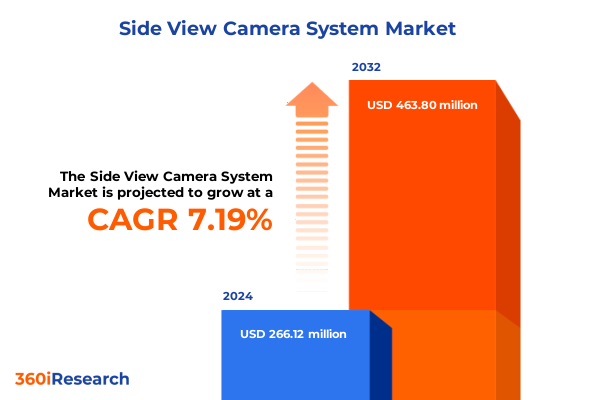

The Side View Camera System Market size was estimated at USD 284.18 million in 2025 and expected to reach USD 309.73 million in 2026, at a CAGR of 7.24% to reach USD 463.79 million by 2032.

Exploring the Critical Role of Side View Camera Systems in Enhancing Vehicle Safety, Driver Awareness, and Regulatory Compliance Across Global Markets

Side view camera systems are rapidly transforming the way drivers perceive their vehicle’s surroundings, delivering critical enhancements in safety, convenience, and regulatory compliance. As automotive manufacturers and suppliers face mounting pressure to reduce blind spots and adhere to stringent safety mandates, side view cameras have emerged as a pivotal solution for modern vehicles. These imaging systems not only augment visibility in urban traffic and tight parking scenarios but also integrate seamlessly with advanced driver assistance systems, laying the groundwork for higher levels of driving automation.

With technological sophistication accelerating at an unprecedented pace, vehicle designers are leveraging high-resolution sensors, advanced image processing algorithms, and compact form factors to embed side view cameras into sleek exterior mirror housings and modular mounts. This evolution is further influenced by consumer demand for smarter mobility features and by regional safety regulations that increasingly recognize camera-based systems as viable alternatives to traditional mirror assemblies. Consequently, the side view camera market has become a focal point for innovation, strategic partnerships, and regulatory dialogue across global automotive ecosystems.

Assessing the Technological Innovations and Regulatory Dynamics Driving Unprecedented Transformation in the Side View Camera System Market

The landscape of side view camera systems has undergone transformative shifts driven by breakthroughs in sensor technology, artificial intelligence, and regulation. As image sensors evolve, complementary metal-oxide semiconductor (CMOS) solutions featuring global and rolling shutter variants deliver superior dynamic range and lower power consumption compared to older charge-coupled device (CCD) implementations, which themselves have matured with frame and interline transfer mechanisms to support challenging lighting conditions. These technological innovations are unlocking new use cases, from enhanced blind spot detection to advanced lane change assistance, fundamentally altering how cameras capture, process, and relay critical visual data.

Simultaneously, evolving regulatory frameworks in North America, Europe, and Asia have accelerated the adoption of camera-based visibility systems. Policymakers are increasingly permitting side view camera assemblies as legitimate replacements for traditional mirrors, prompting original equipment manufacturers to revisit vehicle design paradigms. This regulatory shift is complemented by growing consumer expectations for seamless parking assistance and integrated safety suites, motivating suppliers to fuse cameras with ultrasonic sensors and radar modules. The convergence of these market drivers has set in motion a wave of strategic alliances between semiconductor providers, camera module specialists, and tier-one automotive suppliers, heralding a new era of collaborative innovation.

Unpacking the Cumulative Impact of 2025 United States Tariffs on Supply Chains, Component Costs, and Manufacturer Strategies in Side View Camera Systems

In 2025, newly imposed United States tariffs targeting imported imaging sensors and electronic components have introduced heightened complexity into supply chain planning. Camera module manufacturers reliant on specialized CCD and CMOS wafer fabrication have encountered elevated input costs, prompting a reassessment of sourcing strategies and supplier relationships. Faced with duty levies on key semiconductor imports, several system integrators have begun qualifying domestic foundries and forging joint ventures to mitigate tariff exposure and ensure uninterrupted production.

The ripple effects of these policy measures extend beyond raw material costs, affecting lead times, inventory carrying expenses, and cross-border logistics. In response, companies are diversifying their manufacturing footprints, with some establishing assembly lines closer to vehicle production plants in North America to minimize transit and tariff burdens. These adjustments, while initially resource-intensive, are fostering a more resilient supply chain capable of weathering future trade fluctuations. Moreover, the experience of navigating 2025 tariffs is strengthening data-driven procurement practices and accelerating investments in predictive analytics to anticipate regulatory changes and optimize component sourcing scenarios.

