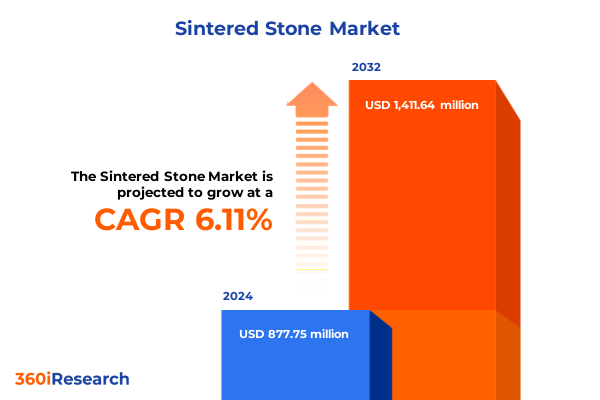

The Sintered Stone Market size was estimated at USD 929.45 million in 2025 and expected to reach USD 984.57 million in 2026, at a CAGR of 6.15% to reach USD 1,411.64 million by 2032.

Comprehensive overview of sintered stone’s emergence as a high-performance surface solution reshaping architecture and design industry demand

Sintered stone has rapidly established itself as a next-generation engineered surface solution, distinguished by its manufacturing process that replicates geological metamorphism in a controlled industrial setting. By combining finely ground minerals such as quartz, feldspar, silica and natural pigments, manufacturers achieve a composite material that forgoes resin binders in favor of extreme heat and pressure. In this process, powders undergo hydraulic compaction at pressures of up to 400 bars followed by sintering in kilns at temperatures exceeding 1200 °C, resulting in slabs that boast exceptional density, structural homogeneity and virtually zero porosity. This binder-free composition enhances thermal stability, scratch resistance and UV resilience, positioning sintered stone as a durable alternative to traditional natural stones and engineered quartz surfaces.

Moreover, sintered stone transcends conventional countertop applications by extending into architectural facades, flooring and wall cladding across residential and commercial projects. Its availability in large-format dimensions, combined with varied finishes ranging from matte to high-gloss, supports seamless installations in both indoor and outdoor environments. As sustainability imperatives intensify, sintered stone’s eco-friendly profile-driven by high recycled content and full recyclability-resonates with architects and designers seeking low-impact materials. Transitioning into broader use cases, sintered stone addresses demands for easy maintenance, hygienic surfaces and design versatility, solidifying its role as a material of choice for stakeholders focused on long-term performance and aesthetic excellence.

Exploring how technological innovations sustainability imperatives and design trends are driving transformative shifts in the sintered stone market ecosystem

Over the past decade, the sintered stone landscape has undergone transformative shifts fueled by technological breakthroughs, sustainability commitments and evolving aesthetic preferences. Advanced manufacturing techniques now leverage digital printing and high-definition surface mapping, enabling ultra-realistic patterns that mimic natural stone, marble and concrete. Manufacturers such as Neolith have pioneered patented processes that integrate three-dimensional textures directly into slabs, enhancing tactile appeal without compromising durability. Simultaneously, innovations in nanoscale particle sintering optimize material compaction, yielding flat panels that resist abrasion, thermal shock and chemical exposure at unprecedented levels. These technological strides not only broaden design possibilities but also streamline production workflows and reduce defect rates.

In parallel with these engineering advancements, the industry has embraced stringent environmental protocols that prioritize water conservation, energy efficiency and waste reduction. Leading producers have implemented closed-loop water recycling systems that reclaim more than 90 percent of process water, while sourcing raw minerals from certified, low-impact quarries. Some have even repurposed post-industrial ceramics and glass cullet as alternative feedstocks, further curbing resource depletion. As a result, sintered stone has transitioned from a niche premium offering into a preferred eco-conscious option for both corporate and residential developments. Moreover, design trends toward minimalist aesthetics and integrated interior-exterior environments have heightened demand for ultra-thin, large-format panels that deliver seamless visual continuity. By aligning product innovation with sustainability and style imperatives, sintered stone suppliers are redefining performance benchmarks within the surfacing sector.

