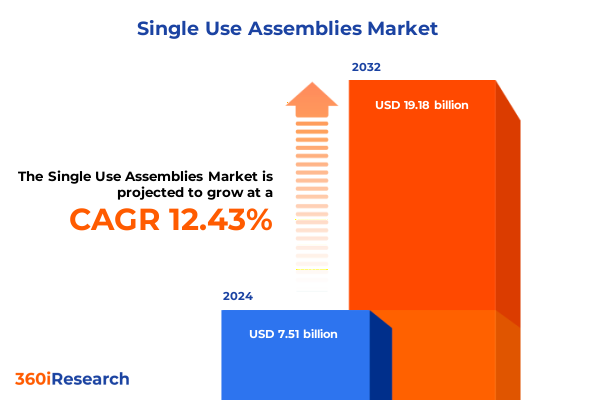

The Single Use Assemblies Market size was estimated at USD 8.39 billion in 2025 and expected to reach USD 9.39 billion in 2026, at a CAGR of 12.52% to reach USD 19.18 billion by 2032.

Overview of Single Use Assemblies in Bioprocessing Highlighting Market Drivers Transformations and Strategic Imperatives for Stakeholders

The Single Use Assemblies landscape has emerged as a pivotal component in modern bioprocessing operations, redefining the way biologics, vaccines, and advanced therapies are manufactured. By replacing traditional stainless steel systems with modular, disposable components, organizations gain unparalleled flexibility and efficiency. This shift toward single use technology aligns with broader industry imperatives to accelerate time-to-market, reduce the risk of cross-contamination, and optimize facility footprints. As research pipelines expand and product life cycles compress, the agility offered by single use assemblies becomes a critical strategic asset.

Initially adopted by niche research laboratories, single use assemblies have rapidly migrated into full-scale manufacturing environments, driven by robust adoption in upstream cell cultivation and downstream purification steps. The inherent advantages of reduced cleaning validation requirements and lower capital expenditure have catalyzed demand across both emerging biotechs and established pharmaceutical companies. Simultaneously, stringent regulatory guidelines around extractables and leachables have spurred innovation in polymer science, ensuring that single use assemblies meet rigorous safety and performance standards.

Looking ahead, industry stakeholders are poised to harness the scalability of single use assemblies in tandem with digital process control and advanced analytics. By integrating real-time monitoring and process analytical technology, manufacturers can further de-risk production and enable predictive maintenance across their facilities. Consequently, the strategic adoption of single use assemblies not only addresses current operational challenges but also lays the foundation for next-generation biomanufacturing paradigms.

Exploration of Key Technological and Process Shifts Reshaping Single Use Assembly Landscape to Drive Operational Efficiency and Innovation

Single use assemblies have undergone transformative advancements that are reshaping operational paradigms and elevating performance benchmarks in bioprocessing. One key shift is the integration of smart sensors and IoT connectivity, whereby assemblies now provide real-time data on fluid paths, pressure differentials, and integrity checks. This connectivity enhances process understanding, enabling more agile responses to variability and offering a seamless pathway toward continuous manufacturing.

Equally significant is the evolution of materials science, which has yielded next-generation polymers with enhanced inertness and reduced extractables and leachables. These advanced materials not only comply with increasingly stringent regulatory requirements but also extend the usable life of single use components. As regulatory agencies worldwide focus on stringent quality controls, these material innovations ensure that single use assemblies remain at the forefront of safe and reliable bioprocessing solutions.

Moreover, the convergence of automation platforms with single use systems has accelerated end-to-end process standardization, reducing human error and driving consistency across multiple scales. Process analytical technologies (PAT) and digital twins are increasingly paired with disposable assemblies to create closed, automated loops that optimize yield and minimize batch failures. This synergy between automation and single use design underscores a broader industry pivot toward lean, flexible production models.

Assessment of Continued United States Tariff Policies and Their Cumulative Impact on Single Use Assemblies Supply Chain Dynamics in 2025

In 2025, the United States maintained and, in some cases, expanded tariff measures on polymer resins critical to single use assemblies, which has had a cascading effect on cost structures and supply chain resilience. Tariffs on imported polyethylene and polyether sulfone resins led to an immediate uptick in raw material pricing, compelling manufacturers to reassess sourcing strategies. In response, many firms have pursued qualified alternative suppliers in tariff-exempt regions to mitigate cost pressures.