Highlighting Key Market Segmentation Insights That Reveal Diverse Vehicle Types, Technological Variants, and Application-Specific Opportunities

The side view camera market exhibits pronounced diversity when viewed through the lens of vehicle type, technology, application, sales channel, resolution, and mounting location. In terms of vehicle type, commercial applications ranging from heavy-duty trucks to light commercial vans demand robust camera units engineered for prolonged vibration and temperature extremes, while the passenger car segment spans small hatchbacks to luxury SUVs, each with distinct aesthetic and performance requirements. Technology segmentation reveals that CCD sensors utilizing frame and interline transfer techniques still find footholds in legacy vehicle lines, even as global shutter and rolling shutter CMOS variants rise to prominence due to their lower power drain and higher integration potential.

Application-driven insights show that blind spot detection remains a foundational use case, with lane change assistance emerging as a critical safety enhancement in high-speed driving contexts. Parking assistance continues to expand, subdividing into parallel and perpendicular parking scenarios that challenge camera resolution and field-of-view optimization. From the perspective of sales channels, original equipment pathways dominate early adoption cycles, yet the aftermarket space is gaining traction as vehicle owners seek replacement and upgrade options for aging mirror assemblies. Performance tiers in image clarity-spanning full high definition to ultra high definition-align with vehicle class expectations, and the choice between left side and right side mounting locations is dictated by regulatory zones and driver orientation preferences.

This comprehensive research report categorizes the Side View Camera System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Mounting Location

- Technology

- Resolution

- Vehicle Type

- Application

- Sales Channel

Examining Key Regional Market Dynamics Across the Americas, Europe Middle East Africa, and Asia-Pacific for Side View Camera Systems

Regional dynamics play an integral role in shaping the adoption and innovation trajectories of side view camera systems. In the Americas, North American regulations have steadily evolved to accept camera-based mirror replacements as compliant visibility solutions, which is catalyzing aftermarket interest and OEM pilot programs. Infrastructure for advanced driver assistance systems is particularly mature in urban corridors, prompting system suppliers to tailor solutions for integration with domestic vehicle platforms and North American manufacturing standards.

In the Europe, Middle East & Africa zone, stringent safety mandates combined with a robust luxury vehicle market are fueling demand for high-resolution imaging and multi-sensor fusion architectures. European OEMs are at the vanguard of adopting camera-mirror hybrids, driven by both regulation and premium consumer expectations. Meanwhile, in the Middle East, the prevalence of high ambient temperatures is steering sensor design toward higher thermal tolerance, whereas components in Africa are optimized for cost-effective reliability.

Asia-Pacific remains a dynamic epicenter of growth, with China and India leading in production volumes and regulatory evolution. Government incentives for autonomous vehicle research are accelerating pilot deployments of side view cameras within urban ride-sharing fleets. In Japan, close partnerships between sensor fabricators and automotive OEMs are producing cutting-edge global shutter CMOS modules, and in Southeast Asia, localized assembly hubs are reducing cycle times and enabling faster adaptation to market requirements.

This comprehensive research report examines key regions that drive the evolution of the Side View Camera System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Key Industry Players and Strategic Collaborations Shaping the Future of Side View Camera System Solutions Worldwide

Leading tier-one suppliers and specialist imaging companies are at the forefront of shaping the side view camera ecosystem. Global automotive technology companies are forging strategic alliances with semiconductor fabs to secure preferential wafer capacity for frame transfer CCD and global shutter CMOS sensors. In parallel, camera module integrators are collaborating with artificial intelligence startups to refine object detection algorithms, thereby enhancing blind spot and lane change assistance fidelity.

Original equipment manufacturers are increasingly engaging with technology partners to co-develop custom sensor housings that meet stringent aerodynamic and aesthetic guidelines. Meanwhile, aftermarket vendors are leveraging online distribution networks to offer OEM-equivalent upgrade kits, creating competitive pressure on established supply chains. These market participants are also investing heavily in research partnerships with academic institutions to explore next-generation imaging approaches, including event-based vision sensors and lidar-camera fusion systems, signaling a broadening of the competitive landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Side View Camera System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisan Industry Co., Ltd.

- Aptiv PLC

- Continental AG

- Denso Corporation

- Exeros Technologies Ltd.

- Magna International Inc.

