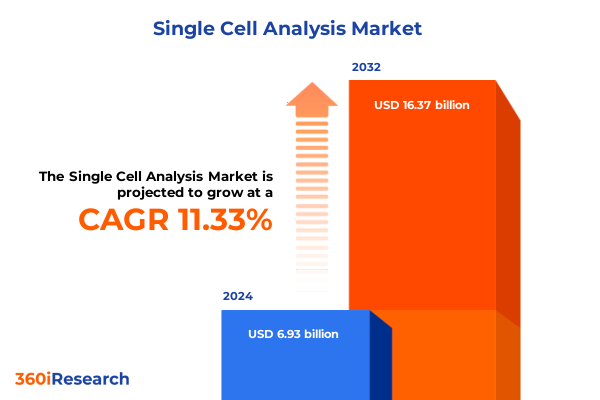

The Single Cell Analysis Market size was estimated at USD 7.62 billion in 2025 and expected to reach USD 8.37 billion in 2026, at a CAGR of 11.54% to reach USD 16.37 billion by 2032.

Unveiling the New Era of Single-Cell Analysis and Precision Biology Insights Revolutionizing Our Understanding of Cellular Complexity in Health and Disease

Single-cell RNA sequencing has emerged as a transformative tool, enabling researchers to dissect cellular heterogeneity with unprecedented precision. By profiling the transcriptome of individual cells, scientists can now unravel the complex tapestry of cellular states and rare subpopulations that were previously masked by bulk analysis methodologies.

This granular level of insight has profound implications for clinical diagnostics and personalized medicine. Examining unique cellular outliers within diseased tissues reveals critical drivers of pathology and therapeutic resistance, informing targeted intervention strategies. As the technology matures, its application in identifying molecular signatures of rare cell types is becoming indispensable for crafting individualized treatment plans.

In cancer research, single-cell transcriptomic approaches are redefining our understanding of tumor heterogeneity and microenvironmental interactions. By profiling individual tumor and immune cells, researchers can map oncogenic pathways, uncover resistance mechanisms, and identify novel therapeutic targets, ultimately refining precision oncology paradigms and improving patient outcomes.

Charting the Transformative Shifts Driving Single-Cell Technologies from AI-Driven Automation to Spatial Multi-Omics Integration Shaping Future Discoveries

Artificial intelligence and machine learning have become integral to single-cell analysis workflows, enhancing the interpretation of high-dimensional datasets generated by techniques such as scRNA-seq and mass cytometry. By automating cell type classification and pathway inference, these computational tools accelerate discovery timelines and reduce analytical bottlenecks, allowing researchers to focus on biological interpretation rather than data wrangling.

Simultaneously, automation and miniaturization trends are streamlining single-cell protocols, from sample preparation to data acquisition. Robotic platforms and microfluidic devices are reducing manual labor and variability, while compact, bench-top instruments make high-throughput experimentation more accessible in clinical and decentralized settings. These advances are crucial for scaling single-cell studies across larger cohorts and driving reproducibility in both research and diagnostic applications.

The integration of multi-omics layers at the single-cell level is reshaping investigative paradigms, uniting genomics, transcriptomics, proteomics, and epigenomics to provide a holistic cellular portrait. Coupling spatial transcriptomics with single-cell workflows further contextualizes molecular profiles within tissue architecture, unlocking insights into cell–cell interactions and microenvironmental niches. These convergent approaches are paving the way for comprehensive studies in developmental biology, neuroscience, and pathology.

Moreover, cloud-based bioinformatics platforms are facilitating collaborative analysis and long-term data management by offering scalable storage solutions and shared pipelines. This shift to cloud infrastructure not only addresses the computational demands of large-scale single-cell projects but also supports cross-institutional partnerships, fostering a more interconnected research ecosystem.

Assessing the Cumulative Impact of 2025 United States Trade Tariffs on Single-Cell Analysis Costs Supply Chains and Innovation Momentum

In early April 2025, the United States implemented a universal 10 percent tariff on most imported laboratory goods, followed by country-specific increases-most notably a cumulative 145 percent tariff on key Chinese imports. These policies have significantly elevated the cost base for single-cell instrumentation and consumables, reshaping procurement strategies across academic and commercial laboratories.