The cumulative impact of these tariff policies extends beyond material costs, as logistics and warehousing expenses have also risen due to longer lead times and increased customs processing. Some companies have responded by near-shoring production or vertically integrating resin compounding operations to regain control over critical inputs. While these strategies bolster supply security, they also necessitate capital investment and extended validation timelines, influencing project roadmaps and operational budgets.

Looking forward, the broader supply chain recalibration driven by tariff dynamics underscores the importance of strategic procurement and collaborative partnerships. Suppliers and end users alike are leveraging multi-tiered agreements and volume pooling arrangements to stabilize pricing and ensure continuity of supply. These collective efforts demonstrate a sector-wide commitment to sustaining single use assembly adoption despite evolving trade regulations.

Insightful Analysis of Single Use Assemblies Market Segmentation Across Product Workflows Applications and End User Verticals

An examination of product segmentation reveals that bag assemblies continue to serve as the backbone of single use solutions, providing versatile fluid management from seed train expansion to harvest clarification. Meanwhile, bottle assemblies have secured a niche role in small-scale bioprocessing and laboratory workflows, offering cost-effective containment for media preparation and buffer storage. Filtration assemblies, with their critical role in sterile clarification and virus removal, underscore the imperative for high-performance, single use membranes. At the same time, mixing system assemblies have become essential for precise reagent blending and formulation tasks where homogeneity and sterility are paramount.

When viewed through the lens of workflow segmentation, upstream processing commands significant attention, as single use assemblies streamline cell culture expansion and facilitate rapid scale-up. In downstream operations, fill-finish workflows benefit from disposable assemblies that minimize cross-contamination risks and reduce turnaround times between campaigns. Quality control and analytics functions increasingly integrate single use sampling systems to ensure aseptic testing without compromising process integrity, while ancillary single use devices support crucial buffer preparation and media dispensing steps.

The application segmentation highlights the growing prominence of aseptic filling in biopharmaceutical production, driven by the rise of personalized therapeutics and cell therapies. In parallel, cell culture applications leverage single use bioreactors and perfusion systems to achieve higher cell densities, and filtration modules play a pivotal role in both depth and tangential flow separations. Mixing assemblies support formulation finalization, purification steps rely on modular chromatographic platforms, and specialized sampling and storage devices preserve product quality throughout the manufacturing lifecycle.

End user segmentation illuminates differential adoption patterns across academia and research institutes, which often pilot single use concepts before large-scale deployment. Contract manufacturing organizations and contract research organizations are early adopters seeking to maximize facility utilization and shorten project lead times. At the same time, pharmaceutical and biotechnology companies integrate single use assemblies into mainstream production to drive cost efficiencies and meet complex regulatory demands.

This comprehensive research report categorizes the Single Use Assemblies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Workflow

- Application

- End User

Comprehensive Regional Perspectives Highlighting Growth Drivers and Challenges in Americas Europe Middle East Africa and Asia Pacific

In the Americas, the single use assemblies landscape is anchored by robust demand from leading biopharmaceutical clusters in the United States and Canada. Large-scale vaccine manufacturing capacity expansions and bioreactor upgrades have fueled investments in disposable systems, while the ongoing trend toward regional supply chain consolidation has bolstered distribution networks. As a result, North America remains a strategic hub for both innovation and production, with key players establishing localized support centers to deliver rapid technical assistance and service offerings.

Over in Europe, Middle East, and Africa, regulatory harmonization efforts and increasing harmonized GMP standards have driven broader single use assemblies acceptance. The European Union’s push for sustainable manufacturing aligns well with the reduced water and energy footprints offered by disposable systems. Meanwhile, emerging markets in the Middle East and Africa are scaling up capabilities for biomanufacturing, with government-backed initiatives incentivizing local production of vaccines and biologics. This regional diversity challenges suppliers to develop tailored solutions that address both regulatory compliance and infrastructure constraints.

In the Asia-Pacific region, rapid growth in domestic biopharmaceutical pipelines, particularly in China, India, and South Korea, has underpinned surging demand for single use assemblies. Manufacturers are partnering with local system integrators and contract developers to navigate unique market dynamics, including price sensitivity and local content requirements. At the same time, investments in biologics research institutes and translational medicine centers have galvanized demand for disposable technologies, enabling agile responses to emerging health threats and accelerating regional innovation.