Analyzing the cumulative effects of United States antidumping and countervailing duty measures on quartz surface imports and industry dynamics in 2025

In early 2025, the United States completed its five-year (sunset) reviews of antidumping and countervailing duty orders on quartz surface products imported from China, affirming that revoking these measures would likely lead to continued dumping and material injury to domestic industries. As a result, existing duties under HTSUS subheadings for quartz composites remain in effect, sustaining tariff rates that can exceed 20 percent of the invoice value. These protections reinforce the competitiveness of North American fabrication facilities by narrowing price differentials between imported sintered stone equivalents and locally produced alternatives.

Furthermore, concurrent USITC investigations initiated on May 1, 2025, into quartz surface products from India and Turkey signal an expanding regulatory landscape, potentially extending trade remedies to additional sourcing regions. Together, these measures shape global supply chain strategies as importers evaluate tariff-inclusive cost structures and country-of-origin risks. Consequently, buyers and distributors may redirect procurement toward non-subject suppliers, including European and Latin American manufacturers, to mitigate escalating duty burdens. In turn, this shift influences capacity planning and investment priorities for leading sintered stone producers, compelling them to optimize production footprints and distribution networks in tariff-advantaged jurisdictions. As a result, the cumulative impact of US trade policies is recalibrating global market dynamics, prompting stakeholders to pursue diversified sourcing, localized manufacturing and value-added services to sustain margin stability and market access.

Uncovering critical segmentation insights revealing how surface finish thickness product application end-use and sales channels define sintered stone demand

Sintered stone demand is intricately shaped by multiple layers of product segmentation that together define performance expectations and channel strategies. In terms of surface finish, consumer preferences range from low-gloss matte textures that evoke natural stone authenticity to highly polished surfaces prized for reflective brilliance and ease of cleaning, as well as nuanced textured variants that offer slip resistance and tactile sophistication. Thickness variations further tailor functionality, with standard 11 to 19 mm slabs striking a balance between structural integrity and weight considerations, while thicker 20 to 30 mm formats command attention for robust commercial applications and ultra-thin 3 to 10 mm profiles catering to lightweight cladding and retrofitting scenarios. Moreover, product applications span countertops that subdivide into kitchen and bathroom segments based on usage intensity and aesthetic priorities, facades that emphasize weather resilience, flooring that demands wear performance and wall cladding that prioritizes design impact and installation efficiency.

Alongside these technical dimensions, end-use segmentation delineates commercial environments-hospitals requiring hygienic, antimicrobial surfaces; hotels seeking premium aesthetics and durability; office spaces balancing design with maintenance; and retail stores emphasizing brand alignment-from residential contexts where bathrooms, kitchens and living areas each impose distinct functionality and style requirements. Complementing these distinctions, sales channels bifurcate into offline networks of showrooms and fabricators that enable tactile evaluation and bespoke fabrication services, and online platforms that streamline specification downloads, quoting and direct order fulfillment. By integrating these segmentation layers, stakeholders can precisely target product development, distribution strategies and marketing efforts to capture value across diverse customer cohorts.

This comprehensive research report categorizes the Sintered Stone market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Surface Finish

- Thickness

- Use Environment

- Installation

- Application

- End-Use Industry

- Sales Channel

Dissecting regional dynamics across Americas Europe Middle East Africa and Asia Pacific to illuminate sintered stone market trajectories globally

Global market performance in sintered stone diverges significantly across three major regions, each shaped by unique supply-demand dynamics and regulatory frameworks. In the Americas, robust construction activity in North America has spurred widespread adoption of high-performance surfacing solutions. Residential remodels and healthcare infrastructure investments have driven requirements for durable, hygienic materials, prompting local distributors to forge partnerships with European producers and invest in domestic fabrication capacity. Latin American nations likewise show growing interest in premium stone alternatives, though cost sensitivity and logistics challenges incentivize sourcing from regional manufacturers or Mexico-based fabrication hubs.