Industry analysts project that the new trade measures will drive a 2 percent average increase in cost of goods sold (COGS) for life science tool manufacturers, with certain firms facing up to a 4 percent spike. This margin compression is likely to translate into higher end-user prices for flow cytometers, sequencers, and reagent kits, potentially stalling budget-constrained projects and slowing technology adoption in cost-sensitive environments.

Supply chain disruptions are compounding these price pressures, as both domestic and international suppliers grapple with the complexities of tariff compliance. Several firms are stockpiling critical reagents sourced from U.S. partners and exploring localized manufacturing options to mitigate future disruptions. Chinese contract research organizations, for example, have begun shifting certain workflows to domestic labs to avoid inflated import costs, underscoring the fragility of global supply chains in the biopharma sector.

According to a BIO membership survey, nearly 90 percent of U.S. biotechnology companies rely on imported components for at least half of their FDA-approved products. Over 80 percent of those surveyed anticipate needing a full year to identify substitute suppliers, while 44 percent foresee delays exceeding two years. These dynamics risk creating significant bottlenecks in drug development pipelines and impeding patient access to novel therapeutics.

Taken together, the cumulative impact of the 2025 tariffs poses a critical challenge to the single-cell analysis ecosystem. Elevated import costs and uncertainty around future policy shifts may cause laboratories to defer instrument upgrades and limit reagent usage, slowing the pace of discovery and translational research at a pivotal moment for precision biology.

Unlocking Key Segmentation Insights to Navigate Product Type Technology Application and End User Dynamics in the Single-Cell Analysis Market Landscape

Based on product type, the single-cell analysis market is segmented into consumables, instruments, and software. Consumables-encompassing kits, reagents, labware, and other high-volume items-drive recurring revenue streams due to their one-time-use nature and critical role in every experiment. Instruments such as flow cytometers, imaging systems, mass cytometers, and sequencers represent high-capital investments and often dictate the scope and throughput of studies. Complementing these physical assets, software solutions for data analysis and data management are gaining prominence as laboratories contend with increasingly complex datasets and regulatory requirements.

When viewed through the lens of technology, the market encompasses flow cytometry platforms (including high-throughput FACS and microflow systems), imaging modalities, mass cytometry, and single-cell sequencing techniques. The latter, featuring scATAC-seq, scDNA-seq, scRNA-seq, and spatial transcriptomics, has seen rapid growth, driven by its ability to deliver comprehensive gene expression and chromatin accessibility profiles. While flow cytometry remains a workhorse for immunophenotyping, the ascendancy of sequencing-based approaches reflects the broader shift toward multi-omics studies and the need for high-dimensional cellular resolution.

Application-based segmentation highlights developmental biology, immunology, neurology, and oncology as primary end-use areas. Within immunology, research into autoimmune and infectious diseases is rapidly expanding, fueled by the rise of immunotherapies and vaccine development. Neurological applications, focusing on neurodegenerative and neurodevelopmental disorders, are emerging in response to unmet clinical needs. Oncology, subdivided into hematological and solid tumor investigations, continues to command the largest share of single-cell workflows due to its critical role in understanding tumor heterogeneity and guiding precision treatments.

Finally, end-user segmentation spans academic research (government institutes, universities, and colleges), clinical diagnostics (hospital and reference labs), contract research organizations (clinical and preclinical CROs), and the pharma & biotech sector (large pharmaceutical firms and small biotechnology enterprises). Academic laboratories often pioneer methodological innovations, while pharmaceutical and biotech companies leverage single-cell assays to de-risk drug development. CROs are expanding their service offerings to accommodate both early-stage discovery and regulatory-compliant clinical workflows, and clinical diagnostics are beginning to adopt single-cell assays in specialized applications such as minimal residual disease monitoring and immunoprofiling.

