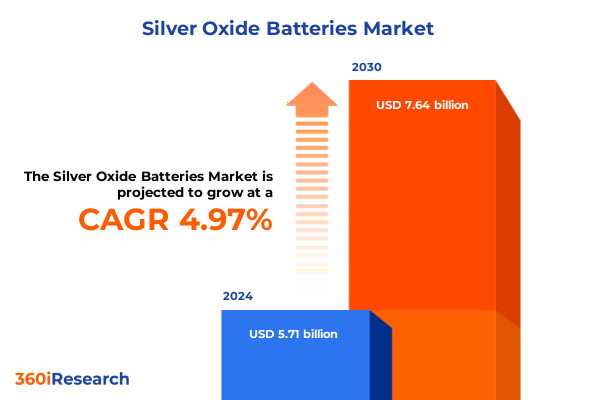

The Silver Oxide Batteries Market size was estimated at USD 5.71 billion in 2024 and expected to reach USD 5.99 billion in 2025, at a CAGR of 4.97% to reach USD 7.64 billion by 2030.

Unveiling the Strategic Foundation: An In-Depth Overview of Silver Oxide Battery Market Dynamics and Emerging Priorities for Stakeholders

In an era defined by escalating demand for compact and efficient power sources, silver oxide batteries have become indispensable across a wide array of industries. These cells are prized for their high energy density, stable discharge voltage, and exceptional shelf life, making them a go-to solution for applications where reliability and longevity are paramount. From the precision of medical monitoring devices to the rugged demands of defense communications, silver oxide technology underpins critical functions that hinge on uninterrupted and predictable performance.

As consumer electronics continue to miniaturize, there is a parallel push toward thinner, lighter power solutions that can deliver consistent power without compromising device form factors. Concurrently, the rise of customized battery requirements has spurred innovation in cell architecture, material purity, and assembly techniques. In particular, the evolution of secondary (rechargeable) configurations alongside established primary (single-use) offerings illustrates how the segment is adapting to sustainability imperatives and evolving user preferences.

Against this backdrop of technological progress and market expansion, stakeholders are navigating a complex ecosystem that balances material costs, regulatory compliance, and competitive pressures. Silver, a critical raw material, faces its own supply-chain dynamics, influencing both pricing and accessibility. Moreover, recent shifts in regional trade policies have introduced additional variables, prompting manufacturers to reassess sourcing strategies and production footprints.

This executive summary delivers a strategic foundation for understanding current market drivers, disruptive trends, and emergent challenges within the silver oxide battery landscape. By examining the interplay of technological innovation, regulatory forces, and evolving end-use requirements, decision-makers can position their organizations to capitalize on emerging opportunities while mitigating potential risks.

Charting Disruption and Innovation: Key Transformative Shifts Redefining the Silver Oxide Battery Ecosystem Across Technology, Regulation, and Supply Chains

Over the past several years, the silver oxide battery segment has undergone profound shifts that are redefining its competitive contours. Technological breakthroughs in electrode formulations have significantly enhanced cycle life for secondary batteries, narrowing the historical performance gap with primary cells. This convergence paves the way for broader adoption of rechargeable silver oxide solutions across high-reliability applications, from medical implantables to aerospace instrumentation.

Meanwhile, regulatory landscapes are evolving in tandem with sustainability mandates and conflict-minerals scrutiny. Stricter environmental guidelines regarding silver extraction and disposal have accelerated investment in closed-loop recycling processes, compelling producers to integrate circular economy principles into their business models. Consequently, collaborations between battery manufacturers, recyclers, and materials suppliers are gaining traction as a pathway to reduce environmental impact while securing critical raw material supply.

Furthermore, digitization across the value chain is unlocking new efficiencies and data-driven insights. Implementation of Industry 4.0 practices-such as real-time process monitoring, predictive maintenance, and automated quality control-is enhancing yield rates and reducing batch variability. In parallel, advanced analytics are enabling deeper comprehension of cell degradation mechanisms under diverse operating conditions, informing next-generation product roadmaps.

Supply chain resilience has also assumed paramount importance amid global disruptions. Diversification of procurement sources for silver and ancillary components, as well as nearshore manufacturing initiatives, are being embraced to mitigate concentration risks. Taken together, these transformative shifts in technology, regulation, and supply-chain design are forging a more robust and sustainable silver oxide battery ecosystem.

