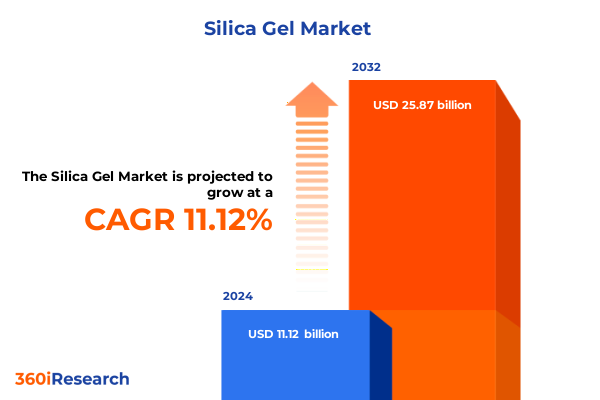

The Silica Gel Market size was estimated at USD 12.27 billion in 2025 and expected to reach USD 13.53 billion in 2026, at a CAGR of 11.24% to reach USD 25.87 billion by 2032.

A comprehensive exploration of silica gel’s multifaceted role across pharmaceutical, electronics, and packaging sectors amid rapidly evolving technological, regulatory, and sustainability imperatives

Silica gel has evolved from a simple moisture absorber to a critical material underpinning numerous advanced industrial applications, reflecting its versatility and functional resilience. Originally celebrated for preserving product integrity during shipping and storage, it now plays an indispensable role in chromatography, catalyst support in chemical manufacturing, and as a precision desiccant across a spectrum of sectors. Its high surface area and tunable pore structure position it at the intersection of purity, performance, and reliability, addressing challenges from moisture control in pharmaceutical packaging to fine separation processes in analytical laboratories.

As industries pursue enhanced quality standards and stricter regulatory requirements, silica gel applications have expanded into areas demanding exceptional chemical inertness and thermal stability. Innovations in material science have unlocked new grades, including ultra-high purity and specialized formulations, enabling breakthroughs in semiconductor moisture management and advanced catalyst frameworks. Simultaneously, sustainability considerations are driving manufacturers toward greener production processes, recycled sorbent cycles, and waste minimization, underpinning silica gel’s role in circular economy initiatives. The convergence of these technological, regulatory, and environmental drivers sets the stage for significant shifts in market dynamics and strategic decision-making.

Advanced purification technologies and sustainability imperatives reshaping silica gel application frameworks globally

The silica gel landscape is undergoing transformative shifts, driven by breakthroughs in material engineering and intensifying demands for sustainability. Recent advances in hierarchical pore design have enhanced adsorption kinetics, enabling faster moisture uptake and improved catalyst dispersion in chemical processes. At the same time, nanostructured silica gels are emerging as critical enablers in high-performance chromatography applications, offering superior resolution and reduced analysis time for increasingly complex analytical methodologies.

Moreover, the industry is responding to global imperatives for eco-friendly operations by integrating recycled silica streams and developing low-energy regenerative drying techniques. These sustainable processes not only reduce greenhouse gas emissions but also align with corporate environmental, social, and governance (ESG) targets, making silica gel manufacturers valuable partners in broader decarbonization efforts. This convergence of advanced material capabilities and green manufacturing paradigms is reshaping the competitive landscape, compelling stakeholders to prioritize R&D, forge strategic partnerships, and redefine value propositions to address the evolving needs of end-use industries.

United States tariff adjustments driving strategic sourcing realignments and supply chain resilience imperatives across silica gel stakeholders

In 2025, revised United States tariff structures targeting imported raw materials and specialty chemicals have compelled industry participants to reassess supply chain configurations. Increased duties on key silica gel precursors have spurred an acceleration of near-shoring initiatives, with manufacturers exploring domestic sourcing options and strategic partnerships to mitigate import cost pressures. As a result, several end-use sectors are recalibrating procurement strategies, balancing the benefit of local inventory buffers against potential premium costs associated with shorter supply chains.

These tariff-induced adjustments have also intensified collaboration between silica gel producers and downstream formulators to co-develop value-added products that absorb part of the increased costs through enhanced performance attributes. In parallel, some companies are expanding contract manufacturing arrangements in lower-tariff regions or securing volume-based exemptions to preserve competitiveness. Throughout these dynamics, the emphasis on supply chain resilience, coupled with evolving trade policies, underscores the necessity for proactive risk management and agile commercial models that can withstand further regulatory shifts.