This comprehensive research report categorizes the Single Cell Analysis market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Exploring the Strategic Regional Dynamics Shaping Growth and Adoption across Americas Europe Middle East Africa and Asia-Pacific in Single-Cell Analysis

In the Americas, the single-cell analysis market is anchored by robust funding from government agencies and private institutions, a dense network of biotechnology hubs, and a culture of early technology adoption. The United States, in particular, leads in both instrument procurement and consumable usage, supported by an ecosystem of research universities and pharmaceutical headquarters. Canada’s growing biopharma sector also contributes, leveraging strong academic-industry collaborations to accelerate translational single-cell research

This comprehensive research report examines key regions that drive the evolution of the Single Cell Analysis market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Players and Their Strategic Innovations Partnerships and Product Launches Driving the Single-Cell Analysis Industry Forward

10x Genomics has solidified its position through strategic partnerships and product innovations. Its 2024 collaboration with Hamilton Company introduces automated, high-throughput library preparation solutions capable of processing dozens of single-cell samples simultaneously, reducing hands-on time and streamlining workflows for large-scale studies.

BD Biosciences extended its robotics-compatible reagent offerings in late 2024, launching the OMICS-One XT WTA assay in partnership with Hamilton Company. This kit enhances consistency and scalability in single-cell gene expression studies, particularly in oncology and immunology research applications.

Illumina strengthened its market footprint with the MiSeq i100 Series, designed to simplify next-generation sequencing workflows and broaden accessibility. The acquisition of Fluent BioSciences by Illumina in mid-2024 underscores a strategic move to capture a larger share of prep kit revenues and integrate end-to-end single-cell solutions, prompting competitive responses from peers.

Thermo Fisher Scientific and other major manufacturers are investing heavily in AI-driven software platforms and cloud-based data management tools. Collaborations such as the Deepcell–NVIDIA partnership illustrate the push toward generative AI applications in cell imaging and morphology analysis, accelerating data interpretation and enabling real-time decision support in both research and clinical settings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Single Cell Analysis market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 10x Genomics, Inc.

- Agilent Technologies, Inc.

- Becton, Dickinson and Company

- BGI Genomics Co., Ltd.

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Bruker Corporation

- Cellarity, Inc. by Flagship Pioneering, Inc.

- Corning Incorporated

- Danaher Corporation

- Deepcell, Inc.

- Diasorin S.p.A.

- General Electric Company

- Illumina, Inc.

- LumaCyte, Inc.

- MedGenome Inc.

- Menarini Group

- Merck KGaA

- Novogene Co., Ltd.

- Oxford Nanopore Technologies PLC

- PerkinElmer Inc.

- Promega Corporation

- QIAGEN N.V.

- Sartorius AG

- Singleron Biotechnologies

- Standard BioTools Inc.

- Takara Bio Inc.

- Thermo Fisher Scientific, Inc.

- Zafrens

Crafting Actionable Strategies for Industry Leaders to Mitigate Risks Embrace Innovation and Accelerate Growth in Single-Cell Analysis

Industry leaders should prioritize the localization of critical reagent and instrument manufacturing to mitigate tariff-related disruptions. Establishing or expanding regional production hubs, and forming alliances with domestic suppliers, will create a more resilient supply chain and safeguard research continuity amidst policy uncertainties.

Investing in automation and advanced computational tools is essential to address the bottlenecks of manual workflows and high-dimensional data interpretation. Deploying robotic liquid-handling platforms and AI-powered analytics will enable organizations to scale single-cell experiments while ensuring data quality and reproducibility.

Adopting integrated multi-omics and spatial transcriptomics strategies can unlock deeper biological insights, driving innovation in therapeutic development and biomarker discovery. By diversifying assay portfolios and leveraging convergent technologies, teams can establish competitive differentiation and enhance translational impact.

Fostering cross-sector collaborations among academic institutions, contract research organizations, and pharmaceutical companies will accelerate knowledge exchange and resource optimization. Joint consortia and shared data platforms can reduce duplication of effort, streamline validation studies, and amplify collective expertise.

