procurement constraints and acceptance-test practices. Technical performance characteristics were validated against whitepapers, manufacturer technical brochures, and standards documents to ensure accurate representation of device architectures and operational trade-offs.

Secondary research integrated authoritative technical guidance and sector analysis from laboratory and industry sources to frame trends in renewable integration, grid-forming technology adoption, and supply-chain dynamics. Policy and tariff impacts were assessed through public government notices and contemporaneous trade commentary to construct a risk-aware procurement narrative. Wherever possible, qualitative assertions were cross-checked with multiple independent sources to ensure balanced representation and to avoid single-source bias. The methodology emphasizes traceability of claims, explicit sourcing for policy-sensitive statements, and an audit trail linking recommendations to both technical and commercial evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Shunt Reactor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Shunt Reactor Market, by Type

- Shunt Reactor Market, by Cooling

- Shunt Reactor Market, by Installation

- Shunt Reactor Market, by Phase

- Shunt Reactor Market, by Voltage Range

- Shunt Reactor Market, by End-User / Application

- Shunt Reactor Market, by Region

- Shunt Reactor Market, by Group

- Shunt Reactor Market, by Country

- United States Shunt Reactor Market

- China Shunt Reactor Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

A concluding synthesis highlighting how technical choices paired with supply-chain and policy-aware procurement preserve grid stability and accelerate energy transitions

In an operating environment defined by rapid renewable integration, intensifying electrification, and fluctuating trade policy, shunt reactors remain core enablers of voltage stability and reactive power management. The device choices made today-from type and cooling medium to installation architecture and voltage rating-have disproportionate influence on project timelines, lifecycle costs, and operational flexibility. At the same time, supply-chain realities and tariff dynamics add a strategic layer to procurement decisions that goes beyond price and performance.

The actionable takeaway for infrastructure owners and manufacturers is clear: technical decisions must be made in lockstep with supply-chain and policy-aware procurement strategies. Early standardization, targeted supplier partnerships, and embedding monitoring and service provisions into vendor contracts are practical levers that materially reduce risk and accelerate deployment. Implemented thoughtfully, these measures will preserve grid reliability and enable the clean-energy transition while mitigating the near-term disruptions associated with trade and capacity constraints.

Access comprehensive, actionable shunt reactor intelligence and arrange a tailored briefing with Ketan Rohom to accelerate procurement and deployment decisions

For decision-makers seeking the most practical intelligence on shunt reactor dynamics, supply-chain pressures, and strategic options, purchasing the full market research report unlocks detailed vendor profiles, procurement playbooks, technical comparisons, and region-by-region deployment case studies. The report distills primary interviews with utility engineers, procurement leads, and manufacturing executives; it maps procurement windows and standardization levers that materially shorten lead times and lower total cost of ownership across a range of installation archetypes.

To discuss how this research aligns with your portfolio priorities, connect with Ketan Rohom, Associate Director, Sales & Marketing. Ketan can arrange a customized briefing, demonstrate sample report extracts tailored to your technical and commercial interests, and outline enterprise licensing and consulting add-ons that accelerate implementation. Engaging directly ensures you receive the research outputs most relevant to your planning horizons, capital programs, and vendor selection processes.

If you prefer a focused conversation before purchase, Ketan can coordinate a 30-minute consultation to review the report’s scope and how its insights apply to immediate procurement or modernization decisions. This consultative approach helps translate market intelligence into actionable procurement specifications, RFP language, and risk-mitigation checklists for critical shunt reactor acquisitions.

- How big is the Shunt Reactor Market?

- What is the Shunt Reactor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?