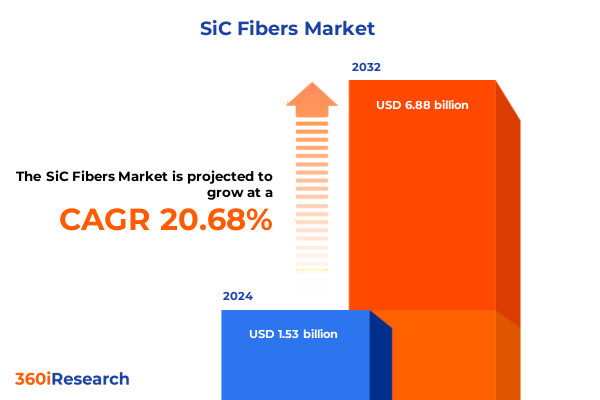

The SiC Fibers Market size was estimated at USD 1.84 billion in 2025 and expected to reach USD 2.22 billion in 2026, at a CAGR of 20.70% to reach USD 6.88 billion by 2032.

Exploring how silicon carbide fiber innovations are reshaping high-performance applications across industries seeking durability and lightweight advantages

Silicon carbide fibers have emerged as a cornerstone of next-generation materials, offering unmatched strength, thermal stability, and oxidation resistance that address the most demanding performance requirements. As industries strive to reduce weight while maintaining structural integrity, these fibers deliver a unique combination of mechanical and thermal advantages that traditional materials cannot match. With applications spanning aerospace turbine components to electric vehicle thermal barriers, the versatility of silicon carbide fibers is driving innovative design approaches and redefining engineering benchmarks.

In recent years, accelerated adoption of ceramic matrix composites has underscored the critical role of silicon carbide fibers in achieving higher operating temperatures and longer service lives for high-performance systems. The aerospace sector has validated these fibers through extensive flight hours, confirming their ability to withstand extreme environments without significant weight penalties. Meanwhile, the automotive industry is integrating silicon carbide fibers into battery enclosures and heat-treatment systems to enhance safety and efficiency under high thermal loads. Underpinning these advancements are ongoing material science breakthroughs that refine precursors, optimize fiber spinnability, and improve matrix compatibility, laying the groundwork for broader industrial uptake.

Moreover, global supply chain realignments and sustainability mandates have intensified focus on domestic production capabilities and secure sourcing. Strategic investments by both public and private stakeholders aim to shorten lead times and mitigate geopolitical risks associated with critical fiber precursors. Consequently, silicon carbide fibers are no longer a niche specialty; they are stepping into mainstream engineering portfolios, shaping new frontiers for high-temperature and high-stress applications across diverse market segments.

Identifying pivotal shifts in technology, supply chain realignment, and sustainability driving the silicon carbide fiber landscape into new frontiers

The silicon carbide fiber landscape is undergoing a profound transformation driven by converging technological, environmental, and market forces. Foremost among these trends is the push toward decarbonization, which has elevated the importance of lightweight materials that improve fuel efficiency in aerospace and automotive powertrains. As regulatory bodies worldwide tighten emissions standards, engineers are turning to silicon carbide fiber-reinforced composites to achieve higher temperature capabilities and reduce vehicle mass without compromising safety or reliability.

Simultaneously, advances in manufacturing processes, such as improved chemical vapor deposition techniques and polymer precursor routes, are enabling more consistent fiber quality and cost efficiencies. These enhancements are unlocking new use cases in electronics cooling and power semiconductor packaging, where exceptional thermal conductivity and electrical insulation properties are paramount. The semiconductor industry’s enthusiastic shift to silicon carbide devices has, in turn, stimulated demand for compatible fiber materials that can serve as heat spreaders under extreme operating conditions.

In parallel, supply chain resilience has become a strategic imperative. Recent geopolitical shifts have highlighted vulnerabilities in procurement of polycarbosilane precursors, prompting stakeholders to diversify sourcing and expand domestic fabrication capacity. Investment in new production facilities, supported by government subsidies, is fostering regional clusters of fiber and composite manufacturing. Collectively, these transformative shifts are propelling silicon carbide fibers from specialty applications into widespread industrial adoption, establishing a new paradigm for high-performance materials integration.

