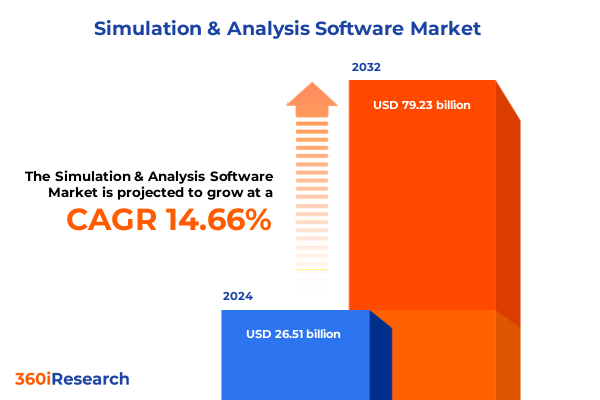

The Simulation & Analysis Software Market size was estimated at USD 30.21 billion in 2025 and expected to reach USD 34.49 billion in 2026, at a CAGR of 14.76% to reach USD 79.23 billion by 2032.

Unleashing the Potential of Simulation and Analysis Software to Redefine Operational Excellence and Drive Strategic Decision-Making in Modern Enterprises

Simulation and analysis software has emerged as a fundamental enabler of digital transformation across industries, propelling organizations into a new era of data-driven decision-making and process optimization. In today’s landscape, companies leverage simulation capabilities to validate design concepts virtually, anticipate maintenance needs through predictive algorithms, and streamline complex workflows that once required extensive physical prototyping. This convergence of computational power and domain expertise fosters unprecedented operational agility, allowing enterprises to innovate more rapidly while mitigating risk.

Moreover, the ubiquity of cloud computing, combined with advances in artificial intelligence, has democratized access to sophisticated simulation tools. Businesses of every scale can now deploy virtual environments that mirror real-world conditions, test scenarios under a multitude of variables, and derive actionable insights with remarkable speed. This paradigm shift not only accelerates time-to-market but also transforms how organizations allocate resources, manage supply chains, and respond to market fluctuations.

As we embark on an in-depth exploration of the simulation and analysis software market, this executive summary will provide a clear framework for understanding the pivotal trends, regulatory dynamics, and segmentation drivers shaping future growth. Readers will gain a holistic view of how technology innovations intersect with geopolitical factors to redefine competitive advantage. With this foundation, stakeholders can craft strategies that capitalize on emerging opportunities while anticipating potential challenges ahead.

Charting the Revolutionary Technological Tides That Are Reshaping Simulation and Analysis Software to Deliver Unprecedented Efficiency and Innovation

The simulation and analysis software landscape is witnessing transformative shifts driven by breakthroughs in artificial intelligence, high-performance computing, and data interoperability standards. Cutting-edge machine learning algorithms enable self-learning models within digital twins to predict system behavior with ever-increasing accuracy, while the integration of edge computing extends real-time simulation capabilities to remote and resource-constrained environments. As a result, organizations can deploy advanced predictive maintenance solutions at scale, reducing unplanned downtime and extending asset lifecycles.

Furthermore, the convergence of virtual reality and simulation platforms is creating immersive engineering environments that facilitate deeper collaboration among multidisciplinary teams. Designers, process engineers, and field technicians can interact with virtual prototypes in three-dimensional spaces, accelerating problem-solving cycles and fostering innovation. In parallel, open-source frameworks and standardized data formats are lowering integration barriers, enabling heterogeneous toolchains to communicate seamlessly and driving a shift toward modular, service-oriented architectures.

Evidently, these technological tides are reshaping value chains across industries. The ability to run complex multiphysics analyses in the cloud, leverage hybrid environments for sensitive workloads, and integrate live IoT feeds into process simulations underscores a fundamental evolution: simulation and analysis software is no longer an isolated domain but an integral component of enterprise-wide digital ecosystems. This transformative reality demands that organizations adapt their strategies, invest in scalable infrastructure, and cultivate interdisciplinary talent pools to stay ahead of the curve.

Assessing the Compound Effects of 2025 United States Tariff Policies on the Simulation and Analysis Software Ecosystem Across Supply Chains

The United States’ tariff policies enacted throughout 2025 have had a significant compound impact on the simulation and analysis software supply chain, influencing both cost structures and vendor strategies. Elevated duties on high-performance computing hardware, memory modules, and specialized GPUs have necessitated adjustments in procurement practices, prompting organizations to reevaluate global sourcing strategies and explore alternative component suppliers. Consequently, software providers have faced pressure to absorb higher import costs or to pass them through to end-users, thereby affecting licensing and subscription pricing models.

