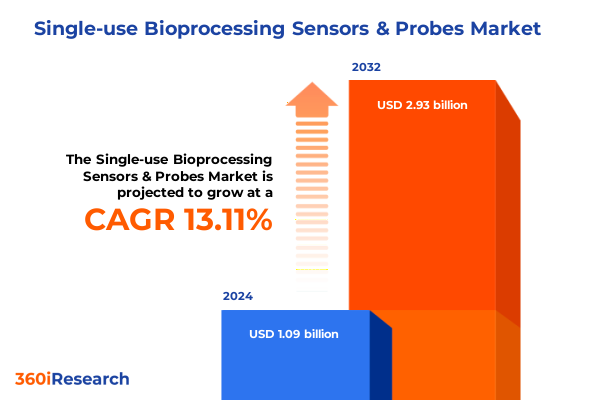

The Single-use Bioprocessing Sensors & Probes Market size was estimated at USD 1.23 billion in 2025 and expected to reach USD 1.38 billion in 2026, at a CAGR of 13.21% to reach USD 2.93 billion by 2032.

An In-Depth Overview of How Single-Use Bioprocessing Sensors and Probes Are Redefining Biomanufacturing Efficiency and Reliability

The global single-use bioprocessing probes and sensors industry has emerged as a vital enabler of modern biologics manufacturing, reaching an estimated market valuation of USD 3.3 billion in 2024 according to leading bioprocessing analytics firms. As biopharmaceutical producers shift away from traditional stainless-steel instrumentation toward disposable monitoring solutions, this sector has demonstrated consistent expansion with double-digit annual growth rates. Probes and sensors are now integral to upstream and downstream workflows, offering critical parameter measurements that underpin real-time process monitoring and automation in cell culture, fermentation, filtration, and purification systems

Advancements in single-use technologies have been reinforced by regulatory initiatives that promote innovative manufacturing approaches. The U.S. Food and Drug Administration’s Advanced Manufacturing Technologies Designation Program encourages early adoption of novel sensor integration strategies that enhance process robustness, reduce development timelines, and support continuous bioprocessing efforts

Consequently, single-use probes and sensors are now pivotal for achieving higher microbial and cell-culture productivity, minimizing cross-contamination risk, and streamlining validation cycles. This introduction sets the stage for a detailed examination of the transformative dynamics, policy influences, segmentation drivers, and actionable strategies shaping this rapidly evolving market landscape.

Emerging Technological Breakthroughs and Operational Innovations That Are Propelling The Next Wave of Single-Use Sensor Integration in Bioprocessing

Recent innovations have ushered in a new era of precision and versatility for disposable bioprocessing sensors. Thin-film electrochemical electrodes and compact fluorescence-based optical probes now integrate seamlessly into single-use bioreactors, enabling multi-parameter monitoring that was once confined to stainless-steel systems. Fiber-optic measurement techniques and spectroscopic platforms have further expanded the analytical capabilities available within closed-aseptic processes, allowing biomanufacturers to capture biomass, pH, dissolved oxygen, conductivity, pressure, and temperature in real time.

Simultaneously, process intensification trends-characterized by modular, continuous manufacturing lines-have elevated the demand for miniaturized and robust sensor architectures. Piezoelectric flow sensors and rapid-response conductivity modules ensure consistent feed rates and media composition, while advanced optical fiber bundles provide nonintrusive measurements that maintain sterility and eliminate calibration drifts under gamma irradiation. These technological breakthroughs have redefined quality-by-design frameworks, granting bioprocess engineers unprecedented control and visibility across upstream and downstream operations.

Operationally, manufacturers are harnessing predictive analytics and digital twins powered by real-time sensor feeds. By embedding spectroscopic and optical sensor outputs into digital process models, firms can simulate scale-up scenarios, optimize harvest timings, and predict equipment maintenance needs, thereby boosting throughput and reducing operational costs. This confluence of sensor technology advancements and data-driven process management is transforming bioprocessing into a more agile, resilient, and economically sustainable discipline.