Meanwhile, Europe, the Middle East and Africa (EMEA) represent a mosaic of mature and emerging markets. Western European countries benefit from proximity to leading producers in Spain and Italy, facilitating just-in-time supply of large-format panels. Sustainability regulations in the EU further elevate demand for low-emission, recyclable products, reinforcing the appeal of sintered stone in green building certifications. The Middle East is witnessing a surge in luxury real estate and hospitality developments that leverage sintered stone for façades and interiors, while select African economies focus on public infrastructure projects where maintenance-free materials improve lifecycle cost efficiency.

In Asia-Pacific, expansive urbanization in China and India underscores the growth potential for engineered surfaces. China’s domestic sintered stone industry leverages cost advantages and scale, resulting in aggressive export strategies to North America and the Middle East. Australia and Japan, with mature design markets, prioritize high-end finishes and technological innovation, leading to niche demand for ultra-thin, digitally printed panels. Across these geographies, regulatory trends related to fire safety, VOC emissions and import duties prompt stakeholders to adopt regionally compliant products and optimize supply chains through localized distribution or joint ventures.

This comprehensive research report examines key regions that drive the evolution of the Sintered Stone market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading global manufacturers highlighting strategic differentiators innovation focus and competitive positioning within the sintered stone sector

The competitive landscape of sintered stone is characterized by a handful of global leaders that differentiate through innovation, vertical integration and sustainability. Spain’s Cosentino Group, the creator of the Dekton brand, leverages proprietary nanotechnology and a vertically integrated model that spans raw material sourcing to distribution in over 110 countries. Dekton’s ultra-compact technology delivers resistance to extreme temperatures, UV exposure and abrasion, securing its position in high-visibility commercial projects and specialty architectural applications.

Similarly, Neolith by TheSize distinguishes itself through advanced digital manufacturing and patented HypeR NDLS process, enabling ultra-realistic designs and large-format panels up to 320×150 cm. Its carbon-neutral production system features closed-loop water reuse rates exceeding 94 percent, appealing to eco-driven developers. The Italian Iris Ceramica Group, encompassing the Laminam brand, emphasizes sustainable production with 95 percent recycled water usage and minimal waste through high-pressure hydraulic presses. Its strategic acquisition of American company Stonepeak has reinforced its North American footprint, further intensifying competition within the premium segment.

On the other hand, industry players such as Caesarstone have expanded from engineered quartz into sintered composites, using hybrid formulations that combine resin-free sintered surfaces with antimicrobial properties. Meanwhile, Lapitec from Italy offers full-body through-color slabs, ensuring color consistency even after extensive edge profiling. Emerging Chinese manufacturers like Guangdong Newpearl leverage cost-competitive pricing to capture entry-level markets, albeit with fewer certifications in durability and environmental compliance. Together, these strategic differentiators shape a marketplace where R&D investment, sustainability credentials and supply chain agility determine long-term viability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Sintered Stone market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkelam

- Atlas Concorde S.p.A.

- Bellus Group Pte. Ltd.

- Cosentino, S.A.

- Decorcera Sintered Quartz Slab

- DELFONE Group

- Dongpeng Ceramics Co., Ltd.

- Gallery 77

- GGCL GRUPO GRIFFIN CERAMICA LLP

- Hangzhou Nabel China Co., Ltd.

- Hebei LingBiao Technology Development Co.,Ltd.

- Hup Kiong Pte Ltd

- LAPITEC S.p.a

- Levantina y Asociados de Minerales, S.A.

- Marazzi Group S.r.l.

- Moreroom Building Materials Co., Ltd.

- Motto Group

- Neolith Group

- Petros Stone LLP

- PORCELANOSA Grupo A.I.E.

- White Mapping Global Pvt Ltd.

