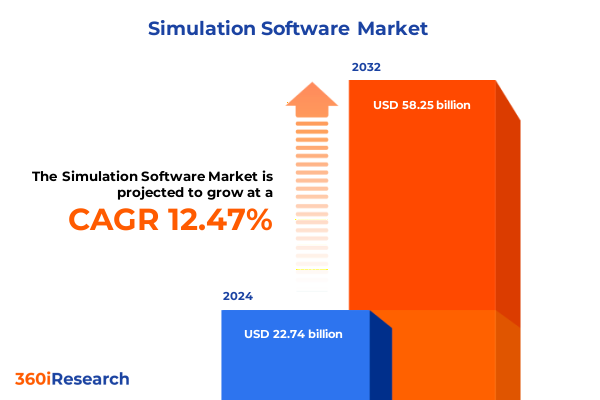

The Simulation Software Market size was estimated at USD 25.45 billion in 2025 and expected to reach USD 28.48 billion in 2026, at a CAGR of 12.55% to reach USD 58.25 billion by 2032.

Setting the Stage for Unparalleled Growth and Innovation in Simulation Software Ecosystems Across Industries to Navigate Future Engineering Challenges

The simulation software market has emerged as a cornerstone of modern engineering and product development, enabling organizations to model complex physical phenomena, optimize design parameters, and accelerate time to market. By leveraging high-fidelity virtual environments, companies in diverse industries-from aerospace to healthcare-gain unprecedented insights into performance, reliability, and safety before committing to costly physical prototypes. This executive summary provides an authoritative overview of the forces driving innovation, adoption, and competitive dynamics within the global simulation software ecosystem, equipping decision makers with the knowledge required to navigate an increasingly dynamic landscape.

In recent years, the convergence of advanced computing architectures, cloud-based infrastructures, and sophisticated physics solvers has expanded the capabilities of simulation platforms. Organizations are shifting from traditional on-premise deployments to more scalable, flexible cloud and hybrid solutions that democratize access and reduce barriers to entry. This shift is enabling small and medium enterprises to harness simulation in ways that were previously feasible only for large multinational corporations. The next sections will delve deeper into the transformative shifts reshaping the market, the influence of recent US tariff policies, critical segmentation insights, regional dynamics, leading competitors’ strategies, and actionable recommendations for industry leaders.

A comprehensive understanding of segmentation-across offerings, technologies, deployment models, applications, and end-user verticals-and the regional nuances that drive uptake is essential for charting a successful course. Key market participants are differentiating through service portfolios, cloud-enabled platforms, integrated multiphysics solvers, and specialized training programs to address the unique challenges of sectors such as automotive, energy, and electronics. Drawing on rigorous primary and secondary research, this report synthesizes these insights to inform strategic decision making and identify growth opportunities at the intersection of innovation and market demand.

Analyzing the Wave of Transformative Technological Breakthroughs and Operational Strategies Reshaping the Global Simulation Software Market Landscape

The simulation software market is undergoing a profound transformation characterized by rapid technological innovation, evolving business models, and increasing expectations for tailored solutions. At the core of this evolution is the integration of artificial intelligence and machine learning with traditional physics-based solvers, yielding hybrid workflows that significantly reduce simulation time while improving predictive accuracy. These intelligent platforms are enabling users to automate design optimization, error detection, and result interpretation, freeing engineers to focus on strategic problem solving rather than routine tasks.

Concurrently, the rise of cloud-native architectures and the proliferation of high-performance computing services have revolutionized computational accessibility. Where in the past only organizations with extensive on-premise clusters could run large-scale finite element or computational fluid dynamics simulations, today’s cloud-based offerings allow on-demand scaling, pay-per-use pricing, and seamless collaboration across distributed teams. This democratization of resources is unlocking new use cases, from real-time digital twin monitoring to virtual commissioning of industrial equipment.

Operational shifts are also redefining how organizations engage with simulation providers. Managed services, platform-as-a-service offerings, and outcome-based contracts are supplanting traditional perpetual licensing models. Customers now seek end-to-end partnerships that encompass consulting, deployment and integration, ongoing support, and bespoke training services. By aligning commercial terms with business outcomes-such as reduced development cycle times or optimized energy performance-vendors are forging deeper relationships and driving more predictable, recurring revenue streams.

