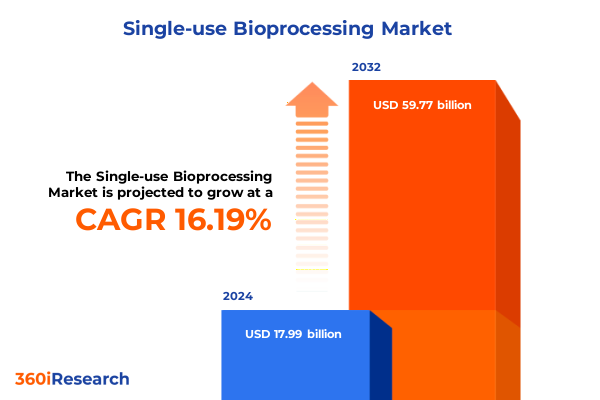

The Single-use Bioprocessing Market size was estimated at USD 20.81 billion in 2025 and expected to reach USD 24.11 billion in 2026, at a CAGR of 16.26% to reach USD 59.77 billion by 2032.

Innovative Single-Use Bioprocessing Solutions Catalyzing Efficiency and Flexibility in Modern Biomanufacturing Environments

The accelerating move toward single-use technologies has become a defining feature of contemporary biomanufacturing, driven by a need for enhanced process flexibility, reduced contamination risk, and accelerated time to market. Historically, stainless steel systems formed the backbone of large-scale production, but pressure to accommodate smaller batches, personalized treatments, and rapid process changeovers has elevated the appeal of disposable systems. By eliminating the extensive cleaning and sterilization steps inherent in fixed equipment, single-use solutions facilitate shorter turnaround cycles. Coupled with stringent regulatory expectations for traceability and contamination control, these attributes are making single-use platforms integral to biologics, cell and gene therapies, and vaccine production.

Beyond operational efficiencies, the adoption of disposable systems addresses growing sustainability concerns. While environmental debates around plastic waste persist, advancements in material science are yielding recyclable and bio-circular polymers tailored to single-use applications. Leading manufacturers are collaborating with waste management and recycling specialists to develop end-of-life stewardship programs that divert used assemblies from landfills. In parallel, digital process monitoring tools are increasingly embedded within disposable sensor suites, generating real-time analytics that enable proactive process adjustments and enhance batch consistency.

As biopharmaceutical pipelines expand in complexity and volume, the integration of single-use components into modular processing trains empowers companies of all sizes to capitalize on emerging opportunities. Such agility fosters innovation, enabling rapid scale-up from early-stage development to commercial manufacturing without significant capital expenditure. Consequently, a growing share of industry investment is directed toward scaling out distributed networks of flexible facilities, heralding a new era in bioprocess design and execution.

Moreover, cost pressures within the industry are reshaping capital deployment strategies. The reduced upfront investment associated with single-use systems compared to traditional stainless steel assets frees up resources for R&D and capacity expansions in burgeoning therapeutic segments. This financial flexibility is crucial for small and mid-sized companies navigating competitive landscapes and aiming to fast-track first-in-human studies. Meanwhile, established biopharma firms are leveraging single-use solutions to consolidate multi-product facilities, enhancing facility utilization rates. Together, these economic dynamics underscore the pivotal role of disposable bioprocessing in driving both innovation and financial prudence across the sector.

Evolving Paradigms in Bioprocessing Reflecting a Shift from Traditional Stainless Steel to Single-Use Technologies and Integrated Platforms

In recent years, the bioprocessing industry has witnessed a transformative shift away from traditional fixed stainless steel infrastructure toward modular, disposable platforms that accelerate process development and commercialization. This paradigm shift has been fueled by mounting therapeutic demands, particularly in cell and gene therapies, where smaller batch volumes and heightened sterility requirements necessitate flexible processing trains. As a result, single-use technologies have matured from niche adoption to mainstream deployment, supported by robust standards for extractables and leachables testing as well as enhanced regulatory guidance for validation of disposable assemblies.