Assessing the cumulative ramifications of the 2025 United States Section 301 tariff increases on silicon carbide fiber imports and supply strategies

Beginning in January 2025, the United States implemented additional Section 301 tariffs that raised import duties on certain critical materials from China by 25 percent. These measures apply to a broad spectrum of industrial inputs covered under new Harmonized Tariff Schedule headings, which include ceramic and mineral products vital to silicon carbide fiber production. As a result, companies relying on imported precursors such as polycarbosilane and specialized chemical vapor deposition gases have faced increased procurement costs and extended lead times.

The cumulative impact of these tariffs has driven manufacturers to reassess global supply chains and consider nearshoring of key processes. In response, several leading fiber producers have announced plans to expand domestic precursor synthesis and fiber-spinning operations, supported by federal research grants and state-level incentives. Although these efforts address long-term supply security, they require substantial capital investment and multi-year qualification cycles to meet stringent aerospace and nuclear standards.

Moreover, the tariff environment has incentivized the adoption of alternative fabrication methods, including melt spinning and polymer-derived routes that rely on locally available feedstocks. While these techniques offer potential cost advantages, they also present trade-offs in fiber uniformity and high-temperature performance. Consequently, navigating the 2025 tariff landscape demands strategic collaboration between suppliers, end users, and policy stakeholders to balance cost, quality, and supply chain resilience for silicon carbide fiber applications.

Revealing deep segmentation insights by fiber type, application, fabrication, form, and grade that underpin divergent growth trajectories in the silicon carbide fiber market

Deep segmentation of the silicon carbide fiber market reveals nuanced growth drivers across multiple dimensions. By fiber type, continuous filament leads investment and adoption due to its superior tensile strength and consistent dimensional stability at elevated temperatures. Particulate short fiber remains relevant for cost-sensitive polymer infiltration routes, whereas whisker grades find niche applications requiring enhanced fracture toughness and crack-bridging capabilities.

End-use applications further differentiate the market, as aerospace and defense leverage fiber properties to achieve unprecedented performance in turbine shrouds and hypersonic vehicle thermal shields. Automotive and electronics sectors are pioneering battery fire-barrier panels and semiconductor heat spreaders, respectively, capitalizing on the material’s thermal insulation and conductivity trade-offs. Energy applications, including gas-turbine and nuclear reactor components, demand fibers that maintain structural integrity under cyclic thermal stresses, while industrial and medical segments explore filtration and high-temperature reactor linings.

Fabrication methods such as chemical vapor deposition, melt spinning, and polymer precursor routes each impart distinct microstructural characteristics. CVD fibers exhibit the highest purity and oxidation resistance, whereas melt-spun variants offer scalable production at moderate cost. Polymer-derived precursors grant flexibility in fiber diameter and composition but often require additional post-treatment to achieve comparable performance.

Form and grade represent further axes of segmentation. Composite forms integrate fibers into CMC panels or woven preforms for complex geometries, while pure forms serve as standalone heat-resistant textiles. High-purity grades address the most demanding aerospace and semiconductor applications, whereas standard grades support broader industrial adoption. Understanding these segmentation insights is critical for aligning product development and commercial strategies.

This comprehensive research report categorizes the SiC Fibers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Fabrication Method

- Form

- Grade

- End Use Application

Uncovering regional dynamics across the Americas, Europe, Middle East & Africa, and Asia-Pacific that are shaping silicon carbide fiber demand and development

Regional dynamics in the silicon carbide fiber market exhibit distinct patterns driven by local industries, infrastructure, and policy frameworks. In the Americas, strong aerospace and defense ecosystems, combined with federal funding for domestic semiconductor and composite manufacturing, have spurred capacity expansions in precursor synthesis and fiber spinning facilities. Collaborative R&D programs between national laboratories and industry players have accelerated qualification timelines for advanced fiber reinforcements in both military and commercial platforms.