Evaluating the Ongoing Impact of United States 2025 Tariff Policies on Simulation Software Supply Chains Development and Adoption

The introduction of new tariff measures by the United States in early 2025 has introduced additional complexity into global supply chains, particularly affecting hardware-intensive industries and software vendors reliant on imported components. While simulation software itself is an intangible product, its delivery depends on a hardware infrastructure comprising high-performance servers, GPUs, and networking equipment. Increased duties on semiconductor chips and specialized accelerators have raised capital expenditure costs for cloud service providers and enterprise data center operators. These higher infrastructure expenses have, in some cases, been passed through to end users in the form of elevated subscription fees or compute charges, altering total ownership costs.

Moreover, tariff uncertainties have prompted simulation vendors to reassess the location of their research and development and cloud-hosting operations. Many providers are strategically diversifying their data center footprints to regions with more favorable trade policies, thereby mitigating the risk of cost fluctuations. In parallel, end users in impacted verticals such as automotive manufacturing and aerospace are recalibrating their simulation roadmaps to optimize compute-intensive tasks during periods of lower import duties. The need for long-term hardware procurement strategies is more pronounced, with organizations seeking flexible procurement frameworks that accommodate shifting regulatory regimes.

Despite these headwinds, some segments have exhibited resilience. Cloud-based simulation services offering elastic resource allocation and geographically distributed compute clusters have proven less vulnerable to localized tariff effects. Furthermore, vendors are increasingly embedding hardware-agnostic workflows and containerized solvers that can operate across heterogeneous infrastructures, reducing dependency on specific hardware vendors affected by trade policies. As a result, simulation users are better positioned to maintain project continuity and budget predictability, even amid geopolitical disruptions.

Decoding Multidimensional Segmentation Insights That Reveal Critical Drivers and Opportunities Across Simulation Software Offerings Technologies and Applications

A nuanced segmentation analysis reveals the multifaceted drivers that underpin simulation software adoption. Within the offering dimension, consulting services, deployment and integration, maintenance and support, and training services form the backbone of professional services that complement core software licenses. These services address the growing demand for domain expertise, ensuring that organizations realize maximum value from integrated simulation platforms or standalone solvers. In parallel, the bifurcation of the software market into integrated simulation platforms and standalone simulation tools highlights a clear dichotomy in customer preferences. Enterprises with established multi-physics requirements gravitate toward comprehensive suites, while specialized users often select focused solutions tailored to singular phenomena such as structural analysis or fluid flow.

From a technology perspective, computational fluid dynamics, finite element analysis, electromagnetic simulation, structural simulation, process simulation, and multiphysics simulation represent the core methods driving innovation. CFD remains dominant in industries with complex fluid interactions, whereas FEA and structural solvers are indispensable for mechanical stress analysis in automotive and aerospace applications. Electromagnetic and multiphysics capabilities are rapidly gaining traction in electronics design and energy sector use cases, while process simulation is crucial for chemical industries and manufacturing optimization.

Deployment models further delineate customer priorities: cloud-based solutions deliver scalability and ease of collaboration, essential for agile development teams, whereas on-premise implementations continue to prevail in highly regulated sectors with stringent data governance requirements. Application segmentation into diagnostics and analysis, product development, and training and education underscores the versatility of simulation across the product lifecycle. Finally, end-user verticals such as aerospace and defense-with subsegments in aircraft and spacecraft design validation, defense strategy and mission simulations, flight simulation and training, MRO optimization, and weapon system development-highlight a deep specialization. Automotive and transportation also exhibit layered needs, including supply chain planning, traffic flow modeling, and vehicle performance testing, revealing how each industry leverages simulation to address its unique challenges.

This comprehensive research report categorizes the Simulation Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Technology

- Deployment

- Application

- End-user

Unearthing Regional Dynamics and Market Drivers Shaping Simulation Software Adoption Trends Across Americas EMEA and Asia Pacific

Regional dynamics play a pivotal role in shaping simulation software adoption patterns, influenced by factors such as industrial priorities, regulatory frameworks, and digital infrastructure readiness. In the Americas, strong demand from aerospace, automotive, and energy sectors, coupled with significant investment in digital twin initiatives, has cemented the region’s leadership in adopting advanced simulation solutions. Enterprises here are leveraging cloud-based and on-premise hybrid models to streamline product development cycles and meet increasingly stringent regulatory and safety mandates.