Concurrent advances in digital integration have further revolutionized disposable bioprocessing. Smart sensors and inline analytics now feed into centralized data management systems, enabling real-time monitoring of critical process parameters and predictive quality control. This confluence of digital and single-use innovations is paving the way for fully automated, end-to-end biomanufacturing facilities that can be rapidly repurposed for different products, whether monoclonal antibodies, viral vectors, or recombinant proteins.

Moreover, strategic partnerships between polymer developers, equipment OEMs, and contract manufacturers have yielded next-generation materials engineered for higher temperature thresholds, improved gas permeability control, and lower risk of particulate generation. These material improvements not only extend the applicability of single-use components to more demanding upstream and downstream operations but also reinforce confidence among large biopharma players reluctant to migrate away from legacy stainless infrastructure.

Taken together, these developments are redefining process economics and facility design. Modular, single-use processing trains equipped with integrated analytics are now recognized as critical enablers of biomanufacturing agility, allowing organizations to respond nimbly to market shifts, supply chain disruptions, and evolving therapeutic pipelines.

Impact of Recent US Tariff Policies Redefining Trade Flow Structures in Single-Use Bioprocessing Supply Chains and Import Dynamics Through 2025

The introduction of new tariff policies in the United States during early 2025 has exerted significant influence on the supply chains underpinning single-use bioprocessing. Components such as polymer films for bags, disposable sensors, and specialized tubing encounter elevated import duties, prompting manufacturers to reassess sourcing strategies. These additional costs have strained margins for companies relying on global suppliers, particularly those importing raw materials from regions affected by Section 301 measures.

In response, many organizations are accelerating their diversification efforts, establishing dual-sourcing agreements and exploring local manufacturing options for critical components. Contract manufacturers are investing in domestic capacity expansions to serve as contingency production hubs, while OEMs are entering joint ventures with polymer producers to mitigate exposure to cross-border tariff volatility. These shifts have also catalyzed a renewed focus on nearshoring, as reduced logistical complexity and improved lead-time predictability become paramount for mission-critical biologics and vaccine programs.

At the same time, downstream partners and end users are renegotiating long-term supply contracts to incorporate tariff escalation clauses and pass-through mechanisms that balance risk among suppliers and buyers. Regulatory bodies have offered limited relief through temporary exclusions for certain medical-grade polymers, though these measures remain under periodic review. Consequently, forward-looking organizations are building comprehensive duty management frameworks that combine tariff classification optimization, bonded warehousing, and enhanced customs compliance.

Collectively, these adaptive strategies are reshaping trade flows within the single-use ecosystem. By embracing a more resilient approach to sourcing and logistics, industry stakeholders can safeguard continuous production and maintain competitive positioning despite evolving policy landscapes through 2025 and beyond.

Deep Dive into Product Workflow Stage Application and End User Segmentation Revealing Critical Drivers in the Single-Use Bioprocessing Sector

A nuanced exploration of the single-use bioprocessing market reveals distinct segments that each contribute unique dynamics to industry growth. When viewed through the lens of product type, the landscape encompasses comprehensive apparatus and plants, simple and peripheral elements, as well as work equipment. The highest capital intensity resides in apparatus and plants, which include bioreactors, chromatography systems, filtration systems, mixing, storage, and filling systems, along with pumps. Within this group, bioreactors represent a critical focal point, subdivided into capacity tiers up to 1,000 liters, 1,001 to 2,000 liters, and above 2,000 liters, each tier aligned with specific process scales and therapeutic modalities. In parallel, simple and peripheral elements cover disposable bags, probes and sensors, sampling systems, and tubing, filters, connectors, and transfer systems, where probes and sensors themselves span conductivity, flow, oxygen, pH, pressure, and temperature monitoring devices. Work equipment further completes this product classification, featuring cell culture systems and syringes designed for sterile handling and precise dosing of biologics.