Europe, Middle East & Africa present a diverse landscape. Western European nations, notably Germany and France, leverage robust automotive and gas-turbine sectors to drive demand for high-temperature composites, supported by regulatory incentives for emissions reductions. Emerging Middle Eastern markets are investing in advanced energy and petrochemical complexes, fostering pilot programs for CMC-lined reactors and thermal-shock-resistant liners. Across Africa, nascent industrial clusters are evaluating lightweight ceramics for power generation and processing applications, with technical partnerships facilitating knowledge transfer.

Asia-Pacific remains the fastest-growing region, underpinned by Japanese mastery of polycarbosilane chemistry and South Korean investments in semiconductor heat-spreaders and electric vehicle power modules. China’s ambitious hypersonic and aero-engine research initiatives continue to scale domestic fiber fabrication, while India’s expanding aerospace sector and burgeoning renewable energy infrastructure are emerging as significant future markets. These regional insights inform targeted market entry strategies and investment priorities for silicon carbide fiber stakeholders.

This comprehensive research report examines key regions that drive the evolution of the SiC Fibers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading silicon carbide fiber innovators and their strategic initiatives that are defining competitive advantages in high-temperature materials

The competitive landscape of silicon carbide fibers is dominated by a handful of vertically integrated innovators that control key stages of the value chain. Leading Japanese firms, with decades of expertise in precursor formulation and defect-controlled spinning, maintain premium positions through sustained research investments and high-reliability supply agreements with aerospace primes. Their third-generation fibers deliver unprecedented tensile strength retention at temperatures exceeding 1,600 °C, cementing their role as benchmark materials for turbine and hypersonic applications.

In North America, major diversified engineering groups have pursued strategic partnerships and government-backed funding to establish domestic precursor plants and trial CMC manufacturing lines. These initiatives are aimed at reducing reliance on imports, shortening qualification pathways, and securing long-term supply for critical defense and energy infrastructure projects. Select specialty materials companies focus on niche segments such as fiber-reinforced filtration systems and high-temperature insulation, differentiating through rapid prototyping and agile production capabilities.

European players leverage advanced weaving and braiding technologies to produce complex preforms that streamline composite fabrication. Strategic collaborations under regional consortia enable shared testing facilities and accelerated certification processes. Meanwhile, emerging entrants in Asia-Pacific are aligning with national defense and commercial aerospace development programs, fostering co-development agreements that integrate local manufacturing with international technology flows. These company insights shape competitive strategies, guide partnership opportunities, and highlight areas for differentiation in the silicon carbide fiber market.

This comprehensive research report delivers an in-depth overview of the principal market players in the SiC Fibers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- BJS Ceramics GmbH

- CeramTec GmbH

- CoorsTek, Inc.

- DowAksa Advanced Composites Ltd.

- Entegris, Inc.

- Kyocera Corporation

- Mitsubishi Chemical Holdings Corporation

- Morgan Advanced Materials PLC

- Morgan Advanced Materials plc

- Nippon Carbon Co., Ltd.

- Suzhou Saifei Group Co., Ltd.

- TISICS Ltd.

- Toyo Tanso Co., Ltd.

- Ube Industries, Ltd.

Formulating targeted recommendations for industry leaders to capitalize on emerging silicon carbide fiber trends and optimize strategic positioning

Industry leaders should prioritize a multifaceted approach to harness the full potential of silicon carbide fibers. First, aligning R&D efforts with end-user performance requirements will drive differentiated product offerings; for example, optimizing fiber surface chemistry to enhance matrix bonding can yield measurable improvements in composite fatigue life. Collaboration with aerospace and automotive OEMs on co-development projects can accelerate validation cycles and create embedded supply relationships.

Second, supply chain resilience must be fortified by diversifying precursor sources and scaling domestic fabrication capacity. Pursuing joint ventures with regional chemical manufacturers can mitigate tariff impacts and geopolitical risks. Concurrently, investing in flexible fabrication platforms-such as modular melt-spinning units and adaptive CVD reactors-enables rapid pivoting between grades and forms, catering to evolving market demands.

