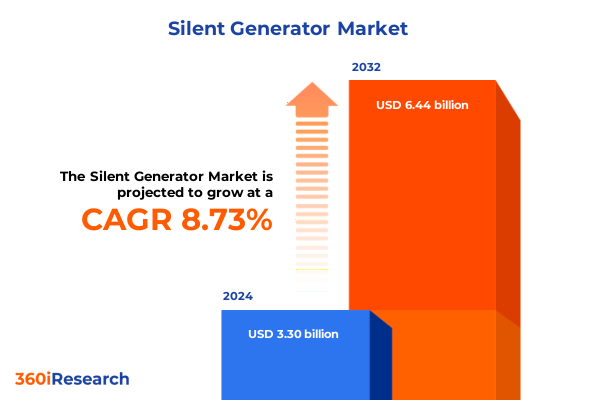

The Silent Generator Market size was estimated at USD 3.58 billion in 2025 and expected to reach USD 3.89 billion in 2026, at a CAGR of 8.75% to reach USD 6.44 billion by 2032.

Initiating a comprehensive exploration of market dynamics, emerging technologies, and strategic inflection points shaping the generator industry’s evolving trajectory

Embarking on a thorough exploration of the generator industry’s evolving landscape reveals the convergence of increasing energy demands, digital innovation, and shifting regulatory mandates. Across commercial, industrial, and residential segments, stakeholders face mounting pressure to balance reliability with environmental stewardship. While traditional diesel and gasoline generators continue to underpin critical backup power solutions, market participants are pivoting toward integrated systems that leverage remote monitoring and predictive maintenance to optimize uptime and lower lifecycle costs. Such imperatives underscore the necessity of a holistic analysis that captures both enduring fundamentals and emergent disruptions.

Moreover, the imperative for decarbonization has elevated natural gas and dual-fuel platforms as transitional technologies that reduce emissions without sacrificing performance. Simultaneously, parallel innovations in miniature grid architectures and hybrid configurations are reconfiguring value chains. In turn, vendor strategies must reconcile component sourcing complexities, evolving end-user expectations, and heightened scrutiny from policymakers focused on national security and supply chain resilience. Consequently, this executive summary provides an integrated perspective designed to inform decision-makers navigating a period of profound transformation.

Unveiling critical technological innovations, regulatory pressures, and sustainability-driven transformations that redefine competitive strategies within the generator ecosystem

Within the generator ecosystem, a wave of technological innovations is redefining competitive dynamics. Leading manufacturers integrate Internet of Things–enabled sensors and cloud-based analytics to provide real-time diagnostics, enabling predictive maintenance and minimizing unplanned downtime. Edge computing platforms now process high-frequency performance data on-site, while AI-driven algorithms identify anomalies before they escalate into failures, ultimately enhancing operational reliability and extending asset lifecycles.

Concurrently, stringent emissions regulations and corporate sustainability commitments are accelerating the shift from conventional diesel units toward lower-carbon alternatives. Natural gas, dual-fuel, and hybrid systems-capable of seamless transitions between fuel sources-are gaining traction, supported by incentives and evolving infrastructure. Moreover, consumers increasingly demand turnkey solutions that integrate renewable energy systems with backup generation and advanced energy management controls, forging new alliances between traditional OEMs, software providers, and energy service companies.

Examining the cascading consequences of recent U.S. steel and aluminum tariffs on manufacturing costs, component sourcing, and supply chain resilience across the generator sector

Recent U.S. trade measures have imparted significant upstream cost pressures on generator manufacturers. In mid-March 2025, the restoration of a comprehensive 25 percent tariff on steel and derivative steel articles, coupled with the elimination of country exemptions under Section 232, imposed new duties across core components such as alternator casings, frames, and support structures. These surcharges translated into recalibrations of sourcing strategies as suppliers sought tariff-free alternatives through regional content optimization and nearshoring initiatives.

