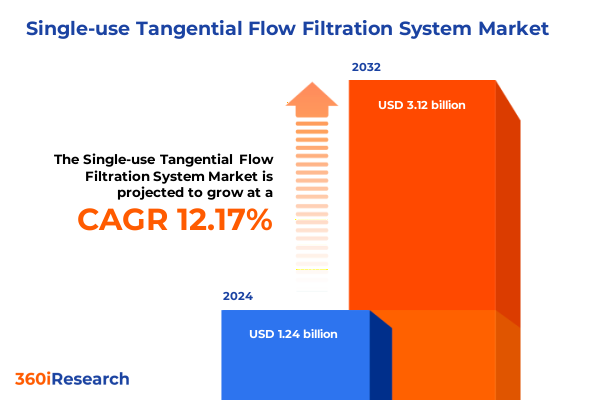

The Single-use Tangential Flow Filtration System Market size was estimated at USD 1.39 billion in 2025 and expected to reach USD 1.56 billion in 2026, at a CAGR of 12.25% to reach USD 3.12 billion by 2032.

Understanding the Rise and Strategic Importance of Single-Use Tangential Flow Filtration Systems in Modern Bioprocessing and Beyond

Single-use tangential flow filtration systems have emerged as transformative tools in modern bioprocessing, delivering both operational efficiency and contamination control in ways that traditional stainless-steel assemblies cannot match. By eliminating the need for extensive cleaning and sterilization, these disposable modules accelerate time to result and reduce cross-contamination risk, making them especially attractive to organizations prioritizing rapid process turnover and stringent quality standards. Moreover, the modular architecture of single-use systems provides the flexibility to scale quickly from early-stage development through commercial production without substantial capital expenditures, enabling organizations to respond agilely to evolving project demands.

In recent years, the adoption of single-use tangential flow filtration has been further driven by growing interest in continuous processing and the rise of personalized therapies. The ability to integrate disposable filtration modules into closed-loop bioreactor setups has not only streamlined downstream workflows but has also supported the acceleration of cell therapy and viral vector purification processes. As biopharmaceutical pipelines expand into more complex molecules, the demand for highly efficient, low-particle-shedding filtration solutions continues to grow. Consequently, organizations seeking to maintain competitive edge are increasingly focusing on the benefits offered by disposable tangential flow filtration platforms-namely, operational simplicity, reduced turnaround times, and minimized contamination footprints.

Exploring the Key Technological and Operational Shifts Revolutionizing Single-Use Tangential Flow Filtration Across Multiple Application Areas

Over the last decade, technological innovation has reshaped the landscape of single-use tangential flow filtration, with manufacturers pioneering advanced membrane materials and streamlined module designs that enhance performance and usability. The introduction of high-flux polyethersulfone and polyvinylidene fluoride membranes, alongside regenerated cellulose and ceramic variants, has elevated permeate clarity and fouling resistance, meeting the most stringent requirements of therapeutic protein and viral vector purification. Concurrently, manufacturers are embedding sensors for real-time monitoring of transmembrane pressure and flow rates, providing operators with unprecedented visibility into process parameters and enabling proactive maintenance interventions.

Operationally, the integration of single-use modules into automated process skid architectures has driven a shift towards continuous, closed-loop systems. This evolution supports robust process control, fewer manual interventions, and standardized cleaning validation. As Industry 4.0 principles gain traction in biomanufacturing, digital connectivity allows for remote diagnostics and data analytics, ensuring traceability and process consistency across multiple sites. Furthermore, the trend toward miniaturized, bench-top TFF units facilitates rapid feasibility testing at lab and pilot scales, bridging the gap between R&D and full-scale production and helping organizations de-risk scale-up challenges.

Assessing How the 2025 United States Tariff Adjustments Are Shaping Supply Chains for Single-Use Tangential Flow Filtration Equipment in North America

In early 2025, revisions to the United States tariff structure impacted the import duties on key raw materials and consumables integral to tangential flow filtration modules. The increased duties on polyvinylidene fluoride resins and certain polymeric membrane components prompted manufacturers to reevaluate supply chains and seek cost efficiencies. While some vendors absorbed these added expenses to maintain customer pricing stability, others passed through marginal cost increases, leading end users to reconsider sourcing strategies and negotiate longer-term supply agreements.

These tariff-induced cost pressures have also spurred an accelerated shift toward domestic production of membrane substrates and preassembled modules. Companies have explored partnerships with local resin producers and invested in new manufacturing lines within North America to mitigate duty exposure. At the same time, smaller-scale laboratories facing tighter budgets have postponed capital acquisitions or opted for multi-round validation of lower-cost membrane alternatives. Although the short-term impact has been an uptick in per-unit pricing, industry leaders anticipate that the longer-term effect will be a more resilient domestic supply network, reduced lead times, and improved capacity planning across the tangential flow filtration ecosystem.