Moving along the workflow continuum, upstream and downstream process stages capture distinct investment and technology focus areas. Upstream processing concentrates on cell expansion and bioreactor operation, while downstream processing addresses separation and purification. Quality control and analytics underpin every phase, with advanced instrumentation ensuring product integrity, and fill-finish operations finalize aseptic product containment.

Application-based segmentation highlights aseptic filling, cell culture, filtration, mixing, purification, sampling, and storage, each application bearing discrete performance criteria and regulatory considerations. Aseptic filling and sampling demand the highest sterility assurance, whereas mixing and purification processes prioritize control over shear stress and residence time. Storage meanwhile emphasizes material compatibility and stability under cryogenic and controlled-temperature conditions.

End users span academic and research institutes, contract manufacturing and research organizations, as well as pharmaceutical and biotechnology companies, each bringing varied purchasing behaviors and technical requirements. Research institutions often pilot novel single-use configurations, CMOs and CROs seek standardized, high-throughput solutions, and pharma and biotech producers prioritize scale, consistency, and compliance in their advanced manufacturing networks.

This comprehensive research report categorizes the Single-use Bioprocessing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Workflow Stage

- Bioprocess Mode

- Single-use Subassemblies

- Manufacturing Processes

- Application

- End User

Regional Trends Across Americas Europe Middle East Africa and Asia Pacific Highlighting Distinct Growth Patterns and Market Drivers

Across the Americas, the maturity of the biopharmaceutical industry has positioned the region as a key adopter of single-use bioprocessing technologies. Hubbed by centers of excellence in North America and significant contract manufacturing capacity in Latin America, stakeholders benefit from streamlined regulatory pathways and established logistics infrastructure. Advances in personalized medicine and immune-oncology programs have further fueled demand for flexible, disposable systems that can accommodate small batch sizes and rapid process changes.

In Europe, Middle East, and Africa, regulatory harmonization initiatives and substantial public–private investments in biomanufacturing capacity are driving increased uptake of single-use equipment. The European Union’s emphasis on modular facilities and digitalization has encouraged pilot projects that integrate smart sensors with disposable assemblies. In the Middle East, national life science strategies are fostering collaborations between local research institutions and global suppliers to build regional manufacturing hubs. Across Africa, nascent vaccine manufacturing initiatives are seizing single-use platforms to leapfrog traditional infrastructure constraints, enabling expedited responses to public health challenges.

Asia-Pacific stands out for its aggressive capacity expansions and cost-competitive production ecosystems. Countries like China, India, and South Korea are scaling domestic single-use component manufacturing, supported by government incentives and technology transfer partnerships. Japan remains at the forefront of quality control instrumentation for disposable systems, while Australia and Singapore are leveraging advanced digital frameworks to monitor and optimize single-use processes in real time. This regional mosaic underscores a shared imperative: balancing speed, cost, and regulatory compliance to serve both local and export markets.

Ultimately, each region’s distinct regulatory landscapes, investment climates, and therapeutic priorities converge to shape a global market that is increasingly interconnected. Stakeholders must navigate these diverse dynamics to develop resilient supply chains and align technology deployment with regional growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Single-use Bioprocessing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiles of Leading Innovators Strategic Partnerships and Technological Advancements Shaping the Future of Single-Use Bioprocessing Solutions

Key players within the single-use bioprocessing arena are continually advancing their portfolios through strategic alliances, acquisitions, and in-house innovation. Leading equipment manufacturers have focused on expanding their single-use bioreactor lines, integrating advanced sensor packages, and offering comprehensive automation capabilities that reduce operator intervention. By embedding digital twins and machine learning algorithms into process control suites, these innovators are enabling predictive maintenance and real-time process optimization.

At the same time, specialty polymer suppliers are collaborating with OEMs to co-develop high-performance films and thermoplastics that withstand the rigorous demands of both upstream and downstream applications. These partnerships address emerging needs for higher integrity under extended storage, enhanced barrier properties against gas exchange, and lower extractables profiles to ensure pharmaceutical purity.