Developing in-house bioinformatics capabilities and promoting specialized training programs will address talent shortages and strengthen analytical pipelines. Building robust teams with expertise in data science, machine learning, and multi-omics integration will underpin long-term strategic growth in single-cell research.

Detailing the Robust Research Methodology Underpinning Comprehensive Analysis of Segmentation Regional Trends Competitive Landscape and Expert Engagement

This analysis is grounded in a comprehensive two-step research methodology involving both secondary and primary data collection. Secondary research encompassed an exhaustive review of published literature, regulatory filings, corporate press releases, industry white papers, and reputable news sources to identify macroeconomic trends, policy developments, and technological advancements.

Building on these findings, primary research was conducted through structured interviews and surveys with key stakeholders, including academic researchers, biotech executives, laboratory managers, and instrumentation vendors. These engagements provided qualitative insights and validation of emerging market dynamics.

Data triangulation was employed to reconcile disparate information sources, ensuring consistency and reliability of insights. Quantitative data on technology adoption, R&D expenditure, and partnership activity were cross-verified against multiple industry reports and financial disclosures.

Segmentation analysis was validated by comparing product, technology, application, and end-user categories against real-world usage patterns observed in clinical and research settings. Regional trends were assessed by synthesizing market intelligence with policy analysis and funding landscapes.

Finally, expert consultations with thought leaders in bioinformatics, regulatory affairs, and supply chain management informed the actionable recommendations, ensuring they are both feasible and aligned with current industry needs.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Single Cell Analysis market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Single Cell Analysis Market, by Product Type

- Single Cell Analysis Market, by Technology

- Single Cell Analysis Market, by Application

- Single Cell Analysis Market, by End User

- Single Cell Analysis Market, by Region

- Single Cell Analysis Market, by Group

- Single Cell Analysis Market, by Country

- United States Single Cell Analysis Market

- China Single Cell Analysis Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Drawing Conclusions on Emerging Opportunities Challenges and Strategic Imperatives Shaping the Future Trajectory of Single-Cell Analysis Across Disciplines

The convergence of technological innovations, such as AI-driven analytics, multi-omics integration, and cloud-based infrastructure, is redefining the boundaries of single-cell research by enabling deeper, context-rich cellular insights. As these capabilities mature, they will unlock new therapeutic avenues and diagnostic applications, driving personalized medicine into mainstream practice.

The 2025 United States tariff landscape presents both challenges and opportunities: while supply chain disruptions and cost inflation may delay certain projects, they also incentivize the development of domestic manufacturing ecosystems and diversified sourcing strategies. Companies that adapt quickly by localizing production and optimizing workflows will secure a competitive edge.

Segmentation analysis reveals that growth will be propelled by high-volume consumables, innovative sequencing technologies, and an expanding suite of software solutions for data interpretation. Oncology and immunology will remain primary application areas, but emerging fields such as neurology and developmental biology offer significant untapped potential.

Leading market players are leveraging strategic partnerships and product innovations to expand their footprints, yet the influx of new entrants and disruptive start-ups underscores the need for continuous investment in R&D and talent development. Collaboration across academia, CROs, and industry will be critical to accelerate translational breakthroughs and ensure sustainable market expansion.

Ultimately, the single-cell analysis market stands at a pivotal juncture: stakeholders who embrace integrative technologies, fortify their supply chains, and cultivate expert teams will drive the next wave of discovery, transforming insights into impact across biomedical and clinical domains.

Connect with Ketan Rohom to Acquire the Definitive Single-Cell Analysis Market Research Report Unlocking Actionable Insights for Strategic Decision-Making

To explore how deep cellular insights can drive your strategic initiatives, reach out to Ketan Rohom, Associate Director, Sales & Marketing, to secure a comprehensive single-cell analysis market research report tailored to your needs. By partnering with Ketan, you’ll unlock in-depth expertise that enables data-driven decisions and accelerates innovation across your organization. Contact him today to access a definitive resource designed to inform your next breakthrough.

- How big is the Single Cell Analysis Market?

- What is the Single Cell Analysis Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?