Assessing 2025 Tariff Impact on Silver Oxide Batteries: Analyzing the Cumulative Ramifications of United States Levies on Manufacturing and Trade Flows

The introduction of new tariffs by the United States in 2025 has produced multifaceted repercussions for the silver oxide battery market, affecting import costs, supplier negotiations, and end-customer pricing strategies. By raising duties on critical precursor chemicals, manufacturers have faced squeezed margins and the imperative to re-evaluate sourcing pathways. In response, some producers have shifted toward long-term contracts with non-US suppliers, seeking to hedge against future tariff escalations, while others have explored domestic silver refining partnerships to localize value creation.

As procurement costs rose, the knock-on effects extended to pricing negotiations with original equipment manufacturers and channel distributors. Whereas historically stable cost structures supported predictable contract terms, the new levy regime has introduced contractual risk, compelling buyers to incorporate price escalation clauses and inventory buffer strategies. Additionally, project timelines for high-volume deployments have been recalibrated to account for elongated lead times, as customs procedures and tariff documentation requirements become more stringent.

In the manufacturing realm, some organizations have accelerated investments in process automation to offset increased input costs and drive operational efficiencies. By reducing reliance on manual labor and optimizing yield rates, these firms aim to preserve competitive positioning without transferring the full burden of cost increases to customers. Moreover, efforts to redesign cell chemistries for reduced silver content are underway, balancing performance retention with material optimization.

In sum, the cumulative impact of the 2025 United States tariffs has catalyzed strategic pivots across sourcing, pricing, and production disciplines. Stakeholders are increasingly focused on building adaptable supply networks, leveraging cost-management technologies, and redesigning offerings to thrive in a shifting trade policy environment.

Segmentation Insights Into Silver Oxide Batteries Revealing Demand Variations by Type, Voltage, Capacity, Cell Size, Sales Channel and Application

A nuanced understanding of demand dynamics emerges when examining silver oxide battery performance and consumer preferences through multiple segmentation lenses. Across the fundamental distinction between primary and secondary configurations, the market is navigating a transition toward rechargeable chemistries that align with sustainability targets, while maintaining specialty roles for single-use cells where reliability and shelf stability are critical.

Voltage requirements further delineate use cases, with high-voltage formats gaining traction in aerospace and military applications where performance consistency under extreme conditions is nonnegotiable. In contrast, low-voltage solutions dominate consumer devices such as calculators and watches, and medium-voltage cells serve a broad middle ground, powering everything from glucose monitors to specialty communications equipment.

Capacity tiers also offer key insight into installation strategy. Cells rated between 50 and 150 mAh strike a balance between runtime and form factor, rendering them ideal for compact medical devices. Meanwhile, units boasting capacities above 150 mAh are increasingly deployed in industrial instrumentation and tactical equipment, where extended operational cycles justify incremental increases in size and weight. At the lower boundary, cells below 50 mAh continue to support ultra-miniature devices that demand minimal power but cannot accommodate larger formats.

Cell form factors represent another pivotal segmentation aspect. Button cells remain ubiquitous across the consumer electronics and medical sectors, prized for their low-profile design. Conversely, custom-designed cells are emerging to meet the stringent specifications of aerospace and defense clients, reflecting a willingness to invest in specialized engineering in exchange for optimal integration and performance.

Finally, distribution and application layers underscore the importance of channel strategy and end-use focus. Traditional electronics retail and specialty battery outlets continue to serve customers requiring immediate availability and expert guidance, while brand websites and major e-commerce platforms offer broad reach for high-volume orders and recurring purchases. In tandem, applications spanning calculators, cameras, watches, glucose monitors, hearing aids, pacemakers, navigation devices, and tactical communications underscore the versatility of silver oxide batteries across consumer, medical, industrial, aerospace, and defense domains.

This comprehensive research report categorizes the Silver Oxide Batteries market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Voltage

- Capacity

- Cell Size

- Sales Channel

- Application

Revealing Regional Dynamics: Critical Insights Into How Silver Oxide Battery Demand and Infrastructure Varies Across Americas, EMEA, and Asia-Pacific Markets

Regional nuances in silver oxide battery demand are driven by distinct industrial strengths, regulatory frameworks, and infrastructure capabilities. In the Americas, robust healthcare and consumer electronics sectors anchor growth, with North American manufacturers benefiting from proximity to major medical suppliers and electronics OEMs. Meanwhile, Latin America’s burgeoning diagnostic and instrumentation markets are catalyzing niche opportunities for specialized battery formats, fostering partnerships between regional distributors and global cell producers.

Across Europe, Middle East & Africa, the landscape is shaped by stringent environmental regulations and defense modernization programs. European nations are tightening standards around battery disposal and silver recovery, prompting recycling programs and corporate sustainability commitments. In the Middle East, investments in tactical communications and aerospace initiatives are driving demand for high-voltage and custom-designed solutions. Simultaneously, select African markets are exploring microgrid and portable power applications, leveraging silver oxide cells for off-grid medical and instrumentation needs.