Assessing the Ripple Effects of 2025 U.S. Trade Measures on Single-Use Bioprocessing Sensor Cost Structures and Supply Chain Resilience

The introduction of comprehensive U.S. tariffs on sensor components and critical raw materials in 2025 has reshaped cost structures and supply chain strategies in the single-use bioprocessing sensor sector. Under new Section 232 inquiries into pharmaceutical and semiconductor imports, manufacturers of disposable probes and sensors now face the risk of elevated duties on glass, polymer resins, specialized coatings, and electronic subassemblies-elements essential to pH, oxygen, conductivity, and fiber-optic sensing modules.

Leading life-science equipment providers, such as Danaher, have forecast incremental tariff-related expenses exceeding USD 350 million in 2025. To counterbalance these headwinds, companies are deploying cost-mitigation measures, including supply chain reengineering, dual-sourcing agreements, and targeted regionalization of manufacturing footprints in North America. Regional production investments in new single-use technology facilities and resin plants have emerged as a key defensive response to tariff volatility, shortening lead times and preserving competitive margins.

Despite these near-term challenges, the sector has embraced tariff-driven redesigns that emphasize leaner sensor architectures and tariff engineering. By reevaluating bill-of-materials and qualifying components under preferential trade classifications, suppliers are refining assembly processes to maintain price stability for end users. Collaborative partnerships among suppliers, contract manufacturers, and logistics providers have become crucial to sustaining continuity, underscoring the industry’s adaptability in the face of fluctuating trade policy dynamics.

Dissecting Multiple Segmentation Dimensions to Reveal Critical Demand Drivers and Niche Opportunities in Single-Use Bioprocessing Sensors

The demand for single-use bioprocessing sensors and probes is underpinned by a nuanced set of segmentation dimensions that illuminate both high-volume necessities and specialized niche requirements. When considering product type, pH sensors have historically accounted for the bulk of market deployments due to their centrality in cell culture monitoring, while oxygen sensors and pressure probes serve critical roles in aerobic fermentation and filtration control. Conductivity and temperature sensing modules have likewise gained traction for media conditioning and heat-exchange oversight, and biomass and flow sensors are increasingly integrated within upstream process intensification strategies.

Sensor technology segmentation reveals clear preferences for electrochemical platforms in applications demanding rapid response and cost efficiency; fiber-optic and optical sensors for remote, noninvasive measurements; piezoelectric modules for accurate flow and pressure determinations; and spectroscopic sensors where multi-parameter, inline analytics are paramount. These technology choices are further influenced by material type, with glass offering inert, high-fidelity interfaces; metal enabling rugged, high-pressure constructs; and advanced plastics delivering lightweight, gamma-stable alternatives suited to disposable formats.

From the perspective of measurement modality, biological probes-capable of detecting specific biomolecules-are carving out new roles in PAT-driven workflows, whereas chemical sensors focus on ionic strength and pH balance, and physical sensors address parameters such as temperature and pressure. Workflow applications span both upstream and downstream domains: in upstream cell culture and fermentation control, sensors enable immediate adjustments to bioreactor conditions, while in downstream operations, they oversee filtration control and purification monitoring to ensure product integrity and yield. Finally, end-user segmentation highlights pronounced adoption by pharmaceutical and biotechnology companies, growing utilization among academic and research institutes, and a rising trend of outsourcing to contract research organizations seeking turnkey, aseptic monitoring solutions.

This comprehensive research report categorizes the Single-use Bioprocessing Sensors & Probes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Sensor Technology

- Material Type

- Measurement Type

- Application

- End User

Uncovering How Key Geographies—Americas Europe Middle East & Africa and Asia-Pacific Are Shaping Adoption Patterns and Growth Trajectories for Single-Use Sensors

Regional dynamics exert a significant influence on the adoption patterns and technological priorities of single-use bioprocessing sensors and probes. In the Americas, the confluence of a mature biopharmaceutical industry, extensive single-use manufacturing infrastructure, and strong regulatory incentives has fostered early adoption of advanced sensor architectures and digital integration frameworks. U.S. manufacturers are pioneering regional manufacturing hubs to mitigate tariff impacts and optimize supply chain resilience, further propelling sensor proliferation across both upstream and downstream workflows.

