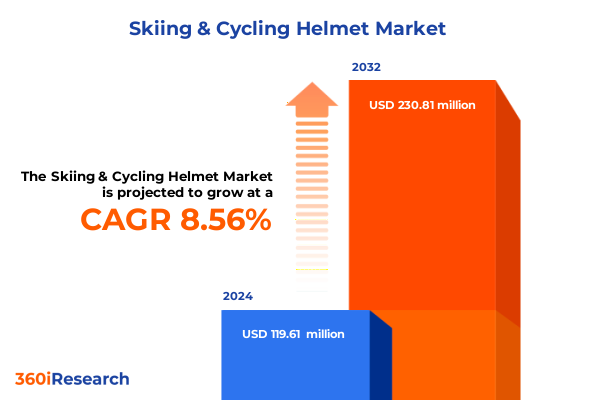

The Skiing & Cycling Helmet Market size was estimated at USD 129.25 million in 2025 and expected to reach USD 140.68 million in 2026, at a CAGR of 8.63% to reach USD 230.81 million by 2032.

Laying the Foundation for Understanding the Evolutionary Pressures and Consumer Demands Driving Innovations in Skiing and Cycling Head Protection

The evolving head protection landscape for skiing and cycling has become a critical focal point for industry stakeholders seeking to address multifaceted safety, performance, and consumer demand imperatives. As recreational sports participation continues to rise, helmet developers are contending with growing expectations for impact mitigation, comfort, and style. In parallel, regulatory bodies across major markets are tightening certification standards, elevating the baseline for product compliance and safety assurance. These converging pressures have catalyzed an era of rapid innovation that transcends traditional design boundaries, driving collaboration among material scientists, digital technology providers, and sports brands.

This report initiates a comprehensive exploration of how the helmet sector is adapting to these dynamic forces, emphasizing the interplay among advanced materials, smart functionality, and user-centric design. By contextualizing recent shifts in consumer preferences-ranging from enhanced rotational impact protection to integrated connectivity features-this introduction frames the critical themes that underpin the subsequent analysis. Stakeholders will gain an appreciation for the strategic imperatives motivating product development, market segmentation, and regional positioning, thereby establishing a foundation for informed decision-making in an increasingly complex competitive environment.

Exploring the Paradigm Shifts Reshaping the Skiing and Cycling Helmet Arena Amid Technological Advances and Emerging Consumer Expectations

The skiing and cycling helmet market is undergoing transformative shifts driven by a convergence of technological breakthroughs, sustainability imperatives, and evolving athletic disciplines. Digital integration in the form of embedded sensors, Bluetooth connectivity, and app-enabled performance tracking has moved from niche to mainstream, fostering a new category of smart helmets that seamlessly blend protection with data analytics. In response to heightened eco-consciousness among consumers, manufacturers have begun experimenting with recycled and bio-based polymers, as well as refining production processes to reduce carbon footprints.

Concurrent with these material and technological advances is a growing emphasis on customization, with adjustable fit systems, modular accessory attachments, and customizable aesthetic options becoming industry benchmarks. The surge in e-bike usage has prompted cycling helmet designers to prioritize enhanced ventilation and crash impact standards tailored to higher cycle speeds. Similarly, the rise of backcountry skiing and freestyle disciplines has spurred innovations in multi-use helmets equipped with improved coverage, integrated audio systems, and quick-release fit mechanisms. Collectively, these paradigm shifts underscore the market’s transition from basic protective gear to multifunctional, user-centric head safety systems.

Assessing the Multifaceted Effects of 2025 Tariff Adjustments on Supply Chains Distribution Strategies and Cost Structures in Head Protection Markets

In 2025, new U.S. tariff measures imposed on imported head protection components and finished helmets have generated significant repercussions across supply chains and cost structures. Manufacturers dependent on external production partners in low-cost regions have encountered elevated duties on thermoplastic resins, composite shells, and electronic sensor modules. As a result, many leading producers have embarked on nearshoring initiatives, establishing assembly facilities in Mexico or seeking partnerships with domestic injection molding and composite fabrication firms to mitigate exposure to fluctuating trade levies.

Beyond direct cost implications, the tariff landscape has introduced heightened complexity in trade compliance and logistics, prompting organizations to enhance their sourcing risk management capabilities. Companies are increasingly diversifying supplier bases to reduce single-country dependency and leveraging free trade zones to optimize tariff classifications. Meanwhile, some brands have initiated price harmonization strategies, absorbing a portion of incremental costs to preserve end-user affordability, while accelerating R&D into alternative materials less susceptible to import restrictions. These adaptive measures collectively illustrate the market’s resilience and strategic agility in the face of evolving trade policy pressures.

Unveiling Critical Segmentation Dimensions Driving Nuanced Consumer Behaviors and Innovation Pathways Across Safety Feature End User and Product Categories

A nuanced understanding of segmentation in the skiing and cycling helmet domain reveals distinct consumer profiles and innovation pathways that shape product design and marketing approaches. Based on safety feature, the market is studied across MIPS and non-MIPS, which underscores the differential value propositions associated with rotational impact protection technologies versus conventional liner-based systems. In parallel, end users range from professional athletes demanding competition-grade performance enhancements to recreational participants seeking reliable, user-friendly helmets for casual use.