Uncovering Critical Segmentation Dynamics That Drive Demand for Single-Use Tangential Flow Filtration Systems Across Diverse Processes and Industries

Market segmentation underscores a diverse set of drivers and opportunities tied to scale of operation, application focus, material selection, module format, and end-use profile. At the lab scale, disposable TFF modules facilitate rapid process development and quality screening, whereas pilot-scale setups serve to de-risk scale-up with configurations that mirror industrial throughput. Production-scale platforms, in contrast, emphasize robust design and automation compatibility to support commercial-volume purification demands.

Diverse applications fuel adoption in biopharmaceutical manufacturing-spanning cell therapy expansions, monoclonal antibody purification, recombinant protein clarifications, and bacterial and viral vaccine downstream processing-while nonpharmaceutical segments such as food and beverage and water treatment leverage single-use membranes for beverage clarification and ultrafiltration of industrial effluents. The choice of membrane material also plays a pivotal role: ceramic variants deliver exceptional chemical stability for aggressive cleaning cycles, polyethersulfone and polyvinylidene fluoride options offer broad pH tolerance and high flux, and regenerated cellulose provides cost-effective performance in neutral pH applications.

Module formats range from compact discs designed for small-volume trials, to cassettes that balance throughput and footprint, and high-capacity cartridges optimized for large-batch purifications. Finally, end users span academic and research institutions, contract research and manufacturing organizations, and pharmaceutical and biotechnology companies, each with distinct validation requirements, throughput targets, and quality benchmarks. Holistic understanding of these segmentation dimensions enables stakeholders to align product development and marketing strategies with specific use-case demands.

This comprehensive research report categorizes the Single-use Tangential Flow Filtration System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Process Scale

- Membrane Material

- Product Type

- Application

- End User

Investigating Regional Variations in Adoption and Implementation of Single-Use Tangential Flow Filtration Systems to Identify High-Growth Geographies

Regional adoption of single-use tangential flow filtration systems reveals varying growth trajectories and strategic priorities across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In North America, strong presence of biopharmaceutical clusters and contract development and manufacturing organizations has fostered rapid uptake of advanced disposable filtration technologies, supported by favorable regulatory frameworks and local manufacturing capabilities. The focus on accelerating clinical pipelines and personalized medicine has further heightened demand for flexible, single-use solutions.

Across Europe, Middle East & Africa, regulatory harmonization within the European Union has streamlined qualification of single-use systems, while emerging markets in the Middle East and Africa are gradually building bioprocessing infrastructures, often in partnership with multinational firms. In these regions, cost efficiency and facility modularity are key drivers, prompting interest in plug-and-play filtration skids.

In the Asia-Pacific region, major pharmaceutical hubs in China, India, Japan, and Australia are investing heavily in biomanufacturing capacity expansion. Local policies to encourage biotech innovation, combined with growing domestic therapeutic pipelines, have accelerated adoption of single-use filtrations. Supply chain resilience remains a priority, leading to partnerships between global module suppliers and regional OEMs to ensure consistent access to membrane materials and technical support.

This comprehensive research report examines key regions that drive the evolution of the Single-use Tangential Flow Filtration System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Positions of Leading Manufacturers Driving Innovation in Single-Use Tangential Flow Filtration Technology

Several established manufacturers and emerging specialists are vying to define the next generation of single-use tangential flow filtration solutions. Leading players have focused on strategic initiatives such as expanding global manufacturing footprints, investing in membrane R&D for enhanced throughput and selectivity, and integrating digital monitoring systems to support predictive maintenance. Collaborative partnerships with biotechnology firms have enabled customized module designs, optimized for specific cell culture or viral vector processes, bolstering value propositions.

To differentiate, some companies have introduced proprietary coatings to extend membrane lifespan and reduce fouling rates, while others emphasize service models that include process validation support, on-site training, and rapid module exchange programs. Meanwhile, a subset of innovative vendors is exploring hybrid systems that combine disposable fluid contact pathways with reusable structural components, aiming to balance environmental considerations with operational performance. The resulting competitive landscape reflects a mix of product-centric innovation, tailored customer engagement, and strategic alliances designed to capture market share in critical therapeutic and industrial applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Single-use Tangential Flow Filtration System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cytiva UK Ltd.

- Danaher Corporation

- GE Healthcare Life Sciences

- KUBio Systems Inc.

- Liquidyne Process Technologies Inc.

- Merck KGaA

- MilliporeSigma

- Pall Corporation

- Pall Life Sciences LLC

- Parker Hannifin Corporation

- Repligen Corporation

- Sartorius AG

- Thermo Fisher Scientific Inc.

- Verdot Biotechnologies Inc.

- Wautoma Biotech (Pvt) Ltd.