Within Europe, the Middle East, and Africa, divergent market maturity levels have led to a dual-track landscape: Western European bioprocessing centers emphasize sustainability, focusing on recyclable plastic sensor alternatives and energy-efficient optical designs, while emerging markets in Eastern Europe, the Gulf region, and Africa demonstrate rapid uptake of cost-effective electrochemical probes for fermentation and cell culture applications.

In Asia-Pacific, the fastest-growing market segment is driven by capacity expansions in China, India, South Korea, and Southeast Asia, where large-scale biosimilar and vaccine production projects are integrating single-use sensor solutions at green-field facilities. Government incentives to localize production, combined with competitive labor and material costs, are accelerating regional sensor manufacturing and customization, making Asia-Pacific a hotbed for new product launches and collaborative innovation partnerships.

This comprehensive research report examines key regions that drive the evolution of the Single-use Bioprocessing Sensors & Probes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovation Portfolios of Leading Manufacturers Powering the Single-Use Bioprocessing Sensor Ecosystem

Leading corporations are shaping the single-use bioprocessing sensor landscape through strategic product innovations, targeted facility investments, and collaborative partnerships. Thermo Fisher Scientific leverages its global footprint and regulatory expertise to deliver integrated sensor-bioreactor platforms that streamline process qualification, while Sartorius AG has focused on modular, disposable sensor cartridges that simplify installation and validation in downstream purification systems.

Danaher Corporation continues to expand its bioprocessing portfolio with localized manufacturing investments in North America, establishing dedicated single-use facility expansions in South Carolina and resin plants in Michigan to neutralize tariff exposures. Danaher’s multi-brand approach-encompassing Cytiva’s optical sensors and Pall Corporation’s flow modules-enables cross-technical synergies and value-added service offerings.

Innovative players such as PreSens Precision Sensing GmbH are advancing optical sensor integration with Luer Lock adapters for continuous cell culture monitoring, while emerging specialists are pioneering fiber-optic pH sensing films and spectroscopic biomass probes that reduce calibration intervals and enhance inline analytics. Across the ecosystem, established companies and agile startups are pursuing partnerships with contract development and manufacturing organizations to deliver turnkey, consumable sensor solutions that align with evolving single-use bioprocessing paradigms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Single-use Bioprocessing Sensors & Probes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ABEC Inc.

- Avantor, Inc.

- Broadley-James Corporation

- Compagnie de Saint-Gobain S.A.

- Cytiva by Danaher Corporation

- Emerson Electric Co.

- Eppendorf SE

- ESCO BIOENGINEERING CO., LTD

- ESI Technologies Group by Keysight Technologies

- GE HealthCare Technologies Inc.

- Getinge AB

- Hamilton Bonaduz AG

- Honeywell International, Inc.

- Infors AG

- Meissner Filtration Products, Inc.

- Merck KGaA

- Parker-Hannifin Corporation

- PBS Biotech, Inc.

- PendoTECH

- Polestar Technologies, Inc.

- Sartorius AG

- SmarAct GmbH

- Thermo Fisher Scientific Inc.

- Vekamaf Services B.V.

Strategic Imperatives and Tactical Recommendations for Industry Leaders to Drive Competitive Advantage in Single-Use Sensor Development and Deployment

To capitalize on evolving market dynamics, industry leaders should adopt a three-pronged strategic imperative: first, pursue agile sensor design that minimizes dependency on tariff-sensitive components by standardizing on modular, interchangeable subassemblies. Engineering teams can reconfigure product architectures to leverage tariff-exempt materials and local supply sources, ensuring pricing stability and rapid scalability.

Second, invest in digital integration and data-driven process analytics. Embedding spectroscopic, optical, and electrochemical sensor outputs into cloud-based process control platforms will unlock predictive maintenance, model-based scale-up, and real-time quality assurance. Cross-functional teams must collaborate with process engineers to establish digital twins that drive continuous improvement across upstream and downstream workflows.