The Asia-Pacific region remains the epicenter of manufacturing excellence, hosting leading silver refineries and battery cell fabrication facilities. China, Japan, and South Korea dominate production, with extensive downstream supply networks for electronics and medical device assembly. Moreover, Southeast Asian economies are emerging as dynamic growth centers, bolstered by investments in healthcare infrastructure and defense communications. In parallel, domestic policy initiatives supporting local value creation are encouraging manufacturers to expand production footprints beyond established hubs.

Collectively, these regional insights underscore the importance of tailoring strategies to local market drivers, regulatory landscapes, and distribution ecosystems. By aligning product development roadmaps and channel investments with regional dynamics, organizations can optimize market penetration and enhance service responsiveness across the Americas, EMEA, and Asia-Pacific.

This comprehensive research report examines key regions that drive the evolution of the Silver Oxide Batteries market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Players: Strategic Competitive Positioning and Innovations Driving Growth for Major Silver Oxide Battery Manufacturers and Suppliers

Leading companies within the silver oxide battery arena differentiate themselves through a combination of advanced research capabilities, diversified product portfolios, and strategic alliances. Key manufacturers invest heavily in proprietary electrode coatings and separator technologies to enhance energy density and thermal stability, addressing the precise demands of medical implantables and aerospace instrumentation.

Partnerships with material suppliers and recyclers strengthen the resilience of supply chains, ensuring access to high-purity silver and facilitating closed-loop recovery processes. Firms with vertically integrated operations, spanning silver refining through cell assembly, achieve tighter quality control and cost efficiencies that support competitive pricing and rapid innovation cycles. Meanwhile, collaborations with technology providers enable the deployment of Industry 4.0 manufacturing lines, reducing variability and accelerating time to market.

On the distribution front, top companies differentiate their channel strategies by offering comprehensive value-added services, including technical training for specialty battery retailers and customization capabilities for brand-direct e-commerce clients. These initiatives foster deeper customer engagement and facilitate rapid response to evolving application requirements, from glucose monitor manufacturers seeking extended lifecycle products to defense contractors requiring bespoke tactical energy solutions.

Innovation pipelines are further bolstered by in-house research labs and joint development agreements with academic institutions. Through these channels, leading players explore next-generation electrode materials, silver-alloy formulations, and solid-state designs that promise incremental performance gains while addressing environmental and safety considerations. Collectively, these competitive strategies form the backbone of corporate differentiation, positioning select manufacturers as authoritative partners for organizations seeking reliable, high-performance silver oxide power solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Silver Oxide Batteries market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ansmann AG

- Camelion Battery Co., Ltd.

- Dantona Industries, Inc.

- Energizer Holdings, Inc.

- Fujitsu Corporation

- GP Industries Limited

- Guangdong TIANQIU Electronics Technology Co. Ltd.

- Guangzhou Fanli Electronic Technology Co., Ltd.

- Maxell Electric Industrial Co., Ltd.

- Murata Manufacturing Co., Ltd.

- Panasonic Corporation

- Renata SA by Swatch Group SA.

- Seiko Corporation

- Shenzhen Ctechi Technology Co., Ltd.

- Sony Corporation

- The Duracell Company

- Toshiba Corporation

- Varta AG

- Vinnic Power Co. Limited

Actionable Strategic Roadmap: Proven Recommendations and Best Practices for Industry Leadership to Capitalize on Silver Oxide Battery Market Opportunities

Industry leaders must adopt a multi-pronged approach to secure their foothold in the evolving silver oxide battery market. First, prioritizing research and development focused on advanced rechargeable chemistries can unlock new revenue streams and meet growing demand for sustainable power sources. By aligning R&D investments with application-specific requirements, organizations can tailor cell performance for medical, aerospace, or defense use cases, capturing high-value segments.

In addition, diversifying supplier networks for silver and related precursor materials will be critical to mitigating geopolitical and trade-policy risks. Establishing strategic partnerships with alternative silver producers and exploring emerging recycling technologies can stabilize input costs while supporting corporate sustainability targets. Moreover, integrating digital procurement platforms can enhance transparency and enable real-time risk assessments across tiered supply chains.

Manufacturers should also expand their footprint in online sales channels to capture shifting buyer behaviors, providing seamless ordering experiences and technical support through brand portals and major e-commerce platforms. Simultaneously, fostering deeper relationships with specialty battery and electronics retail outlets will ensure availability for customers requiring hands-on consultation and immediate fulfillment.