Contract manufacturing organizations and research entities are also playing an influential role, leveraging their multi-client facilities to pilot next-generation single-use configurations. By offering flexible, rate-based service models, they accelerate the commercialization pathways for novel biologics, from early-stage proof-of-concept to full-scale production. Their feedback loops contribute critical user insights into component reliability, cleaning validation simplifications, and process transfer efficiencies.

Collectively, these strategic moves are setting industry benchmarks for performance, quality, and adaptability. As the competitive landscape evolves, stakeholders that effectively bridge material science innovations, digital transformation, and service-based delivery models will maintain a leadership edge in orchestrating agile, cost-effective biomanufacturing frameworks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Single-use Bioprocessing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AdvantaPure by NewAge Industries

- Agilitech

- Aseptic Group

- Avantor, Inc.

- Bionet Servicios Técnicos SL

- BioPharma Dynamics Ltd.

- CellBios Healthcare & Lifesciences Pvt. Ltd.

- Compagnie de Saint-Gobain

- Corning Incorporated

- Cytiva by Danaher Corporation

- Entegris, Inc.

- Eppendorf SE

- Foxx Life Sciences

- Freudenberg Group

- Getinge AB

- Kuehne + Nagel International AG

- Lonza Group AG Ltd.

- Meissner Corporation

- Merck KGaA

- Mettler-Toledo International Inc.

- Parker-Hannifin Corporation

- PBS Biotech, Inc.

- PharmNXT Biotech

- PSG Dover by Dover Corporation

- Repligen Corporation

- SaniSure

- Sartorius AG

- Satake Multimix Corporation

- Single Use Support GmbH

- Tekni-Plex, Inc.

- Thermo Fisher Scientific Inc.

- Watson-Marlow Fluid Technology Solutions by Spirax Group PLC

Actionable Strategies for Industry Leaders to Enhance Single-Use Bioprocessing Operations Collaboration and Sustainable Growth

To navigate the rapidly shifting single-use bioprocessing landscape, industry leaders must prioritize a set of actionable strategies that reinforce operational resilience and foster sustainable growth. First, investing in collaborative supply ecosystems by forming joint ventures with polymer producers and local manufacturers can alleviate tariff pressures and mitigate geopolitical risks. These partnerships should include technology transfer components and clauses that ensure consistent quality standards across all manufacturing sites.

Next, deploying integrated digital platforms that unify data from disposable sensors, quality control analytics, and facility automation systems will enhance process visibility. Stakeholders should adopt standardized communication protocols and invest in scalable cloud-based architectures to facilitate cross-site benchmarking and predictive maintenance. Such digital infrastructure not only drives cost efficiencies but also supports compliance with evolving regulatory frameworks.

In parallel, organizations should engage in proactive lifecycle management of single-use components by establishing standardized validation templates and end-of-life recycling programs. Collaborating with academic and recycling partners to develop sustainable disposal pathways can reinforce corporate environmental responsibility and bolster stakeholder trust.

Finally, forging strategic alliances with contract research and manufacturing organizations to co-develop proof-of-concept projects in emerging therapeutic modalities will accelerate time to clinic. By aligning commercial roadmaps early with service providers, companies can de-risk scale-up activities and capture first-mover advantages in cell and gene therapies. Through these integrated measures, industry leaders will strengthen agility, minimize supply chain disruptions, and position their operations for long-term competitive success.

Robust Research Framework Emphasizing Comprehensive Data Collection Analysis and Validation Practices in Single-Use Bioprocessing Studies

The methodology underpinning this analysis is anchored in a multi-tiered research framework designed to ensure both breadth and depth of insight generation. It commences with exhaustive secondary research, drawing from peer-reviewed journals, regulatory filings, patent databases, and technology white papers, to establish baseline understanding of material innovations, regulatory developments, and market structure.