Finally, foster collaborative manufacturing networks with contract research and manufacturing organizations, prioritizing regional partnerships that enhance supply chain resilience. Co-development initiatives can shorten development timelines, reduce capital outlays for green-field facilities, and accelerate product customizations tailored to localized regulatory and operational requirements. By aligning R&D roadmaps, procurement strategies, and service models, companies will solidify competitive positions and sustain growth amid geopolitical and trade uncertainties.

Detailing the Robust Research Framework and Analytical Techniques Utilized to Generate Actionable Insights on Single-Use Bioprocessing Sensors

This report’s insights and analyses are grounded in a rigorous, multi-method research framework. Extensive primary interviews were conducted with senior executives, process engineers, and procurement specialists at leading pharmaceutical, biotechnology, and contract manufacturing organizations to capture firsthand perspectives on sensor performance requirements, procurement challenges, and emerging application trends.

Secondary research encompassed a systematic review of regulatory guidance-including FDA’s Advanced Manufacturing Technologies Designation Program documentation and patent filings for novel sensor designs-peer-reviewed publications in bioprocessing and analytical chemistry journals, and competitive intelligence sourced from public financial filings, press releases, and industry conferences.

Quantitative data validation employed triangulation across multiple datasets, reconciling production capacity projections, consumable penetration rates, and trade statistics to refine segmentation analyses. Additionally, a proprietary survey of bioprocessing professionals provided supplemental benchmarking on sensor adoption rates, end-user satisfaction metrics, and pricing dynamics across global regions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Single-use Bioprocessing Sensors & Probes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Single-use Bioprocessing Sensors & Probes Market, by Product Type

- Single-use Bioprocessing Sensors & Probes Market, by Sensor Technology

- Single-use Bioprocessing Sensors & Probes Market, by Material Type

- Single-use Bioprocessing Sensors & Probes Market, by Measurement Type

- Single-use Bioprocessing Sensors & Probes Market, by Application

- Single-use Bioprocessing Sensors & Probes Market, by End User

- Single-use Bioprocessing Sensors & Probes Market, by Region

- Single-use Bioprocessing Sensors & Probes Market, by Group

- Single-use Bioprocessing Sensors & Probes Market, by Country

- United States Single-use Bioprocessing Sensors & Probes Market

- China Single-use Bioprocessing Sensors & Probes Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Reflections on Current Market Dynamics and Future Trajectories for the Single-Use Bioprocessing Sensor Industry Landscape

The single-use bioprocessing sensor and probe market stands at a pivotal juncture, shaped by accelerating technology innovation, evolving regulatory imperatives, and shifting trade policies. As bioprocessors increasingly embrace modular, disposable workflows, the demand for real-time, multi-parameter measurement solutions will intensify, driving further R&D in advanced materials, digital integration, and sustainable design.

While U.S. tariffs and global supply chain uncertainties present near-term cost pressures, they also catalyze opportunities for reshoring, material substitution, and tariff-engineering innovations that strengthen domestic manufacturing capabilities. Concurrently, Asia-Pacific expansion and EMEA sustainability efforts will diversify regional growth vectors, underscoring the importance of tailored strategies that align with local market drivers.

Ultimately, companies that blend engineering agility, data-centric process management, and collaborative manufacturing partnerships will secure leadership positions in this dynamic landscape. This conclusion synthesizes the critical insights and trends discussed throughout the report, reaffirming that strategic foresight and operational adaptability remain the foundations of success in single-use bioprocessing sensor deployment.

Engage to Acquire the Comprehensive Single-Use Bioprocessing Sensor Market Research Report with Associate Director Ketan Rohom for Tailored Strategic Insights

To explore the full breadth of insights, data, and strategic analysis captured in the comprehensive report on single-use bioprocessing sensors and probes, engage to acquire the report directly through Associate Director, Sales & Marketing, Ketan Rohom. His deep expertise and dedicated support will ensure that you receive tailored guidance, customized data excerpts, and a seamless purchasing experience. Reach out to Ketan Rohom for a personalized consultation on how this research can drive your strategic initiatives and operational excellence in bioprocessing.

- How big is the Single-use Bioprocessing Sensors & Probes Market?

- What is the Single-use Bioprocessing Sensors & Probes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?