- Mando Corporation

- Motherson Group

- Robert Bosch GmbH

- STONKAM CO., LTD.

- Valeo SA

- Visteon Corporation

- ZF Friedrichshafen AG

Delivering Actionable Recommendations to Industry Leaders for Accelerating Innovation and Strengthening Competitive Advantage in Side View Camera Offerings

Industry leaders should prioritize modular platform architectures that allow rapid integration of emerging sensor variants and software updates. By adopting open standards, suppliers can foster interoperability across camera modules, central processing units, and display interfaces, expediting time-to-market for new safety features. Strategic partnerships with semiconductor foundries and automation vendors will be essential for securing advanced wafer allocation and scaling production volumes without compromising quality.

Expanding presence in high-growth regions, particularly Asia-Pacific, calls for establishing local engineering centers and assembly capabilities. These on-the-ground operations can accelerate customization for regional regulatory requirements and environmental conditions. In parallel, companies should invest in comprehensive aftersales service programs that include predictive maintenance analytics and over-the-air software upgrades to cultivate customer loyalty and unlock new revenue streams.

Finally, strengthening competitive advantage will depend on embedding artificial intelligence capabilities directly within camera modules, enabling real-time image processing and anomaly detection at the edge. Such innovations will not only improve system responsiveness but also reduce dependency on central computing resources, positioning adopters for the next wave of autonomous driving functionalities.

Outlining a Rigorous Research Methodology Combining Primary Interviews, Secondary Data Analysis, and Validation Protocols for Robust Market Insights

Our research methodology combined an extensive review of secondary sources, including industry journals, regulatory filings, and technical whitepapers, with in-depth interviews conducted with senior engineers, product managers, and procurement specialists across leading OEM and tier-one organizations. Data triangulation was achieved by cross-referencing company financial reports, trade association publications, and patent filings to validate emerging technology trajectories and supply chain shifts.

Primary research included structured questionnaires and one-on-one consultations to capture nuanced perspectives on regional regulatory changes and aftermarket dynamics. We also employed a multi-phase validation protocol, wherein preliminary findings were shared with a panel of industry experts for feedback and corroboration. This iterative process ensured the robustness of our insights, minimizing potential biases and reinforcing the credibility of strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Side View Camera System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Side View Camera System Market, by Mounting Location

- Side View Camera System Market, by Technology

- Side View Camera System Market, by Resolution

- Side View Camera System Market, by Vehicle Type

- Side View Camera System Market, by Application

- Side View Camera System Market, by Sales Channel

- Side View Camera System Market, by Region

- Side View Camera System Market, by Group

- Side View Camera System Market, by Country

- United States Side View Camera System Market

- China Side View Camera System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Drawing a Compelling Conclusion That Reinforces the Strategic Importance of Side View Camera Systems in Future Mobility Ecosystems

As automotive ecosystems continue to evolve toward higher levels of autonomy and stringent safety benchmarks, side view camera systems have solidified their role as indispensable components in modern vehicle architectures. The convergence of advanced sensor technologies, regulatory acceptance, and shifting consumer expectations has created a fertile environment for sustained innovation and strategic collaboration.

By understanding the nuanced segmentation of vehicle types, sensing technologies, applications, sales channels, resolution tiers, and mounting configurations, industry stakeholders can pinpoint untapped opportunities and anticipate emerging challenges. Coupled with regional intelligence across the Americas, Europe Middle East & Africa, and Asia-Pacific, these insights form the foundation for informed strategic decisions. As companies navigate tariff landscapes, supply chain realignments, and rapid technological evolution, the ability to act on data-driven intelligence will determine leadership in the next generation of side view camera solutions.

Engage with Associate Director Ketan Rohom Today to Secure Your Customized Side View Camera System Market Research Report and Stay Ahead in Innovation

To seize the competitive edge and gain comprehensive insights into the side view camera system landscape, we encourage you to engage with Ketan Rohom, Associate Director of Sales & Marketing. His industry expertise and deep understanding of market dynamics make him the ideal partner for tailoring research deliverables to your strategic needs. By initiating this collaboration, you will secure a customized report packed with in-depth analysis, actionable recommendations, and forward-looking perspectives that can drive your product innovation and market positioning.

Contact Ketan today through our corporate website to discuss your specific requirements and explore flexible subscription options that align with your organizational goals. Empower your decision-making with a data-driven roadmap and stay at the forefront of safety, regulatory compliance, and technological advancements in side view camera systems.

- How big is the Side View Camera System Market?

- What is the Side View Camera System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?