Third, firms should cultivate cross-industry partnerships to explore unconventional applications, including thermal management in power electronics and novel filtration systems for high-temperature process streams. By leveraging pilot demonstrations and shared qualification data, companies can lower entry barriers for new use cases and expand total addressable markets.

Finally, embedding digital twins and advanced analytics in quality control and production planning will enhance operational efficiency and yield consistency. Transparent data sharing across the supply chain can preemptively identify production anomalies and accelerate corrective actions. Implementing these strategic recommendations will position industry leaders to capture sustainable growth in the silicon carbide fiber sector.

Detailing the rigorous research methodology harnessed to deliver data-driven insights into the silicon carbide fiber market’s evolving framework

The research methodology underpinning this analysis integrated a blend of primary and secondary research, quantitative data synthesis, and triangulation against authoritative sources. Primary interviews were conducted with senior executives, technical directors, and materials scientists across leading fiber producers, composite manufacturers, and end-use OEMs. These discussions yielded insights into emerging performance requirements, qualification hurdles, and strategic investment plans.

Secondary research involved rigorous review of trade publications, technical journals, regulatory filings, and patent databases to capture the latest advancements in precursor chemistry, spinning technologies, and composite integration techniques. Harmonized Tariff Schedule modifications and government press releases were examined to quantify the impact of policy changes on supply chains and cost structures. Market intelligence reports provided supplementary context on regional demand drivers and capacity expansions, which were then cross-checked against official company statements and industry consortium announcements.

Data points were validated through triangulation, ensuring consistency between independently sourced information and stakeholder interviews. Where discrepancies arose, follow-up consultations clarified ambiguities, resulting in a coherent dataset that supports strategic market insights. This rigorous methodological framework delivers a high degree of reliability and relevance for decision-makers navigating the evolving silicon carbide fiber landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our SiC Fibers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- SiC Fibers Market, by Type

- SiC Fibers Market, by Fabrication Method

- SiC Fibers Market, by Form

- SiC Fibers Market, by Grade

- SiC Fibers Market, by End Use Application

- SiC Fibers Market, by Region

- SiC Fibers Market, by Group

- SiC Fibers Market, by Country

- United States SiC Fibers Market

- China SiC Fibers Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing critical findings and strategic foresight to contextualize the silicon carbide fiber market’s trajectory and industry implications

Silicon carbide fibers stand at the forefront of advanced materials innovation, delivering performance thresholds that redefine high-temperature and high-stress applications. From aerospace engine components that endure extreme thermal cycles to emerging electric vehicle and semiconductor platforms demanding efficient thermal management, these fibers are catalyzing transformative engineering solutions. Key market shifts-including decarbonization mandates, supply chain realignment, and manufacturing advancements-are converging to expand both the scale and scope of fiber deployments.

The 2025 tariff environment underscores the imperative for strategic supply chain diversification and domestic capacity development, while segmentation insights reveal targeted opportunities across fiber types, applications, fabrication methods, forms, and grades. Regional dynamics further highlight the importance of localized investments and collaborative frameworks that align with distinct industry ecosystems in the Americas, Europe, Middle East & Africa, and Asia-Pacific.

Competitive analysis shows that firms with vertically integrated capabilities and strong R&D pipelines will retain market leadership, yet novel entrants and cross-industry partnerships can unlock adjacent growth avenues. By synthesizing these findings, stakeholders gain a holistic perspective on the silicon carbide fiber market’s trajectory, enabling informed decisions that balance innovation, resilience, and commercial viability.

Connect with Ketan Rohom to secure comprehensive silicon carbide fiber market research that empowers strategic decision-making and growth

Elevate your strategic planning with unparalleled expertise by connecting directly with Ketan Rohom, who will guide you through the nuances of silicon carbide fiber innovations and market imperatives. Ketan’s deep understanding of advanced materials and market intelligence will ensure you receive a tailored research package that aligns with your organization’s goals. Engage now to transform insights into actionable strategies and secure your competitive edge in this dynamic sector.

- How big is the SiC Fibers Market?

- What is the SiC Fibers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?