Age group distinctions further refine the landscape, as adult helmets emphasize advanced ventilation, adjustable fittings, and style-driven appeal, while kids’ models integrate playful aesthetics, simplified retention systems, and impact indicators to encourage parental confidence. The type of helmet-cycling or skiing-drives specialized design adaptations; cycling helmets are further subdivided into E Bike, mountain, and road categories to address unique airflow, speed, and terrain requirements, whereas skiing helmets are segmented into Alpine, freestyle, and touring variants that balance warmth, coverage, and multifunctionality. Distribution channels also delineate the market’s contours, with offline sales through specialty stores, sports goods outlets, and supermarkets and hypermarkets complementing online sales via brand websites and e-commerce marketplaces.

Material considerations introduce another layer of differentiation, as ABS is prized for cost-effective durability, composite shells deliver premium impact absorption, and polycarbonate offers a balance of lightness and strength. Finally, price ranges from economy to mid range and premium align with end-user priorities, translating segmentation insights into tailored product portfolios that address diverse demand signals and performance expectations.

This comprehensive research report categorizes the Skiing & Cycling Helmet market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Material

- Age Group

- Price Range

- End User

- Distribution Channel

Examining Geographic Variances and Localized Preferences Impacting Head Protection Innovations in the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics in the skiing and cycling helmet industry reflect variations in consumer awareness, infrastructure maturity, and regulatory frameworks across the Americas, Europe Middle East and Africa, and Asia-Pacific. In the Americas, established cycling networks and a growing outdoor recreation culture have fostered broad helmet adoption, with an emphasis on e-bike compatibility and smart features aligned to North American certification standards. Transitioning southward, market participants are witnessing rising demand for versatile helmets that cater to mixed-terrain riding and ski resort safety regulations, prompting brands to localize fit systems and design aesthetics for diverse demographics.

Europe Middle East and Africa exhibit differentiated growth drivers, with Western European countries emphasizing stringent CE certifications and cutting-edge design, while Middle Eastern markets show growing interest in urban mobility helmets that blend safety with lifestyle appeal. African regions are at an earlier stage of helmet penetration, where educational initiatives and regulatory enforcement are instrumental in driving first-time adoption. In Asia-Pacific, the interplay between high-density urban cycling in East Asia and burgeoning backcountry skiing trends in countries like Japan and South Korea has created a dual market for both performance-driven cycling helmets and lightweight skiing models. Localization strategies, from material sourcing to distribution partnerships, remain critical for navigating regional complexities and capitalizing on emerging opportunities.

This comprehensive research report examines key regions that drive the evolution of the Skiing & Cycling Helmet market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Differentiators and Strategic Initiatives Undertaken by Leading Manufacturers in the Skiing and Cycling Helmet Sector

Leading manufacturers have distinguished themselves through a combination of technological prowess, strategic partnerships, and brand positioning that resonates with target demographics. Companies investing heavily in proprietary impact mitigation systems and sensor-based telemetry have cultivated reputations for safety leadership, whereas those forging collaborations with competitive athletes and ski resorts have amplified credibility in performance-centric segments. Several players have adopted vertically integrated supply chain models, controlling everything from composite layup to final assembly, to streamline quality oversight and accelerate time to market.

Meanwhile, other firms focus on differentiated design language, leveraging collaborations with fashion and lifestyle brands to infuse helmets with unique color palettes and form factors that appeal to style-conscious consumers. A subset of companies has prioritized sustainability, integrating recycled materials and circular economy principles, which strengthens their position among eco-aware segments. Distribution strategies also vary, with some market leaders extending direct-to-consumer e-commerce platforms that offer customization and digital engagement, while others rely on expansive retail footprints to capture impulse purchases and last-mile consumer service.

This comprehensive research report delivers an in-depth overview of the principal market players in the Skiing & Cycling Helmet market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABUS August Bremicker Söhne KG

- Bell Sports

- Casco International GmbH

- Decathlon S.A.

- Dorel Industries Inc.

- Endura Ltd.

- Fox Head, Inc.

- Giant Manufacturing Co. Ltd.

- Head Sport GmbH

- K2 Sports, LLC

- Kali Protectives

- Kask S.p.A.

- Lazer Sport NV

- Louis Garneau Sports Inc.

- Mavic SAS

- Merida Industry Co., Ltd.

- MET S.p.A.

- Oakley, Inc.

- POC Sweden AB

- Pret Inc.

- Safilo Group S.p.A.

- Salomon SAS

- Scott Sports SA

- Skis Rossignol S.A.

- Smith Optics, Inc.

- Specialized Bicycle Components, Inc.

- Uvex Safety Group GmbH & Co. KG

- Vista Outdoor Inc.