Diverse application and product form segmentation revealing nuanced demand drivers and functional priorities in silica gel utilization

Granular analysis across application, product form, end-use industry, and purity grade reveals intricate demand drivers within the silica gel market. Adsorbent applications dominate due to their versatility across moisture control, catalyst support in chemical manufacturing and petrochemical processes, and precision separations in HPLC and TLC chromatography. In contrast, desiccant configurations span household dehumidification to industrial moisture control and bespoke packaging sachets of varying sachet sizes, each tailored to specific moisture thresholds and logistical requirements.

Product form diversity-from beads and granules to pouches, powders, and rods-reflects the need for adaptable delivery formats that align with process integration and handling efficiencies. Meanwhile, end-use industry segmentation highlights sustained momentum in high-growth arenas such as semiconductors and branded pharmaceutical manufacturing, while traditional chemicals and packaged foods maintain stable demand due to established moisture control standards. Purity grades ranging from analytical to laboratory, medical, and technical grades illustrate a continuum of performance requirements, with high purity technical and standard technical variants enabling cost-performance trade-offs in industrial applications. Together, these segmentation insights illuminate the nuanced interplay between functional requirements, regulatory demands, and cost considerations.

This comprehensive research report categorizes the Silica Gel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Form

- Purity Grade

- Application

- End Use Industry

Regional dynamics highlighting growth pockets and competitive landscapes across Americas, EMEA, and Asia-Pacific silica gel markets

Regional dynamics in the silica gel market reveal distinct growth patterns and competitive forces across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, innovation in packaging desiccants and chromatography supplies continues to thrive, fueled by stringent pharmaceutical and food safety standards in the United States and Canada. Conversely, Latin American markets are gradually embracing advanced catalyst support roles, driven by emerging petrochemical projects seeking reliable moisture control solutions.

Europe, the Middle East, and Africa present a mosaic of opportunities, from robust demand for high-purity silica in Western European semiconductor fabs to growing interest in Middle Eastern refinery upgrades and North African agro-industry desiccation schemes. Within Asia-Pacific, rapid industrialization in Southeast Asia and resilient electronics manufacturing hubs in East Asia are catalyzing uptake of specialized silica grades. Meanwhile, investments in medical and laboratory infrastructure across the region are further broadening the user base. These regional insights underscore the strategic importance of localized product portfolios and targeted service models to capture diverse market segments.

This comprehensive research report examines key regions that drive the evolution of the Silica Gel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive positioning and innovation strategies of leading silica gel producers shaping market trajectories and differentiation

Leading silica gel producers are differentiating through a combination of product innovation, integrated service offerings, and strategic partnerships. Key players are leveraging proprietary pore-engineering techniques to develop specialty grades that deliver enhanced adsorption kinetics and thermal resilience. Such advancements are particularly valued in chromatography consumables and catalyst support media, where performance consistency directly impacts process efficiency.

Strategic acquisitions and joint ventures are also reshaping the competitive landscape, as companies seek to broaden geographic reach and gain access to complementary technologies. Collaborative alliances between silica gel suppliers and packaging enterprises, for instance, are delivering custom desiccant solutions with real-time moisture monitoring capabilities, adding tangible value for end-users. Additionally, several manufacturers have established dedicated technical service teams to assist customers in optimizing silica gel integration, reflecting an industry shift toward solutions-oriented business models rather than simple commodity supply.

This comprehensive research report delivers an in-depth overview of the principal market players in the Silica Gel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Chemicals

- Arkema S.A.

- Clariant AG

- Desiccare, Inc.

- Evonik Industries AG

- Fuji Silysia Chemical Co., Ltd.

- Gelest, LLC

- Huber Engineered Materials

- Kao Corporation

- Merck KGaA

- Nissan Chemical Corporation

- OhE Chemicals Co., Ltd.

- Oker‑Chemie GmbH

- PQ Corporation

- Qingdao Makall Group, Inc.

- Shandong Sinchem Silica Gel Co., Ltd.

- Shanghai Jiuzhou Chemicals Co., Ltd.

- SiliCycle Inc.