Europe, the Middle East, and Africa present a heterogeneous landscape. Western Europe’s mature markets benefit from robust R&D ecosystems and supportive government programs aimed at Industry 4.0 transformation, driving growth in multiphysics and process simulation. Meanwhile, the Middle East and Africa are characterized by targeted investments in oil and gas process optimization, energy transition projects, and the gradual uptake of simulation-driven infrastructure planning. Regional collaborations and cross-border data center alliances are enhancing solution accessibility, even as geopolitical complexities require agile deployment and support strategies.

Asia-Pacific has emerged as the fastest-growing region, fueled by rapid industrialization, smart manufacturing initiatives, and expanding electronics and semiconductor industries. Emerging markets in Southeast Asia and India are witnessing increased uptake of cost-effective cloud simulation offerings, enabling local SMEs to compete on a global scale. In parallel, established markets such as Japan and South Korea are investing heavily in next-generation solvers, AI-enhanced simulation workflows, and digital twin applications for automotive and electronics sectors, setting new benchmarks for innovation and integration.

This comprehensive research report examines key regions that drive the evolution of the Simulation Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Industry Contenders and Their Strategic Moves That Influence Competitive Positioning in the Simulation Software Market

Competition in the simulation software market is intense and dynamic, with leading providers differentiating through innovation, strategic partnerships, and customer-centric services. Established incumbents such as ANSYS and Siemens Digital Industries Software maintain market leadership by continuously expanding their multiphysics capabilities and integrating cloud-native architectures. These vendors also emphasize robust professional services, ensuring customers can deploy complex simulations at scale and extract actionable insights.

Meanwhile, Dassault Systèmes leverages its 3DEXPERIENCE platform to unite simulation, design, and lifecycle management into a cohesive environment, targeting enterprises seeking end-to-end digital continuity. Altair has carved out a competitive position by offering a flexible licensing model and emphasizing AI-driven solvers that accelerate optimization tasks. Autodesk and PTC are making strategic inroads through partnerships with cloud service providers and by offering tailored solutions for product development and training, particularly in small-to-medium enterprise segments.

Emerging pure-play simulation vendors and specialized niche players are also influencing market dynamics. These firms often focus on high-performance computing innovations, containerized solvers, and domain-specific applications-ranging from advanced electromagnetic analysis for 5G design to fluid-structure interaction modeling for renewable energy systems. Such targeted offerings, combined with agile go-to-market strategies and consultative delivery models, are challenging traditional business models and driving overall market innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Simulation Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AnyLogic North America, LLC

- Aspen Technology Inc

- Autodesk, Inc.

- Bentley Systems, Incorporated

- Certara, Inc.

- COMSOL AB

- Coreform LLC

- Dassault Systèmes S.E.

- dSPACE GmbH

- EMERSON ELECTRIC CO

- Epic Games, Inc.

- Hexagon AB

- Keysight Technologies, Inc.

- Koninklijke HaskoningDHV Groep B.V.

- OPAL-RT Technologies Inc.

- Powersim Software AS

- PTC Inc.

- Rockwell Automation Inc.

- Schlumberger N.V.

- Siemens AG

- Simul8 Corporation

- Simulations Plus, Inc.

- Synopsys, Inc.

- The Boeing Company

- The MathWorks, Inc.

Defining Actionable Strategic Imperatives for Industry Leaders to Capitalize on Emerging Trends and Sustain Competitive Advantage in Simulation Software

Industry leaders must embrace a multi-pronged strategic approach to capitalize on the evolving simulation software landscape. First, investing in scalable, cloud-enabled platforms with seamless integration of AI and machine learning will differentiate offerings and meet the growing demand for real-time insights and optimization. Such investments should be complemented by outcome-based commercial models that align pricing with measurable business benefits-reducing barriers for customers and driving predictable revenue streams.