- ZENITH C Spa

Delivering actionable recommendations for industry leaders to capitalize on emerging opportunities and navigate challenges in the sintered stone landscape

To thrive in a maturing sintered stone industry, stakeholders should prioritize research and development investments that extend product lifecycles and introduce novel functionalities such as antimicrobial coatings and lightweight formulations. In parallel, cultivating a diversified supply chain through partnerships with tariff-advantaged producers or localized fabrication centers can mitigate trade-related risks and reduce lead times. Embracing digital tools for client engagement-such as AR visualization platforms and online specification portals-will strengthen customer relationships and accelerate project approvals.

Furthermore, companies must align sustainability narratives with measurable performance metrics by obtaining international certifications related to water use, emissions and end-of-life recyclability. Proactively engaging with regulatory bodies to anticipate changes in import duties and building code requirements will ensure uninterrupted market access. Finally, forging design collaborations with leading architects and interior firms can elevate brand visibility and secure marquee reference projects that reinforce premium positioning. By executing these strategic actions in concert, industry leaders can reinforce their competitive moats and capitalize on emergent opportunities.

Detailing robust research methodology encompassing primary interviews secondary data analysis and triangulation to ensure rigorous insights validity

Our research framework integrates primary and secondary methodologies to deliver rigorous, unbiased insights. Primary research consisted of in-depth interviews with over 30 industry stakeholders, including sintered stone manufacturers, distributors, fabricators and end-users. These consultations provided qualitative perspectives on product performance, channel dynamics and regulatory impacts. Concurrently, secondary research compiled data from government sources such as the U.S. International Trade Commission, Federal Register notices and customs databases, as well as technical publications from leading industry associations.

To ensure data integrity, we employed a triangulation approach, cross-validating quantitative trade statistics with proprietary shipment records and corporate disclosures. Regional market analyses incorporated case studies on major construction and renovation projects to contextualize adoption patterns. Finally, all findings underwent peer review by subject-matter experts to confirm logical consistency and factual accuracy before report publication.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Sintered Stone market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Sintered Stone Market, by Surface Finish

- Sintered Stone Market, by Thickness

- Sintered Stone Market, by Use Environment

- Sintered Stone Market, by Installation

- Sintered Stone Market, by Application

- Sintered Stone Market, by End-Use Industry

- Sintered Stone Market, by Sales Channel

- Sintered Stone Market, by Region

- Sintered Stone Market, by Group

- Sintered Stone Market, by Country

- United States Sintered Stone Market

- China Sintered Stone Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Synthesizing critical findings to underscore the strategic imperatives guiding stakeholders in the evolving sintered stone market landscape

The sintered stone sector stands at the intersection of innovation, sustainability and global trade complexity. Technological enhancements have elevated material performance, while environmental imperatives and design trends continue to broaden use cases across residential, commercial and infrastructure applications. At the same time, evolving trade policies-particularly in key markets such as the United States-introduce new competitive pressures and source diversification strategies.

Looking ahead, stakeholders who integrate advanced manufacturing techniques with robust sustainability frameworks and agile supply chain models will secure preferred positions in this dynamic environment. Moreover, customized product offerings-enabled by digital design tools and strategic collaborations-will differentiate market leaders and drive continued expansion. Ultimately, the ability to anticipate regulatory shifts, align with shifting customer preferences and deliver demonstrable value will determine which organizations shape the future trajectory of the global sintered stone market.

Connect with Associate Director of Sales and Marketing Ketan Rohom to access tailored insights and drive growth through the definitive sintered stone market research report

Seize the opportunity to deepen your competitive edge by acquiring the comprehensive market research report covering sintered stone trends regulatory developments and competitive dynamics. Reach out directly to Ketan Rohom Associate Director of Sales & Marketing to discuss how customized insights can empower your strategic initiatives and accelerate growth. His expertise will guide you through detailed findings and help translate the data into actionable plans that align with your organization’s objectives

- How big is the Sintered Stone Market?

- What is the Sintered Stone Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?