Primary research follows, involving structured interviews with industry experts, including bioprocess engineers, regulatory affairs specialists, polymer scientists, and procurement executives. These dialogues probe current adoption barriers, component performance metrics, and strategic sourcing approaches. Interview data is triangulated with supply chain mappings and company disclosures to validate emerging trends and identify potential inflection points.

Quantitative data modeling is then applied to segment analysis, profiling unit volumes across apparatus and plants, simple and peripheral elements, work equipment, workflow stages, applications, and end users. While precise market sizing is outside the scope of this narrative, relative growth drivers and adoption rates are inferred to reveal the most dynamic subsegments.

Finally, the findings undergo expert review by an advisory panel comprising biomanufacturing veterans and regulatory consultants. This validation step ensures that insights accurately reflect on-the-ground realities and align with evolving industry best practices. The integrated approach delivers a robust, reliable portrait of the single-use bioprocessing ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Single-use Bioprocessing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Single-use Bioprocessing Market, by Offering

- Single-use Bioprocessing Market, by Workflow Stage

- Single-use Bioprocessing Market, by Bioprocess Mode

- Single-use Bioprocessing Market, by Single-use Subassemblies

- Single-use Bioprocessing Market, by Manufacturing Processes

- Single-use Bioprocessing Market, by Application

- Single-use Bioprocessing Market, by End User

- Single-use Bioprocessing Market, by Region

- Single-use Bioprocessing Market, by Group

- Single-use Bioprocessing Market, by Country

- United States Single-use Bioprocessing Market

- China Single-use Bioprocessing Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Consolidated Insights Illustrating the Pivotal Role of Single-Use Bioprocessing in Driving Agility Innovation and Competitive Advantage

The convergence of modular equipment design, digital integration, and strategic partnerships has cemented single-use bioprocessing as a cornerstone of agile biomanufacturing. By enabling rapid process transfers and minimizing capital outlays, disposable systems empower organizations to respond swiftly to clinical feedback and evolving patient needs. The ability to scale out production networks through standardized, interchangeable assemblies has also enhanced supply chain resilience, reducing dependency on large, monolithic facilities.

Furthermore, ongoing material science advancements are expanding the operational envelope of single-use components, making them suitable for high-temperature sterilization, increased pressure tolerance, and extended-duration campaigns. These improvements mitigate historical concerns around extractables and leachables, thereby elevating confidence in disposable platforms for both upstream cultures and downstream purification processes.

Regional dynamics underscore the critical role of local policy environments and investment climates in shaping technology adoption. While the Americas lead in early implementation and innovation, Europe, Middle East, Africa, and Asia-Pacific are quickly closing gaps through targeted capacity expansions and regulatory streamlining. Collectively, these forces point toward a global ecosystem in which single-use bioprocessing facilitates not only operational efficiency but also strategic differentiation.

As biopharmaceutical pipelines diversify to include advanced therapies, vaccines, and biosimilars, the imperative for flexible, robust, and sustainable manufacturing solutions will only intensify. Single-use technologies are uniquely positioned to meet these demands, delivering a competitive advantage to those organizations that embrace their full potential.

Secure a Customized Single-Use Bioprocessing Market Research Report by Connecting Directly with Ketan Rohom Associate Director Sales and Marketing

To gain access to an in-depth market research report tailored to your organization’s unique needs, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engaging directly with Ketan will provide personalized guidance on how the report’s comprehensive insights can address your strategic objectives, from optimizing supply chain resilience to capitalizing on emerging opportunities in single-use bioprocessing. By partnering with him, you ensure timely delivery of the research, expert walkthroughs of key findings, and bespoke recommendations aligned with your operational priorities. Take the next step toward informed decision-making by contacting Ketan Rohom today and secure the competitive intelligence necessary to drive growth and innovation within your biomanufacturing programs

- How big is the Single-use Bioprocessing Market?

- What is the Single-use Bioprocessing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?