Second, deepening domain expertise through specialized consulting services and training programs will become a critical source of differentiation. By developing vertical-specific accelerators and preconfigured workflows, vendors can address unique engineering challenges in sectors like aerospace, energy, and semiconductor manufacturing. This domain-centric approach will not only enhance customer satisfaction but also create upsell opportunities for advanced modules and complementary services.

Third, forging strategic alliances with cloud infrastructure providers, high-performance computing specialists, and hardware vendors will ensure optimized performance and geographic reach. Collaborative go-to-market partnerships can also facilitate joint marketing initiatives and bundle offerings, amplifying brand visibility and accelerating customer acquisition. Finally, a relentless focus on user experience-through intuitive interfaces, low-code customization, and integrated collaboration tools-will streamline adoption across distributed teams and drive long-term customer loyalty.

Outlining Rigorous Mixed Methodologies Employing Primary and Secondary Research to Ensure Robust Insights in Simulation Software Market Analysis

This analysis is grounded in a rigorous mixed-method research approach, combining extensive primary and secondary sources to ensure validity and depth. Primary research included structured interviews with senior executives, R&D leaders, and domain specialists across key verticals, supplemented by quantitative surveys of simulation software users to capture real-world usage patterns, investment priorities, and pain points. These insights were further enriched by vendor briefings, hands-on product evaluations, and expert panels, facilitating triangulation of qualitative and quantitative data.

Secondary research encompassed the review of corporate filings, industry white papers, academic publications, and technology roadmaps to establish historical context and emerging trends. Trade association reports and regulatory documents provided additional perspective on compliance requirements and policy influences. Data from public cloud providers, hardware OEMs, and academic supercomputing centers informed analysis of infrastructure and deployment model dynamics.

Analytical frameworks employed include SWOT (strengths, weaknesses, opportunities, threats) assessments for major vendors, Porter’s Five Forces evaluations to gauge competitive intensity, and segmentation matrices to elucidate market drivers across offerings, technologies, and applications. Forecasting scenarios were developed through scenario planning workshops with industry experts, ensuring that findings are robust across a range of potential market developments. This meticulous methodology underpins the credibility and strategic relevance of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Simulation Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Simulation Software Market, by Offering

- Simulation Software Market, by Technology

- Simulation Software Market, by Deployment

- Simulation Software Market, by Application

- Simulation Software Market, by End-user

- Simulation Software Market, by Region

- Simulation Software Market, by Group

- Simulation Software Market, by Country

- United States Simulation Software Market

- China Simulation Software Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Critical Conclusions to Provide a Coherent Perspective on Emerging Opportunities and Challenges in Simulation Software

In synthesizing these findings, it is evident that the simulation software market stands at an inflection point defined by technological convergence, shifting commercial models, and geopolitical influences. Organizations that proactively adopt cloud-based, AI-augmented simulation platforms will gain a decisive advantage in product innovation and operational efficiency. Simultaneously, the ability to navigate tariff-induced supply chain complexities through hardware-agnostic workflows and diversified data center footprints will mitigate cost volatility and support sustained growth.

Specialized consulting services, vertical-focused accelerators, and outcome-based contracting models emerge as critical differentiators for vendors seeking to deepen customer relationships and expand revenue per user. Regional market dynamics further underscore the need for tailored go-to-market strategies, whether by leveraging advanced manufacturing initiatives in Europe or tapping into the rapid industrial expansion across Asia-Pacific.

Ultimately, the winners in this evolving landscape will be those who integrate technological innovation with customer-centric delivery, forging strategic partnerships and embedding simulation into the core of enterprise digital transformations. This report equips decision makers with a comprehensive framework to assess their current capabilities, identify growth opportunities, and chart a course toward sustained leadership in the simulation software arena.

Inviting Decision Makers to Engage with Associate Director of Sales and Marketing for a Comprehensive Simulation Software Market Intelligence Report

Ready to propel your organization to the forefront of engineering innovation? Connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive market intelligence report can inform your strategic investments and uncover untapped growth opportunities. Benefit from tailored insights, expert analysis, and custom advisory support designed to align your simulation software initiatives with evolving industry demands. Don’t miss out on the chance to gain a competitive edge-reach out today to secure your copy of the definitive guide to the simulation software landscape and chart a course for sustained success.

- How big is the Simulation Software Market?

- What is the Simulation Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?