Outlining Actionable Strategies Industry Leaders Can Implement to Advance Safety Performance Design Innovation and Market Penetration in Head Protection

Industry leaders seeking to capitalize on emerging trends should prioritize the integration of sensor-based technologies that provide real-time impact analytics and enhance post-incident assessment capabilities. Concurrently, expanding研发 into sustainable raw materials and exploring bio-derived polymers can preempt regulatory shifts and align product portfolios with growing consumer sustainability priorities. Supply chain flexibility must be enhanced through multi-location manufacturing strategies and strategic alliances with domestic partners to mitigate trade uncertainty and optimize inventory responsiveness.

Furthermore, brands should refine their direct-to-consumer platforms, offering digital customization tools and virtual fit assessments to deepen customer engagement and gather valuable usage data. Collaborations with certification bodies and sports federations can bolster credibility and fast-track access to new performance segments. Additionally, developing modular accessory ecosystems-such as detachable audio units, integrated lighting modules, and climate-adaptive liners-can drive incremental revenue streams while reinforcing a brand’s perceived innovation leadership. By pursuing these actionable strategies, organizations can strengthen market positioning and sustain growth momentum across diverse helmet categories.

Detailing the Robust Research Approach Utilized to Gather Qualitative and Quantitative Insights Ensuring Comprehensive Analysis of Helmet Market Dynamics

This research leverages a robust mixed-methodology framework to deliver comprehensive insights into the skiing and cycling helmet market. The initial phase involved extensive desk research, encompassing regulatory filings, patent databases, and technical standards documentation to map the evolving safety requirements and certification protocols. Concurrently, product catalogues and material datasheets were analyzed to identify prevailing design attributes, material compositions, and innovation trajectories.

Subsequently, primary research was conducted through structured interviews with executive leadership and R&D specialists at helmet manufacturers, raw material suppliers, and distribution partners to validate secondary findings and uncover qualitative perspectives on strategic imperatives. In parallel, surveys and focus groups with end users-from professional athletes to casual enthusiasts-were utilized to capture preferences related to fit, comfort, functionality, and aesthetic appeal. Secondary data sources, including trade journals and specialized industry publications, provided context for macroeconomic factors and trade policy developments.

The data synthesis phase employed triangulation techniques to reconcile quantitative inputs with qualitative insights, ensuring analytical rigor and minimizing bias. Findings were subjected to expert review rounds with third-party consultants to verify accuracy and contextual relevance. This multi-stage approach underpins the credibility and depth of the analysis presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Skiing & Cycling Helmet market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Skiing & Cycling Helmet Market, by Type

- Skiing & Cycling Helmet Market, by Material

- Skiing & Cycling Helmet Market, by Age Group

- Skiing & Cycling Helmet Market, by Price Range

- Skiing & Cycling Helmet Market, by End User

- Skiing & Cycling Helmet Market, by Distribution Channel

- Skiing & Cycling Helmet Market, by Region

- Skiing & Cycling Helmet Market, by Group

- Skiing & Cycling Helmet Market, by Country

- United States Skiing & Cycling Helmet Market

- China Skiing & Cycling Helmet Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Core Discoveries and Highlighting Pivotal Trends Shaping Future Directions and Competitive Advantages in Skiing and Cycling Helmet Markets

The core discoveries of this analysis highlight the trajectory of skiing and cycling helmets from basic protective gear to sophisticated, multi-functional safety systems that blend advanced materials, digital connectivity, and user-centric design features. Segmentation based on safety technology, user demographics, and distribution pathways has become a critical lens through which brands can tailor offerings and differentiate value propositions. Regional nuances-driven by certification standards, consumer maturity, and infrastructure development-underscore the need for localized strategies and agile supply chain configurations.

Competitive differentiation is increasingly predicated on proprietary impact mitigation technologies, strategic partnerships with athletic organizations, and sustainability credentials. Meanwhile, the tariff-driven supply chain realignments of 2025 have illuminated the strategic importance of manufacturing footprint diversification and trade compliance expertise. By synthesizing these trends, stakeholders can identify high-opportunity segments, anticipate regulatory shifts, and refine product roadmaps to meet evolving consumer expectations. Ultimately, the ability to integrate safety performance, technological innovation, and brand storytelling will determine market leadership in the dynamic head protection landscape.

Engage with Associate Director of Sales and Marketing to Empower Your Strategy with In-Depth Skiing and Cycling Helmet Market Intelligence

To explore detailed insights tailored to your strategic goals and secure comprehensive analysis of the skiing and cycling helmet market, reach out directly to Ketan Rohom, Associate Director of Sales and Marketing. Engaging with Ketan Rohom will enable you to receive a personalized briefing on the report’s core findings, segmentation overviews, and actionable recommendations. His expertise in guiding decision-makers through complex market dynamics ensures you will have clarity on the most pertinent trends, regional nuances, and competitive strategies shaping the head protection landscape.

Don’t miss the opportunity to gain a competitive advantage and equip your organization with the intelligence needed to navigate evolving consumer expectations, regulatory developments, and technology-driven innovations. Contact Ketan Rohom today to arrange a consultation, obtain access to exclusive data sets, and discuss customization options to align the market research report with your specific requirements. Unlock the full value of this market research offering and position your team for success in an increasingly dynamic and demanding head protection segment.

- How big is the Skiing & Cycling Helmet Market?

- What is the Skiing & Cycling Helmet Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?