In response, some vendors have accelerated the migration of compute workloads to public cloud platforms located in jurisdictions with favorable trade agreements to mitigate tariff-induced cost increases. Others have invested in local data center partnerships or initiated captive infrastructure deployments in North America to maintain service level commitments. Additionally, simulation software companies have intensified negotiations with hardware manufacturers to bundle software licenses with in-region hardware offerings, effectively insulating customers from unpredictable tariff fluctuations.

Despite these headwinds, forward-looking enterprises have leveraged tariff-related supply chain disruptions as an impetus to optimize their software architectures. By adopting containerized deployment models and embracing cloud-native orchestration frameworks, organizations enhance flexibility and portability, enabling rapid workload relocation when geopolitical or regulatory changes occur. This strategic response underscores a wider industry realization: agility in infrastructure and licensing strategies is crucial to navigate the evolving tariff landscape and safeguard operational continuity.

Unlocking Profound Insights from Multi-Dimensional Segmentation Across Application Deployment Organization Size and End User Verticals in Simulation Solutions

A multi-faceted segmentation analysis reveals deep insights into where simulation and analysis software adds the greatest value across diverse operational domains and organizational structures. When examining the market through the lens of application, digital twin implementations dominate performance monitoring, predictive maintenance, and virtual commissioning use cases, enabling enterprises to create real-time replicas of physical assets. Equally important, process simulation spans chemical process optimization, flow simulation to refine fluid dynamics, and thermal simulation for heat transfer analysis, supporting critical decisions in industries such as chemicals and energy. Product simulation further extends capabilities with computational fluid dynamics for aerodynamic testing, structural analysis for load-bearing assessments, and thermal analysis to guide materials selection, illustrating a broad suite of engineering tools that drive product innovation.

Assessing deployment mode uncovers a dynamic balance between agility and control. Cloud offerings, both private and public, empower organizations to scale compute resources on demand and manage costs efficiently. Hybrid configurations, split between managed and self-managed architectures, deliver the flexibility to host sensitive workloads on-premise while leveraging cloud burst capacity. Traditional on-premise licenses, whether enterprise or perpetual, continue to retain relevance for mission-critical applications requiring full data sovereignty and predictable long-term cost structures.

Organization size also influences adoption patterns. Global enterprises and national corporations frequently lead digital twin and high-fidelity simulation projects, supported by substantial IT budgets and dedicated Centers of Excellence. In contrast, medium, micro, and small enterprises prioritize modular, easy-to-deploy analytical tools that balance performance with cost efficiency, reflecting resource constraints and a need for rapid time-to-value. Lastly, end-user verticals such as commercial aviation and defense engineering demand stringent validation standards, automotive OEMs and Tier1 suppliers focus on cycle time reduction, oil and gas and renewable energy players emphasize process safety and efficiency, while medical device and pharmaceutical firms concentrate on regulatory compliance and accelerated product lifecycles.

This comprehensive research report categorizes the Simulation & Analysis Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Deployment Mode

- Organization Size

- Application

- End User

Illuminating Regional Dynamics and Growth Drivers Across Americas Europe Middle East Africa and Asia-Pacific Simulation and Analysis Software Markets

Regional dynamics in the simulation and analysis software market reveal differentiated growth drivers, regulatory environments, and technological adoption curves across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, a combination of mature manufacturing ecosystems, strong aerospace and automotive hubs, and advanced energy sector requirements drives robust demand for high-fidelity digital twin and process simulation solutions. Leading research institutions and government initiatives around Industry 4.0 further accelerate investments in predictive maintenance and performance optimization technologies.

Conversely, Europe Middle East & Africa exhibits a blend of regulatory complexity and innovation incentives. Stringent emissions and safety regulations in automotive and energy sectors spur adoption of thermal and flow simulation to ensure compliance. Meanwhile, defense engineering projects in the Middle East underscore the importance of simulation to validate mission-critical systems under extreme operating conditions. Collaborative consortia between public and private entities in Europe foster R&D into sustainable manufacturing and circular economy frameworks, enhancing the appeal of virtual commissioning and lifecycle analysis tools.