- The PQ Corporation

- Tokuyama Corporation

- Tosoh Corporation

- W. R. Grace & Co.–Conn.

- Wacker Chemie AG

- Wihai Pearl Silica Gel Co., Ltd.

- Zhejiang Zhengguang Industrial Co., Ltd.

Strategic imperatives for industry leaders to capitalize on emergence of specialty applications and evolving regulatory regimes

Industry leaders must prioritize agility in manufacturing and supply chain operations to navigate evolving regulatory and trade environments. By investing in flexible production platforms capable of handling multiple purity grades and product forms, companies can respond swiftly to shifting customer requirements and tariff fluctuations. Equally important is the development of end-to-end digital traceability systems, enabling transparent moisture monitoring and compliance documentation throughout distribution networks.

Moreover, strategic collaboration with end-use partners can accelerate co-innovation of value-added silica gel formulations that justify premium pricing through demonstrable performance benefits. Sustainability should remain a cornerstone of strategic roadmaps, with emphasis on closed-loop regeneration systems and reduced carbon footprints. Finally, proactive engagement with policymakers and industry consortia will ensure that evolving trade policies and environmental regulations are shaped by practical insights, safeguarding both market access and operational viability.

Rigorous multi-source research methodology integrating primary stakeholder interviews and secondary data analysis to ensure holistic market intelligence

This analysis integrates insights from a rigorous research framework combining primary and secondary sources to deliver robust market intelligence. Primary data were collected through in-depth interviews with senior executives across silica gel production, distribution, and end-use segments, as well as consultations with regulatory and technical experts to validate material performance criteria and compliance priorities. Secondary research encompassed a comprehensive review of peer-reviewed journals, industry white papers, patent filings, and trade association publications to map technological advancements and emerging best practices.

Data triangulation ensured consistency across qualitative narratives and quantitative indicators, while cross-verification with publicly available corporate disclosures and government trade databases provided contextual depth. An iterative validation process with domain specialists helped refine segmentation structures and regional analyses. This layered approach guarantees that the conclusions and recommendations presented herein reflect both current realities and forward-looking perspectives necessary for informed strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Silica Gel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Silica Gel Market, by Product Form

- Silica Gel Market, by Purity Grade

- Silica Gel Market, by Application

- Silica Gel Market, by End Use Industry

- Silica Gel Market, by Region

- Silica Gel Market, by Group

- Silica Gel Market, by Country

- United States Silica Gel Market

- China Silica Gel Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing insights to underscore the pivotal trajectory of silica gel markets amidst innovation and regulatory shifts

In synthesizing these insights, it is clear that silica gel’s strategic value extends far beyond basic moisture control. Technological innovations in pore architecture and sustainable regeneration are elevating its role in precision manufacturing, advanced analytics, and chemical processing. Meanwhile, trade policy shifts and tariff adjustments underscore the criticality of supply chain agility and localized market strategies. Diverse segmentation parameters reveal a complex tapestry of functional requirements and cost considerations that demand tailored solutions rather than one-size-fits-all approaches.

Looking ahead, the interplay of regulatory developments, sustainability imperatives, and evolving end-user expectations will continue to shape market trajectories. Organizations that align R&D investments with customer-centric co-innovation models, while maintaining operational resilience and environmental compliance, will be best positioned to capture emerging opportunities. Ultimately, the convergence of advanced material capabilities and strategic foresight will define the next chapter of silica gel market leadership.

Connect with Ketan Rohom to unlock comprehensive insights and strategic guidance for silica gel market leadership

To gain comprehensive strategic insights and leverage actionable guidance tailored to your organization’s unique objectives, reach out to Associate Director, Sales & Marketing, Ketan Rohom. With a proven track record of supporting decision-makers across chemical, electronics, and consumer goods industries, Ketan can provide personalized walkthroughs of the full silica gel market research report and facilitate bespoke data solutions that address your most pressing challenges. Engage with an expert who can translate complex market dynamics into clear, prioritized action plans. Connect today to unlock exclusive access to in-depth analysis, expert interpretations, and forward-looking recommendations that will empower your team to make informed strategic investments and stay ahead of the competition in an increasingly dynamic global landscape

- How big is the Silica Gel Market?

- What is the Silica Gel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?