Finally, embedding Industry 4.0 practices across production operations-such as predictive maintenance, automated quality inspection, and data analytics-will drive cost efficiencies and yield improvements. By leveraging these technologies, firms can optimize batch consistency, reduce waste, and accelerate product iterations, thereby gaining agility in responding to market fluctuations and regulatory changes.

Comprehensive Research Blueprint: Methodological Framework and Analytical Techniques Ensuring Rigorous and Transparent Silver Oxide Battery Market Analysis

This analysis combines rigorous primary and secondary research methodologies to ensure comprehensive and credible insights into the silver oxide battery market. The process began with a thorough review of technical literature, patent filings, and industry white papers to map the technological landscape and identify emerging innovation trends. Proprietary databases and trade publications supplemented this review, offering up-to-date information on raw material dynamics and regulatory developments.

Concurrently, in-depth interviews were conducted with battery manufacturers, materials suppliers, industrial OEMs, and distributors across core regions. These conversations yielded qualitative perspectives on supply-chain challenges, application requirements, and strategic imperatives, enriching quantitative findings. Interviewees provided firsthand insights into cost structures, process optimization initiatives, and channel strategies, enabling nuanced interpretation of market drivers.

Data triangulation techniques were then applied, cross-referencing primary input with company disclosures, financial reports, and trade-association statistics to validate trends and reconcile discrepancies. Segmentation analyses were performed across multiple dimensions-type, voltage, capacity, cell size, sales channel, and application-to reveal demand dynamics. Regional breakdowns into the Americas, EMEA, and Asia-Pacific further contextualized performance drivers and competitive intensity.

Quality assurance protocols, including expert reviews and consistency checks, were implemented at each stage to ensure analytical rigor. This multifaceted research framework ensures that the insights presented here rest on a robust evidentiary foundation, supporting confident decision-making for stakeholders navigating the silver oxide battery landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Silver Oxide Batteries market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Silver Oxide Batteries Market, by Type

- Silver Oxide Batteries Market, by Voltage

- Silver Oxide Batteries Market, by Capacity

- Silver Oxide Batteries Market, by Cell Size

- Silver Oxide Batteries Market, by Sales Channel

- Silver Oxide Batteries Market, by Application

- Silver Oxide Batteries Market, by Region

- Silver Oxide Batteries Market, by Group

- Silver Oxide Batteries Market, by Country

- United States Silver Oxide Batteries Market

- China Silver Oxide Batteries Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Synthesizing Insights and Strategic Imperatives: Conclusive Reflections on Silver Oxide Battery Market Evolution and Future Pathways for Stakeholder Success

In synthesizing the insights from technological advances, trade-policy shifts, segmentation dynamics, and regional nuances, a clear strategic narrative emerges for silver oxide battery stakeholders. The confluence of improved rechargeable performance, regulatory emphasis on sustainability, and digital manufacturing adoption is empowering manufacturers to deliver increasingly differentiated solutions. At the same time, policy interventions such as the United States’ 2025 tariff adjustments underscore the necessity for resilient supply-chain architectures and agile pricing models.

Segmentation analyses highlight the importance of aligning product attributes-voltage, capacity, cell size, and form factor-with application requirements, from ultra-compact medical devices to high-reliability defense equipment. In regional markets, tailored strategies that reflect local regulatory climates, infrastructure readiness, and channel preferences are proving essential to capturing growth momentum. Moreover, leading firms are reinforcing their market positions through strategic partnerships, integrated recycling initiatives, and investment in next-generation materials.

Looking ahead, the competitive landscape will be shaped by organizations that can seamlessly integrate circular-economy principles, digital production practices, and targeted R&D agendas. Companies that execute on these imperatives will not only mitigate the impacts of external shocks but also capitalize on emerging opportunities in high-value market segments. Ultimately, success in the silver oxide battery arena will hinge on a holistic approach that anticipates industry inflection points and translates insights into decisive action.

Seize the Opportunity Now with Expert Guidance from Ketan Rohom; Secure Your Comprehensive Silver Oxide Battery Market Report Today

Taking decisive action to secure comprehensive insights into the silver oxide battery market can define your organization’s competitive trajectory. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore how this in-depth report can inform strategic decisions and drive revenue growth. With expert guidance and tailored support, you can unlock opportunities, mitigate risks, and accelerate your path to market leadership. Contact Ketan today to purchase the complete market research report and empower your team with the critical intelligence needed to thrive in this dynamic industry

- How big is the Silver Oxide Batteries Market?

- What is the Silver Oxide Batteries Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?