Subsequently, effective June 4, 2025, the administration escalated tariffs on both steel and aluminum inputs to 50 percent ad valorem, further heightening material cost volatility for genset producers. Ranging from engine blocks to heat-exchanger housings, the intensified levies underscore the criticality of agile procurement, component standardization, and collaborative supplier partnerships. In response, several OEMs have accelerated investments in alternative alloys and modular architectures to mitigate the cascading impact on finished-goods pricing and preserve margin integrity.

Deriving actionable insights from differentiated market segments encompassing fuel types and power ratings to end users and omnichannel distribution approaches for strategic clarity

Diverse fuel-type offerings reflect a pivotal strategic axis, with diesel remaining a stalwart choice for emergency backup applications, while gasoline units cater to small-scale power needs and natural gas variants gain prominence where infrastructure supports cleaner combustion. Dual-fuel models, capable of switching between diesel and gas, address stringent emission targets and fuel-source flexibility. Along a parallel axis, power-rating tiers ranging from below 5 KVA for residential standby to above 15 KVA for industrial-grade deployments reveal nuanced user requirements and corresponding design priorities.

End-user segmentation further delineates the market, as commercial entities prioritize total cost of ownership and adherence to urban emission ordinances, industrial players demand robust packages with continuous operational profiles, and residential consumers gravitate toward compact, low-noise designs. Equally, distribution channels bifurcate into offline pathways-incorporating direct OEM sales, distributors, and retailer networks-and online platforms encompassing proprietary websites and third-party marketplaces that deliver streamlined procurement and digital after-sales support. This segmentation framework illuminates targeted value propositions and informs tailored go-to-market strategies.

This comprehensive research report categorizes the Silent Generator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Fuel Type

- Power Rating

- Distribution Channel

- End User

Comparing regional performance drivers and policy landscapes across the Americas, Europe Middle East Africa, and Asia-Pacific to uncover diverse growth enablers in generator applications

In the Americas, strong investment in critical infrastructure and backup power systems drives continued reliance on diesel and gasoline-fueled generators, while regulatory incentives in key U.S. states bolster natural gas adoption. Utilities, data centers, and healthcare facilities emphasize rapid response and lifecycle service agreements to uphold uptime commitments. Conversely, Europe, Middle East & Africa present a heterogeneous landscape: mature EU markets enforce rigorous emissions regulations that propel dual-fuel and hybrid system uptake, Gulf nations leverage abundant natural gas reserves to adopt high-efficiency gensets, and emerging African markets prioritize cost-effective diesel units to address grid instability.

Meanwhile, the Asia-Pacific region exhibits the most dynamic growth profile, supported by rapid industrialization, grid modernization projects, and ambitious energy security agendas. Countries such as China and India are scaling production of modular generator sets that integrate renewable-sourced power with backup generation, while Southeast Asian and Pacific Island markets emphasize resilient microgrids and portable solutions to navigate climate-induced interruptions. This regional mosaic underscores the need for adaptive product portfolios and flexible service models.

This comprehensive research report examines key regions that drive the evolution of the Silent Generator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic initiatives, innovation pipelines, and competitive positioning among leading global generator manufacturers steering industry evolution toward resilience

Leading OEMs are advancing their competitive positioning through multifaceted innovation agendas. Caterpillar and Cummins intensify R&D in modular skid-mounted solutions and digital service platforms that augment remote diagnostics and predictive analytics. Generac and Kohler concentrate on residential and small-commercial segments with acoustically optimized units and integrated automatic transfer switch technologies. Meanwhile, Atlas Copco and Rolls-Royce Power Systems leverage advanced materials and additive manufacturing techniques to pioneer lightweight, high-efficiency alternators and power blocks.

To bolster market presence, companies such as GE Vernova, Siemens Energy, and Mitsubishi Power form strategic alliances with EPC firms and infrastructure developers, securing long-term power-generation contracts tied to gas-turbine and microturbine solutions. Additionally, service-oriented models are emerging as key differentiators, with enhanced aftermarket agreements offering condition-based maintenance, digital twin simulations, and mobile response teams to reduce mean time to repair and maximize fleet availability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Silent Generator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aggreko plc

- Ashok Leyland Limited

- Atlas Copco AB

- Briggs & Stratton Corporation

- Caterpillar Inc.