Asia-Pacific stands out for its rapid digitalization across manufacturing, healthcare, and infrastructure sectors. Government-led smart city initiatives and investments in renewable energy projects propel demand for process simulation in utilities and grid optimization. The burgeoning medical devices market in countries such as Japan and South Korea prioritizes regulatory-aligned simulation workflows to expedite product approvals. Moreover, competitive pressures among automotive OEMs in China and India drive the integration of computational fluid dynamics and structural analysis into early-stage design, reflecting a shift toward virtual prototyping as a means to reduce development costs and time-to-market.

This comprehensive research report examines key regions that drive the evolution of the Simulation & Analysis Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Footprints and Innovation Trajectories of Key Players Dominating the Simulation and Analysis Software Landscape Globally

Key players in the simulation and analysis software arena have charted strategic pathways that reflect both depth in specialized offerings and breadth across complementary domains. Global engineering software manufacturers continue to leverage robust R&D pipelines, introducing AI-enhanced modules and expanding multiphysics solvers to address emerging challenges in electrification, additive manufacturing, and autonomous systems. Strategic acquisitions of niche simulation startups enable incumbents to integrate cutting-edge functionalities-such as real-time digital twin streaming and physics-informed machine learning-into established platforms, thereby enriching value propositions for large enterprise clients.

In parallel, cloud-native challengers have disrupted traditional licensing paradigms by offering elastic, subscription-based models that attract small to medium enterprises seeking predictable costs and rapid deployment. These providers often excel at embedding user-centric interfaces and workflow automation, lowering the technical barrier for organizations without dedicated simulation centers. Partnerships between cloud platform vendors and specialized application developers further amplify this trend, creating turnkey solutions that seamlessly connect data ingestion, model creation, and result visualization across hybrid infrastructures.

Investments in global service networks and certification programs distinguish vendors’ go-to-market strategies. Professional services teams deliver custom implementation, validation, and training engagements, guaranteeing that simulation solutions align with industry-specific compliance requirements. As digital ecosystems become more interconnected, companies that foster open APIs and developer communities stand to gain traction by enabling tailored integrations and accelerating innovation cycles.

This comprehensive research report delivers an in-depth overview of the principal market players in the Simulation & Analysis Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ansys, Inc. by Synopsys, Inc

- Aspen Technology, Inc. by Emerson Electric Co.

- Autodesk Inc.

- AVEVA Group plc by Schneider Electric SE

- Bentley Systems, Incorporated

- CAE Inc.

- Certara, Inc.

- COMSOL AB

- Dassault Systèmes S.E.

- GSE Performance Solutions, LLC

- Hexagon AB

- Honeywell International Inc.

- Keysight Technologies, Inc.

- MathWorks, Inc.

- MOSIMTEC, LLC

- PTC Inc.

- Rockwell Automation, Inc.

- Siemens AG

- SimScale GmbH

- Simulations Plus, Inc.

- Synopsys, Inc.

- The AnyLogic Company

Empowering Industry Leaders with Actionable Strategic Pathways to Harness Advanced Simulation Capabilities and Cement Competitive Advantage in Dynamic Markets

To secure lasting competitive advantage, industry leaders must align their simulation and analysis software strategies with overarching business imperatives and technological evolutions. First, investing in cross-functional Centers of Excellence that bridge engineering, IT, and operations will ensure coherent governance over digital twin and analytics initiatives. By establishing clear data standards, workflow protocols, and success metrics, organizations can avoid siloed deployments and fully leverage the synergies of integrated simulation environments.

Second, leaders should embrace flexible deployment models that balance agility and data sovereignty. Adopting a hybrid cloud approach enables rapid scaling of compute-intensive tasks while preserving on-premise control for sensitive or legacy-critical operations. This flexibility is further enhanced by containerization and microservices, which facilitate workload portability, reduce vendor lock-in, and simplify disaster recovery planning.

Third, nurturing talent with interdisciplinary skill sets-spanning computational physics, software engineering, and domain-specific expertise-will be vital. Upskilling programs, academic partnerships, and participation in open-source communities can fuel a continuous influx of innovation, ensuring that simulation initiatives remain aligned with emerging best practices such as digital thread integration and model-based systems engineering.

Finally, monitoring geopolitical factors, including tariff policies and data privacy regulations, must be embedded into strategic roadmaps. By proactively assessing potential trade implications and compliance requirements, executives can architect resilient supply chains and licensing strategies that safeguard performance while optimizing total cost of ownership.