This comprehensive research report examines key regions that drive the evolution of the Single Use Assemblies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Profile of Leading Single Use Assembly Providers Emphasizing Innovation Partnerships and Expansion Initiatives Worldwide

Leading providers of single use assemblies have intensified their focus on integrated solution portfolios that span fluid handling, monitoring, and control technologies. Sartorius Stedim Biotech and Thermo Fisher Scientific continue to expand their global manufacturing infrastructures, ensuring that high-value bag and mixing assembly products are available near major biomanufacturing hubs. At the same time, Cytiva, formerly part of a major life sciences conglomerate, has enhanced its filtration and chromatography systems through strategic acquisitions and joint ventures.

Innovation partnerships have emerged as a key theme, with suppliers collaborating closely with polymer manufacturers to co-develop materials that address extractables and leachables concerns. For example, select cartridge and filter module producers have entered alliances with advanced resin suppliers to introduce low-protein-binding membranes and bioinert tubing assemblies. These partnerships not only elevate performance standards but also provide a competitive differentiation in regulatory submissions.

Capacity expansion remains a strategic priority, as evidenced by recent investments in dedicated single use manufacturing campuses. Several firms have launched state-of-the-art facilities in Europe and North America, featuring ISO-7 cleanrooms and automated assembly lines. Such expansions enable just-in-time delivery models and reduce lead times, which are critical for high-mix, low-volume production runs.

Mergers and acquisitions have reshaped the competitive landscape, with larger life sciences conglomerates integrating niche single use specialists to broaden their offering scopes. Additionally, service-based models that include training, maintenance, and performance validation have gained traction, reflecting increasing customer demand for end-to-end support.

This comprehensive research report delivers an in-depth overview of the principal market players in the Single Use Assemblies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Accuflow Systems, Inc.

- AdvantaPure by NewAge Industries, Inc.

- Ami Polymer Pvt. Ltd.

- Antylia Scientific

- Avantor, Inc.

- avintos AG

- BioProcess Engineering Services Limited

- BioPulse Solutions Pvt. Ltd.

- Cellexus Limited

- Cobetter Filtration Group

- Colly Flowtech AB

- Compagnie de Saint-Gobain S.A.

- Corning Incorporated

- Danaher Corporation

- Distek, Inc.

- Dover Corporation

- DrM, Dr. Mueller AG

- DuPont de Nemours, Inc.

- DWK Life Sciences GmbH

- Entegris, Inc.

- Foxx Life Sciences

- GE HealthCare Technologies Inc.

- Getinge AB

- ILC Dover LP

- Intellitech, Inc.

- Keofitt A/S

- Liquidyne Process Technologies, Inc

- Lonza Group Ltd.

- Meissner Corporation

- Merck KGaA

- Owen Mumford Limited

- Parker-Hannifin Corporation

- Pharsol Ltd.

- Purity One

- Repligen Corporation

- Romynox B.V.

- SaniSure Inc.

- Sartorius AG

- Satake Multimix Corporation

- Single Use Support GmbH

- Thermo Fisher Scientific Inc.

- Trelleborg AB

- WHK BioSystems, LLC

Practical Strategic Imperatives and Actionable Roadmap for Industry Leaders to Capitalize on Opportunities in Single Use Assemblies Ecosystem

To effectively navigate the evolving single use assemblies ecosystem, industry leaders should prioritize strategic diversification of their supply chains. By qualifying multiple regional and global raw material sources, organizations can insulate themselves against geopolitical disruptions and tariff fluctuations. Entering into long-term, volume-based agreements and collaborative sourcing consortia will further strengthen procurement resilience.

In tandem, companies should accelerate co-innovation efforts by forging alliances with polymer scientists and automation experts. Joint research initiatives focusing on next-generation materials, sensor integration, and end-to-end digital workflows will position organizations at the vanguard of technological advancements. Such partnerships can also streamline regulatory filings by generating robust data sets that demonstrate material safety and performance.