- Cummins Inc.

- Denyo Co., Ltd.

- FG Wilson Ltd.

- Generac Power Systems, Inc.

- Greaves Cotton Limited

- Himoinsa S.L.

- Honda Power Equipment Co., Ltd.

- Kirloskar Oil Engines Limited

- Mahindra Powerol Ltd.

- Multiquip Inc.

- Rolls-Royce Holdings plc

- Yamaha Motor Co., Ltd.

- Yanmar Holdings Co., Ltd.

Outlining targeted strategies for industry leaders to navigate supply chain disruptions, regulatory shifts, and sustainability imperatives in the evolving generator landscape

Industry leaders should prioritize supplier diversification and local sourcing partnerships to minimize exposure to tariff-driven material cost escalations. By collaborating with ascending regional manufacturers and leveraging bonded warehouses, companies can shorten lead times and buffer price fluctuations. In parallel, investment in digital service capabilities-spanning remote monitoring, cloud-based analytics, and AI-powered maintenance scheduling-will enhance uptime guarantees and foster recurring aftermarket revenues.

Furthermore, aligning product roadmaps with tightening emissions standards demands accelerated development of dual-fuel, natural gas, and hybrid gen-set platforms. Proactively engaging with regulatory bodies and capitalizing on incentive programs for low-carbon technologies can differentiate offerings and unlock fast-track certification channels. Lastly, establishing customer-centric value bundles that integrate financing options, installation services, and outcome-based performance contracts will cultivate deeper customer relationships and sustainable market growth.

Detailing a rigorous mixed-method research framework integrating primary interviews, secondary data sources, and expert validation to ensure robust market intelligence accuracy

This analysis synthesizes insights from a rigorous mixed-method research framework. Primary data stems from in-depth interviews with senior executives at OEMs, distributors, and end-user organizations across major regions. Concurrently, secondary sources including government tariff proclamations, industry journals, and peer-reviewed case studies inform the contextual and regulatory backdrop.

Data triangulation ensures accuracy by cross-verifying interview findings with published trade statistics, corporate disclosures, and supply chain performance reports. An expert advisory panel comprising energy consultants, supply chain specialists, and environmental policy analysts provided iterative validation of key assumptions and identified emergent risks. This structured approach delivers robust, actionable intelligence grounded in empirical evidence and expert judgment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Silent Generator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Silent Generator Market, by Fuel Type

- Silent Generator Market, by Power Rating

- Silent Generator Market, by Distribution Channel

- Silent Generator Market, by End User

- Silent Generator Market, by Region

- Silent Generator Market, by Group

- Silent Generator Market, by Country

- United States Silent Generator Market

- China Silent Generator Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing key discoveries to reaffirm market opportunities, address emerging challenges, and guide stakeholders toward informed decisions in the generator domain

In summary, the generator market stands at the intersection of robust legacy demand and transformative imperatives. Pressures from tariff-induced material costs, stringent emissions regulations, and accelerated technological disruption compel stakeholders to adopt agile sourcing, diversify product portfolios, and embrace digital service models. Concurrently, regional nuances-from Americas infrastructure renewal to Asia-Pacific microgrid innovations-affirm the importance of localized strategies.

Looking ahead, success will hinge on forging strategic collaborations across supply chains, accelerating low-carbon product development, and delivering integrated solutions that marry availability with environmental compliance. By internalizing these insights, industry participants can secure competitive advantage and guide the sector toward sustainable resilience.

Encouraging proactive engagement with Ketan Rohom to access an in-depth market research report that empowers strategic foresight and competitive differentiation

Unlock unparalleled depth and strategic context by engaging with Ketan Rohom, Associate Director, Sales & Marketing, to secure the full market research report. His expertise will ensure you obtain tailored insights on evolving supplier landscapes, competitive benchmarks, and actionable intelligence designed to sharpen decision-making, fuel growth initiatives, and safeguard your market position.

- How big is the Silent Generator Market?

- What is the Silent Generator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?