Elucidating Rigorous Research Methodologies Employed to Capture Comprehensive Data and Ensure Robustness and Credibility of Simulation Software Market Insights

This analysis draws upon a rigorous combination of primary and secondary research methodologies to deliver comprehensive and reliable market insights. Primary data was collected through in-depth interviews with senior simulation architects, IT decision-makers, and process engineers across North America, Europe Middle East Africa, and Asia-Pacific. These conversations provided nuanced perspectives on technology adoption drivers, deployment preferences, and evolving use cases, ensuring that the report captures real-world challenges and success stories.

Secondary research supplements these findings through systematic reviews of peer-reviewed journals, technology roadmaps, and regulatory publications. Specialized databases tracking software releases, patent filings, and open-source contributions were leveraged to identify emerging trends and assess vendor innovation pipelines. Additionally, trade association reports, government policy documents, and conference proceedings informed the analysis of regional regulatory frameworks and industry-specific compliance obligations.

Robust data triangulation techniques were employed to validate market patterns, while statistical sampling and benchmarking against analogous technology markets ensured the credibility of qualitative insights. Advanced analytics tools enabled the visualization of segmentation overlaps and the modeling of supply chain sensitivities related to geopolitical events. This methodological rigor underpins the actionable recommendations and strategic imperatives outlined in this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Simulation & Analysis Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Simulation & Analysis Software Market, by Type

- Simulation & Analysis Software Market, by Deployment Mode

- Simulation & Analysis Software Market, by Organization Size

- Simulation & Analysis Software Market, by Application

- Simulation & Analysis Software Market, by End User

- Simulation & Analysis Software Market, by Region

- Simulation & Analysis Software Market, by Group

- Simulation & Analysis Software Market, by Country

- United States Simulation & Analysis Software Market

- China Simulation & Analysis Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Core Findings to Illuminate the Transformative Trajectory of Simulation and Analysis Software and Guide Stakeholders Toward Informed Decisions

In summary, simulation and analysis software stands at the vanguard of digital innovation, transforming how enterprises design, operate, and optimize complex systems. The convergence of AI-driven predictive models, immersive virtual environments, and hybrid deployment paradigms is redefining the scope of what is possible, enabling organizations to leapfrog legacy constraints and deliver superior performance outcomes.

The cumulative impact of 2025 tariff policies underscores the importance of agile infrastructure strategies and diversified licensing models. Organizations that embrace containerization, hybrid cloud architectures, and localized compute solutions are better positioned to navigate supply chain uncertainties while maintaining cost efficiency. Meanwhile, segmentation analysis reveals that tailored approaches across applications, deployment modes, organizational scales, and verticals are essential to unlock maximum value from simulation investments.

Regional nuances-from the mature manufacturing hubs in the Americas to the regulatory-driven markets of EMEA and the rapid digitalization in Asia-Pacific-highlight the need for context-specific go-to-market strategies. Vendors and end-users alike must remain vigilant to shifts in policy and technology standards, ensuring that their roadmaps adapt to evolving demands.

Ultimately, the insights presented here form a strategic toolkit for decision-makers. By aligning research-backed recommendations with organizational objectives, industry leaders can harness the full potential of simulation and analysis software to drive innovation, resilience, and competitive differentiation.

Seize the Opportunity to Elevate Your Strategic Vision by Engaging Ketan Rohom for Exclusive Access to a Comprehensive Simulation Software Market Report

If you are seeking to harness the full power of simulation and analysis software to drive competitive differentiation and operational excellence, now is the moment to take decisive action. Engage with Ketan Rohom, an industry veteran with a proven track record in guiding global organizations through digital transformation and advanced analytics adoption. By partnering with him, you will gain exclusive insights into market dynamics, best practices, and emerging trends curated in a comprehensive report that is tailored to your strategic priorities.

Ketan’s blend of sales acumen and marketing expertise ensures a collaborative experience where your unique challenges inform every recommendation. Whether you aim to optimize asset performance through digital twin implementations, accelerate product development cycles with computational simulations, or streamline processes across hybrid deployments, Ketan will connect you with the intelligence and advisory support you need to succeed.

Act now to secure your copy of the definitive simulation and analysis software market research report. Empower your leadership team with data-driven insights and roadmaps that translate cutting-edge innovations into tangible business outcomes. Reach out to Ketan Rohom today to explore custom briefing sessions, ask targeted questions, and begin the journey toward unlocking new levels of performance and growth.

- How big is the Simulation & Analysis Software Market?

- What is the Simulation & Analysis Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?