Upholding rigorous quality and compliance standards remains non-negotiable. Establishing dedicated extractables and leachables testing protocols, coupled with comprehensive validation frameworks, will safeguard product integrity and expedite approval timelines. Embedding process analytical technology within single use assemblies further enhances real-time monitoring, reducing batch failures and compliance risks.

Finally, embracing circular economy principles and sustainability metrics will resonate with stakeholders and end users alike. Implementing take-back programs for used single use components, investing in recyclable polymer research, and quantifying lifecycle environmental impacts can amplify corporate social responsibility objectives. When combined with digital twin simulations for resource optimization, these measures unlock both ecological and economic value.

Rigorous Research Methodology Outlining Data Sources Analytical Techniques and Validation Processes Ensuring Comprehensive Market Intelligence

This research draws upon a rigorous blend of primary and secondary data sources to ensure holistic market intelligence. Primary research efforts included in-depth interviews with over seventy industry stakeholders, encompassing engineers, procurement managers, regulatory experts, and senior executives. These qualitative insights were synthesized with quantitative survey data obtained from leading biomanufacturing facilities across multiple regions, enabling robust cross-validation of key trends.

Secondary research comprised a thorough review of regulatory documents, peer-reviewed publications, patent filings, and white papers from recognized institutions. Company annual reports, technical brochures, and validated digital archives provided additional context on strategic initiatives and product roadmaps. Insights from trade associations and conference proceedings further enriched the analysis of emerging technologies and adoption patterns.

Data triangulation played a central role in this study, as findings from disparate sources were systematically reconciled to mitigate bias. Each thematic dimension underwent iterative validation through expert workshops and advisory board consultations, ensuring that interpretations align with real-world applications. The segmentation framework was meticulously mapped to industry standards, with categories refined through pilot testing and stakeholder feedback.

Finally, all data points and qualitative observations were subjected to rigorous quality checks and peer reviews. This comprehensive methodology underpins the reliability and depth of the presented insights, equipping decision makers with the confidence to chart strategic pathways in the single use assemblies domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Single Use Assemblies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Single Use Assemblies Market, by Product

- Single Use Assemblies Market, by Workflow

- Single Use Assemblies Market, by Application

- Single Use Assemblies Market, by End User

- Single Use Assemblies Market, by Region

- Single Use Assemblies Market, by Group

- Single Use Assemblies Market, by Country

- United States Single Use Assemblies Market

- China Single Use Assemblies Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Reflections on Single Use Assemblies Market Evolution Underscoring Strategic Insights and Future Trajectories for Decision Makers

In summary, single use assemblies have transcended their early niche applications to become indispensable enablers of agile and cost-effective bioprocessing. Technological advancements in materials, automation, and digital integration continue to expand the boundaries of what disposable systems can achieve. Meanwhile, strategic responses to evolving tariff environments and supply chain complexities underscore the sector’s resilience and adaptability.

Segmentation analysis highlights diverse adoption patterns across product types, workflows, applications, and end users, underscoring opportunities for targeted innovation. Regionally, each global market presents unique drivers-from North America’s advanced biomanufacturing infrastructure to Asia-Pacific’s rapid pipeline growth and EMEA’s regulatory alignment-calling for differentiated go-to-market approaches.

The competitive landscape is characterized by dynamic partnerships, capacity expansions, and M&A activity, signaling continued consolidation and value chain integration. Against this backdrop, actionable recommendations emphasize supply chain resilience, co-innovation, stringent compliance protocols, and sustainability imperatives as pillars of strategic success. By embracing these insights, industry participants can navigate emerging challenges and harness transformative opportunities.

Ultimately, this report equips decision makers with a comprehensive perspective on the single use assemblies ecosystem, laying a foundation for informed strategies that drive growth and operational excellence.

Engage with Ketan Rohom to Secure Your Comprehensive Single Use Assemblies Market Research Report Tailored to Strategic Business Needs

To access the full depth of insights, data, and strategic analyses presented in this report, please connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He will guide you through tailored solutions designed to support your organization’s decision-making around single use assemblies. By partnering with Ketan, you will unlock customized research deliverables, priority briefing sessions, and exclusive advisory support. Contact him today to secure your copy of the comprehensive Single Use Assemblies market research report and gain a competitive edge in bioprocessing.

- How big is the Single Use Assemblies Market?

- What is the Single Use Assemblies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?