Providing Clear Strategic Recommendations for Technology Providers to Navigate Market Challenges and Capitalize on Opportunities in Tangential Flow Filtration

Technology providers should prioritize investments in advanced membrane chemistries that offer superior fouling resistance and broad pH compatibility, enabling end users to streamline cleaning protocols and extend module life where partial reusability is feasible. In parallel, establishing flexible manufacturing networks through partnerships with regional suppliers can reduce lead times and shield operations from tariff-driven cost fluctuations.

Furthermore, collaborating directly with bioprocessing stakeholders to co-develop validated protocols will strengthen relationships and accelerate qualification of new products. Service-centric offerings-such as on-site commissioning, operator training programs, and remote diagnostics-can create stickiness and differentiate vendors in a competitive market. Embracing digital integration by deploying smart sensors and cloud-based analytics platforms will not only enhance process control but also generate valuable usage data to inform continuous product improvements.

Lastly, targeting emerging markets with modular, turnkey filtration skids tailored to smaller-scale operations will capture demand from academic institutions and start-up organizations. By balancing product innovation with agile service models and robust supply chain strategies, industry leaders can gain sustainable advantage and meet the evolving needs of a dynamic biomanufacturing ecosystem.

Outlining the Comprehensive Research Approach and Analytical Framework Employed to Gather, Validate, and Synthesize Insights on Tangential Flow Filtration Systems

This analysis draws on a dual-pronged research methodology combining both primary and secondary sources to ensure comprehensive and validated insights. Primary research included in-depth interviews with process engineers, R&D leaders, and procurement specialists at biotechnology and pharmaceutical firms, as well as discussions with subject-matter experts at contract research and manufacturing organizations. These conversations provided first-hand perspectives on adoption barriers, performance expectations, and emerging use cases for single-use tangential flow filtration.

Secondary research encompassed a review of scientific literature, technical white papers, patent filings, and industry conference proceedings, alongside scrutiny of regulatory guidance from agencies in key markets. Market mapping techniques were applied to align product portfolios with application segments, while data triangulation protocols cross-verified vendor-reported performance metrics against academic studies and user feedback. Qualitative insights were synthesized with quantitative indicators of technology uptake, enabling a balanced view of current trends, competitive dynamics, and potential future trajectories within the single-use filtration space.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Single-use Tangential Flow Filtration System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Single-use Tangential Flow Filtration System Market, by Process Scale

- Single-use Tangential Flow Filtration System Market, by Membrane Material

- Single-use Tangential Flow Filtration System Market, by Product Type

- Single-use Tangential Flow Filtration System Market, by Application

- Single-use Tangential Flow Filtration System Market, by End User

- Single-use Tangential Flow Filtration System Market, by Region

- Single-use Tangential Flow Filtration System Market, by Group

- Single-use Tangential Flow Filtration System Market, by Country

- United States Single-use Tangential Flow Filtration System Market

- China Single-use Tangential Flow Filtration System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Key Findings and Strategic Imperatives to Equip Industry Stakeholders with Actionable Intelligence for Tangential Flow Filtration Success

The landscape of single-use tangential flow filtration is marked by rapid technological advancement, shifting operational paradigms, and evolving supply chain considerations. From the rise of high-performance membrane materials and integrated digital monitoring to the strategic realignments prompted by tariff changes, stakeholders must remain vigilant and adaptable. Detailed segmentation analysis highlights the diverse needs across lab, pilot, and production scales, as well as the specialized demands of biopharmaceutical, food and beverage, and water treatment applications.

Geographic insights reveal pockets of accelerated adoption in North America and Asia-Pacific, balanced by emerging growth opportunities in Europe, the Middle East, and Africa. Competitive reviews illustrate how leading technology providers are leveraging R&D investments, partnerships, and service models to differentiate their offerings. To thrive in this environment, decision-makers should couple strategic innovation in membrane design with robust supply chain strategies and client-centric service offerings.

By synthesizing these findings, industry stakeholders are equipped with the intelligence necessary to make informed technology selections, optimize process workflows, and position their organizations for success in an increasingly dynamic bioprocessing and industrial filtration marketplace.

Unlock Tailored Insights for Your Tangential Flow Filtration Strategy by Engaging Directly with Ketan Rohom, Associate Director, Sales & Marketing

For decision-makers who are ready to advance their understanding and capabilities in single-use tangential flow filtration, engaging directly with Ketan Rohom offers a tailored opportunity to explore the comprehensive market research insights your organization needs. As Associate Director of Sales & Marketing, Ketan Rohom brings deep expertise in translating complex data into strategic actions. By reaching out today, you can secure personalized guidance on how these findings apply to your unique processes and goals. Don’t miss the chance to leverage a full report that synthesizes the most critical intelligence on technology evolution, market shifts, and competitive dynamics in tangential flow filtration-contact Ketan Rohom to acquire your copy and empower your next steps.

- How big is the Single-use Tangential Flow Filtration System Market?

- What is the Single-use Tangential Flow Filtration System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?